The world is drowning in debt, about $260,000,000,000,000 which is approximately 325% of global GDP. The world also has too much US dollar denominated debt, about $12,000,000,000,000 of which 33% is in emerging markets. The US dollar is the United States largest export, 80% of all global transactions occur in dollars. There are actually two dollar markets. The United States domestic US dollar market and the eurodollar market that sits outside of the United States. The eurodollar market is not the Euro, it refers to the dollar-denominated accounts at foreign banks or overseas branches of American banks. It is one of the world’s biggest capital markets, if not bigger than US domestic dollar market. These dollars are used for trade, for bank reserves and for debt service payments in US dollars all over the world. These markets require a steady supply of depositors putting their money into foreign banks and can run into liquidity issues if the supply of dollar deposit drops.

The net-net is there’s massive global demand for US dollars.

However, when the global economy slows down or comes to a halt, spending goes down and the velocity of dollars goes down, which means less dollars circulating through the system. The global economy has been slowing down over the last couple years, and then came to a halt in March due to the pandemic.

This creates a massive dollar short. There’s not enough dollars to make trades for things like oil or to service debt payments, predominately payments to the US.

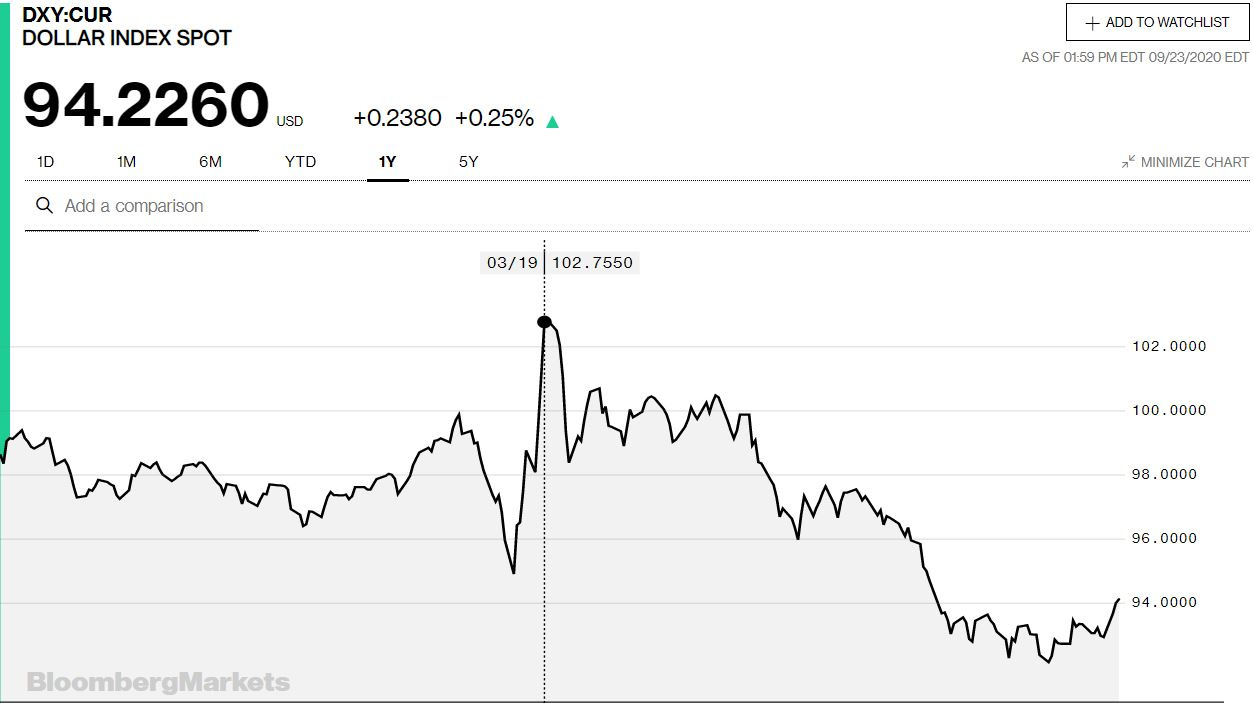

This is one of the reasons why we saw all markets - equities, credit, gold, bitcoin, etc - drop in March as the world essentially had a global margin call. Everyone was leveraged way too long and immediately needed to sell risk assets to get dollars. You can see the dollar spike in March on the US Dollar DXY chart.

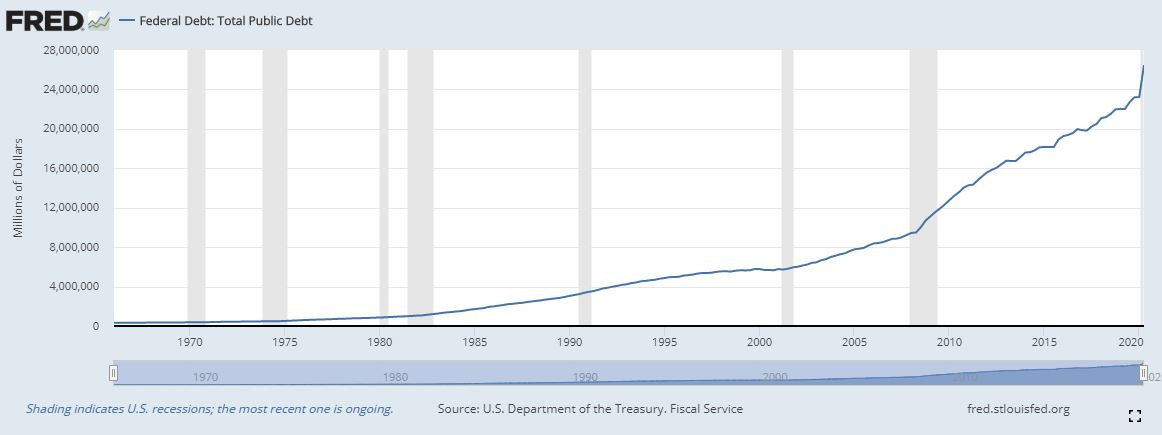

There’s a crazy amount of debt. What happens next? Money printers go brrrrrrr.

Central banks, banks and multinational corporations still need dollars to service their debt and pay their bills, but trade has slowed and they’re short. Their options are 1) sell their US dollar reserves; 2) if they’re lucky and have a US Federal Reserve swap line, they can print their domestic currency, use it as collateral for a US dollar loan with interest, increasing their future debt burden; or 3) they print money in their local currency buy dollars on the open market. In each case, this creates a death loop as countries are inflating away their local currency for dollars and only exacerbating the local economic fallout, especially for emerging markets.

While a strong US Dollar makes imports cheaper in the US and in theory bolsters the dollar as the world reserve currency, the rest of the world suffers. Their local currencies fall against the dollar and causes more capital flight to the stronger currencies.

However, the US needs a weaker dollar and not because it wants increase exports, but because capital gets sucked back into the US, in particular, into US treasuries. This can cause interest rates (% yield) to go negative. Bond yields are inversely correlated to the supply of treasuries. If there are more available bonds then the interest rate increases, a higher % yield. If there’s more capital parked in the bond market looking for a return, the yield decreases.

The Dollar Milkshake Theory In Action.

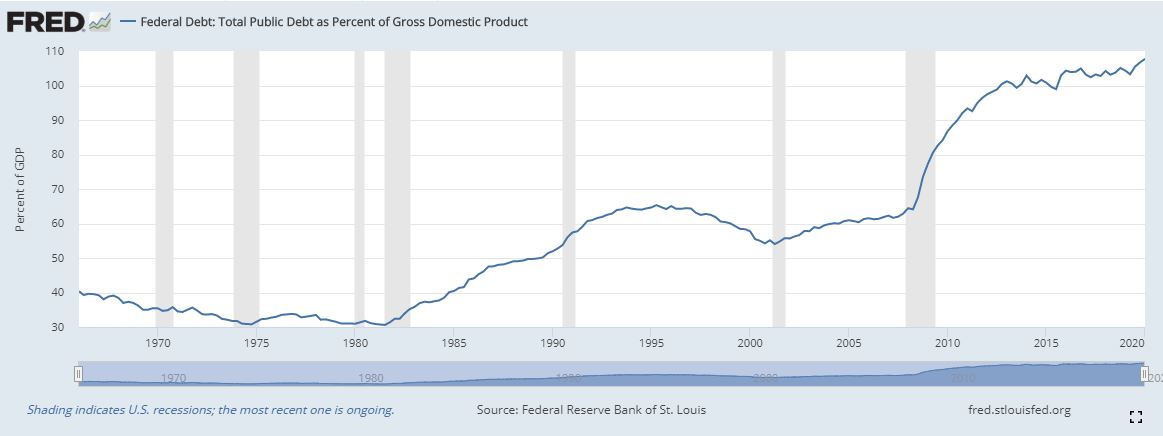

US treasuries are the main risk-off instrument to protect wealth from volatility and protect against inflation. Negative yields for investors mean investors are guaranteed to lose money over time. Essentially, a broken bond market. When the bond market breaks, investors are pushed farther out on the risk curve leaving treasuries and moving into equities and other riskier assets. As capital leaves the bond market in the search for yield, interest rates spike against treasuries. This makes the US debt more expensive for the US government to service and the US is already running the largest deficit of all time, at $26T which is 109% of GDP.

US 10 Year Treasury Yield (The Chart of Truth)

Total US Debt: $26.48 Trillion

US Debt to GDP: 109%

Where does all this lead? Inflation.

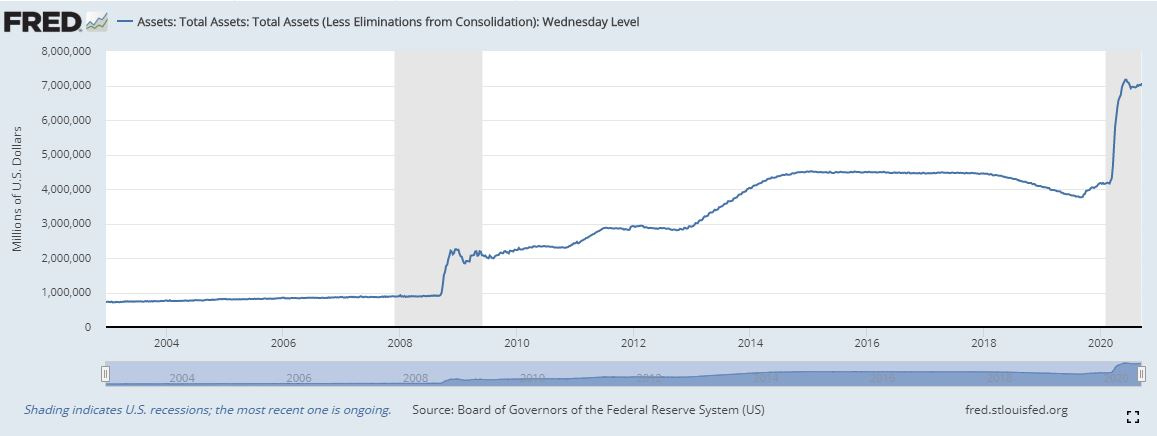

The US is left with one option. Can you guess? Print more money and run deeper fiscal deficits. The Fed needs to loan more dollars to the countries that are short dollars and then they need to deal with the bond market. As investors leave the bond market in the search for yield and the interest rates spikes, the Fed will need to activate yield curve control. Yield curve control is when the government monetizes it’s own debt by having the Fed indirectly buy government treasuries via the primary dealer banks. The primary dealer banks buy the US treasuries and then swap them with the Fed for “bank reserves.” The bank reserves are printed out of thin air and the treasuries sit on the Fed’s balance sheet. This ongoing process keeps the interest rate on treasuries flat and under control at the cost of the dollar.

US Federal Reserve Balance Sheet: $7.06 Trillion

Conclusion

There you have it folks. The Dollar Milkshake Theory. Essentially a death spiral for the US dollar. What are the average investors supposed to do about this? Buy scarce assets. Equities should do well until the dollar breaks. However, if the dollar doesn’t break and we’re able maintain this amount of inflation, then equities should boom. But, in my humble opinion, I recommend thinking in terms of buying power. All of this printing should devalue the dollar and equities are dollar denominated assets. When it comes time to sell your stocks, what are you going to buy? All of the other scarce and hard assets will have also benefited from an increased money supply, therefore being dramatically more expensive. I believe all roads lead to gold, silver and definitely bitcoin.

If you’d like to learn more about the Dollar Milkshake Theory, check out Brent Johnson out on YouTube and follow him on Twitter. Brent Johnson runs money for Santiago Capital and is the theorist behind Dollar Milkshake Theory.

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.