MAJR Newsletter 037

Bitcoin Leaving Exchanges - Bullish, Senators Preach Benefits of Bitcoin as Store of Value and a Open, Permissionless and Private Digital Dollar, ETH Increase in Trading Volume and Beats BTC

@palerlotus

MAJR NEWS BRIEF

Top Stories

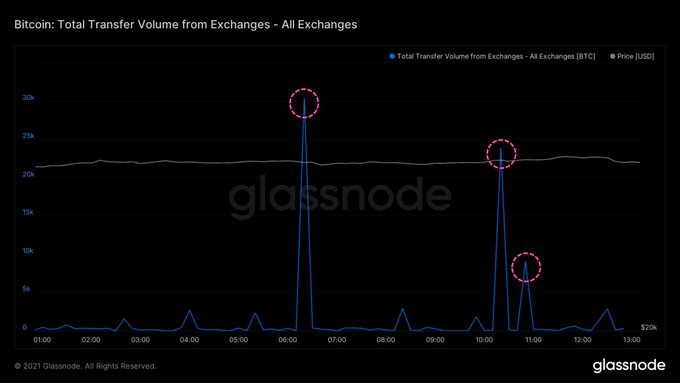

BITCOINOver $2.5 billion worth of bitcoin left exchanges yesterday

The above chart shows massive outflows to the tune of $2.5 billion of bitcoin that left exchanges yesterday. It can be assumed that these outflows are from institutions given the volume. The bitcoin most likely was sent to cold storage to keep it safe and hold long term. This a very bullish signal and can be interpreted as the beginning or middle of a bitcoin shortage. Similar outflows were seen in the fall of 2020 prior to the bull run from $20k to $65k. Less liquid bitcoin available to buy and sell suggest demand will eventually outstrip supply causing a dramatic increase in price.

Sen. Pat Toomey (R. PA) Explains to Congress Why We Need Bitcoin

GOP Sen. Pat Toomey (PA) explained to congress what bitcoin and crypto may be good for and that they could serve as a good store of value when governments devalue currency. He compares the US to Venezuela, mentions how crypto could make transactions faster and cheaper. H finally states that bitcoin and crypto could bank the unbanked bringing financial services to more Americans. Sen. Toomey was also in the news previously disclosing that he purchased $30k of shares in Grayscale’s Bitcoin and Ethereum Trusts.

Genesis Digital Assets Raises $125M to Fuel US and Nordic Expansion

Bitcoin mining company Genesis Digital Assets raised $125 million to build out US and Nordic region bitcoin mining operations. They purchased 10,000 miners from manufacture Canaan, which should double the company’s hashrate. The investment was led by Kingsway Capital, a UK private equity group with over $2 billion in AUM. Kingsway is focused on emerging markets and sees bitcoin as a potential tool for financial inclusion.

Bitcoin rewards provider Lolli raises $10 million in Series A funding

Lolli the bitcoin rewards start up raised $10 million in Series A round to expand products focused on the gaming industry, roll out their Android application and scale team from 20 to 40. The round brings Lolli’s total funding to $20.25 million. Lolli has given out $3.5 million in bitcoin rewards and is growing significantly on mobile.

CRYPTOETH’s trading volume grew much faster than BTC’s in first half of 2021

Trading volumes for ETH increased by 1,461% over the first half of 2021. Ethereum (ETH) is the the second largest cryptocurrency by market cap, $270 billion and is a more general blockchain than Bitcoin, where it currently acts as platform for a variety of decentralized applications (dApps). While, Bitcoin did more in terms of volume, $2.1 trillion and Ethereum did $1.4 trillion, Bitcoin’s growth was “only” up 489%.

Aave to Launch Institutional DeFi Platform AAVE Arc Within Weeks

DeFi lending platform Aave rebranded it’s institutional DeFi platform from Aave Pro to Aave Arc and aims to be the gateway between institutional investors into the decentralized finance industry. Institutions are heavily regulated which present obstacles to interacting with DeFi protocols, however Aave Arc will allow pools of funds who’ve passed the strict KYC requirements can enter the high yield interest offerings. The platform plans to launch in the next few weeks.

Prime Trust Raises $64M to Scale Fintech Infrastructure Biz

Fintech infrastructure and custody firm Prime Trust raised $64 million in their Series A. The funds will be used for a major expansion hiring folks across all departments. Prime Trust provides payment, settlement, KYC and liquidity via APIs which is a full stack infrastructure for crypto and fintech companies. Included in the round was Mercato Partners, Nationwide, Samsung Next, Kraken Ventures and Seven Peaks Ventures.

Coca-Cola creates its first collection of brand-inspired NFTs

Coca-Cola has partnered with digital art creator Tafi to release unique one-of-a-kind collection that will be tracked with its own non-fungible token (NFT) confirming the authenticity of the piece. It will be sold on NFT marketplace, OpenSea and all proceeds will be going to Special Olympics International. The jacket seen above will be able to be worn in decentralized virtual reality metaverses by user’s avatars, such as Decentraland.

Senator Warren Urges ‘Coordinated and Holistic’ Response to ‘Dangers’ of Crypto

Sen. Elizabeth Warren (D. MA) sent a letter to Treasury Secretary Janet Yellen urging the government to form a regulatory strategy to mitigate the growing risks that cryptocurrencies, bitcoin, stablecoins and DeFi could have against the financial system and to individual Americans. This is Warren’s second attempt to push the government to regulate the industry that’s still in its infancy. The first letter was to SEC Chair Gary Gensler about her concern with stablecoins. She was also on CNBC yesterday morning describing her wealth tax across every asset class and “how the little wealth tax on Americans with $50 million in assets could pay for universal childcare, pay for our kids to go to college, pay for all the roads and bridges to bring them into the 21st century. We could pay for all of that if we asked the people at the top to pay a little bit more.”

MAJR Take: It’s our understanding that that the math doesn’t add up and she’d be taxing wealth that was already taxed. It’s clear that Sen. Warren hasn’t done her homework on Bitcoin and crypto’s technology as a whole.

MACROUS Lawmakers Want to Avoid Chinese-Like Surveillance With Digital Dollar

Conservative politicians - Tom Emmer (R. MN), Patrick McHenry (R. NC) are among the loudest proponents championing an “open, permissionless and private” US digital dollar (central bank digital currency - CBDC). During a two hour meeting held by the Subcommittee on National Security, International Development and Monetary Policy, US lawmakers discussed the benefits of a CBDC and expressed their concern of following China’s footsteps in building a financial surveillance tool that favors the state.

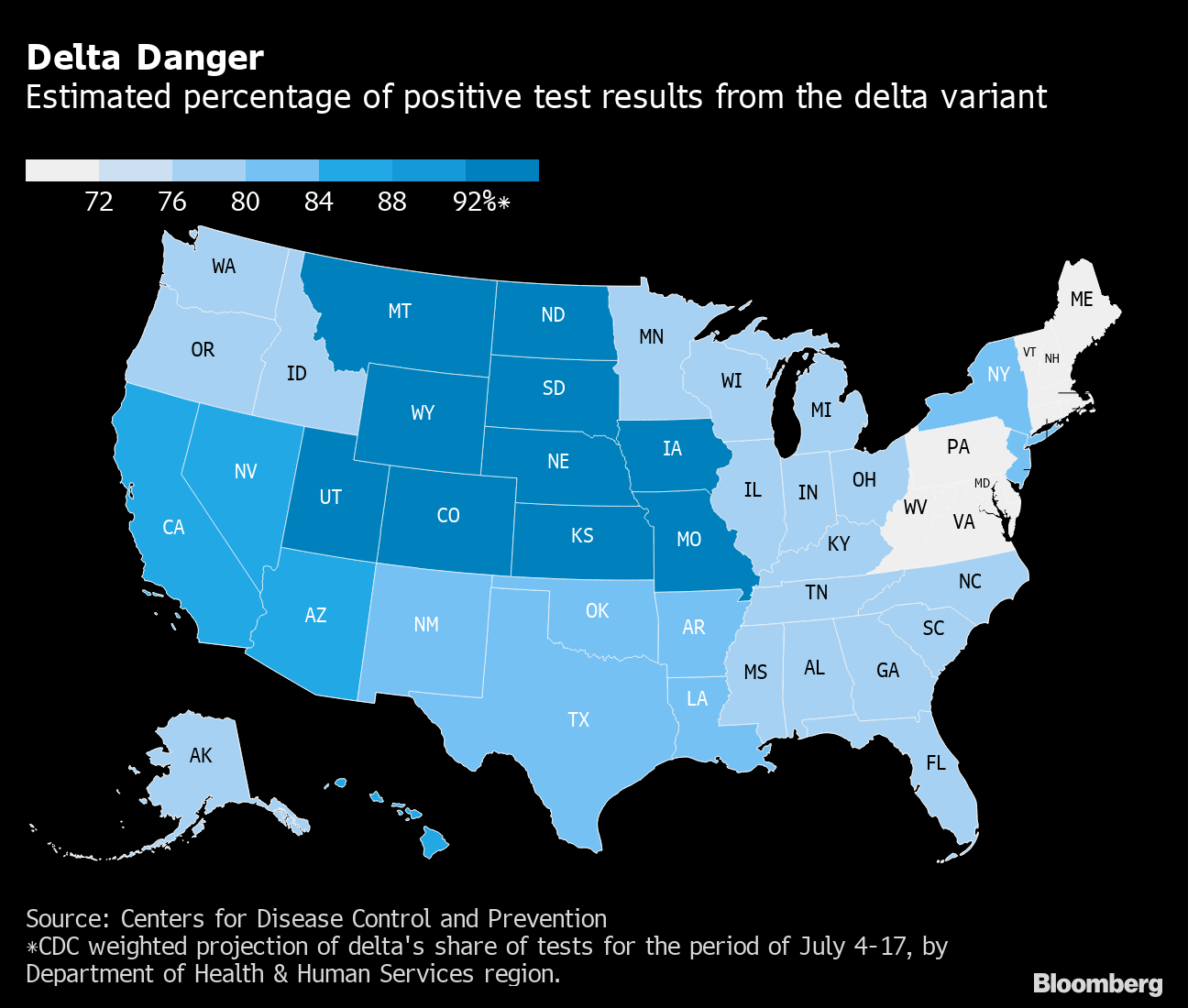

Younger, Sicker, Quicker: The Changing Face of the U.S. Pandemic

The Delta covid-19 variant has been sweeping the country representing 83% of new covid cases, mainly affecting the non-vaccinated and the results aren’t good. Covid patients are getting sick faster and coming to the hospitals sooner. Deaths are still well below last year’s heights of the pandemic, but the virus is more contagious and affecting younger patients. About half the country is vaccinated, 160 million Americans. 40% of all US cases have come from Florida, Texas and Missouri with low vaccination rates.

Fed to Stress Patience on Scaling Back as Virus Threat Lurks

The rise and spread of the Delta variant is playing into the Fed’s rhetoric about being patient around tapering their $120 billion monthly bond and mortgage back security purchases. Being patient coincides with the drop in 10-year Treasury notes which has put fears of inflation at ease. While the data certainly points to increased prices, the Fed continues to preach that inflation is transitory and the economy is far from recovered, but discussions about tapering are on-going.

Fed Takes Big Step Toward Preventing More Repo-Market Blowups

The Federal Reserve is looking to create a liquidity tool to back-stop money markets with a “standing repo facility” to prevent short-term rates markets from blowing up. This repo facility has been discussed seriously since 2019. This comes at a time when market sentiment is concerned with inflation fueled by easy monetary policy and $120 billion per month in asset purchases. The idea is that there is simply too much as cash in the system, however, this facility speaks loudly to the fact that the opposite may be true, where the system may be short quality collateral and need further assistance.

MEDIAWhy Bitcoin Will Be The Next Global Reserve Currency | Greg Foss | Pomp Podcast #611

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.