MAJR News 041

Bitcoin and Ethereum continue their bullish rally, Coinbase is a cash machine destroying Q2 earnings, Coinbase partners with PNC to bring crypto to banking customers, $3.5 trillion fiscal incoming

@pislices

MAJR NEWS BRIEF

Video

Real Vision discusses the Biden $1.1 trillion infrastructure bill and whether it will help the economy.

Top Stories

BITCOINCrypto Market Tops $2 Trillion Again With Bitcoin, Ethereum Leading the Way

Total market cap for the entire crypto industry has once again broken $2 trillion. Bitcoin (BTC - $46,473) and Ethereum (ETH - $3,251), the two largest cryptocurrencies have bounced back after a two month consolidation period and are now trending towards previous all-time highs. Bitcoin is up 20% in the last week, while ether is 28% during the space period. Other major altcoins are Solana, Polkadot, Litecoin, BNB and XRP - all rising more than 20% in the last week.

Bitcoin Avoids Bear Market, Long-Term Uptrend Intact

Retail and institutional buying is fueling bitcoin’s recent rally. The number of bitcoin addresses holding smaller amounts of bitcoin and larger amounts of bitcoin have increased. Bitcoin faces resistance at $50k and $55k price levels, while the relative strength index (RSI) is flashing overbought on the daily charts, but is still in a neutral zone on the weekly chart.

Crypto Trading Surge Boosts Coinbase Stock

Coinbase Q2’21 revenue surged to $2.23 billion. Profits were $1.6 billion, up 4,900% YOY. They have $4.4 billion in cash on hand. Coinbase continues to be a cash machine due to more retail accounts, investors buying the dip and more institutional demand for bitcoin. They have low overhead and get a cut on every transaction with margins close to 50%. They continue to add services and more altcoins available to trade for retail customers. At press time, their stock is priced at $278 with a market cap of $72 billion.

PNC Bank is partnering with Coinbase to bring a crypto offering

US banks will now be able to offer their customer access to digital assets through partnerships with inherit crypto companies like NYDIG and now Coinbase. Coinbase is partnering with PNC Bank to bring crypto solutions their banking customers. Banks realize that financial innovation is happening at break neck speed and are now scrambling for possible crypto solutions to stay alive.

AMC Theatres to Accept Bitcoin Payments by the End of 2021

The movie theater and meme stock AMC Entertainment Holdings (AMC), announced that they will be accepting bitcoin as means of payment by the end of 2021. Shares increased 4% after the announcement. Other companies that are following suit and accepting bitcoin and digital asset for payment include Wellbots, Progressive Care, Sheetz, Landry’s, Quiznos and many more.

CRYPTOHackers Return $342 Million to Cryptocurrency Platform After Massive Theft

Poly Network was hacked for $600 million in cryptocurrency. Poly Network is a decentralized finance application that allows tokens to be swapped across different blockchains. Poly Network has connected the hacker via on-chain messages attached to Ethereum transactions asking for the funds to be returned. The hacker has apparently returned $342 million of the stolen funds. This was the largest crypto hack this year and adds to the already existing $474 million in crypto hacking happening across the space, and mainly DeFi exploits. To be clear, the Ethereum blockchain was not hacked, only Poly Network smart contracts facilitating the cross-chain swaps.

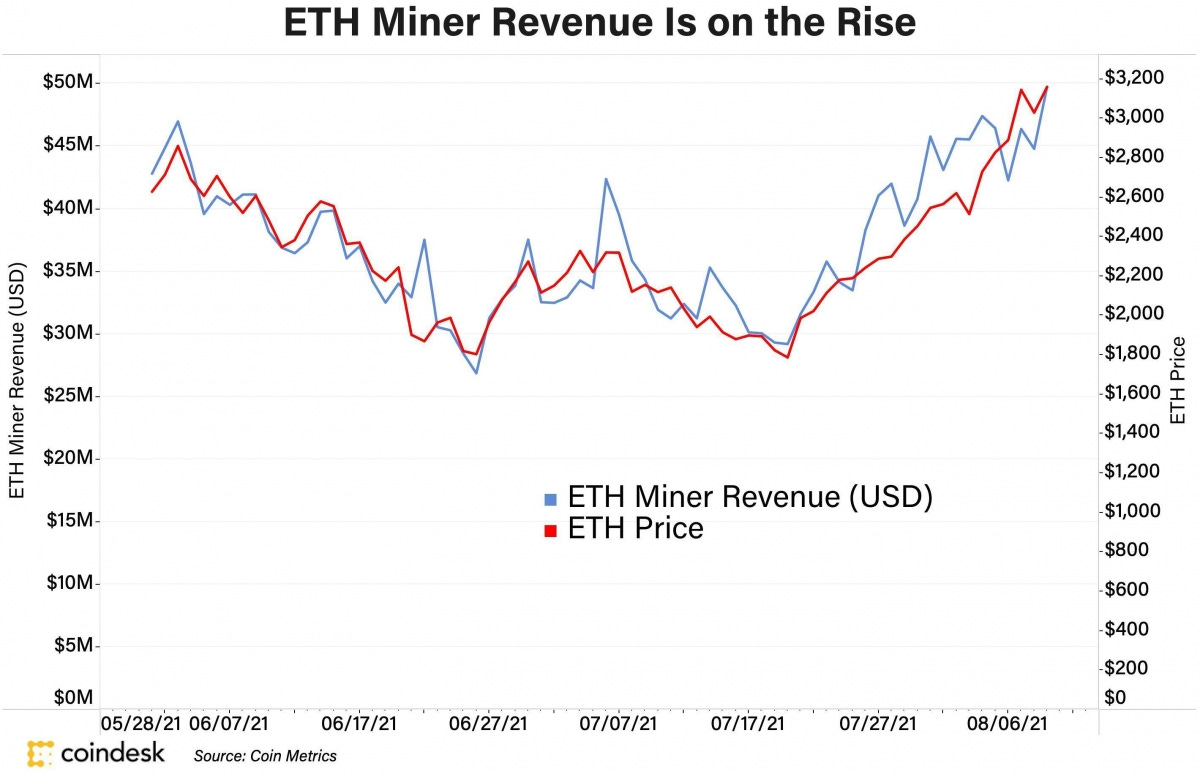

EIP 1559 Hasn’t Affected Ethereum Miner Revenue

The Ethereum upgrade, EIP-1559 that burns a portion of the ETH miner fees (base fee) for validating transactions was implemented on August 5th and has already burned 22,708 ETH or ~$71.6 million. While, there’s technically less ETH going to the miners validating transaction, miners have still maintained their revenue’s given the high amount of usage happening on chain and users will to pay high gas fees in order to process transactions for DeFi, NFTs and other use cases.

SEC Chairman Demands More Authority to Regulate Crypto Industry

The SEC Chairman, Gary Gensler wrote a letter to Senator Elizabeth Warren articulating his concerns for investor protection in the cryptocurrency industry. He feels that the crypto market has many unregistered securities without required disclosures or market oversight. In conclusion, he believes that the US needs more authorities to prevent crypto activity to fall through regulatory cracks. “In my view, the legislative priority should center on crypto trading, lending, and decentralized finance platforms. Regulators would benefit from additional plenary authority to write rules for and attach guardrails to crypto trading and lending,” Gensler wrote. Reminder, when Gary Gensler first took office at the beginning of the year, crypto wasn’t even on his agenda and now it seems to be one of his main objectives.

Andreessen-Backed Helium Raises $111 Million to Grow Crypto Wireless Network

a16z, the giant Silicon Valley VC firm placed an enormous bet on budding crypto wireless network company Helium. Helium (HNT) is a startup that powers consumer IoT devices (112k active online nodes or hotspots) that use a decentralized cryptographic network to deliver WiFi and is now expanding into 5G smartphone activity. The company quadrupled the size of its network in just over three months. Users who run the company’s hotspots to provide their long range WiFi are rewarded in the companies Helium token (HNT). The token’s market cap currently sits around $1.56 billion. Other backers include Alameda Research, Ribbit Capital, 10T Holdings and Multicoin Capital.

MACROBy Taxing Crypto, the US Government Has Accepted It’s Here to Stay

The days of the US government banning crypto seems like a worry of the past as politicians and regulators float legislation attempting to increase reporting in the space for tax purposes. While, the current crypto clause included in the $1.1 Infrastructure bill contains prohibitive and broad language that isn’t good for financial innovation, the silver lining is that crypto is now mainstream and politicians see crypto as a marketing tool to capture votes and a revenue tool to drive taxes. In the bill, crypto was being used as a “pay-for” clause to help account for the spending and lawmakers attached a made-up $28 billion line item for the industry over the next 10 years. While, this number seems like it was pulled out of a hat, it does indicate that crypto is here to stay.

Biden Says His $3.5 Trillion Spending Plan Won’t Stoke Inflation

President Joe Biden says his $3,500,000,000,000 plan won’t cause inflation, and quotes that it will lower drug price and other costs of living. The Senate advanced the bill and is now facing a unified GOP opposition. The July consumer price index increased 0.5% from June and is up 5.4% compared to a year ago. While higher inflation numbers might have been transitory during the April-June months due to base affects, these higher numbers in July are loosing that narrative. The high price tag of this bill is even causing some Democrats to be concerned about backing this amount of social spending. “Senator Joe Manchin, a Democrat from West Virginia, said he couldn’t support a social spending bill with a $3.5 trillion price tag. Senator Kyrsten Sinema, an Arizona Democrat, has said the same. One Democratic objection is all it would take to scuttle the package in the Senate.”

Fannie Mae Aims to Make Home Loans More Accessible

Mortgage finance giant, Fannie Mae is including rent payment history as part of the approval process for getting a mortgage loan. This is to help would be home buyers with limited credit history to use their rent track record to beef up their score and get a better rate. This goes into play next month, but doesn’t require lenders to accept rent history as part of their underwriting. Fannie Mae doesn’t make loans directly, they purchase securitized loans directly from the lenders. However, as they automate their new criteria into what’s acceptable, lenders can now make more loans to individuals who otherwise wouldn’t have qualified before due to poor credit history knowing that Fannie Mae will back-stop risk.

MEDIACan Biden's Infrastructure Bill Reinvigorate the Economy?

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.