MAJR News 048

Bitcoin flash crashes 10% in a matter of hours, Bitcoin is officially legal tender in El Salvador today, ETH approaches new all time highs breaking $4k before crashing with market, SOL makes new ATHs

@escooler

MAJR NEWS BRIEF

Videos

Solana is emerging as a competitive Layer 1 platform, promising scalability and a growing ecosystem. Join community thought leaders Santiago Santos and Konstantin Lomashuck as we assess the Solana Value Proposition. How important is decentralization? Why build on Solana? Can different L1's coexist? Does it seek to compete with mainnet Ethereum or Layer 2 scaling solutions?

In this interview, Peter McCormack talks to Yan Pritzker, co-founder and CTO of Swan Bitcoin. They discuss his family fleeing socialism, onboarding 10 million bitcoiners, and building for global bitcoin adoption.

Top Stories

BITCOINBitcoin Now Legal Tender in El Salvador, Marking World First

Today on September 7 2021, Bitcoin is now officially legal tender in El Salvador, only three months after the legislation was passed. Bitcoin will be used alongside its other national currency, the US dollar. The government has set up a $150 million fund to help citizens opt into the more stable unit of account by automatically swapping BTC for USD every time a citizen wants to sell. In response to the historic day, crypto enthusiasts around the world have been buying $30 worth of bitcoin. El Salvador President Nayib Bukele has tweeted that the country now holds 400 bitcoin after a 200 BTC purchase on September 6th. He said the country will be buying much more BTC in the future. The transition will obviously be a learning curve for the country. For example, the IMF, World Bank and financial pundits have heavily criticized the move for adopting BTC as legal tender and the government sponsored open and digital wallet, Chivo has encountered some issues rolling out.

German Asset Manager Union Investment Plans to Bring Bitcoin to Its Private Wealth Clients

German asset manager Union Investment plans on adding bitcoin to a number of their funds available to private investors. Max exposure will be limited to 2% which is in line with the more conservative allocation for a portfolio. The fund reports to have $386 billion in AUM. Bitcoin adoption in Germany got easier in July when the country passed a law allowing special funds to allocate up to 20% of their capital into crypto.

Bitcoin price plunges below $43K in minutes in crypto market rout

A major bitcoin sell off brought bitcoin from $51k price levels to $43k, a 10% drop or $300 billion in less than 24 hrs. The selling had serious volume and has been attributed to miners and bitcoin whales selling at resistance level and the 61.8% Fibonacci ratio, which is a popular technical indicator.

Visa reportedly aims to integrate Bitcoin payments in Brazil

Fernando Teles, the CEO of Visa Brazil introduces the idea of adopting tokenized payments and an API designed to bridge the gap between traditional financial institutions and crypto services. Visa already offers 180 currencies and has 170 million global customers. They’ve already proven to be one of biggest first movers working with a number of crypto credit cards to help facilitate payments using crypto, along with buying an NFT for $150k.

CRYPTOEther Passes $4K for First Time Since May, Nearing All-Time High

Ethereum (ETH) is back to approaching new all time highs as it breaks $4k for the first time since May. Ethereum, the second largest blockchain by market cap has been the home of non-fungible tokens (NFTs), decentralized finance (DeFi) and social tokens. At press time, the token has seen a swift drop from its highs finding support ~$3,500. The general purpose blockchain underwent a major upgrade in August that burns a portion of the transaction fees in ETH, ultimately making it a more scarce digital asset by decreasing the overall supply. Since the upgrade the protocol has burned approximately 225,575 ETH or $786 million. Ethereum is second to bitcoin for major institutional adoption, but faces serious competition from other emerging blockchains like Solana (SOL), Polkadot (DOT), Avalanche (AVAX) and others.

Former Libra Director Joins Polkadot Builder

Bertrand Perez, the former COO the Facebook-backed Diem stablecoin project and managing director of the Diem Association has joined the Web3 Foundation as their COO. The Web3 Foundation is the leading company handling the development of the Polkadot (DOT) blockchain, an Ethereum competitor. This is not the first time the Diem project leaders have departed the Facebook led initiative which has encountered serious government headwinds since the announcement. Dante Disparte, Diem’s head of policy left to join Circle in April this year.

Solana Hits All-Time High as Coin Rises 14% in 24H

Solana (SOL) the rapidly emerging Ethereum competitor and smart contract blockchain that promises faster and cheaper transaction times has hit another all time high, even against a sudden market pull back. The SOL token hit $193.87 on CoinGecko with a $56 billion market cap. Solana was just launched last year and is now up 70,632%. It’s developed by former Qualcomm employees and uses a novel consensus algorithm called proof-of-history which verifies transactions by using a cryptographic clock. Solana’s started to grab more attention with a $330 million raise to incentive DeFi applications this year and has been backed by crypto leader and entrepreneur Sam Bankman-Fried, the 28 year old billionaire CEO of exchange FTX. FTX just launched NFTs on Solana.

MAJR Take: We’ve been covering Solana’s rise well before it’s rapid price acceleration and included it one of our MAJR Coins articles,here.

Crypto Community Advises NBA Star Steph Curry First Steps in Crypto

Steph Curry, the NBA super star and world champion for the Golden State Warriors has entered the crypto space. He alerted crypto twitter that he’s just starting to get into the game and asked for advice. His tweet has been liked over 75k times. His profile is also a picture of an NFT from the Bored Ape Yacht Club.

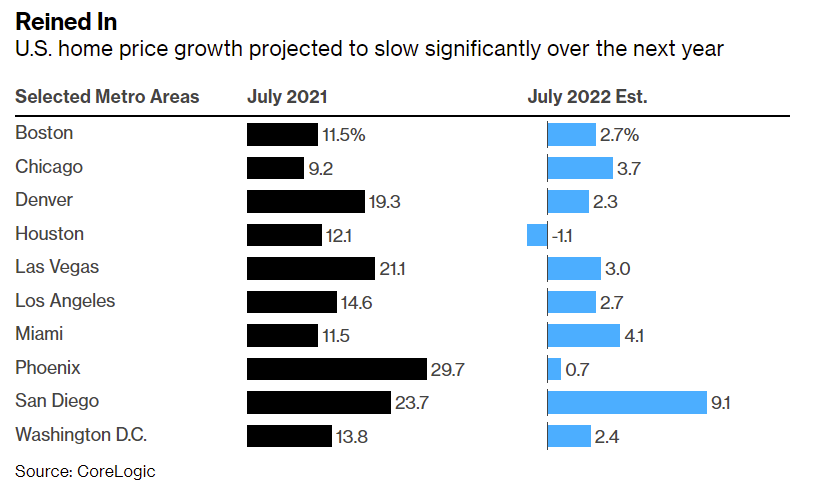

MACROU.S. Annual Home Prices Gain a Record 18% in July

US home prices continue to accelerate and hit a new record in July, rising 18% YOY. This is the largest jump in prices in over 45 years, with a month over month increase of 1.8%. This is largely due to demographics as an older Millennial generation is moving out of big cities and buying their first single family home at a time when supply is super tight. New home supply is tight due to extremely low mortgage rates, increased renters, large financiers and institutions snapping up property and supply chain issues hampering the ability to build. It’s estimated that the supply constraints will take 5-10 years to resolve itself.

U.S. Ports See Shipping Logjams Likely Extending Far Into 2022

US shipping ports have emerged as one of the many bottlenecks facing supply chains and the ability for companies to source and refill inventories. In August, major US ports handled 2.37 million containers which was the most of any month since 2002. Hundreds of thousands of containers are stuck waiting on ships or stacked at terminals waiting to be unpacked and moved. Increased delays are due to shortage of workers and drivers. There’s currently more than 40 ships anchored off the coast waiting further direction. Before than pandemic, it would be rare for a ship to be waiting anchored off the coast.

Jobs Report Likely Derails Case for September Fed Taper

Employers added 235k jobs in August which is well below economist’s estimates and previous averages of more than 876k jobs in May and July. While, the recovery seemed well underway, this jobs report and the surging Delta variant may be what’s needed to keep the Fed’s foot on the gas and table the possibility of tapering the Fed’s monthly bond purchases, $120 billion. Fed Chair Jerome Powell and other economists believe that the September jobs report will be the next indication of where to take monetary policy for the rest of the year and beyond.

MEDIAEverything you need to know about Solana | Santiago Santos & Konstantin Lomashuk

Bitcoin Mass Adoption with Yan Pritzker

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.