MAJR News 052

El Salvador buys the BTC dip, $1.2 billion liquidations due to Evergande, Evergrande possible market contagion, Coinbase invests in DeFi on Bitcoin, Lebanon in Inflation Crisis

@danielamorena

MAJR NEWS BRIEF

Videos

Ivan on Tech discusses one of the hottest crypto games to hit the market with Star Atlas CEO, Michael Wagner.

In this interview, Peter McCormack talks to businessman and TV Personality Kevin O’Leary. They discuss institutional bitcoin allocation, ESG compliance, and the changing economic landscape. “The bitcoin opportunity is massive.”

Top Stories

BITCOINCoinbase Leads $8.5M Raise in Crypto Project Bringing DeFi to Bitcoin

Portal is a decentralized finance project that’s looking to build on Bitcoin’s blockchain just raised $8.5 million lead by Coinbase Ventures. While, DeFi is mainly constrained to Ethereum and other smart contract blockchains, recent upgrades to Bitcoin, such as the Taproot upgrade have provided a new foundation to build more complex smart contract applications on Bitcoin’s second layers. Portal’s second layer technology called, Fabric enables privacy on cross-chain transactions and eliminates the need for centralized custodians.

MAJR Take: Bitcoin may be slow to develop compared to Ethereum and other chains, however second layer solutions that add more utility to the network and the digital asset are coming and they will be massively disruptive. Don’t bet against bitcoin and get distracted by all the shiny new toys in crypto land. Bitcoin is the king and needs to be the focus of anyone’s crypto portfolio to reduce risk and capture asymmetric upside.

Coinbase Drops Lend Product Plans After SEC Lawsuit Threat

Coinbase drops their Lend product that would have helped investors earn up to 4% APY on their USDC stablecoin holdings thanks to an SEC lawsuit threat. The SEC is using regulation by threat of litigation and is now creating more confusion as they’ve let other firms offer interest earning accounts on their digital assets, which have been deemed property vs. securities. They’re calling stablecoins possible securities, even though it doesn’t meet their qualifications under the Howey Test - with stablecoins, there’s no presumption of profit… We lend our money (property) to banks for almost zero yield and it’s not considered a security, but when we lend our crypto (property) for a higher yield it’s now considered a security…

MAJR Take: This should be an outrage and an obvious signal to American’s that regulators don’t care about investor projections, but only care about keeping the status quo (banks) in power at the cost of US financial innovation. Government authorities haven’t provided clear guidance for crypto, they’re now allowing uneven market practices between companies, threating lawsuits before products even come to market and adopting new classification on securities laws in real time as it pleases their goals, not the people’s. Banks provide less than 0.5% APY yield with savings accounts, and they want to prevent Americans from earning 4% APY on their digital assets for investor protections… Bullshit.

‘We Just Bought The Dip’: El Salvador President Boasts Of Doubling Down On Bitcoin As Price Drops

The President of El Salvador, Nayib Bukele stands firm on his commitment to accumulating bitcoin for the country and buys the bitcoin dip as price tumbles to it’s lowest in recent weeks. The country expanded it’s holdings to 700 BTC, buying $6.5 million or 150 BTC over the weekend.

Overly-Stringent Crypto Regulations ‘Preclude’ Banks From Crypto: Financial Trade Groups

Members of the global financial community across banks, asset managers and the blockchain industry represented by the Basal Committee urged regulators to refrain from overly simplified and aggressive crypto regulation that would stifle financial innovation in the US and prevent banks from participating in the emerging market and asset class. The Basal Committee is responsible for setting the standard for the worlds approach to banking regulation.

CRYPTOBitClout creator launches 'Decentralized Social' blockchain with $200 million in funding from a16z and others

Decentralized Social (DESO), the blockchain formerly known has BitClout, has raised over $200 million in funding from crypto venture giants to create a new social media blockchain that’s open for app development. The thesis is social media platforms are broken, as centralized platforms control the public discourse and earn all the profits off the content while never producing anything themselves. DeSo’s blockchain will support features like creating profiles and posts, and add blockchain features like tipping, social tokens and NFTs to help creators earn money. The token can be found here. Investors include a16z, Sequoia, Social Capital, Coinbase Ventures, Winklevoss Capital, Polychain Capital, Pantera Capital and Arrington Capital.

MAJR Take: DeSo is nearly a $1 billion market cap blockchain and only on a limited amount of exchanges with the largest group of prominent crypto investors I’ve seen. Social media is ripe for disruption using blockchain tech. DeSo is up nearly 21% today as the rest of the market is down. This may be a good opportunity to put some capital to work using the riskier side of the barbell investment strategy. We did a write up on BitClout earlier this summer that can be foundhere.

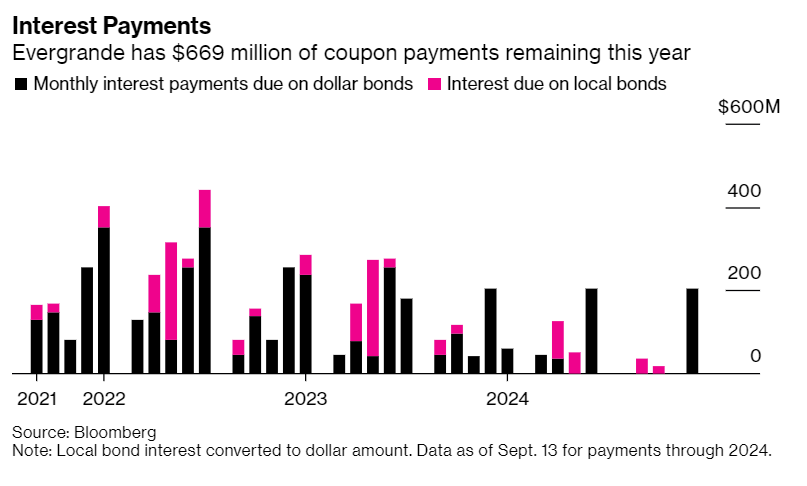

Over $1 Billion in Crypto Futures Liquidated Amid Evergrande Concerns

China’s Evergrande $300 billion ticking debt time bomb is being attributed to more than $1.2 billion in crypto liquidation as all markets pull back. More than 205,000 traders who were mostly long crypto prices going up got wiped out over the last 24hrs. Bitcoin is down 10% at $43,550 and ether is down 12% at $3,079.

Third of U.S. Swing State Voters Favor Crypto as Payment: Newsweek

A Newsweek polls shows that on third of voters living in swing states are in favor of crypto being a legal form of payment. Of the respondents, 28% and 37% of voters from Arizona, Texas and Wisconsin would vote yes to make cryptocurrency legal. Over 9,700 voters from California, Florida, Georgia, North Carolina, Ohio, Pennsylvania and Virginia participated in the survey. Arizona saw the highest opposition with 40% voting against cryptocurrency legalization. The biggest concerns were lack of information about crypto in general, 6 out 10 ten opposed crypto because they didn’t know enough about it.

MAJR Take: Crypto will be the largest bi-partisan issue and topic going into the next election cycle.

Solana Blames ‘Denial of Service Attack’ for Last Week’s Downtime

Solana’s (SOL) network suffered an 18 hour outage last week preventing applications and network users from sending transactions. While, the Solana founders say the blockchain is still in beta, this is a serious security issue for a blockchain with a market cap of over $50 billion. The cause was from a flood of bot traffic trying to take advantage of a token launch, the attack is called a DDOS attack (distributed denial of service attack). Since the attack, the network validators voted to restart the network. The network seems to be back to normal without any reports of loss of funds, however the price has dropped down 18.6% this week, along with the rest of the crypto market.

Avalanche DeFi Platform Vee Finance Suffers $35M Hack

A new DeFi protocol, Vee Finance that launched on new emerging smart contract blockchain Avalanche (AVAX) was hacked for $35M in stolen funds. The lending and borrowing protocol was exploited for 8804 ETH and 213 BTC. This is the second hack against applications on Avalanche and follows a series of other hacks or attacks affecting other applications on other general purpose blockchains like Ethereum, Solana and Binance Smart Chain.

MACROEvergrande Misses Loan Payments to Banks as Bond Deadlines Loom

China’s Evergrande Group, the real estate giant that’s strapped for cash with more than $300 billion in liabilities is a possible concern for market contagion. Investor’s are worried about hidden exposure in what could be China’s Lehman Brother’s moment. The company missed interest payments on Monday to two of their largest creditors. It’s unclear if banks will formerly declare Evergrande in default or provide a loan extension to avoid a possible market collapse hurting China’s economy recovery. The company borrowed about $88.5 billion from banks and financial institutions. Wallstreet banks are putting their faith the Chinese Communist Party and their message to investors is “China has it under control.”

Wall Street’s Message on Evergrande: China Has It Under Control

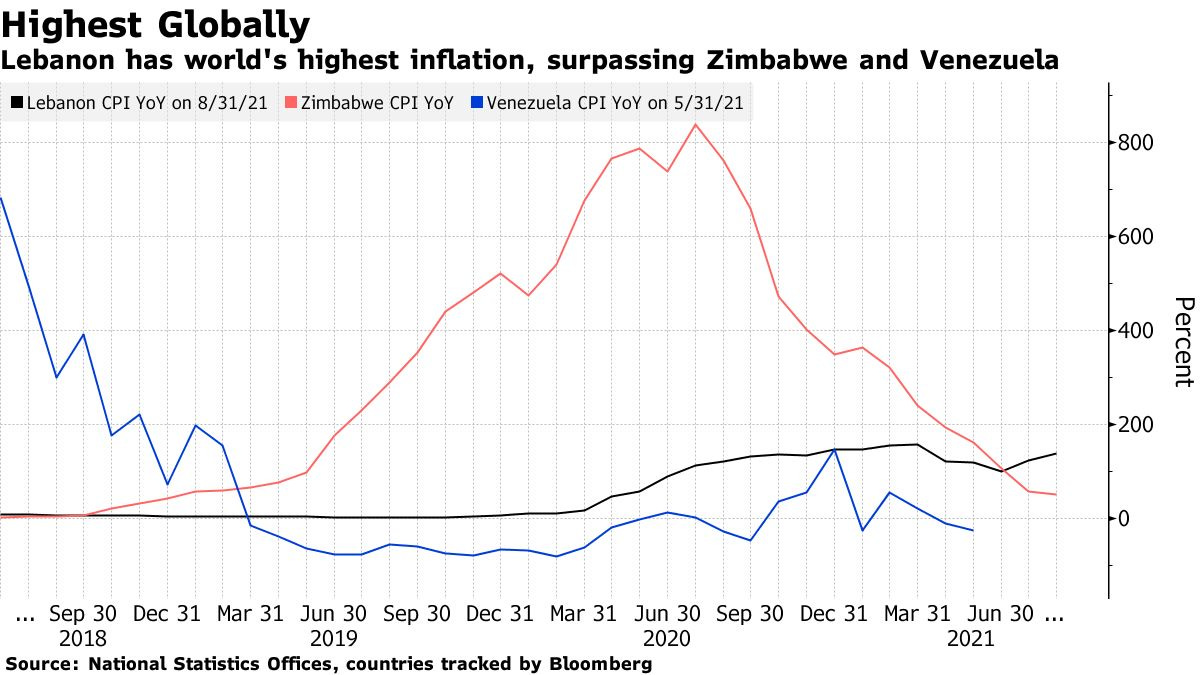

Lebanon’s Inflation Rises to Highest Globally as Crisis Deepens

Lebanon is on the brink of financial collapse and experiencing sky rocketing inflation that has now surpassed Zimbabwe and Venezuela. Consumer prices rose 137.8% in August compared to a year earlier, and to 123.4% in July. Consumer prices rose 10.25% and food prices rose 20.82% from last month. Their currency has lost 90% of it’s value pushing 75% of the citizens into poverty.

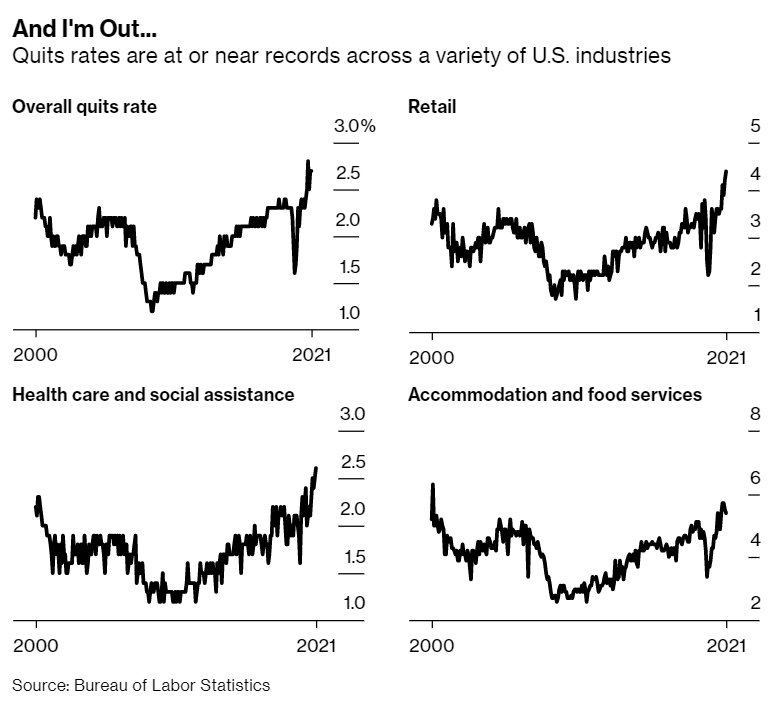

High Quits Rates, Poaching: U.S. Firms Are Plagued by Turnover

The first rule of economics is supply and demand and right now the demand for workers is outstripping supply. Employers are competing for quality employees who will show up on day one and stick around to do the job. Companies desperate for workers across all sectors are experiencing similar treatment from new employees - they don’t show up the first day and they quit only a week into work either going back on unemployment or switching jobs that pay more or that don’t require the vaccine. MGM Resorts will hire 500-800 people during a week, only to lose 300-400 shortly after without notice. They’re calling it “ghosting coasting.” Vaccine mandates that are required for New York City restaurant employees are causing employees to quit to go work in retail and hotel businesses. Employers are forced to attract workers with higher wages, however this has serious ripple effects internally with existing employees wanting increased wages as well and on operational costs and prices. Rising wages on top of supply chain constraints only adds to inflationary pressures - employers have to pay employees more against rising material costs that creates an outcome of less goods for higher prices.

MAJR Take: There’s no doubt that the vaccines are safe and help the economic recovery. There’s been hundreds of millions of vaccinations, the data is clear. However, vaccine mandates and government stimulus / handouts are interfering with the natural forces of markets. This is why central planning doesn’t work and is dangerous. It has unintended consequences and only leads to more harm.

MEDIABIGGEST NFT GAME OF THE DECADE?? Star Atlas Interview 🤯

ESG & Institutional Bitcoin Investment with Kevin O’Leary

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.