MAJR News 043

Mortgage lenders enter bitcoin and crypto, Bitcoin mining daily revenue hit $48 million, Facebook's Diem and digital wallet Novi are ready for prime time, Solana's DeFi ecosystem is surging

@popandsicle

MAJR NEWS BRIEF

Videos

A must watch video for anyone interested in getting a masterclass in the our system’s financial plumbing, money and macroeconomics with Robert Breedlove and George Gammon.

Top Stories

BITCOINSecond-Largest Mortgage Lender in US Expects to Accept Bitcoin by Year's End: CEO

United Wholesale Mortgage (UWM), the second largest mortgage lender in the US plans to accept Bitcoin and crypto payments by end of the year. UWM facilitated ~$183 billion worth of loans in 2020. This is not the first time mortgage companies are embracing crypto. In 2019, Brock Pierce, 2020 Presidential candidate and crypto billionaire received a bitcoin mortgage backed loan where he never had to sell his crypto and ultimately settled the transaction in fiat.

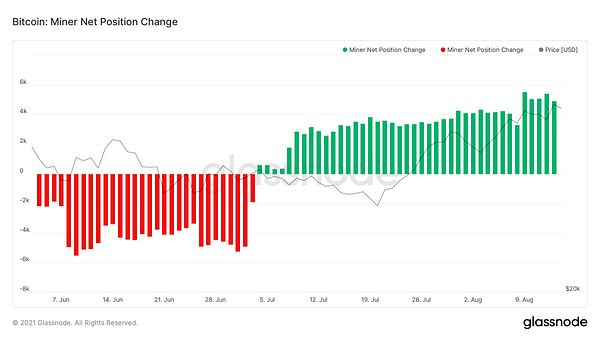

Bitcoin Mining Revenue Up $35 Million Per Day Since China Crackdown

Post China’s crypto crackdown, Bitcoin mining revenue is up $35 million with transaction fees up 22%. Total daily revenues kicking off Bitcoin miners is $48 million compared to $13 million during the China migration. Bitcoin’s mining hashrate dropped nearly 50% which sequentially dropped it’s difficulty adjustment leaving the door open for smaller mining facilities to improve chances of winning block rewards. Since, Bitcoin’s May correction in price from $65 levels, Bitcoin miners have been stock piling their accumulated bitcoin, not selling and waiting for higher prices. Miner net positions have been positive since July.

Mike Novogratz’s Galaxy Digital Files for a Bitcoin Futures ETF

Galaxy Digital joins the growing list of firms filing for a Bitcoin futures ETF. Four months prior, the firm filed for a Bitcoin ETF that would settle with the underlying digital asset. The move to Bitcoin futures comes after the SEC Chairman Gary Gensler suggested that they favor ETFs tied to CME-traded Bitcoin futures. The SEC has been reluctant to approve any ETFs for Bitcoin and other digital assets.

CRYPTOFacebook: Novi Digital Wallet Is ‘Ready to Come to Market’

Facebook’s David Marcus who leads their blockchain efforts and their stablecoin project, Diem (rebrand from Libra) said in a blog post that their digital wallet, Novi is ready to be rolled out. He noted that they have secured licenses and approvals for Novi in nearly every state in the US. Nearly 3 billion people across the planet have a Facebook account which would almost instantly be onboarded into the digital asset ecosystem with their digital Novi wallet.

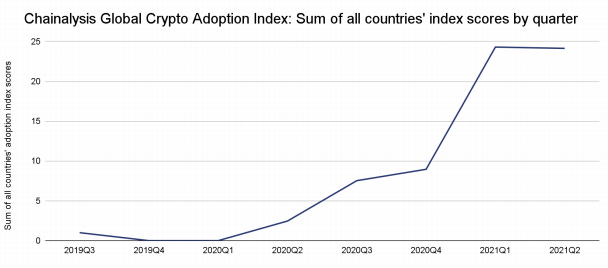

Crypto Adoption Shifts to Emerging Markets as China, US Drop in Chainalysis Global Rankings

Crypto adoption has increased 23x globally over the past year with India, Pakistan, Ukraine and other emerging markets in the driver’s seat. The Chinese and US lead has been declining as more countries engage with digital assets. Emerging markets or countries that wouldn’t necessarily be engaging in financial activity are using crypto to save against inflationary environments, trade and speculate.

Solana DeFi Now Has More Than $2 Billion Flowing Through It

Solana (SOL), the Ethereum competitor layer 1 blockchain has been attracting more DeFi applications and money than ever due to it’s fast and cheap transaction times. The Solana network passed $2 billion in total value locked in DeFi applications - Raydium (RAY), Saber (SBR) and Serum (SRM) to name a few. Solana’s SOL token is up 218% over the last month.

‘Like-to-Earn’ NFT Platform RARA Looks to Monetize the Future of Online Engagement

RARA social is experimenting with “Like-to-Earn” token infrastructure to help incentivize online engagement to help curate popular NFTs from not-so popular NFTs. “Earn” incentive models combined with deflationary tokenomics create a new way to work. This has been exemplified by leading blockchain game Axie Infinity which uses a “Play-to-Earn” incentive model.

MACROGoldman Masks, Scrutiny at Morgan Stanley as Delta Spreads

Goldman Sachs and Morgan Stanley are course correcting their stance with regard to returning to work and work policies. Goldman was the first major bank to require employees to return to the office and now is asking staff to wear masks indoors and increasing testing. Morgan Stanley is requiring staff to soon show proof of vaccination to enter their buildings. This change in policy is happening globally across firms and other financial institutions either pushing back their returns or increasing precautions due to the spread of the Delta variant.

Palantir Buys Gold Bars as Hedge Against ‘Black Swan Event’

Palantir Technologies Inc said it’s preparing for another “Black Swan Event” by buying gold, $50.7 million in the past month. Included in their investment strategy was buying startups, black-check companies and possibly bitcoin. They said they would accept bitcoin as payment, but this hasn’t officially rolled out.

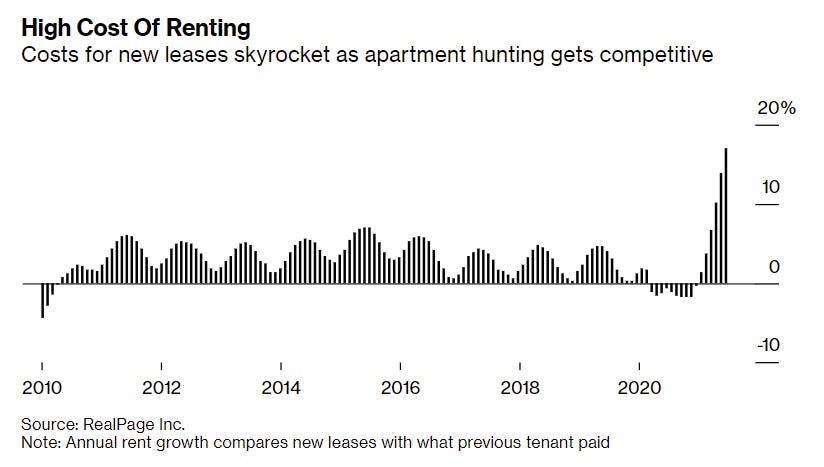

Landlords From Florida to California Are Jacking Up Rents at Record Speeds

Higher prices are spilling over from the home buying market and into the rental market as landlords across the country are jacking up rents. Renters looking for apartments are encountering would be home buyers as their purchases are delayed due to market conditions. Eviction bans are also playing a role on keeping the market tight, 6% is normal each year. Developers can’t build fast enough due to supply constraints. The Sun Belt cities are seeing it the worst as an influx of new buyers relocate from large metro areas with bigger paychecks competing for the same supply.

Roblox, Facebook See the ‘Metaverse’ as Key to the Internet’s Next Phase

The virtual world known as the “Metaverse” will be the next frontier of the internet according to Facebook who own’s Oculus the VR headset company and Roblox the mega online gaming company. Roblox CEO sees their company as a hub for virtual and immersive experiences where thousands of people can simultaneously come together as avatars buying and engaging with digital goods such as land, consumer products, art and even view advertising and attend meetings and conferences.

U.S. Retail Sales Fell 1.1% in July as Spending Fell Across Categories

Retail sales which include purchases at stores and online fell 1.1% in July . These number don’t include services such as travel, entertainment and recreation, which were up 1.7%.

MEDIAWiM036 – Money and Macroeconomics with George Gammon

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.