MAJR News 047

Bitcoin breaks and tests $50k resistance again, More politicians embrace crypto for votes, Cardano gets one step closer to launching smart contracts, Bond yields could go higher as central banks taper

@gifmk7

MAJR NEWS BRIEF

Video

Preston Pysh interviews Bill Barhydt, Founder of Abra, a Bitcoin borrowing and lending platform. They talk about policy, banking, building infrastructure, and much more.

Top Stories

BITCOINBitcoin Holds Support, Testing $50K Resistance

Bitcoin breaks $50k again, the second time in the last week before previously retreating back to $46k support. Bitcoin is testing $50k resistance with next resistance levels at $55k and $47,500 as support. Bitcoin is approaching over bought territory on the 4 hour RSI (relative strength index). We’re seeing slight bearish divergence going into resistance levels as volume is decreasing.

MAJR Take: It feels like bitcoin could see a $10k candle any moment.

New York Mayoral Candidates Turn to Crypto for Votes

More politicians are looking to crypto to increase their platform and galvanize votes and it’s happening across party lines. New York Mayoral candidates Eric Adams (D) pledged to turn New York into the center for bitcoin, which was part his larger push to modernize the city. Andrew Yang (D) formal presidential candidate and mayoral candidate for New York has stated that he wants to make New York the hub for bitcoin and other cryptocurrencies. Yesterday, Curtis Silwa (R) another New York mayoral candidate tweeted his pro-bitcoin position. Mayor Francis Suarez of Miami, FL has been leading the pack of pro-bitcoin politicians and has already tried to incentivized bitcoin miners to come to Miami for cheap electricity and has even launched the first city coin, MiamiCoin (MIA).

“As New York City Mayor, I will make NYC the most cryptocurrency-friendly city in the nation. Property taxes, fines, and fees will be payable in crypto…We will open more crypto ATMs and incentivize businesses to accept crypto. We must modernize our economy and make it accessible for all,” said Silwa.

IMF Repeats El Salvador Bitcoin Warning as Country Launches $150M Adoption Fund

The IMF and the World Bank have again issued warnings to El Salvador and other countries moving to adopt bitcoin as legal tender. El Salvador made bitcoin legal tender this past summer, which is set to go into effect in the coming weeks. The country’s congress has prepared a $150 million fund to help get the initiative off the ground and allow citizens swap between BTC and USD. It’s interesting how such a small country who’s GDP is only $6 billion is drawing global attention from the two biggest fiat driven international institutions.

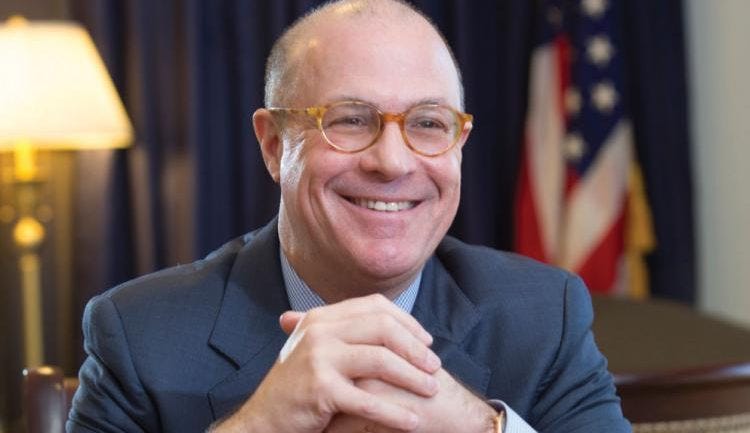

Former CFTC Chair Giancarlo Exits BlockFi Board as States Crack Down on Firm

Former CFTC Chair Chris Giancarlo has stepped away from BlockFi as a board member at a time when BlockFi has come under fire from state regulators for their BlockFi Interest Accounts (BIA). BlockFi, who recently raised $350 million in a Series D valuing the company over $3 billion is being accused of breaking security laws by attorney generals from New Jersey, Alabama, Texas, Vermont and Kentucky. CEO Zac Prince sent an email to customers stating that the New Jersey Bureau of Securities has further postponed the effective order to September 30th reassuring that all BIA funds are unaffected until further notice.

MAJR Take: If you’re a BIA customer, it may be a good idea to move your digital asset to self custody until this scenario is cleaned up.

CRYPTOCardano Launches Smart Contracts on Testnet, Pushing ADA to New Highs

Smart contract platform Cardano (ADA) has finally launched it’s first smart contracts on it’s testnet, not mainnet and the price has surged to new all time highs at $3.09 with $100 billion in market cap, making it the third largest cryptocurrency. The price has rallied for the anticipated hard fork that would allow anyone to launch smart contracts on the platform.

MAJR Take: We’re cautious with the Cardano protocol. It’s market cap is high for a platform that doesn’t have one active smart contract or application on mainnet. It’s a very crowded and competitive space for layer 1 smart contract platforms, and there’s more activity happening with other layer 1s with smaller caps (Solana, Avalanche, Terra, Polkadot). However, we’ve completely missed Cardano’s rise…but we also missed Dogecoin’s price appreciation. We take a fundamental approach to investing in the space and Cardano is overvalued in our humble opinion. Please do your own research.

Internet Computer to release 10,000 free NFTs in debut drop

Every Ethereum competitor is launching their own version of random generated NFTs, CryptoPunks. The Internet Computer which is one of the latest smart contract platforms that’s attempting to replace the entire IT stack with it’s protocol and hardware infrastructure play partnered with NFT project, ICPunks to release their first foray into the NFT space. The two projects are releasing 10k free NFTs in their debut. Users can try to claim their NFTs here.

Blockchain streaming platform Audius announces Solana NFT integration

The blockchain music streaming platform Audius (AUDIO) announcement an NFT integration with emerging smart contract platform Solana (SOL). NFTs are largely based on Ethereum (ETH) but that technology is being reproduced across all the emerging general purpose blockchains. NFTs have taken the crypto by storm centered around collectibles and digital art, but the technology as infinite use cases. One being distribution of music streaming royalties, which could be on the horizon for growing Audius platform, however they’re currently focused on collectibles with the most recent announcement. Audius also announced a partnership with music video platform TikTok.

DeFi Tokens Aave, Uniswap Rally as Ethereum Scaling Solution Arbitrum Launches

Ethereum layer 2 scaling solution Arbitrum has launched it’s tightly controlled beta version, which will be using a technology called Optimistic Rollups. The technology reduces congestion on the Ethereum mainchain by processing transactions on a trusted second layer before batching them onto the mainnet for settlement. DeFi giants like Uniswap (UNI) and Aave (AAVE) have already started exploring the technology that will hopefully create a better user experience due to faster cheaper transactions. They’ve seen their token prices increase with the announcement.

MACROBill Gross Says Bonds Are ‘Investment Garbage’ Amid Low Yields

The once known “Bond King” and PIMCO co-founder, Bill Gross wrote on his website that bonds are investment garbage due to low yields and investors are guaranteed to lose money. The 10-Year Treasury traded at 1.29% this morning, and Gross said they could be trading at 2% or 3% within a year. Bonds yields which trade opposite of price could be in serious trouble once the Fed scales back it’s purchase program who’s been buying nearly 60% of all net US Treasury issuance. Gross even alluded that stocks could be the next investment grade garbage if earnings don’t see double digit performance.

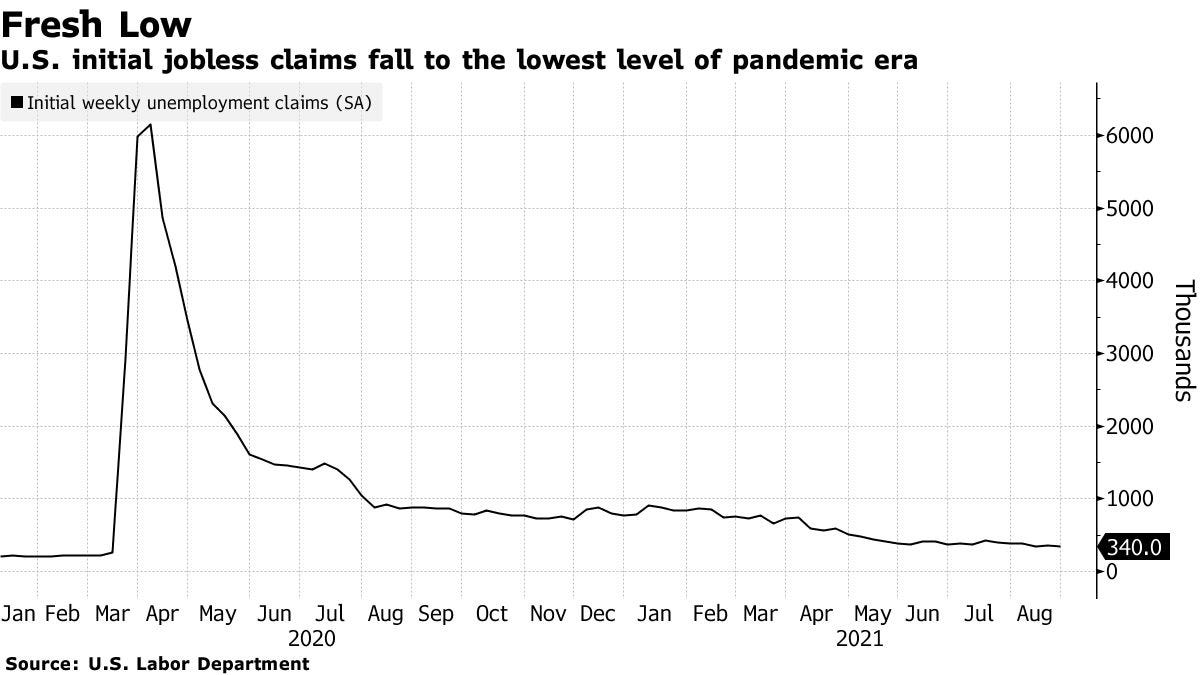

U.S. Initial Jobless Claims Decline to Fresh Pandemic Low

Applications for U.S. state unemployment benefits fell last week to a fresh pandemic low amid a recovering economy. Initial unemployment claims in regular state programs fell 14,000 to 340,000 in the week ended Aug. 28, Labor Department data showed Thursday. The median estimate in a Bloomberg survey of economists called for a slight decrease to 345,000 new applications.

European Bond Yields Rise on ECB Tapering Bets

Investors are betting that rising inflation and an ECB taper could be bearish for bonds and could send yields higher. Core inflation reached 1.6% in July and went even higher in August reaching 3%, which was the highest since 2012. The ECB has been the main buyer snapping up all of the government bonds issued in 2020. This trend has continued in 2021 and economists think the ECB will follow similar direction to the Federal Reserve as it relates to the timing of their tapering program.

India’s Economy Is Healing but Battered by Covid-19 Waves

India’s economy is growing at a record pace. It’s GDP grew 20.1% in the latest quarter. This growth drastically differs from one of its worst recessions a year earlier grappling with Covid lockdowns. While, the country limited it’s lockdowns this year, unemployment and local lockdowns could drag on the country’s recovery, especially as global trade as slowed down hurting factory output. The country has estimated 42% employment rate, which shakes out to an estimated 550 million workers growing at 2% per year. However, unemployment is an issue and it’s starting to bubble up as social protests are springing up across the country. The country expects to have 60%-65% of the total population vaccinated by the end of this fiscal year. Of the 1.3 billion people, an estimated 10% are fully vaccinated as of August 30th.

MEDIABTC041: Bitcoin Banking and Infrastructure Growth

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.