BRIEF:

Uniswap is the top decentralized exchange by trading volume built on the Ethereum blockchain.

The platform enables the ‘swapping’ of any pair of ERC-20 tokens.

Its model and structure attempts to solve the problem of illiquidity for DEXs.

DeFi

Decentralized finance is paving the way for non-custodial products to make waves in the world of blockchain and gain significant traction. A project that is receiving a lot of attention from the Web 3 community is the DEX, Uniswap.

The Uniswap protocol empowers developers, liquidity providers and traders to participate in a financial marketplace that is open and accessible to all.

Uniswap is an Ethereum-based platform that provides a service for the exchanging or swapping of ERC-20 token pairs. Its objective is to be a public good and tool to connect the general population with a tokenized word. Currently, it is doing just that as the network is the second-largest decentralized exchange by value of staked or locked assets and the largest decentralized exchange by trading 24hr volume, $2.1 billion .

Uniswap has over 200 DeFi integrations, 72k liquidity providers, and a total value of $6.53 billion (USD) locked.

How It Works

There a couple of specific features unique to Uniswap that differentiates itself.

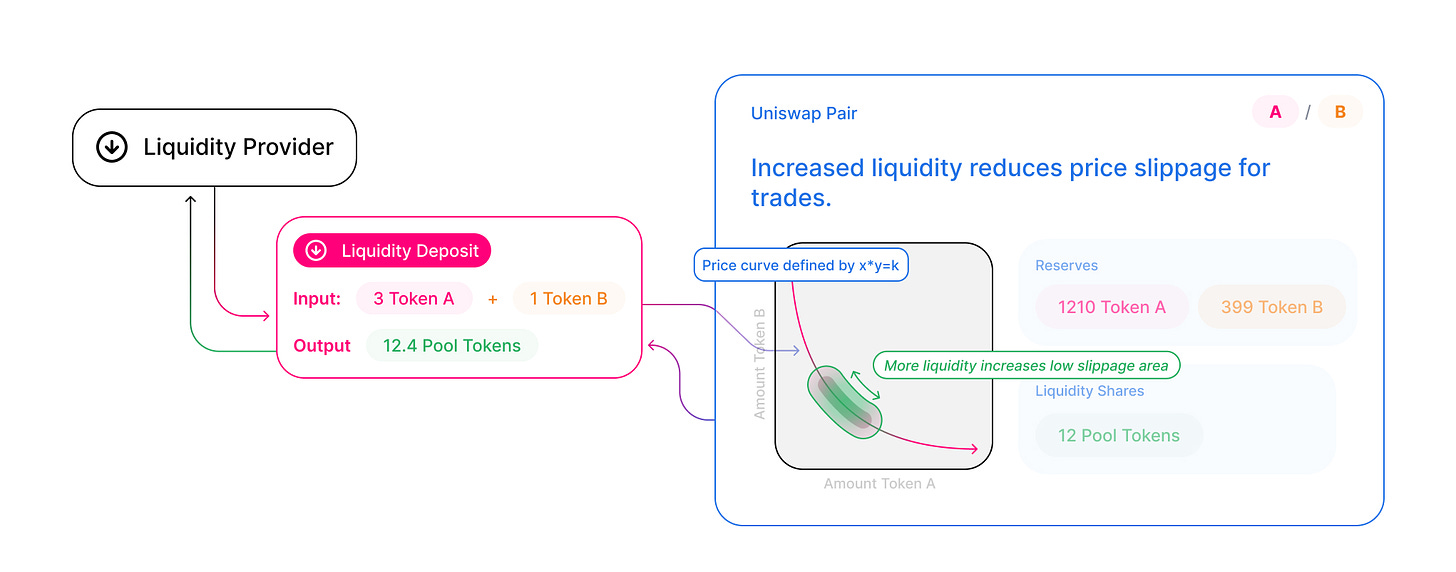

A common obstacle that exchanges need to overcome is illiquidity. This means there isn’t a large amount of free floating money available to enhance the trading experience and make it more efficient. Uniswap is attempting to solve this problem using automated liquidity protocols.

The automated liquidity protocol is powered by a constant product formula and implemented in a system of non-upgradeable smart contracts on the Ethereum blockchain. It obviates the need for trusted intermediaries, prioritizing decentralization, censorship resistance, and security.

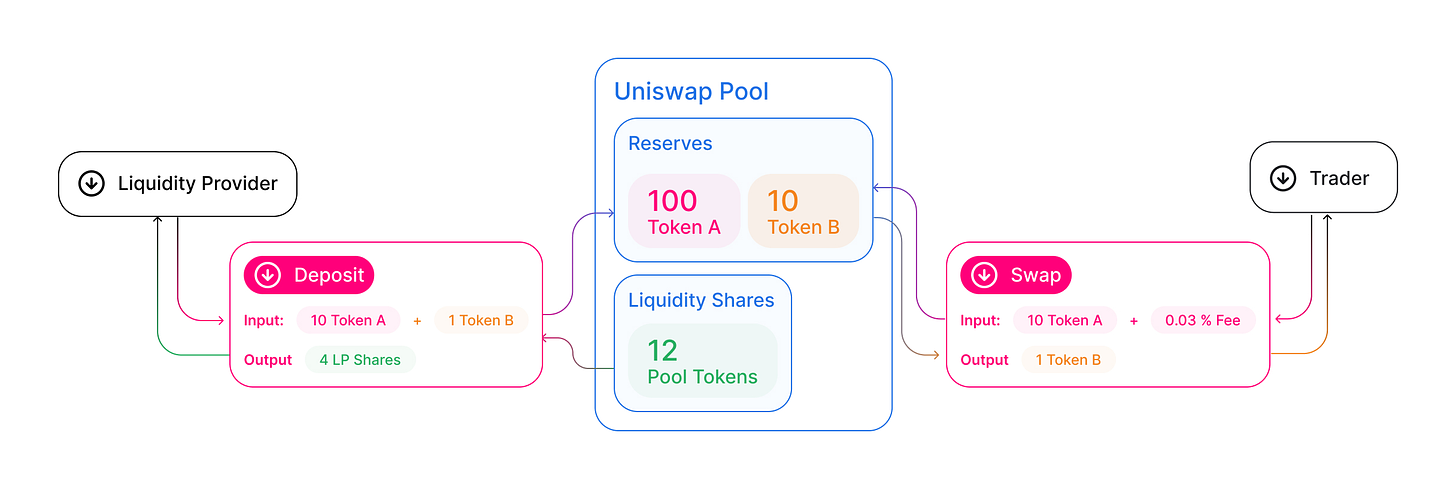

An automated liquidity protocol enables digital assets to be traded in a permissionless and automatic fashion by utilizing liquidity pools rather than traditional buyers and sellers. The pools function by people supplying them with a given token. The prices of the tokens are determined by a constant mathematical formula.

With Uniswap, the user is incentivized to become a liquidity provider (LP) on the exchange. Instead of having to actually connect the buyers and sellers together like other exchanges, Uniswap pools together the funds (ETH/ERC-20 tokens) from the LPs. Then, the pool automatically and instantly executes all the trades that take place through smart contracts.

Each token listed on the exchange has its own liquidity pool that users can contribute funds to. If a certain ERC token is not listed, it is very easy to add a new token by creating a liquidity pool for the given asset. Also, anybody can become a liquidity provider by simply depositing tokens here.

Uniswap V2 and V3 Updates

Uniswap was created by Hayden Adams and launched in November 2018. Despite it only being a few years old, it has become one of the leading products within the current DeFi ecosystem. However, the substantial growth really began as the network started to undergo pivotal updates beginning with the V2 update in May 2020. Also, the rise of yield farming spurred further interest in Uniswap.

The V2 update was critical. It allowed for the direct swapping of ERC-20 tokens completely eliminating the previous need for Wrapped Ether (WETH) to assist the exchange process. Aside from this, there was a host of improvements to the technicalities of the platform.

The latest update of the protocol, Uniswap V3, happened relatively recently in May 2021. A core feature of this upgrade is concentrated liquidity.

In short, concentrated liquidity makes it possible for a liquidity provider’s allocation to be within a custom price range, or limit orders. Previously, this allocation was distributed uniformly along the price curve between 0 and infinity. Now, LPs can choose a single or multiple smaller price intervals to allocate their money.

Outside of concentrated liquidity, the other main feature of Uniswap V3 includes a new fee structure. This update has now established fee tiers, which allow LPs to be more appropriately compensated for taking on varying degrees of risk. There are now three separate fee tiers per pair for the liquidity provider:

0.05% — expected for stablecoin pools like DAI/USDC

0.30% – for standard non-correlated pools like ETH/DAI

1.00% – for exotic non-correlated pairs

Having multiple fee tiers gives all LPs the ability to customize their margins according to expected pair volatility. LPs take on more risk in non-correlated pairs and lower risk in correlated pairs.

The governance community of Uniswap V3 has decided to deploy the protocol on layer-2 scaling networks Optimism and Arbitrum. Though the gas costs of V3 token swaps are already cheaper than V2 swaps on Ethereum, transactions made via these protocols will only decrease the cost and make the process more efficient. Near-instant transactions and a low cost are huge as the Ethereum blockchain has tons of traffic at the moment. Currently, it is under discussion whether V3 will be used on the Polygon network as well.

Wrap Up

Uniswap has not only proven that their model works, but also that there is demand for it.

This is evident through its growing userbase, increase in value, and the fact the protocol has undergone two significant updates. On that note, the updates made in V3 are beneficial, but fairly complex. This may require the user to get educated to fully understand the new capabilities of the protocol and benefits for LPs.

It is important to remember this space is highly competitive as many projects try to cement their spots in the crypto world. However, we at MAJR expect the popular decentralized trading network in Uniswap to continue its growth and maintain its position as a leader in DeFi.

Brevin White

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.