MAJR News 051

Bitcoin whales are accumulating a lot of BTC, Layer 1 smart contract race heats up with Avalanche and Hedera fundraise, Solana network see outage after hacker attack, Inflation is uneven in the US

@pixelplanettoday

MAJR NEWS BRIEF

Videos

Lawmakers question Securities and Exchange Commission Chairman Gary Gensler over the regulator’s plans to regulate cryptocurrency markets.

Top Stories

BITCOINMarket Wrap: Bitcoin Rises as Traders Accumulate Positions

Bitcoin technicals continue to improve as it holds support above $46k and on-chain data suggests that bitcoin whales are steadily accumulating larger positions. Supply shock thesis looks like it’s playing out similar to last fall when launching from $10k in September to $33k in January.

Bitcoin’s Blockchain Data Indicates Renewed Institutional Appetite, but Macro Risks Prevail

Whales are accumulating more bitcoin. On-chain data highlights daily transaction volume in the US with transactions over $100k surged to $480 billion on Wednesday, marking a 2-year high. Each one of these transactions are most likely whales and institutional investors removing available coins from the market and locking them into cold storage for the long-term. Addresses with over 1,000 BTC are accumulating, just this month they’ve added 50k more BTC.

Anti-Bitcoin Protests Escalate on El Salvador Independence Day

Thousands have taken to the streets in El Salvador to protest the government and the new bitcoin law. The protests have gotten worse with individuals vandalizing property, including bitcoin ATMs. Bitcoin became legal tender in El Salvador alongside the US dollar on September 7th after majority in congress voted in favor of President Bukele’s bitcoin brainchild. Citizen’s are not required to use the digital asset, however the legal language actually says that merchants must accept bitcoin for all payments.

MAJR Take: Being the first country to adopt bitcoin as legal tender will not be easy and there will be a lot of learnings that come from this move. However, bitcoin has a steep learning curve and it’s still early for the new legislation. It will be interesting to see where the people stand when bitcoin hits $100k.

CRYPTOPolychain Capital, Three Arrows Lead $230M Investment in Avalanche Ecosystem

Avalanche (AVAX), one of the emerging Ethereum competitors raised $230 million from crypto venture giants - Three Arrows Capital, Polychain Capital, CMS holdings, Dragonfly Capital and others. The fresh funds follow a $180 million incentive program offered by the Avalanche Foundation to drive network adoption and DeFi developers to build on it’s lightening fast and cheap network. Avalanche is led by an industry heavy weight founder Emin Gün Sirer and his team from Cornell University. Avalanche is heavily focused on DeFi, but also has the ability to offer things like social tokens, NFTs and other applications that can be built on a general purpose blockchain.

MAJR Take: We’re super bullish on Avalanche (AVAX). Great team, great tech and smaller market cap then competition. Inflation and new supply of tokens is a risk, however it’s fully diluted market cap is still lower than other chains. And, it’s still isn’t on most US exchanges. AVAX token can be found -here.

Hedera Governing Council Approves $5B in HBAR Tokens to Boost Network Adoption

Hedera Hashgraph (HBAR) another general purpose blockchain has earmarked 10.7 billion HBAR tokens to it’s foundation to spur network adoption, equivalent to $5 billion. The tokens will be split 50/50 to the foundation and other initiatives to strengthen development. Hedera uses a different consensus algorithm called the hashgraph which uses the gossip protocol vs proof of work (POW) or proof of stake (POS) to process more transactions. Like most general purpose blockchains, Hedera will be focusing on DeFi, NFTs, gaming and also help with CBDCs (central bank digital currencies). There are currently 9.7 billion HBAR token circulating in market, it’s unclear how this 10.7 billion token supply will hit the market.

MAJR Take: The race for layer 1 dominance is on for these smart contract platforms. Each have an opportunity to gain market share from Ethereum since it’s still so early with this technology and overall adoption. However, investors should try to focus on risk management when considering where to place bets and position sizing. Smaller market cap platform tokens have yet to prove them selves at scale, and could encounter serious security issues, along with increased centralization. This move to earmark new tokens post launch to the foundation, smells like a security too. We will do a write up on Hedera in the near future to explore the technology and underlying mechanics of the hashgraph algorithm.

Crypto.com’s Sports Sponsorship Spree Continues With Esports Team Fnatic

Crypto.com along with other prominent players in the space have been on a tear partnering with sports teams and organization to help spread awareness targeting potential male investors. Crypto.com who has partnered with Formula One, the UFC, the NHL’s Montreal Canadiens, soccer team Paris Saint-Germain F.C. and now professional gaming team Fnatic. Their 5-year $15 million partnership includes uniform sponsorships, braded digital products such as NFTs and crypto education for the organization.

Solana Sputters Back to Life Following Downtime, Network Restart

This week, the general purpose blockchain Solana (SOL) encountered a DDoS (distributed denial of service) attack, which is when hackers attempt to disrupt network activity by flooding it with traffic or fake packets of information. At peak, Solana was seeing 400k transactions per second, which caused validators to stop producing blocks and causing the network to fork as it couldn’t keep consensus. This caused a network outage and required the validators to come together and agree to restart the network. No money was stolen and the network appears to be back to normal. The price of SOL only dropped from $169 to $145, before returning to $156 at press time. Solana peaked at $213 this august and has been the hottest cryptocurrency of the summer, appreciating ~800% from $24 in May.

MAJR Take: We’ve been huge supporters of Solana since it launched last year, however this network outage is concerning and proves a security issue with the network. We’re still very bullish on Solana in the long run, however, we’ve closed out our position waiting for the dust to settle before reentering.However, this doesn’t mean Solana won’t keep trending higher since we’re already back to previous highs before the outage. Please do your own research.

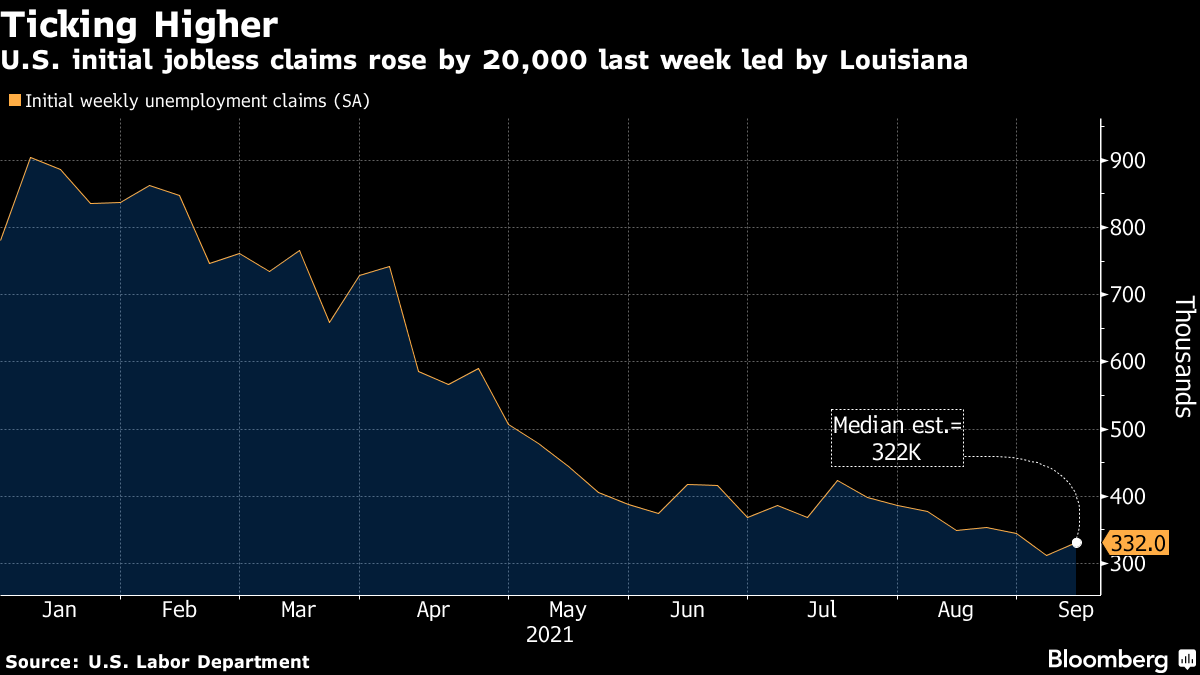

MACROU.S. Initial Jobless Claims Rose Last Week, Led by Louisiana

Jobless claims rose last week despite the overall downtrend and demand for workers with 332k new applications for people seeking unemployment benefits. The increase is largely due to the aftermath of Hurricane Ida’s destruction of the southern coast such as Louisiana.

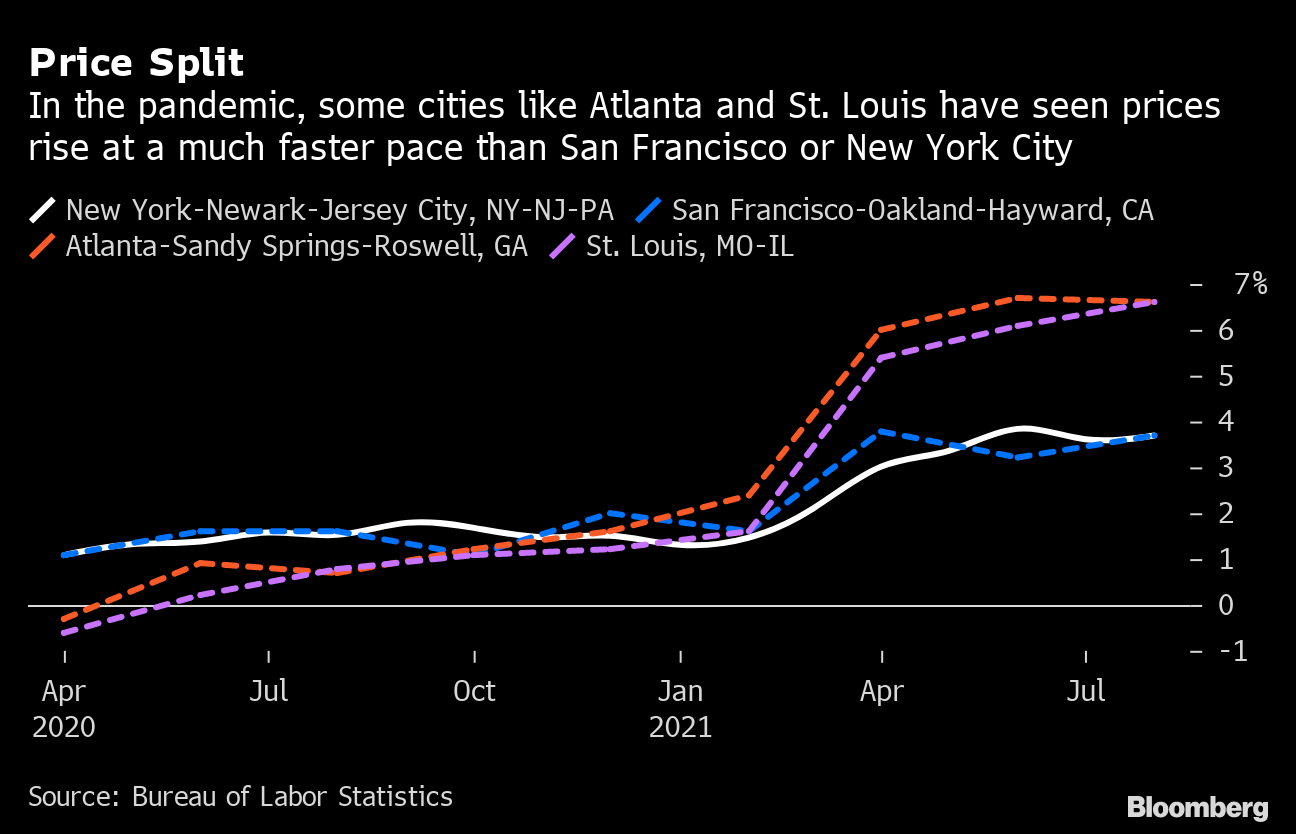

Inflation Soared in Some U.S. Cities, Barely Budged in Others

We’re seeing uneven inflation in consumer prices across the country, which is largely being driven by the large migration away from big cities and into more affordable states and in cities. The sun belt region has seen some of the highest price increases - Tampa, Atlanta, St. Louis and Dallas. More people (demand) are outstripping existing and dwindling supply, enhanced by supply chain issues and higher costs for producers. Atlanta saw a 6.6% increase in prices in August, which is double the rate of San Francisco and New York.

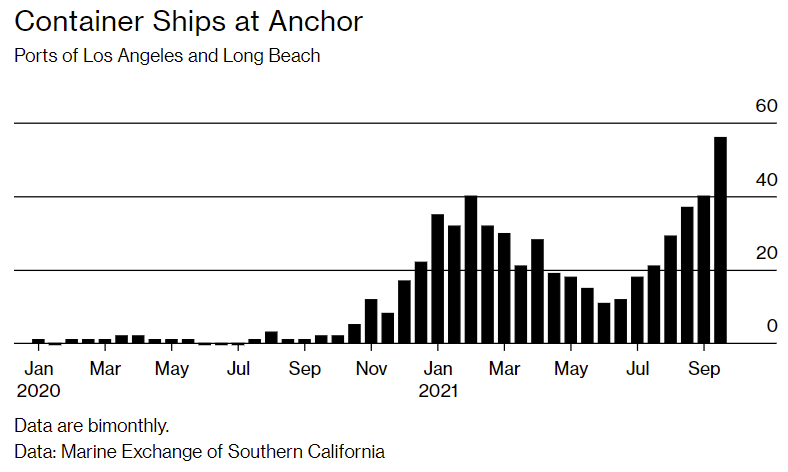

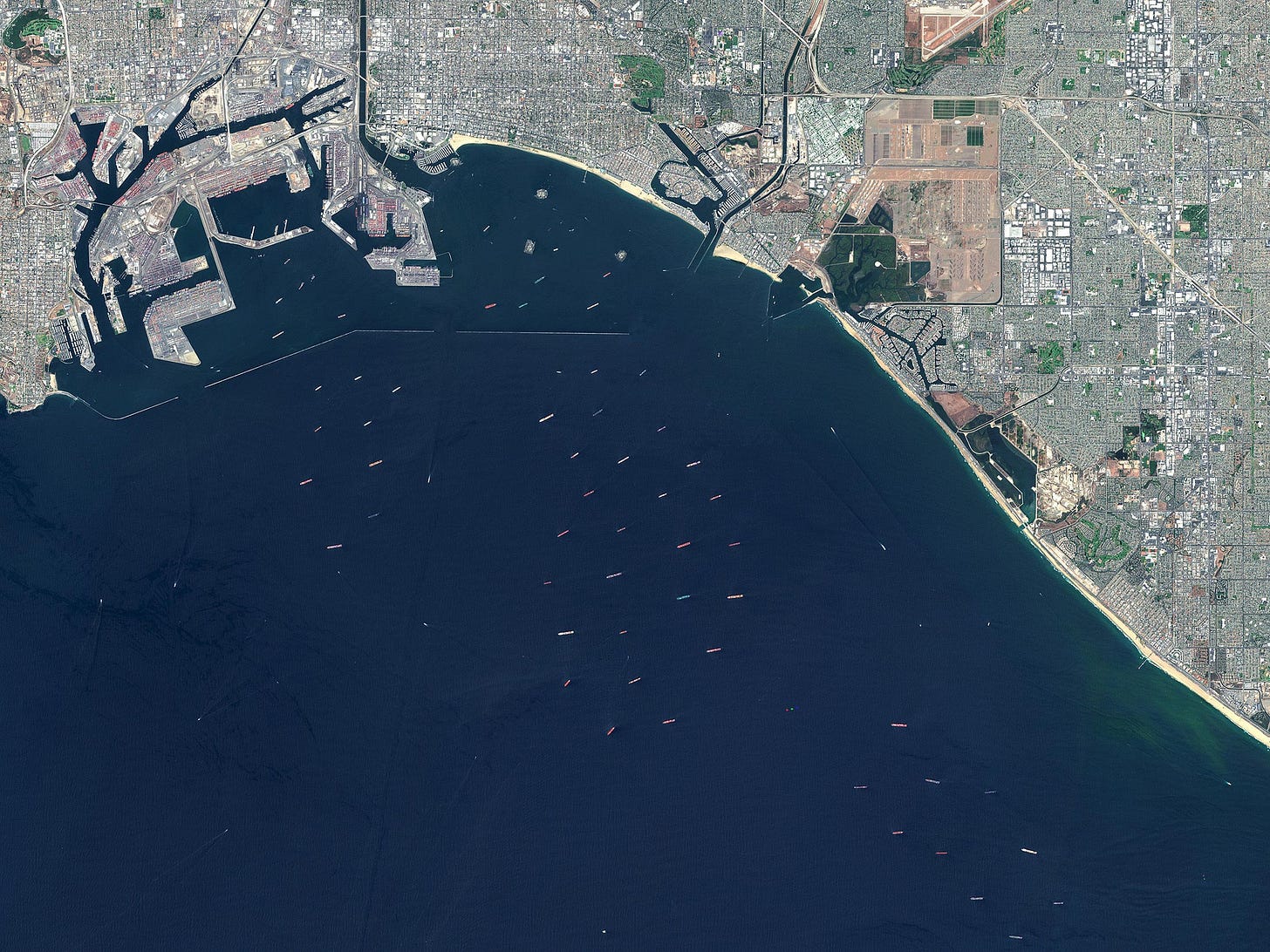

‘Just Get Me a Box’: Inside the Brutal Realities of Supply Chain Hell

Logistics managers are battling the pandemic, a labor shortage, and huge demand to get goods to your front door. Supply shortages on top of supply chain disruptions affect everything from commodities, masks, vaccines, semiconductors, plastics, bicycles, housing materials and equipment, textiles to toys.

There are about 25 million shipping containers traveling on 6,000 ships. These numbers are not enough to keep up with demand as logistic managers fight over available space with soaring shipping prices. These costs trickle down to the consumer. Once, the ships reach land, then comes the unloading and trucking bottlenecks to deliver the products.

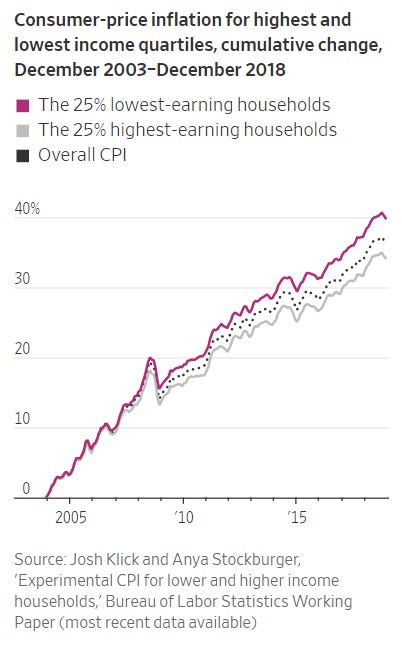

What’s Your Raise Really Worth? Inflation Has Something to Say About It.

Lowest paid Americans, real wages fell 0.5% in August after adjusting for inflation. Even for workers who are finding jobs with higher wages, they’re encountering higher prices in things like cable bills, groceries, dog foods, medical appointments, etc. Used car prices are 31.9% higher than a year ago. Consumer prices rose 5.3% in August from a year earlier. Annual wage growth for 25% of the lowest-earning workers was running at 4.8% in August. But, this isn’t only affecting low income workers, all worker’s pay fell by 1.8% in August, after adjusting for inflation.

MAJR Take: It’s most likely much worse than the above since adjusting for inflation is only taking into account CPI, which is a hand selected measurement of goods used to disguise the real rate of inflation, most likely between 15%-25% given the increase in the money supply.

MEDIASEC Chair Gary Gensler testifies before lawmakers on the plan to regulate crypto — 9/14/2021

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.