MAJR News 054

Twitter's social network plugs into Bitcoin's monetary network for tipping, Yellen warns that the US will run out of money by October, Market worries of possible contagion due to China's Evergrande

@MariaTranDK

MAJR NEWS BRIEF

Videos

Bankless hosts dive into David's recent article "The Metaverse Emerges." What is the Metaverse?

US Debt Clock

If you’re a visual learner and you’re trying to wrap your head around the US national debt, I suggest taking a look at the US Debt Clock (linked above) and bookmarking it. US Total Debt to GDP = 140.69%. You can fast forward the clock to 2025 which forecasts US Total Debt to GDP = 190.58%.

Top Stories

BITCOINAlmost a Third of Salvadorans Are Using the Bitcoin Wallet, Bukele Says

The president of El Salvador, Nayib Bukele tweeted that 2.1 million Salvadorians or one-third of the population are activity using the government sponsored Chivo wallet for bitcoin. More users than any bank in the country. The new bitcoin legal tender laws and wallet went live 20 days ago…

MAJR Take: The Chivo wallet rollout has had its issues, but it only takes a couple central banks to sound the global alarm that bitcoin is a thing, it’s super important…and there’s only 21M of them…this is not a drill.

JPMorgan CEO says Bitcoin price could rise 10x but still won’t buy it

“I don’t really care about Bitcoin. I think people waste too much time and breath on it. But it is going to be regulated…And that will constrain it to some extent. But whether it eliminates it, I have no idea and I don’t personally care. I am not a buyer of Bitcoin. That does not mean it can’t go 10 times in price in the next five years.” The above statement was made by Jamie Dimon in a Times of India interview. While, Mr. Dimon still “doesn’t care” about bitcoin, his bank JPMorgan has started providing financial services to crypto companies, along with a 10% investment in MicroStrategy, one of the largest corporate holders of bitcoin with +105k BTC. In July, JPMorgan posted multiple posting for blockchain developers, engineers and marketers. JPMorgan subsidiary Counterpoint Global is considering offering cryptocurrency investments to its wealthy clientele.

MAJR Take: STOP LISTENING TO BANKERS.

New Twitter Integration Will Drive The Bitcoin Price Above $300,000

Twitter just integrated it’s social network to Bitcoin’s monetary network to allow for tipping in bitcoin. The new feature is rolling out to Twitter’s 300 million users, along with the ability to connect user profiles or identities to an NFT badge. Twitter has partnered with the Strike Lightening wallet app that seamlessly and instantly send fiat to bitcoin transactions, bitcoin to fiat transactions and bitcoin to bitcoin transactions via Bitcoin’s second layer solution called Lightening. This is a big announcement and opens a lot of doors for creators using the platform globally, and could incentivize other social platforms like YouTube, Facebook, Instagram and TikTok to adopt if everything goes well. It’s currently only available for Apple’s iOS users. Technically, Twitter has just become a new payments platform.

“If Bitcoin’s market capitalization consisted solely of the $700 billion global remittance industry, the $13.8 billion influencer marketing industry and the $5.44 trillion global digital payments market (a combined estimated value of $6.1538 trillion) through applications like Twitter’s tipping service, each bitcoin in existence (18,824,860 at the time of this writing) would be worth approximately $326,897.”

What's new in China's crackdown on crypto?

In May, China officially cracked down on bitcoin mining causing crypto prices and bitcoin’s hashrate to crater. Hashrate and prices have since recovered, but now China has officially made any cryptocurrency related activities and mining illegal within the country. In 2013, they allowed people to freely participate in bitcoin trading. A year later they banned banks and payment companies from participating in bitcoin-related services. In 2017, they banned initial coin offerings (ICOs). Now, ten Chinese agencies including the central bank, banks, securities and foreign exchange regulators are clamping down on all virtual currency trading activities. The rules are strict and they’re putting in place severe penalties.

More Crypto Platforms Exit China Following Ban on Transactions

CRYPTOFacebook Is Spending $50 Million to Build Metaverse—'Responsibly'

Facebook’s Mark Zuckerberg announced in June that Facebook will transition to a “metaverse company.” They plan on investing $50 million over the course of two years towards metaverse initiatives, such as their virtual work rooms called Horizon. The metaverse which is a bigger idea than just crypto and is a catch-all term for all digital spaces online where society can come together in real-time - work, entertainment, commerce, social, etc. The metaverse idea has been depicted in the media with the popular Sci-Fi book “Snow Crash” and movies like “Ready Player One.” Facebook stated that they will work towards creating a responsible metaverse with human rights, civil rights, consulting with governments, industry and academia. “We’ll work with experts in government, industry, and academia to think through issues and opportunities in the metaverse,” reads the official post. The metaverse goes hand and hand with crypto, due to the ability to own digital goods, such as NFTs for land and other digital forms of property. Facebook will need to be truly open or users will just adopt other blockchain enabled platforms like Decentraland (MANA), CryptoVoxels and The Sandbox (SAND).

NFTS

Snoop Dogg Is Selling 1,000 NFT Passes for Private Ethereum Metaverse Party

Axie Infinity Has Sold $2 Billion Worth of Ethereum NFTs. Here's What’s Next

Atari Founder Is Launching Augmented Reality NFTs on Ethereum

‘Solcial’ Raises $2.9M to Build Censorship-Free Social Media on Solana

Solana (SOL) the Ethereum competitor and high-throughput blockchain is getting their first crypto social network project, Solcial. Social networks and social tokens are big market targets for crypto companies and it’s all about returning control and monetization to creators. Solcial says it’s going to have heavy creator monetization opportunities. They raised $2.9M from prominent crypto players - Alameda Research, Rarestone Capital, GBV, Shift Capital and Noia Capital, valued at $58 million. The platform has not yet launched and aims for a December 2021 debut.

MAJR Take: Solana experienced a network outage two weeks ago which hurt price. We exited our position. SOL, the token seems to be bouncing back and projects keep announcing Solana partnerships despite the correction and outage.We remain bullish on Solana.

FalconX Eyes Miami for Expansion as CEO Plans Hiring Push

FalconX, the institutional crypto exchange is looking to expand operations to the city of Miami, a rapidly growing crypto hub. They expect to grow from 90 employees to 160 in the next six months, and is considering possible strategic acquisitions.

MACRO

U.S. Debt-Limit Showdown Intensifies as Democrats Under Pressure

Senate Republicans blocked the Democrat bill to suspend the debt ceiling until December 2022. This GOP move puts pressure on Democrats to revise down the $3.5 trillion stimulus and infrastructure legislation. Yellen says the government will run out of money some time in October which would cause a US default on it’s debt obligations. The debt ceiling theatrics has been going on for years on both sides of the isle and it’s always raised to allow more debt to pay for our government expenses.

Evergrande Bond Bills Are Piling Up as Latest Coupon Comes Due

China’s Evergrande, the world’s most indebted developer is showing no signs of paying their interest payments that’s levered to the tune of $300 billion. They’ve fallen behind on their payments to banks and suppliers. They missed a $83.5 million coupon payment last week and have a $45.2 million payment due this Wednesday. The market is concerned of contagion risk from such a huge debt holder, however, some economists believe the market damage is contained within China.

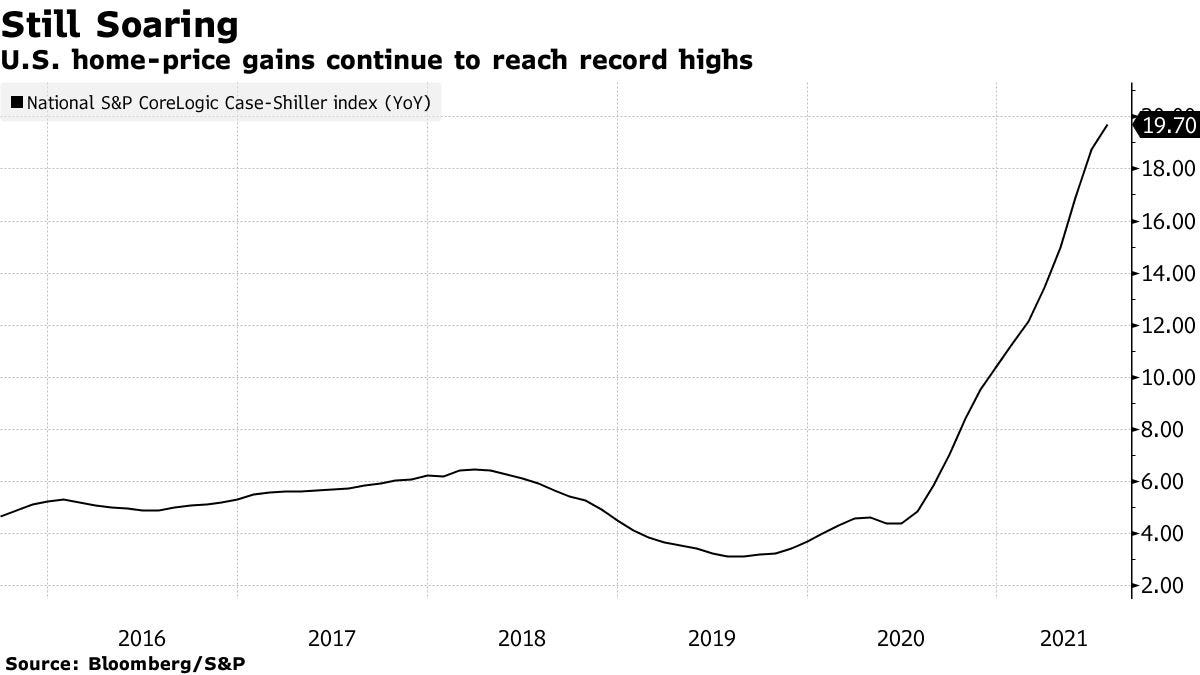

U.S. Home Prices Gain 19.7% in Another Record for Hot Market

Property values across the country reach new heights, recording an 19.7% increase YOY for July, following an 18.7% print in June. The biggest jump in more than 30 years. Cities that increased the most were Phoenix (32.4%), Seattle (25.5%), Dallas (23.7%), Denver (21.3%), New York (17.8%) and Boston (18.7%).

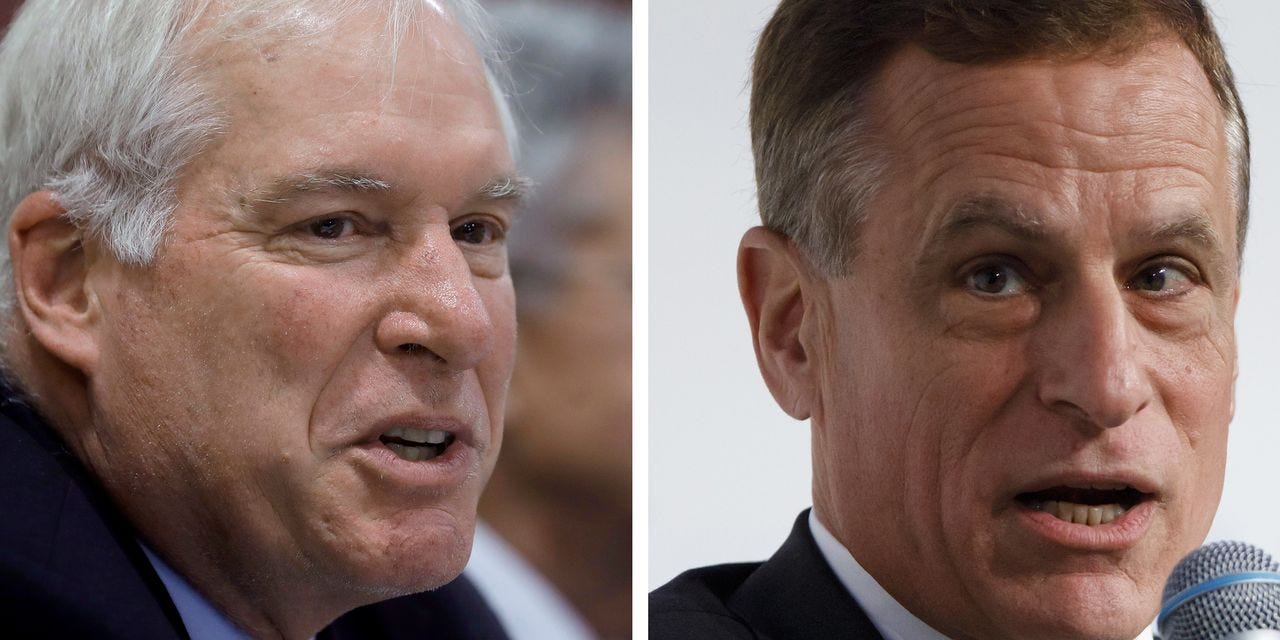

Fed Leaders Eric Rosengren, Robert Kaplan to Resign Following Trading Controversy

Fed leaders Rosengren and Kaplan are resigning after trading controversies have come to light showcasing that Fed officials were actively trading investments that benefited from their monetary policy decisions. Fed officials must retire at 65, both are 64. Kaplan stated that his trading was distracting him from his Federal Reserve work and Rosengren stated health reasons. Kaplan made millions from his trades while Rosengren’s financial successes were less impressive.

Fed Chief Jerome Powell Says Inflation Is Elevated but Likely to Moderate

MEDIADefining the Metaverse

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.