MAJR Newsletter 081

Bitcoin and crypto volatility put into perspective. On-chain analytics says crypto bull market is still intact.

@tverd

MAJR NEWS BRIEF

Bitcoin and crypto volatility is no joke, but digital assets are here to stay.

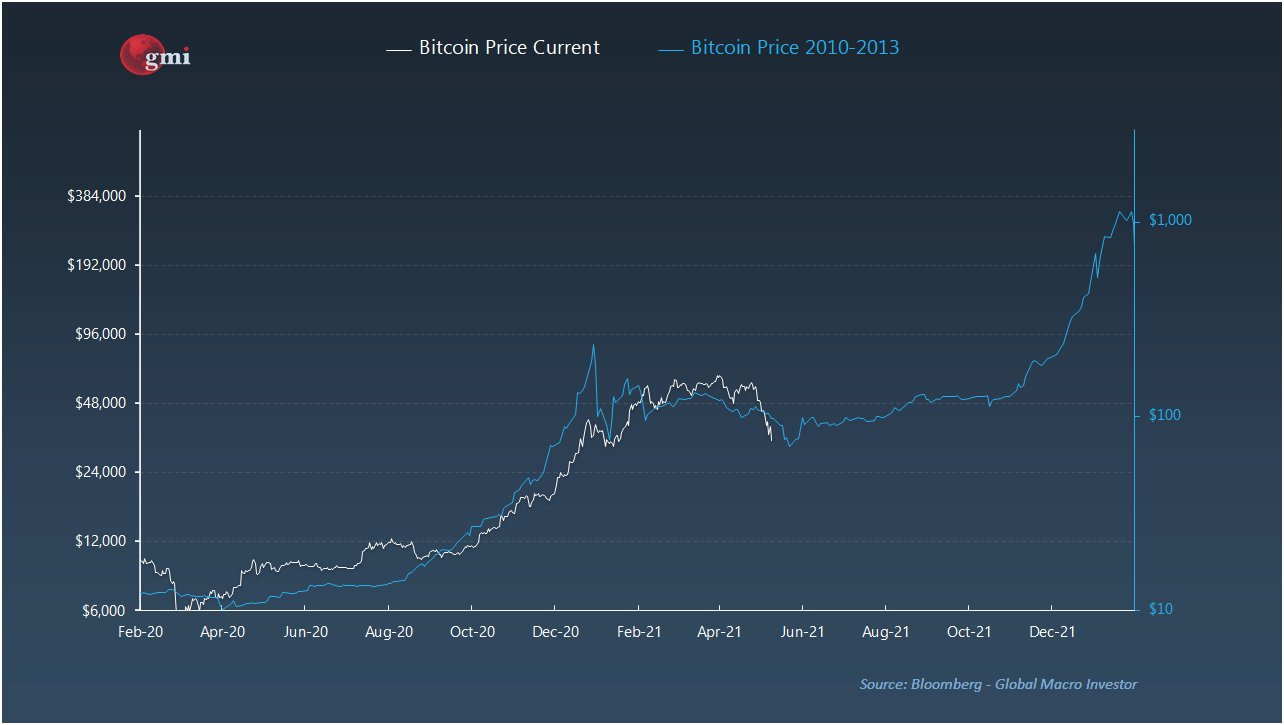

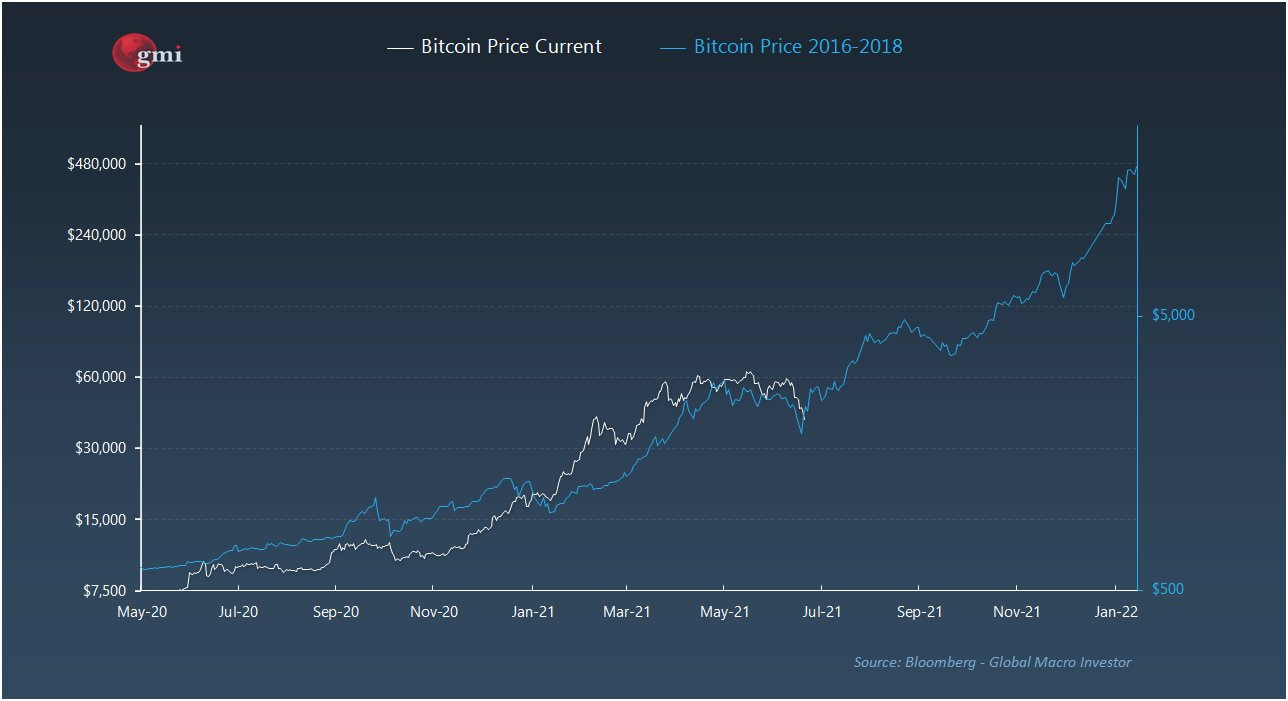

While, this past week’s price action was painful, the same type of deep correction happened in the 2013 and the 2017 bull runs (almost to the day after the bitcoin halving) before rocketing to all-time highs.

Volatility happens in both directions and this was most likely the healthy correction that will carry the asset class to new heights. This bull market is still intact and we’ve included a video breaking down the on-chain analytics from this past weeks events.

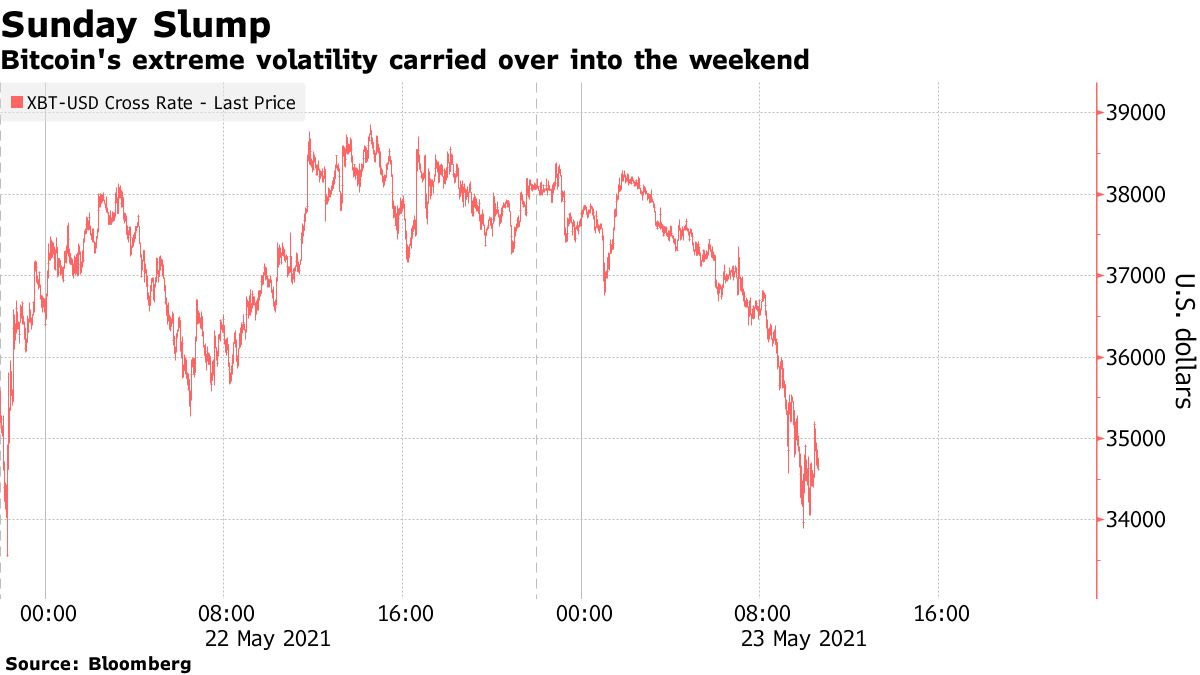

The volatility that shed $1 trillion in 12 days was most likely due to the following factors.

Global markets worried about inflation.

China cracking down on crypto and financial institutions handling digital assets (this is not news and should be expected as they roll out their digital yuan (DC/EP).

Institutional investors and retail taking profits. Billions of dollars entered the bitcoin market between $20k-$30k levels.

Cascading liquidations from margin traders attempting to call the bottom every time the market corrected using leverage ($88 million in 2 hours, $20B total in liquidations). They got rekt, which only increased selling pressure across the market.

New acting OCC Chief, Michael Hsu reviewing previous administration’s crypto guidelines allowing banks to custody digital assets and service crypto companies.

Elon trolling Twitter and tweeting that Tesla is no longer accepting bitcoin as means of payment for environment reasons (most likely theater in order to continue getting government subsidies that allow Tesla to maintain operations given mainstream’s short sighted view on BTC’s energy consumption).

Honestly, Aliens (semi-joking, but if you haven’t watched 60 Minutes’ latest report highlighting US military footage then you need to click here).

Bringing things into perspective.

Bitcoin and crypto are new technologies that will catapult society, finance and literally every business into the future. It’s already captured mainstream media, who’s not just reporting on bitcoin as WSJ, Bloomberg, Reuters and the Financial Times are all discussing DeFi, Dogecoin, NFTs. Crypto hedge funds on average returned 128% in 2020 and have $3.8 billion in AUM investing in bitcoin, ether and DeFI - Uniswap, Chainlink, Polkadot and AAVE to name a few. Meanwhile, 47% of traditional hedge fund managers surveyed, representing $180 billion of AUM, are already invested or looking at investing in crypto. Capital investment and M&A has been surging in the digital asset ecosystem. Bitcoin’s energy consumption is real, but the negative narrative is misinformed as it’s actually an incentive for clean and renewable energy. We’re already seeing a transformation of old fossil fuel plants converting into renewable energy plants in order to mine bitcoin. And, even Elon Musk finally showed his true cards as he tweeted that he favors crypto over fiat. Bitcoin and crypto’s volatility is real and unnerving, but it’s still up 250% in the past year and is currently oversold.

In other news:

China is cracking down on commodity producers (iron ore, steel, copper and aluminum) to prevent collusion due to price speculation, inflation concerns and ultimately hurting their exports.

The UK is combatting the Indian variant rapidly spreading across Britain with a successful vaccine push as 60 million shots have been administered and the economy looks optimistic as it starts to open up.

Eyes are on the service economy as things open back up. Will western consumers bring new spending on travel, entertainment, and personal care? Inflation concerns are real as businesses struggle to find employees due to government stimulus and households have more savings then ever. Oxford Economics estimates the total at $4.7 trillion globally.

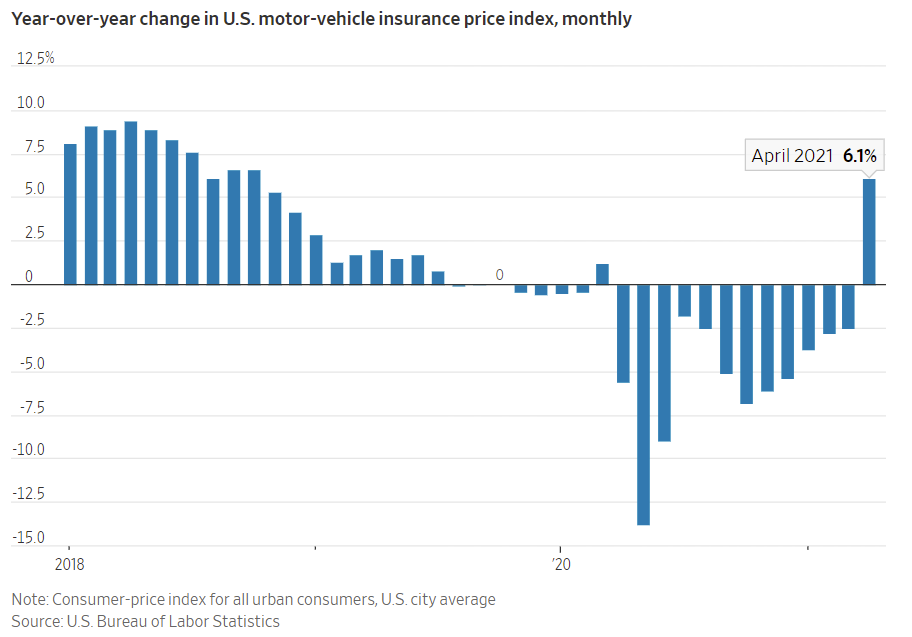

Inflation hitting auto insurance as people are driving more again, up 6.1% from a year. Keep in mind these numbers can be misleading due to base effects (last year was abnormally low given the pandemic therefore YOY numbers are always going to appear much higher).

Stay humble. Manage your position size. And, stack sats.

- Matt Verklin

FACTS

There are 48 million millionaires today.

There are only 21 million bitcoin.

Do the math.

TOP STORIES

BITCOINBitcoin Volatility Puts Weekend Traders on Stomach-Churning Ride, Bloomberg

Bitcoin Miners Are Giving New Life to Old Fossil-Fuel Power Plants, WSJ

Bitcoin Holds Short-Term Support; Faces Resistance at $40K, Coindesk

Bitcoin, Ether Bounce After Disastrous Week for Crypto Market, Coindesk

CRYPTO Upstart Peer-to-Peer Crypto Exchanges Take Aim at Coinbase, WSJ

Crypto Hedge Funds Show Growing Appetite for DeFi: PwC, Coindesk

Goldman’s Crypto Chief Worries About Fraud, but Not Cryptocurrency’s Future, Coindesk

Galaxy Digital Continues M&A Streak With Vision Hill Acquisition, Coindesk

DeFi Tokens Including Uniswap, Chainlink, Aave Crushed By Crypto Crash, Decrypt (fire sale opportunities)

MACROChina Targets ‘Speculators and Hoarders’ to Stop Commodity Boom, Bloomberg

Inflation Bets Mount on Fear Brazil Won’t Hike Rates Enough, Bloomberg

Johnson’s Plan to Open U.K. Economy Gets Boost From Vaccine Data, Bloomberg

Grand Reopening to Test Consumers’ Appetite to Keep Spending, WSJ

Inflation Forces Investors to Scramble for Solutions, WSJ

Inflation Starts to Hit Auto and Home Insurers, WSJ

MEDIABitcoin Crashed! Who Was Buying And Selling?!

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.