MAJR News 049

Ukraine moves to legalize crypto in the country, More mining rigs come to the US from China, Tom Brady is all in on crypto with FTX, Sketchy SEC threatens Coinbase with lawsuit, Solana hits new ATHs

@starfury

MAJR NEWS BRIEF

FTX. You in?

Videos

Had to put Tom Brady front and center on today’s newsletter. Crypto is just getting started. You in?

Preston Pysh talks to macroeconomist, Lyn Alden about the global supply chain impacts & Bitcoin.

Top Stories

BITCOINBitcoin-Hungry Ukraine Moves to Legalize Cryptocurrency

Ukrainians are among the top people who have heavily adopted cryptocurrencies like bitcoin and now the country moves to make crypto more legal in the country. The ministry of digital transformation has drafted legislation that would allow crypto exchanges to officially operate in the country. Crypto has been in a legal gray area within the country, but if the bill is passed into law it would allow banks to provide financial services to crypto companies, similar to the banking guidance in the US, along with legal protection against crypto theft.

Bitmain to Send 56,000 Antminers to US State of Georgia Under ISW Deal

Chinese mining rig maker Bitmain will send 56k Antminers to the state of Georgia in a deal with ISW Holdings and Bit5ive. The mining facility in Georgia, called POD CITY will have 20 megawatts of power by October and ISW plans to run the facility at 200 megawatts by October 2022 which will cost roughly $62 million. ISW currently operates 700 rigs in a mine in PA.

Bitcoin, Ether Steady After SEC Threatens to Sue Coinbase: Markets Wrap

Bitcoin and Ethereum hold strong after SEC threats to sue Coinbase if they launch their high yield interest product on digital assets, Lend. However, Coinbase stock slid 3.2% on the news.

CRYPTOCoinbase Threat Shows There’s a New Crypto Sheriff in Town

Coinbase CEO, Brian Armstrong took to Twitter this week to share what’s happening behind the scenes with the SEC. Coinbase intends to launch an interest earning product for crypto asset holders, called Lend. Similar to the interest earning accounts for BlockFi, Gemini, Celsius, Crypto.com, and many others. However, given that Coinbase is the first publicly traded crypto company and the largest exchange in the US, they wanted to let the SEC know and do everything they can do be compliant. However, the SEC said they cannot and that a lend product is a security, but didn’t share additional detail about why lending is a security and why others in the industry can creating uneven rules for companies. This sparked further conversation in the crypto community about how regulation is coming and the fact the crypto community needs to go on the offensive now, rather than play defense.

Mark Cuban Urges Coinbase to 'Go on the Offensive' Against SEC

MAJR Take: The SEC is working with the Biden administration, the Fed and the Treasury. Gary Gensler is not a friend of crypto, this should be absolutely clear. They are not equipped to regulate this technology that can be enabled by millions of people in the country. They were meant to regulate companies, but now individuals can lend and make better yield than banks provide. The world has changed and so has our financial system. Therefore, they will use blunt force to slow things down, even if it hurts the US in the long run. The fact that we’re still using 1940s regulation such as the Howey Test to determine modern day internet and encryption technologies is a joke. However, crypto assets held on exchanges or at least in interest earning accounts are at risk and we recommend self custody as regulators get more involved.

7 Hottest NFT Trends Happening Right Now

Solana Flips XRP as SOL Outpaces Bitcoin, Ethereum Crash Recovery

Solana (SOL) is now the 6th largest cryptocurrency by market cap and is up over 12% in 24hrs bouncing back from a quick market correction faster than any other top coin. Solana is a smart contract blockchain and Ethereum competitor that offers lower fees and faster transactions. It’s been surging with other Layer 1s, but is definitely having a moment as more users, developers and use cases keep moving to it’s network. It’s up 351% in the last month alone.

MAJR Take: We’re very bullish on Solana and it’s emerging ecosystem. While the price of SOL has sky rocketed, we should focus on it’s market cap ~$60B which is $22B short of Cardano and $354B short of Ethereum…and we’re still SO early for all of these platforms. However, as we get later in the cycle it’s good to be cautious around your position sizing. Solana is a long term hold regardless, and it’s ecosystem tokens are also enjoying strong price action. You can find a list of projects working with Solanahere. We will do a MAJR Coins article breaking down it’s ecosystem shortly.

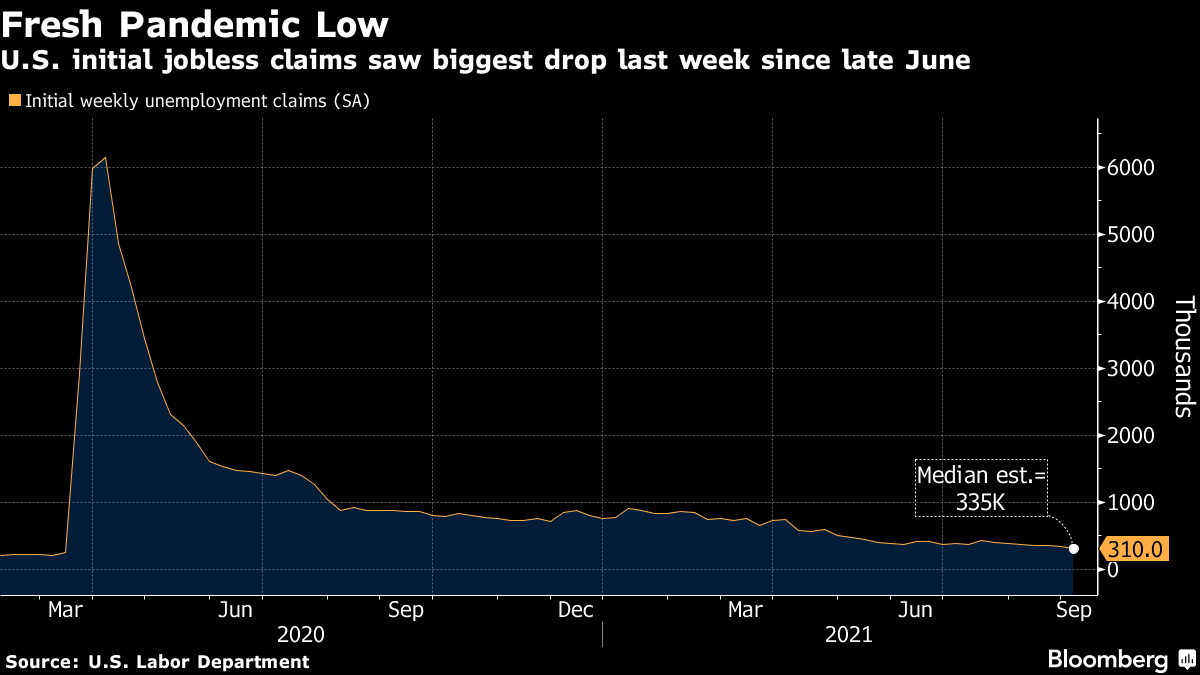

MACROU.S. Initial Jobless Claims Fall by Most Since Late June in Week

Applications for unemployment benefits dropped the most last week since June. Unemployment claims were an estimated 335,000. Claims are still higher than pre-pandemic and they’ve been steadily higher since lockdowns. They’re are still a lot of people out of work, not looking for work and dropping out of the labor force (unaccounted for). This report follows last month’s labor report which had the lowest amount of new hires than earlier months. Economists say the recovery is still underway, but slowing.

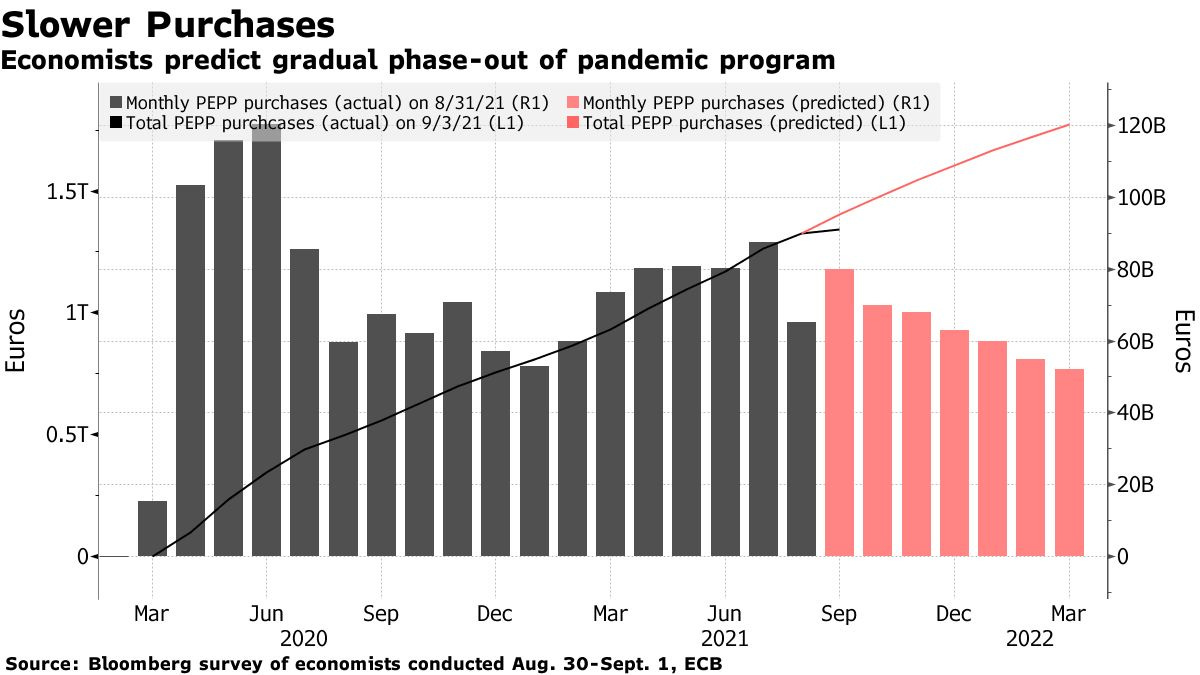

ECB Slows Pandemic Bond Buying as Europe’s Economy Rebounds

The European Central Bank slightly reduces its pandemic bond buying program from it’s 80 billion euros ($95 billion) monthly purchases. However, they said they will continue with it's 1.85 trillion euro program running until March 2022. Officials said inflation will average 1.5% in 2023, below it’s 2% target.

Traders Rush to Dump China Tech Stocks as Gaming Targeted Again

Chinese technology stocks traded lower after they targeted gaming companies saying that too much time playing video games is a social harm to society. China government officials summoned companies Tencent and NetEase to remind them of their social obligations and the harm of putting profits first. Officials said that they would halt approvals for new online games. The Hang Seng Tech Index fell 4.5%, the most in six weeks.

China Factory Inflation Surge to Add Pressure to Global Prices

China’s factory gate inflation accelerated to a 13-year high putting increased pressure on global prices on top of the commodity boom, increased shipping costs and uneven economic recovery from the pandemic. Producer prices in China rose 9.5% in August from a year earlier. US data due next week could show CPI rose by 5% for the third month in a row.

MEDIABTC042: Supply Chain Impacts w/ Lyn Alden

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.