MAJR News 050

MicroStrategy buys more BTC, BTC technicals look bullish, SEC Chair Gary Gensler makes his case for increased regulation for crypto in the name of "investor protections," CPI slightly increases MOM

@robindavey

MAJR NEWS BRIEF

Video

Clip from Anthony Pompliano’s Best Business Show details how no one is selling their bitcoin as 90% of Bitcoin holdings did not move last month.

Cathie Wood is Founder, CEO and CIO of Ark Invest, the investment management firm specializing in disruptive sectors. Yassine Elmandjra is an analyst at Ark, and Chris Burniske is the former blockchain lead at Ark and is now a partner at Placeholder VC. We’re incredibly excited to bring Cathie on the podcast for her industry-leading insights and perspective on the innovative investing space.

Audio

Top Stories

BITCOINMicroStrategy adds another 5,050 bitcoin to its balance sheet to bring its total stash of the cryptocurrency to $5.1 billion

Michael Saylor’s, MicroStrategy purchased another 5,050 bitcoin for $243 million. The company now holds over 114k bitcoin, worth ~$5.1 billion. MicroStrategy’s average purchase price now sits at $27,713 per bitcoin. Bitcoin is currently priced at $46,405.

El Salvador’s Bitcoin Wallet Is Used by More Than Half a Million People, President Says

El Salvador’s population is only 6.5 million people and they’ve on-boarded more than 500k people on the government sponsored Chivo wallet, ~7.69% of the population.

11 Countries That Don't Tax Bitcoin Gains (2021)

Belarus

Germany

Hong Kong

El Salvador

Malaysia

Malta

Portugal

Singapore

Slovenia

Switzerland

Bermuda

Bitcoin technicals: Incoming ‘golden cross’ presents potential bottom for BTC price

Bitcoin technicals are looking very good on the charts. Price action has been in a strong uptrend since mid-July and is about to cross moving averages, which is a lagging indicator called the golden cross. Bitcoin price could have bottomed (see below).

Critical levels for support are $42,800 and $44,000. Resistance levels are $47,000 and $50,500. If bitcoin price breaks these levels to the upside there’s not much in the way of new all time highs.

MAJR Take: There has been strong buying activity for months now. Large investors and retail have been accumulating and not selling. These technicals play into the thesis of a bitcoin supply squeeze.

CRYPTOFake news: Litecoin price surges 35% following Walmart adoption hoax

Major news outlets across the United States announced that Walmart would be using Litecoin as a payment option for it’s ecommerce business. CNBC, Reuters and Decrypt all reported that individuals can now pay using Litecoin at Walmart. This news derived from a single press wire out of GlobeNewsWire went unchecked by media outlets and caused Litecoin to surge in price, reaching about $237.

MAJR Take: Every morning I read mainstream financial news and watch the crypto coverage on CNBC and it’s god awful. They don’t understand the space or the technology. They’ve misguided investors for years. Anyone who get’s their crypto info diet from mainstream media will either be months or years to late to the advances in the space or flat out deceived as media’s incentives don’t align with this new and emerging financial technology. They don’t even check their sources.

Lawmakers to grill SEC Chair Gensler on crypto during Senate hearing

SEC Chair Gary Gensler will face lawmakers today to discuss the agency’s plan to regulate crypto. He put out his prepared remarks yesterday and they’re pretty negative calling crypto operating outside of regulatory framework and the wild west. Gensler didn’t even have crypto on his priority list when he came into office, now seems to be solely focused on it. Gensler, who keeps framing his perspective through the lens of investor protections is focused on exchanges listing tokens that are unregistered securities, issuance of tokens that are securities, stablecoins (which he calls “stable value coins” an attempt to compare them to stable value funds which are under SEC regulation), crypto lending and trading platforms, crypto derivatives and custody of crypto assets.

MAJR Take: First, Gensler is not a friend of crypto. He’s a political insider who made his net worth of $180 million from working at Goldman Sachs. Second, the SEC is not equipped to deal with millions of investors performing financial services such as lending. They deal with companies not people. Finally, investor protections is a façade for banking protections. Our current financial system is based on fractional reserved banking and debt. It’s the end of the line for this sector with the emergence of crypto and when individuals can earn more than 8% APY lending digital assets with less and less risk vs. a banking savings account or bond yielding less than inflation. It makes banks obsolete. Investors have been making a killing in crypto, and he’s claiming investor protections. Read between the lines folks, the SEC, the Treasury, the Fed and the White House are loosing control of their monetary monopoly and they’re willing to hurt financial innovation in the US to keep incumbents in power as long as possible. Sorry for the rant, it’s frustrating to see the US afraid of change and a continuation of bad decisions from our nation’s leaders. They’re not leading at all.

BlockFi CEO Wants SEC to Weigh In on Crypto Lending

CEO of BlockFi, Zac Prince said we’re not going to change our practices around crypto lending because of what New Jersey or Texas thinks, but the regulation needs to come from the SEC (Securities and Exchange Commission) and OCC (Office of Comptroller of the Currency). BlockFi has been in hot water with several states over their crypto interest earning accounts that drive high yields for investors from lending out THEIR crypto. The problem here lies with the definition of a security. Coinbase is facing the same issue with threats from the SEC over it’s new Lend offering. SEC is calling these practices a security similar to a bond, however it's very different than a bond. A bond is when you’re purchasing debt in exchange for interest or income. Crypto lending is when investors take their already owned property and lend their property out for a yield, similar to a banking deposit. When we leave our funds in a bank, they lend out our funds to drive a yield, this is not a security but standard financial services.

MAJR Take: Same rant as the above, but with an emphasis on the SEC trying to change the definition of a security to protect broken and outdated and non-yielding banking practices. It’s not a bond. Investors already own their property and are choosing to lend it out just like they do with a bank. It’s clear what’s happening here and it’s not in favor of the people. Right now investors are starving for yield because cash is a liability that’s being destroyed by the government, government bonds no longer beat real inflation with negative real yields,high yield bonds are driving less high yield and have gone negative, and they’re increasing taxes across the board and threating to tax unrealized gains… What are investors supposed to do with their money? Can’t leave it in the banks. Can’t go into stocks that are at all time highs and only held up by stimulus. Real estate is at all time highs partly due to the Fed’s MBS purchase program… what’s left? Emerging markets? China? Venture? Everything is super far out on the risk curve and digital assets are the only place that have growth and opportunity on their side. Once again, sorry for the rant. This drives me nuts.

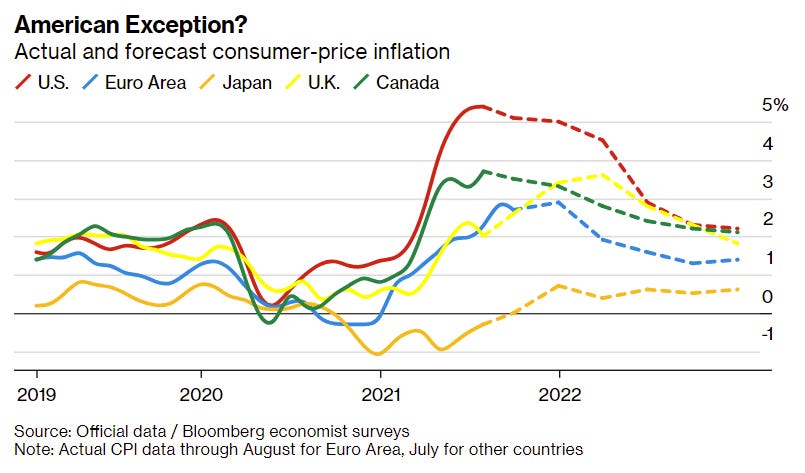

MACROU.S. Consumer Price Growth Cools, Smallest Gain in Seven Months

Consumer Price Inflation (CPI) rose slightly in August compared to July’s numbers with an increase of 0.3%. However, CPI is up over 5.3% from a year earlier. A Federal Reserve survey showed that consumers expect inflation to at 4% over the next three years. In August, airfares fell 9.1% and used cars were down 1.5%.

Evergrande’s Cash Problem is Now Beijing’s Political Problem

China’s most indebted property developer China Evergrande, warned of possible default at the end of August is now facing political protests on top of their massive liquidity crisis. The company has over 215.8 billion in yuan liabilities, mostly coming from home buyer presales. Presales are a common practice in China and a core funding method for developers. Home buyers pay for apartments / homes that are yet to be built. These home buyer’s life savings are now liabilities for the company, and China’s distressed real estate market is producing the cash needed to pay creditors or build these new homes. This could be China’s Lehman brother situation, at at time when China has been trying to curb it’s backstopping policies over the last year. The question now is how much financial turbulence will this leveraged company have on investors and the economy.

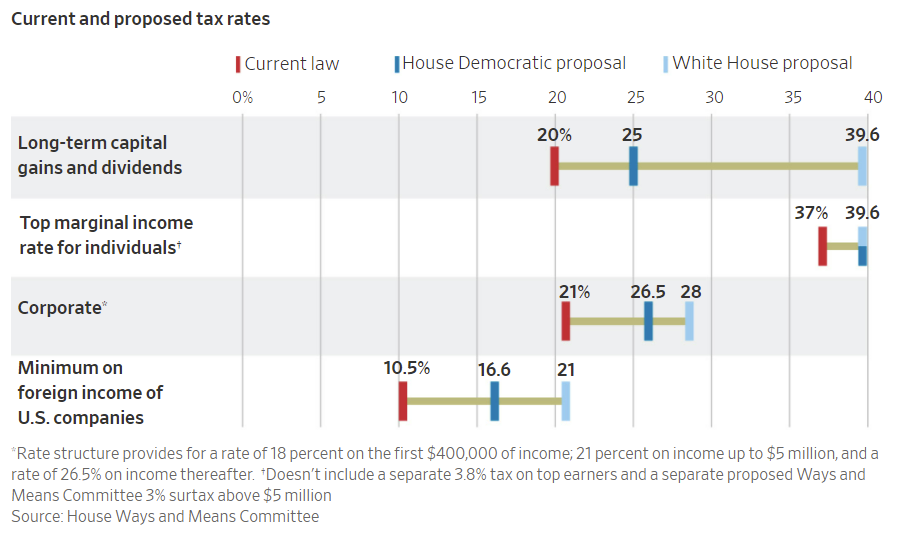

Democrats Release Details of Proposed Tax Increase

House democrats proposed tax increases include a plan to increase taxes on corporations, investors and high income business owners. The plan includes an increase on the top corporate tax from 21% to 26.5% with a 3% surtax on people making over $5M and a raise on capital gains tax. The funding would go to $2 trillion towards expanding the social safety net and combating climate change - expanding Medicare, increasing renewable energy tax breaks, creating a national paid leave program, among other things.

MEDIANO ONE Is Selling Bitcoin. Here Is Proof

Banks are SCARED | Cathie Wood, Chris Burniske, Yassine Elmandjra

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.