MAJR Newsletter 039

SEC Chair Gensler Dominates Crypto Headlines, Grayscale Beefs Up ETF Team, Genesis has Biggest Q2'21 with ETH and DeFi Products Leading Over BTC, a16z Says Crypto is Transformative Technology

@hplus

MAJR NEWS BRIEF

Top Stories

BITCOINSEC Needs Clear Authority Over Crypto Platforms, Gensler Says

SEC chair Gary Gensler made headlines all week discussing his vision for regulating cryptocurrencies. His comments fall against a backdrop of Congress sneaking vague and consequential language into the US Infrastructure Bill. It’s yet to be determined where the MIT and Goldman alum falls on which cryptocurrencies are securities and which are commodities. However he agrees with his predecessor that lots of tokens look like securities and need to be regulated. In his CNBC interview on Wednesday, he said he’s pro innovation and sees crypto as transformative technology that could bring more people into the financial system and wants to work with leaders in the space. He also compared crypto to the invention of the automobile and without quality regulation, the auto industry wouldn’t be what it is today.

More on SEC Chairman Gary Gensler

SEC Chairman Gensler Agrees With Predecessor: ‘Every ICO Is a Security’

SEC’s Gensler: Crypto Market Filled With Unregistered Securities, Prices 'Open to Manipulation'

“I believe we have a crypto market now where many tokens may be unregistered securities, without required disclosures or market oversight,” he explained. “This leaves prices open to manipulation. This leaves investors vulnerable.”

“While each token’s legal status depends on its own facts and circumstances, the probability is quite remote that, with 50 or 100 tokens, any given platform has zero securities,” the SEC chairman added.

In that work I came to believe that though there was a lot of hype masquerading as reality in the crypto field, Nakamoto’s innovation is real. And some in the public sector would say, ‘Well, no’—almost like wishing it away—I really do think there’s something real about the distributed ledger technology moving value on the internet without a central intermediary.”

Grayscale Hires David LaValle to Be ETF Head

Grayscale, the world’s largest digital asset manager hires David LaValle to head its growing ETF team, now 10 people. Grayscale’s ETF ambitions are more than just converting the Grayscale Bitcoin Trust into an ETF, but its reasonable to assume that their ETF business would span across multiple tokens given their diverse token trusts. LaValle is an ETF specialist working at various exchanges, has built out ETF listings on the Nasdaq and led a team at State Street’s ETF business.

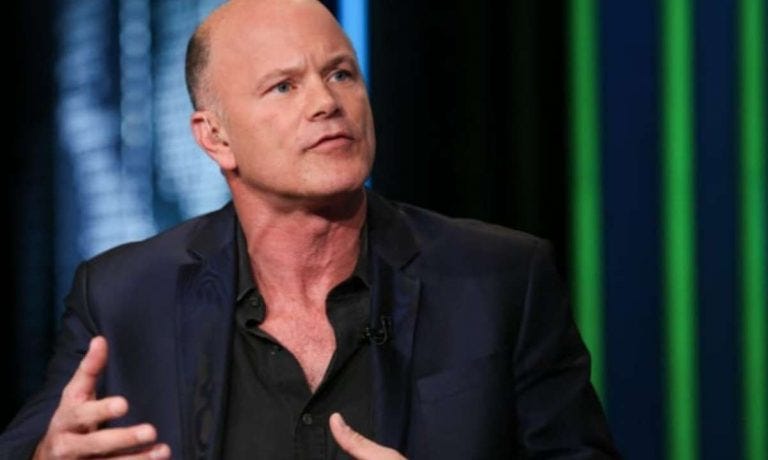

Mike Novogratz blasts US officials for poor grasp of crypto industry

Galaxy Digital CEO, Mike Novogratz (Novo) tweeted that crypto is the future of the financial system and politicians and regulators ought to do their homework before devising policies that regulate the burgeoning industry. The tweets were in response to the swift crypto clause and vague language stuffed into the $1 trillion infrastructure bill and to Sen. Elizabeth Warren’s baseless nonsense calling for serious regulation to protect investors from scammers and “super-coders.”

CRYPTOEthereum and DeFi, Not Bitcoin, Boosting Genesis Lending

Digital Currency Group’s crypto lending subsidiary, Genesis had it’s biggest quarter in Q2’21, with ETH and DeFI tokens driving the business vs. Bitcoin. Bitcoin accounted for 42% of the firm’s book, down from 47% last year. The firm stated that there’s been a huge growth in institutional demand for Ether and DeFi tokens.

Ethereum Addresses Using DeFi Rose 65% Last Quarter

The number of Ethereum addresses increased 10%, but the number of new Ethereum addresses using DeFi protocols increased 65%. Nearly $70 billion in digital asset are tied up in DeFi protocols. In July, 2.91 million Ethereum addresses were using DeFi - Uniswap, Compound and liquidity fund KeeperDAO were among the top protocols. These numbers seem eye popping, but its still only 2.91 million addresses using these new finance applications. We. Are. Early.

Crypto is a fundamental technological breakthrough, a16z co-founder says

Marc Andressen, co-founder and general partner at VC giant, Andressen Horowitz (a16z) says crypto and blockchain technology are the most significant new architecture changes in the tech industry. Andressen Horowitz has raised 3 crypto targeted funds, the most recent is the largest to the tune of $2.3 billion which will be deployed across the crypto ecosystem.

“Crypto is a bit like the parable of the blind men and the elephant. People touch it from different sides. They get distracted and carried away and energized about these different topics…

We view it [crypto] as a technological transformation. There’s a fundamental technological breakthrough that has happened. It’s an area of computer science called distributed consensus…Money is one application…but it’s only one of many…

These are new kinds of computers. This is where it gets very subtle. Bitcoin is an internet computer that’s spread out across hundreds of thousands physical computers around the world. It’s a transaction processing system that runs without any central location…It’s a new kind of financial system.”

No More Lengthy Wallet Addresses – Send USDC to ‘username.coin’

USDC stablecoin users can now send payments to simple address vs. complicated alphanumeric characters, similar to sending a text or email. Circle, the company behind USDC partnered with Unstoppable Domains, the blockchain domain name provider to create this offering, only $40.

Blockchain Builder Alchemy Adds Former Disney, Citigroup Execs as Investors

Alchemy, the rapidly growing blockchain infrastructure and token building company just raised $80 million in a Series B and attracted quite the cast of investors. The company claims to be the Amazon Web Services for crypto and has worked with clients such as OpenSea, Nifty Gateway, UNICEF, global banks and top accounting firms. The new investors include CEOs of Citigroup, DoorDash, Chainalysis and others such as Hollywood mogul Jeffrey Katzenberg and the DJ Zedd. Alchemy has predominately built on Ethereum, but is moving to more platforms like the Flow blockchain and layer 2 solutions like Polygon.

Sun, Sand, and NFT Tickets: Here Come DAO Music Festivals

Croatia’s Circus Maximus looks to put together the first decentralized autonomous organization (DAO) music festival that puts the power back in the hands of the party goers. In combination with using DAO tech, the company will use NFT technology to allow fans to vote on location, performers, budget distribution, future direction, ticketing and more.

MACROFed’s Clarida Says Economy Could Warrant Interest-Rate Increases by Early 2023

Fed’s Clarida says significant fiscal stimulus should speed up a faster recovery to meet central bank’s goals. A much better economy would be needed to even consider lifting rates off near zero by 2023. Clarida is one of the Fed’s leading architects for the Fed’s new framework targeting higher average inflation rates above 2%. He confirmed that interest rate hikes are not even on the radar right now. 13 of 18 Fed officials projected at rate hike by 2023, while 7 expected to raise next year. In March, most officials said rates would stay steady through 2023. The accuracy of the Fed’s models should be questioned if officials have drastically different opinions and opinions on rate hikes have significantly changed in just 5 months.

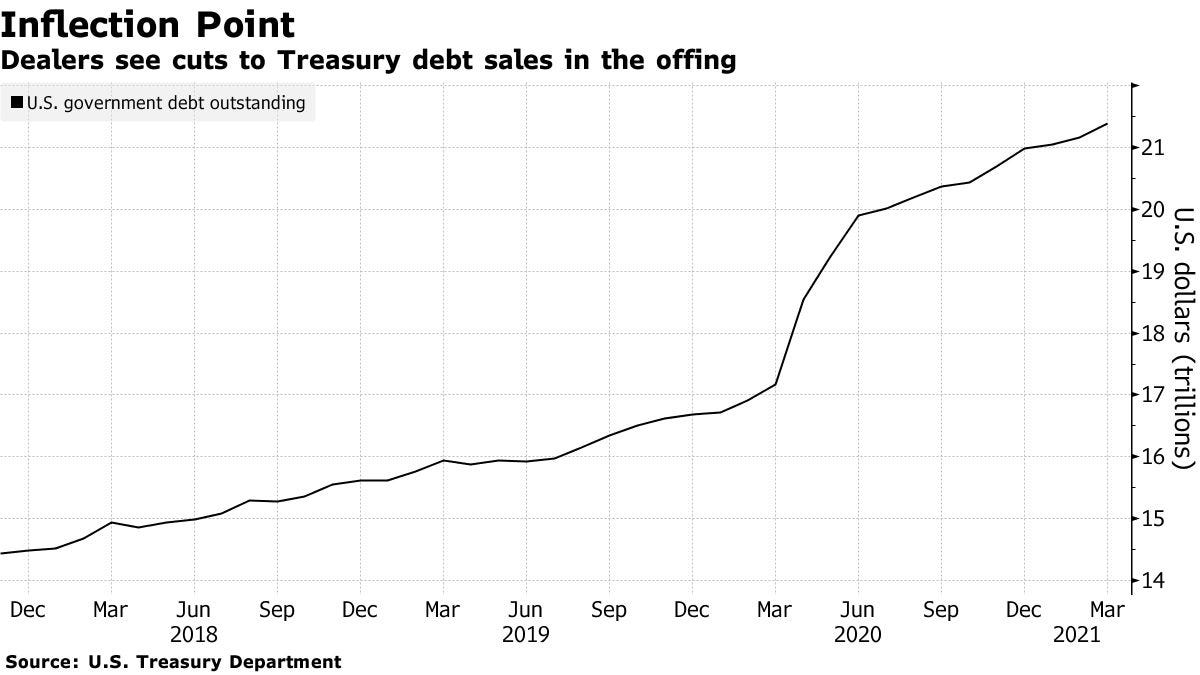

Treasury Sees Cutting Quarterly Bond Sales Soon as November

Janet Yellen, Secretary of the Treasury announced that for the first time in 5 years, the Treasury will issue less debt to finance the government for Nov-Jan timeframe. The Treasury said Congress will be able to find revenues to help finance the upcoming fiscal bills. Yellen also reiterated that it’s uncertain how long the department can forestall a payments default through special accounting measures after the federal debt ceiling was reinstated on Sunday. In other words, the government is broke without the ability to increase its federal deficit. Treasury auctions continue at record sizes and the department said they plan to increase issuance of inflation protected securities due to demand. The government plans on borrowing almost $1.4 trillion in the second half of the fiscal year. Auctions for next week are as follows.

$58 billion of three-year notes on Aug. 10, unchanged from May

$41 billion of 10-year notes on Aug. 11, also unchanged from May

$27 billion of 30-year bonds on Aug. 12, the same as in May

The refunding will raise $67.4 billion in new cash

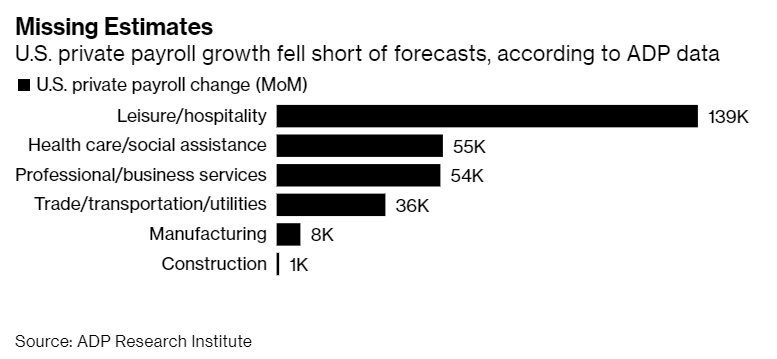

U.S. Companies Add Far Fewer Jobs Than Forecast, ADP Data Show

US companies added significantly less jobs than expected in July indicating obstacles despite improving economy. Payrolls increased 330k last month, the smallest gain since February. In June, companies added 680k new jobs. Firms are trying to keep up with pent up demand with a record number of new job openings, however people or the right people are not showing up.

Japan Sees Cryptocurrency Dealers as Part of Anti-Money Laundering Plan, Top Financial Regulator Says

Japan’s top financial regulator plans to combat money laundering and part of that plan target cryptocurrency dealers which should be treated the same way as traditional financial regulators to make sure they’re not working with terrorists or criminals. They are putting together a system for the whole industry to better identify client accounts.

“In the medium to long term, it is more sustainable if they can eliminate the perception that cryptocurrencies are dangerous financial products with underground money and turn them into a pure investment tool, even though their volatility remains high,” Ms. Otsuki said.

MEDIAErik Townsend (Inflation Deep Dive, Could Oil Price Skyrocket? Future Of CBDC vs Crypto)

Jeff Snider (Reverse Repo Deep Dive, Mind Blowing Intel On Shadow Banking Risks, Why Zoltan's Wrong)

Jim Bianco (Why Inflation Is Here To Stay! More Repo Madness, Will Fed Do Yield Curve Control?)

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.

![The 15+ Best Festivals in Croatia [2020] | Music Festival Wizard The 15+ Best Festivals in Croatia [2020] | Music Festival Wizard](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fc6f13555-b444-4acb-847d-25660e00eeeb_1600x1065.jpeg)