MAJR News 045

El Salvador gets ready to go on their new bitcoin standard, Bitcoin's mining difficulty adjustment increases 13%, 1 in 10 Americans invest in crypto, Avalanche (AVAX) price is up 300% this month

@gustavo

MAJR NEWS BRIEF

Video

In this video, Peter McCormack host of the What Bitcoin Did Podcast talks to Bitcoin Quant Analyst & creator of the popular Stock-to-Flow model, Plan₿ and investor, entrepreneur & publicist Willem Middelkoop. They discuss S2F, gold vs Bitcoin and whether we are heading to a big reset.

Top Stories

BITCOINEl Salvador Gets Ready for a Risky Bitcoin Experiment

In less than two weeks, El Salvador will officially go on a bitcoin standard alongside the US dollar as the two national currencies. The Central American government aims to spend up to $75 million to onboard citizens to a digital wallet called Chivo or “Cool” with free $30 to new users. El Salvador has a $26 billion economy and a levered central bank which may have to spend dollars to buy bitcoin from citizens who want to ditch the volatile digital asset for the US dollars.

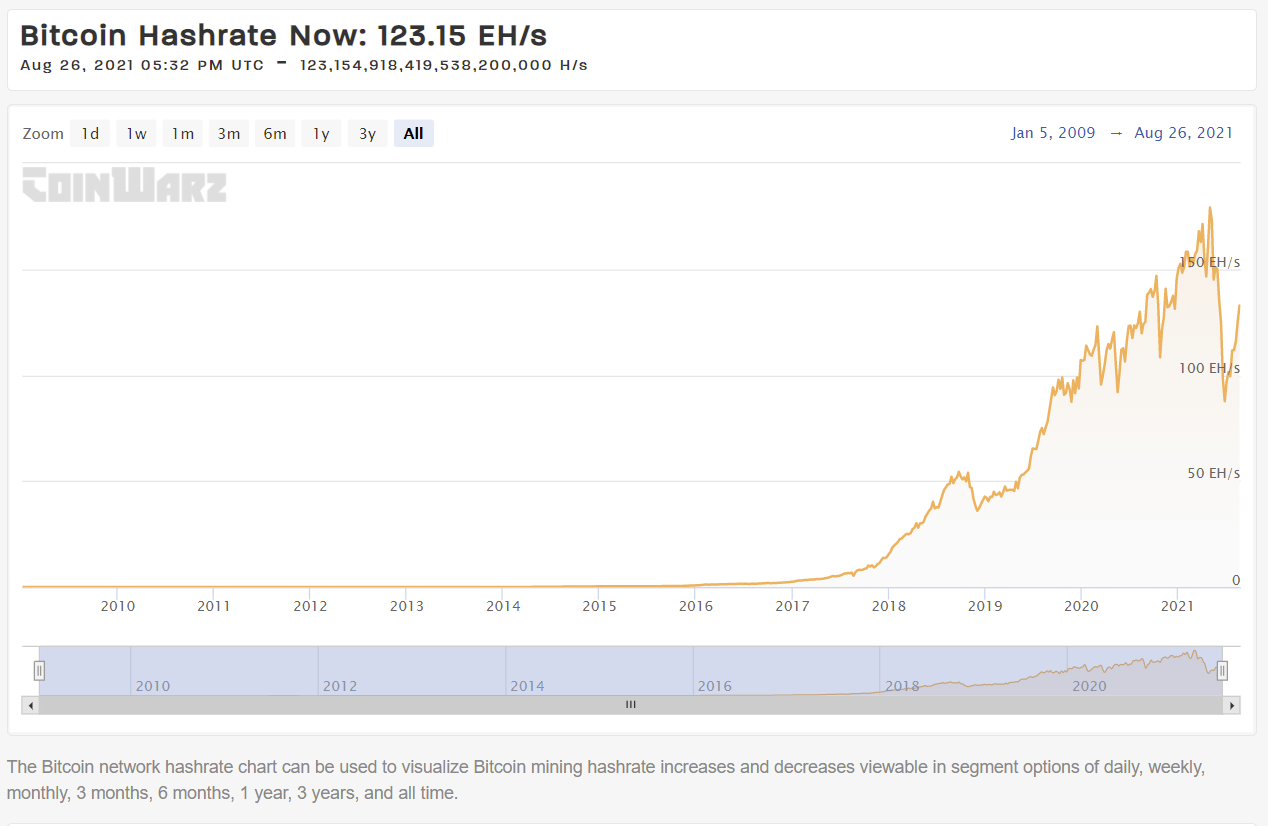

Bitcoin (BTC) mining difficulty increased by almost 13%

Bitcoin’s difficulty adjustment increased by ~13% to stay on it’s issuance schedule of ~10 minute block times. This past May, the Chinese cracked down on crypto companies and miners in the region which caused the difficulty adjustment to click down nearly 50% as miners turned off their machines to change locations. It’s a bullish signal when the difficulty adjustment increases as it means more miners are securing the network with increased computation.

One in Ten People in the US Invest in Crypto: Survey

A recent study that surveyed 5,000 Americans highlight an increase in crypto adoption as 1 in 10 people are investing in the space, or 11% of the country. Less than half of the respondents think investing in crypto is a high risk investment. It showed men are twice more likely to invest in crypto compared to women. Of the respondents, 12% credit social media as the first place they learned how to invest. And, 21% of those surveyed believe bitcoin will finish the year at higher prices than it’s current price, ~$47,000.

CRYPTOCan Avalanche Keep It Up? DeFi Users Rush In as Incentives Roll Out

The Ethereum competitor, Avalanche (AVAX) has seen its token price rally from $13.41 to a high of $55.42 over the last 30 days, a more than 300% increase. Avalanche launched in September 2020, but the recent move in price can be attributed to it’s $180 million DeFi incentive program, Rush to bring projects onto it’s network. Since, the funding announcement, the amount of dollars locked in Avalanche DeFi protocols has swelled to $1.8 billion. Projects and new partners include Aave, Chainlink, Curve and SushiSwap.

3LAU Raises $16M to Tokenize Music Royalties for Artists and Fans

DJ and crypto entrepreneur, Justin “3LAU” Blau is launching a music investing platform called Royal which uses NFTs as a way to distribute music royalties to fans and token holders. Artists will be able to determine the % of royalties that will be available for investors to capture by holding unique tokens, which then can be resold on the platform. Investors in the $16 million seed round included Paradigm and Founder Fund, each investing $7 million and gaining board seats at Royal.

OnlyFans Shows How the Banking System Is Politicized

The content subscription service, OnlyFans recently pivoted from their controversial ban against hosting explicit content on their platform, which is their main source of revenue. According to the founder, Tim Stokely, the reason for the shift in the first place was due to the politicization of banks who were unwilling to finance the company’s controversial business model even though adult entertainment is protected under the First Amendment. OnlyFans has now secured financing and will suspend it’s move against banning explicit content.

Over 100,000 ETH has been burned since EIP-1559 launched earlier this month, ~$315 million of ETH is removed from circulation. This is very bullish for ETH.

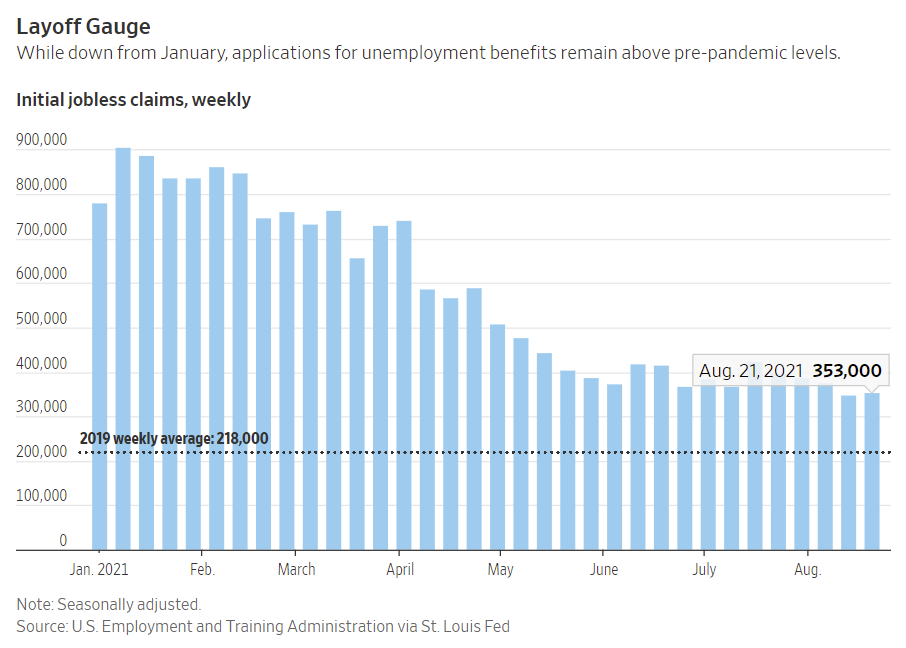

MACROU.S. Jobless Claims Rise but Hold Near Pandemic Low

Initial jobless claims increased slightly to 353,000 last week. The four-week moving average fell to 366,500, a pandemic low. However, jobless claims are still well above the pre-pandemic average of 218,000 weekly jobless claims. Employers added 943,000 jobs in July, which is a pandemic record high. While job growth continues and a recovery seems to be underway, some economists estimate that the recovery is cooling as retail sales fell 1.1%$ in July and University of Michigan consumer survey indicates that sentiment has fallen sharply.

South Korea Raises Interest Rates, First Developed Economy in Asia to Do So During Pandemic

South Korea is now the first developed country in Asia to raise interest rates despite the growing concerns of the Delta variant and disrupted supply chains. The Bank of Korea sees the country’s ballooning debt and inflation as more serious threats to the economy. The country’s household debt to GDP ratio reached 105% in Q1’21 and they lifted their inflation outlook to 2.1% from 1.8%. Home prices have seen a 50% increase since 2017. Rates increased by 0.25% to .75% from it’s low of .50%.

Treasury Yields Still Haven’t Priced In Fed’s Inflation Framework, Research Firm Says

Capital Economics put out a research report reflecting their opinion that even though Treasury yields have risen slightly over the last year, they still don’t account for the new policy framework of average inflation targeting leaving room for yields to rise further. They predict that 10-year Treasury yield will rise from current 1.3% to 2.5% by end of 2023.

MEDIAS2F, Gold & the Big Reset with Plan₿ & Willem Middelkoop

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.