MAJR News 059

Investors are bullish on bitcoin again, Miami mayor wants to pay public workers in bitcoin, Polkadot sets date for milestone Parachain launch, Welcome to the MekaVerse

@starfury

MAJR NEWS BRIEF

Videos

In this Bitcoin Magazine Interview with host Alex McShane, Michael Saylor discusses initially buying Bitcoin for MicroStrategy, number go up mentality vs. Bitcoin maximalism, Bitcoin as digital property, Bitcoin as energy, the human right to property, the predator-prey dynamics of Bitcoin, and his bullish future outlook.

Numbers to know

$31 billion - The total value of BTC transferred on the Bitcoin network on October 6 — an all-time high and a 40x jump since the beginning of 2020.

221 million - The number of people who have bought or sold crypto as of June 2021, up from 66 million in May 2020.

20,000 BTC - Estimated holdings (worth over $1 billion) of the largest publicly traded U.S. crypto mining companies. Firms, including Argo, Hut8, and Marathon, have used their BTC as collateral to secure loans to acquire new equipment and pay energy bills, believing that BTC’s future upside is worth more than the interest owed on the loans.

$135k-$500k - Estimated BTC price predictions in the next 3-6 months.

$500k-$2M - Estimated BTC price predictions in the next 3-4 years.

Top Stories

BITCOINUnited States Overtakes China in Bitcoin Mining

China’s bitcoin mining and crypto ban will go down as one of the biggest geo-political mistakes of all time. China once had 75.5% of Bitcoin’s mining hashrate securing the protocol within it’s borders, now its much less and hard to confirm. The US has capitalized on the CCP’s folly, and has increased US hashrate from 16.8% to 35.4% of the total network, emerging as the new dominant player in the mining industry.

MAJR Take: Thank god for the whatever free markets we still have left to take advantage China’s screw up. Bitcoin is freedom technology and the US should embrace it, even if it means risking reserve currency status.

Bitcoin 'Bullish Sentiment' Is Back Among Institutional Investors: Report

Bitcoin’s price (~$58k) has been steadily climbing for a few months now (up 30% in October) and is starting to come back onto the mainstream’s institutional investors radar. Per the report, "CME's share of the global open interest in the bitcoin futures reaches 17%, the highest level recorded since February 2021." Open interest is a measure of the number of derivatives contracts, which allow people to bet on the future price of an asset.

The crypto-friendly mayor of Miami says the city is moving toward paying public employees in bitcoin

Miami will move ahead with a proposal to allow city workers to be paid in bitcoin, the city's mayor told Bloomberg on Tuesday. Mayor Francis Suarez previously proposed bitcoin be used as a payment vehicle to employees and for city residents. The nonprofit-driven MiamiCoin reportedly made $7 million for Miami in August.

"We're going for a request for proposal in October to allow our employees to get paid in bitcoin, to allow our residents to pay for fees in bitcoin and even taxes potentially in bitcoin if the county allows it," Suarez said in an interview with the business channel.

Bitcoin Could ‘Trigger’ Financial Instability: Bank of England Exec

Sir Jon Cunliffe, who’s an executive at the Bank of England in charge of financial stability said bitcoin could lead to financial instability... It sounds like Sir Jon finally did the bare minimum research on bitcoin. This is in contrast to what the BoE’s Financial Policy Committee stated last week, that crypto has limited risk to the UK’s financial stability.

“Of course $2.3 trillion needs to be seen in the context of the $250 trillion global financial system. But as the financial crisis showed us, you don’t have to account for a large proportion of the financial sector to trigger financial stability problems,” Sir Cunliffe reportedly said.

MAJR Take: Bitcoin was created to make banking near obsolete and the BoE still doesn’t get it. Just another example of the incompetence at the helms of our “trusted” institutions.

More on Bitcoin

Stacks Foundation, Brink to Fund Bitcoin Development Fellowship Using ‘Stacking’ Rewards

Russian President Vladimir Putin: “Bitcoin has the right to exist.”

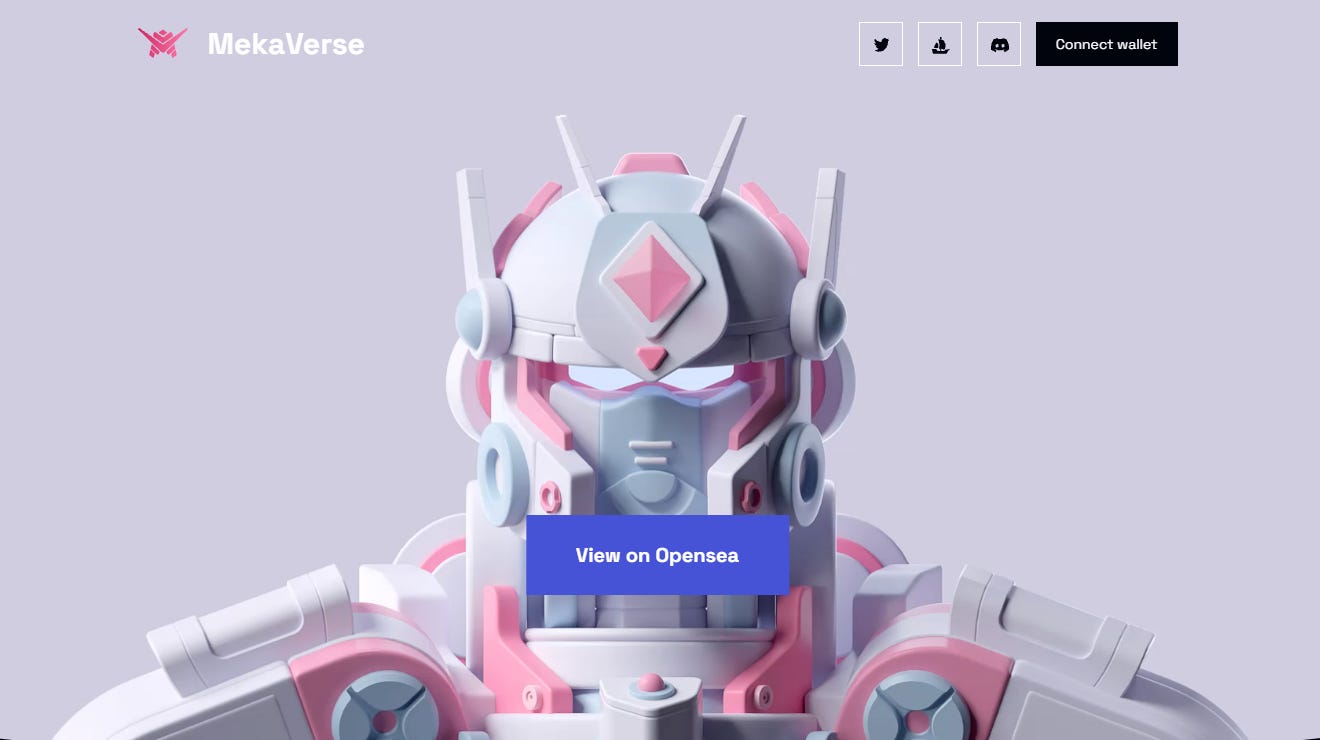

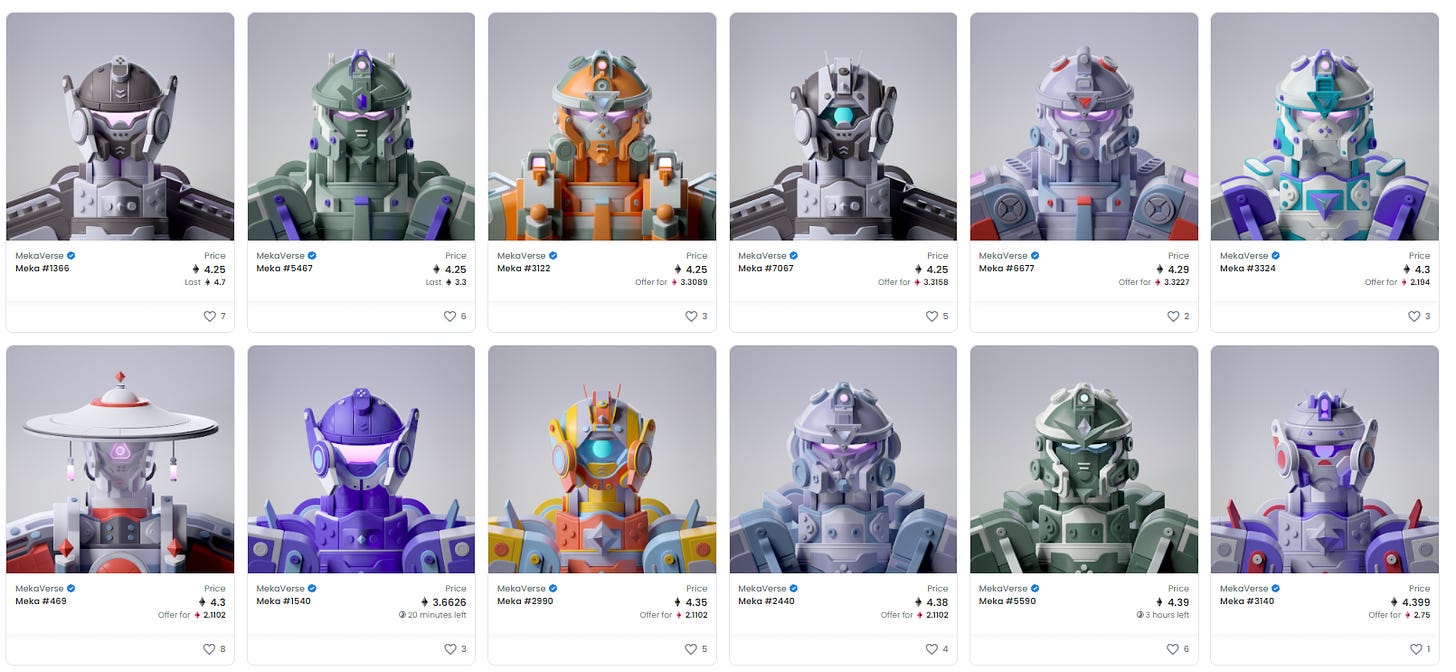

CRYPTOCan Gundam-style NFTs push digital collectibles into the mainstream?

Meet the newest NFT project to captivate crypto Twitter: A collection of 8,888 unique “Mekas” inspired by Japanese anime classics like Mobile Suit Gundam. On October 7, almost a week before actual artwork for the 3D mech-suit avatars was revealed, the entire collection sold out. On OpeaSea, sales have since totaled more than 34k ETH ($125.8M). The designers Matty and Matt B, who’ve worked for clients such as Apple, Nike and MTV created the 3D illustrated generative digital art that integrates hundreds of visual elements. More than 172,000 unique wallets signed up for the right to buy one of the 8,888 Mekas. As soon as the minting process began, values for Mekas began to rise — as of today the floor price for Mekas on OpenSea was 3.4 ETH (~$13k). Click here to bid on OpenSea for Meka NFT.

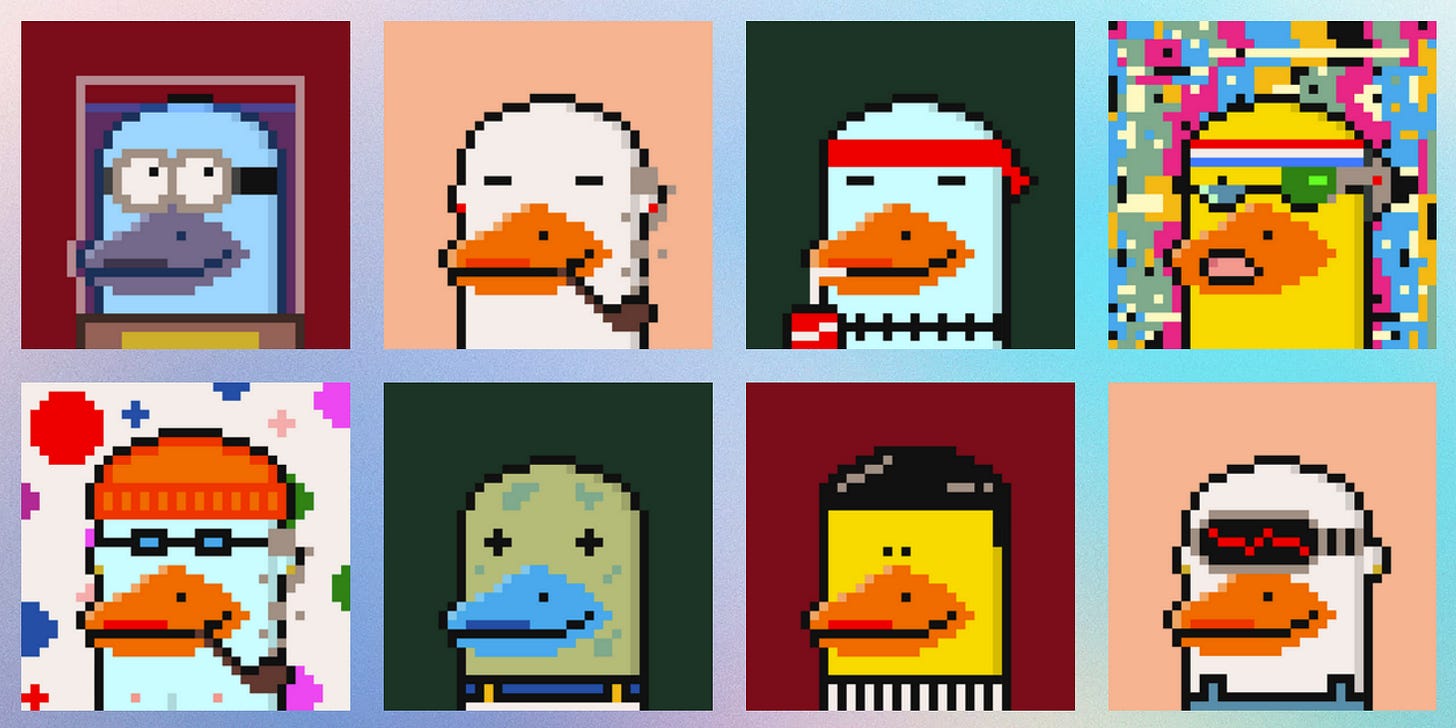

The Secret Duck Society

Algorithmic generative digital art in the form of non-fungible tokens (NFTs) have taken mainstream by storm and the activity has predominately been on the Ethereum blockchain. However, other layer 1s are getting in on the action. Solana (SOL) has been quickly expanded into the NFT space with some popular collections that can be found on Solanart.io. We haven’t actively participated in the NFT bonanza, but The Secret Duck Society has caught our attention. A lot of these NFT projects are hard to parse and value. The key is to get in early and if anything buy for the art, not the profit. We found an upcoming launch for The Secret Duck Society, on Friday October 20th. Minting the ducks costs 0.4 SOL (~$60) and it’s first come first serve. If you look on Solanart, some of the other collections are selling for $10k-$450k and comparing to the famous collections on Ethereum, NFTs have sold for millions. Anyway, we thought we would share as we’re going to try to mint some ducks and if anything gain some learnings.

MAJR Take: Please remember investing in NFTs is highly speculative and extremely risky. Do your own research. This is not investment advice.

Ethereum Rival Polkadot Marks Parachain Milestone With 25% Price Surge

Layer 1 smart contract blockchains are, have been and will continue to rip from a price standpoint. Investing in layer ones like Solana, Avalanche, Fantom, Terra and Polkadot are currently the leaders and have the most upside given where Ethereum has set the bar. Polkadot (DOT), founded by former Ethereum founder, Dr. Gavin Wood, has crossed a new milestone and is ready to launch their “Parachains.” Parachains are their own blockchains that run alongside the main network and settle on the main chain, called the “Relay chain.” The project has been in development for 5 years, is well funded and has a huge community. In order to deploy your project on Polkadot, you need to secure a parachain through auctions which are done in DOT, the native currency. This puts tremendous demand for DOT and we’re seeing price follow demand, up 25% this past week and up over 215% over the last 3 months. First auctions are slated for November 11th.

More on Crypto

Coinbase Sees 1.4 Million Signups for New NFT Platform - JOIN WAITLIST HERE

Crypto Firm Ankr Takes Page From FTX Playbook, Sponsors NBA's Sacramento Kings - Oh yea, they’re mining crypto and have their own token, Kings Token ^

Africa's Top Crypto Artist Launches Social Token Experience at Christie's

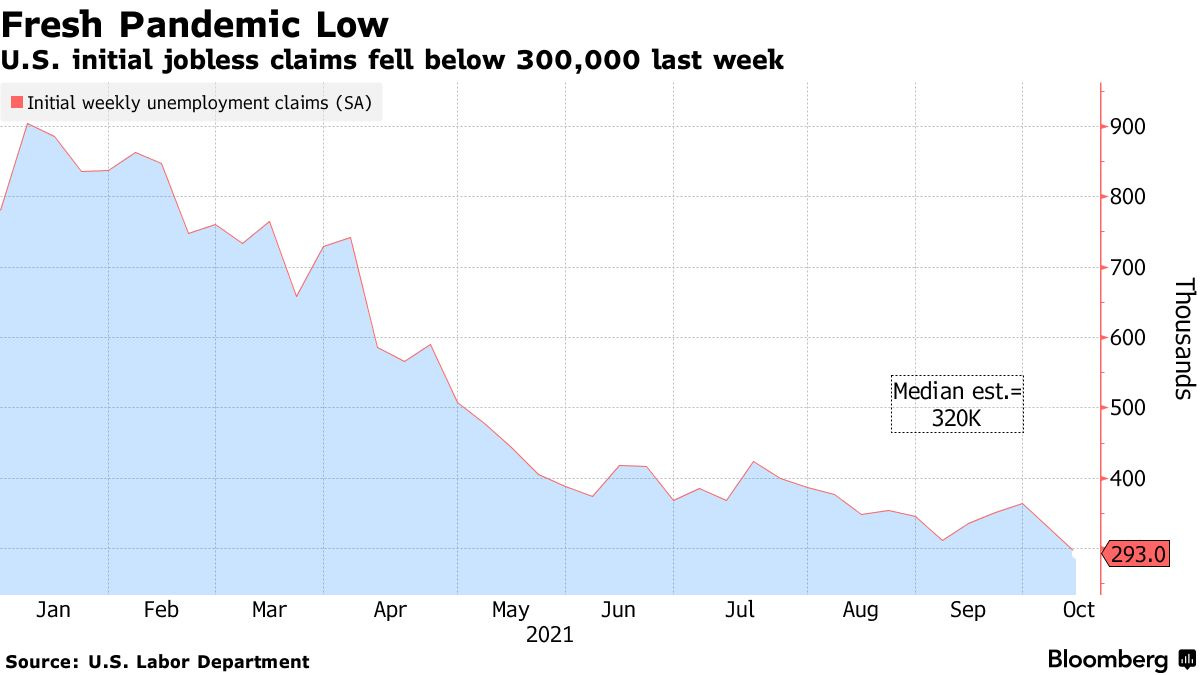

MACROU.S. Initial Jobless Claims Drop to Lowest Since March 2020

Applications for U.S. state unemployment benefits fell last week to the lowest since March 2020, showing employers are hanging onto their workers in a tight labor market. Initial unemployment claims in regular state programs totaled 293,000 in the week ended Oct. 9, a decrease of 36,000 from the prior wee.

Microsoft Folds LinkedIn Social-Media Service in China

Citing operating challenges within China, Microsoft who owns LinkedIn said they will shut down its professional version within the country. The Chinese Communist Party is increasing oversight of its largest tech companies and private enterprises making compliance a nightmare.

Post-Covid Global Economy Falters Due to Inflation and Supply-Chain Woes

Third quarter data suggests a global economic slowdown heading in the end of year mainly due to the rising costs of materials and components for producers and supply chain woes. A precision engineering firm that makes metal connectors used in everything from electric kettles to military drones said it normally takes 6-12 weeks to fulfill an order, now customers need to wait at least 30 weeks to more than a year. A shortage of workers, especially truck drivers has also provided another obstacle for producers trying to meet demand.

More on Macro

MEDIAThe Predator-Prey Dynamics Of Bitcoin: Michael Saylor - Bitcoin Magazine

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.