MAJR News 046

Bitcoin is rangebound btw $46k-$50k, DeFi race heats up on Layer 2s, Genesis Digital Assets buys 20k bitcoin miners, $510M ETH has been burned, SOL breaks top 10 cryptos, Home prices rise 18.6%

@gifmk7

MAJR NEWS BRIEF

Video

In this interview, Peter McCormack talks to Parker Lewis, Head of Business Development at Unchained Capital. They discuss the fraying of society’s fabric, money printing and the wealth gap and why politics are ineffectual.

Top Stories

BITCOINGenesis Digital Assets Buys 20,000 Bitcoin Mining Rigs Amid US, Nordic Expansion

Genesis Digital Assets, an American mining company has purchased 20k bitcoin mining rigs from Canaan, a Chinese crypto mining and chip manufacture. Genesis has the ability to purchase up to 180k more rigs in the future. Genesis’s mission is reach 1.4 gigawatts by the end of 2023. In July 2021, the company made up over 2% of the network hashrate. The Chinese crypto crackdown has been a real and meaningful migration of miners outside of China and into places like the United States. Chinese hashrate has gone from ~65%-80% in April’21 to just 46%. This is bullish for bitcoin and the United States, and could go down as the biggest strategic geo-political and economical blunder in China’s recent history.

New Round of Protests Against President Bukele's Bitcoin Law in El Salvador

El Salvador and pro-bitcoin President Bukele is facing opposition from the general public as they took to the streets to protest the recently passed bitcoin bill legalizing the digital asset as legal tender alongside the dollar. This isn’t the first time the current administration has faced backlash about the expedient legislation. The opposition party has filed lawsuits against the bitcoin law and in July, citizens protested outside the Legislative Assembly. While, the current bitcoin bill has language forcing merchants to accept bitcoin for purchases, the President has stated that accepting bitcoin is not mandatory. The law goes into effect in under a week. A recent survey shows that 61% of respondents said they won’t accept bitcoin as legal tender. The whole world is watching El Salvador, and it’s most likely going to be a bumpy ride as the learning curve is steep.

El Salvador to Create $150M Bitcoin Trust to Facilitate Exchange to US Dollars

Bitcoin Rangebound, Holding Support Above $46K

Bitcoin is rangebound between $46k support and $50k resistance. Bitcoin has rallied over the last month and we’ve seen aggressive accumulation happening across all investors - retail to whales to institutions. It’s approaching oversold conditions on 4hr chart against the RSI (relative strength index) indicator. If $46k support breaks, next support level is $42k. However, there’s only so much accumulation that can happen without seeing an aggressive move to the upside as supply and demand dynamics take over.

MAJR Take: When bitcoin is in a bullish trend and then goes rangebound, we generally see altcoins take off, which is what’s happening right now with top projects. Be cautious as we’re entering the final stages of the bitcoin cycle and massive accumulation is happening against bitcoin’s available supply. A large price move to the upside could be imminent.

CRYPTOEther’s Daily Issuance Drops Below Bitcoin

Ethereum’s daily net issuance dropped below bitcoin for the first time due to the protocol upgrade EIP-1559 which burns a portion of ETH used for transaction fees that goes to miners, ultimately making the token more scarce. The annualized net daily issuance shakes out to 1.11% compared to bitcoin’s 1.75%. Since, the upgrade in early August nearly 150k ETH has been burned or $510 million at current ETH prices ($3,400). This only increases the store of value function for Ethereum.

MAJR Take: Some estimates of where ETH should be truly valued is upwards of $20k per ETH. Please make note, this layer 2 smart contract space is very competitive with newer chains promising much faster and cheaper transaction times which could ultimately threaten Ethereum’s dominance and price.

Treasury Wants Crypto Reporting Rules in $3.5 Trillion Reconciliation Bill

The Biden Administration wants more reporting for crypto included in the filibuster-proof $3.5 trillion reconciliation bill. They want language forcing crypto firms, namely exchanges to report data on non-US users so that the info can be exchanged with other countries to make sure citizens pay their taxes.

MAJR Take: These are last minute added clauses to must pass legislation included in a 3,000 page bill that nobody reads forcing companies to report on things that they literally can’t report on. While distributed ledger technology is unstoppable, our broken political system is trying to stop American innovation and financial dominance out of ignorance. We can do better than this.

Instant DAO Creator Syndicate Raises $20M From Andreessen, Coinbase, Snoop Dogg and Others

Syndicate, a crypto company that has built technology that allows individuals or groups to spin up an investment DAO (decentralized autonomous organization) for only $10. DAOs are and will be the next big wave to sweep over the crypto community and dominate headlines similar to NFTs and the Metaverse. DAOs have no point of failure and allow communities to self organize around shared goals and democratize control over the community’s treasury. In this case, Syndicate is focused on launching DAOs for the purpose of creating investment funds. They raised $20M in a Series A from prominent investors Andressen Horowitz and Coinbase. They’re also working towards decentralizing their own company into a DAO. There’s currently $9 billion in AUM held across the DAO community.

Fantom Token Jumps 50% After Launching $315 Million DeFi Program

Fantom, a layer 1 smart contract blockchain announced a $315 million DeFi (decentralized finance) incentive program to bring developers and projects on to their platform. Their FTM token has jumped 50% since the announcement. Fantom uses a more nuanced consensus protocol called Directed Acyclic Graph (DAG), which is also used by IOTA and Hedera Hashgraph. Right now, there’s a race for layer 1 smart contract dominance given scalability issues facing dominant player Ethereum. Fantom follows Avalanche (AVAX) and Solana (SOL) who both announced similar incentive programs and saw their tokens jump between 200-300% over the last month.

Solana Crosses $100 Milestone, Becomes 8th Largest Cryptocurrency

Solana’s SOL token has appreciated over 200% in the last month and is now a top ten cryptocurrency by market cap breaking $30 billion mark. Solana’s blockchain can process upwards of 1k transactions per second (tps), with some developers saying the blockchain can scale to 50k tps. This dwarfs Ethereum’s blockchain which can process anywhere between 15-30 tps on mainnet without having to use second layer solutions like Polygon. Solana launched a $300 million DeFi incentive program earlier this year and is backed by crypto billionaire and major player Sam Bankman-Fried. The layer 1 competition is heating up.

MACROU.S. Home-Price Growth Rose to Record in June

The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the nation, rose 18.6% in the year that ended in June, up from a 16.8% annual rate the prior month. June marked the highest annual rate of price growth since the index began in 1987. Demand for homes is outpacing the available supply, even though actual demand has slowed. New offers for homes has decreased from 14-17 per house to 2-3. However, with increased pressure on supply chains combined with aggressive institutional purchases, the home price inflation is only moving in one direction, up.

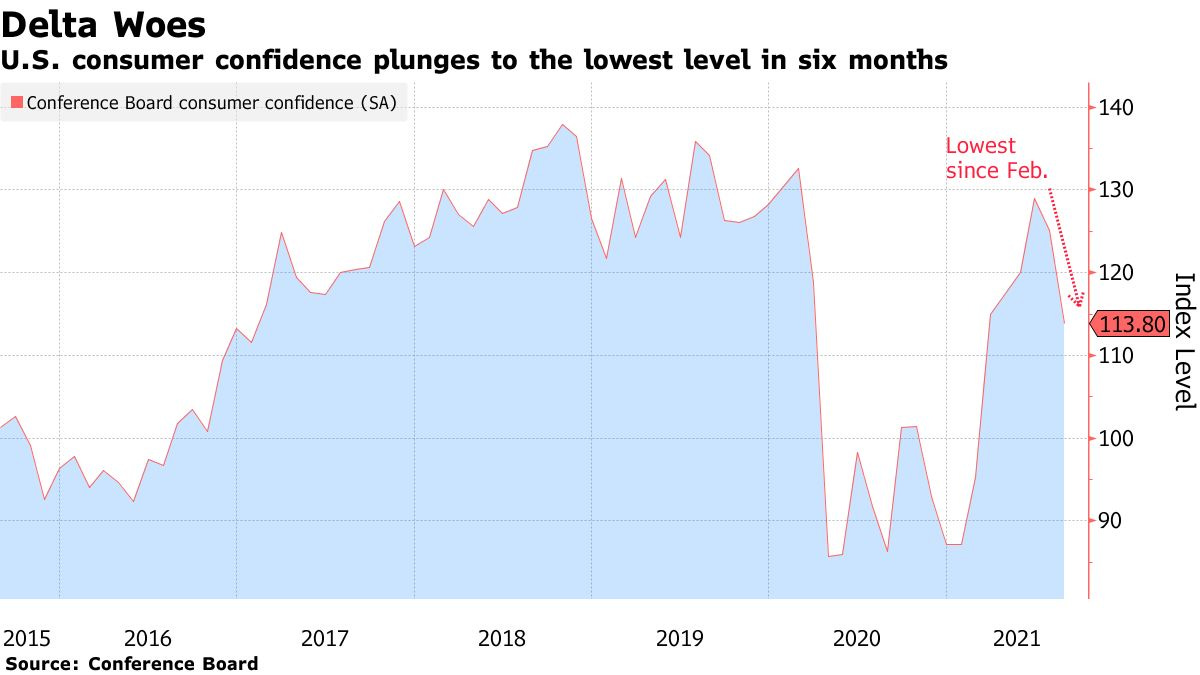

U.S. Consumer Confidence Falls to Six-Month Low on Delta Variant

US consumer confidence has dropped to a six month low as consumer concerns grow against surging Delta variant and increased prices. The shift in sentiment can already be felt across the services and travel industries as restaurant reservations, airline and hotel bookings have already fallen. These figures follow the data detailed in the trusted University of Michigan consumer sentiment index earlier this month. Consumers are also worried about their future income and job prospects.

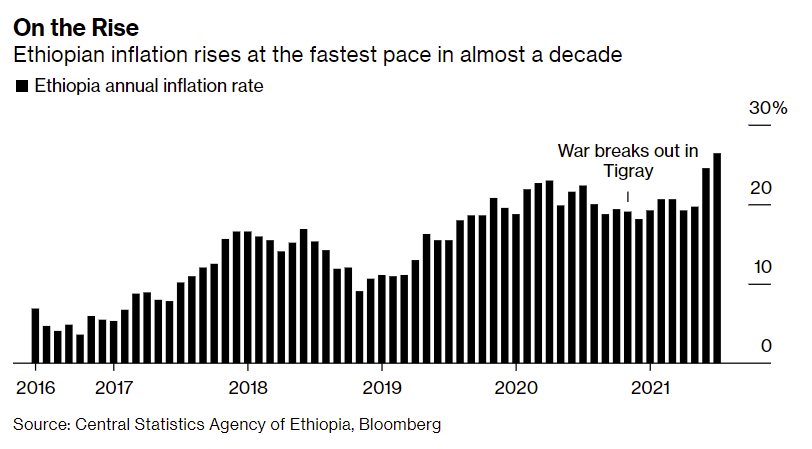

Ethiopia Doubles Reserve Ratio to Rein In Surging Inflation

Ethiopia’s central bank tries to control surging inflation by requiring commercial lenders to double the amount of reserves held to 10% and transfer 50% of the foreign exchange holdings to the central bank, up from 30%. The second most populous nation in Africa has seen inflation make a new decade long record of 26.4% in July. This has made it harder for the country to import goods and services as their buying power has dramatically declined.

MEDIAGradually then Suddenly Pt 4: Bitcoin & The Money Printer with Parker Lewis

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.