@indierocktopus

MAJR NEWS BRIEF

Today’s Top Stories

BITCOINBitcoin Drops Below $30K for First Time in 4 Weeks

Concerns over the covid delta variant spread across markets and have broken bitcoin’s $30k support level. The next level is $27k. Bitcoin has been a range bound between $30k-$35k for 8 weeks and have been in a month long downtrend as the price keeps testing and fails to break the 50 day-moving-average. A bitcoin price below $30k should attract the institutions waiting on the sidelines.

Cathie Wood’s ARK Invest Raises Square Holdings After Dorsey Announcement

ARK Investment increased their holdings of Jack Dorsey’s payment company Square after their announcements supporting bitcoin development and wallet. Square recently announced that they will be creating a company division focused on bringing decentralized finance products and application to the Bitcoin Network and a focus on building a consumer friendly hardware wallet. ARK purchased 225,937 shares of Square.

Bitcoin Network Sees Fourth Straight Downward Difficulty Adjustment

Bitcoin’s network difficulty adjustment recorded a 5% drop over the weekend, its fourth straight drop highlighting the impact of miners moving out of China. The difficulty adjustment is target for bitcoin miners that automatically changes about every two weeks. It takes into account the amount of mining happening on its network and adjusts this measurement to make it either “more or less difficult” for miners to solve the cryptographic puzzles and earn the bitcoin reward, 6.25 BTC. The difficulty adjustment is crucial for keeping the network’s bitcoin issuance on schedule and close to 10 minute block times. The adjustment clicked down as an incentive for more miners to mine the network and earn the reward since the overall hashrate has dropped.

Elon Musk to Talk Bitcoin With Jack Dorsey at ‘The B Word’ Conference

On this Wednesday July 21st, “The B Word” Conference will feature top speakers demystifying bitcoin and cryptocurrencies aimed at getting more institutions up to speed on the asset class and it’s transformational promise. The event is put on by the Crypto Council for Innovation which includes industry leaders from Fidelity, Coinbase, Square and VC firms like Paradigm. Speakers include Elon Musk, Jack Dorsey, Cathie Wood, Nic Carter, and Adam Back.

CRYPTOGrayscale Unveils DeFi Fund Linked to New CoinDesk Index

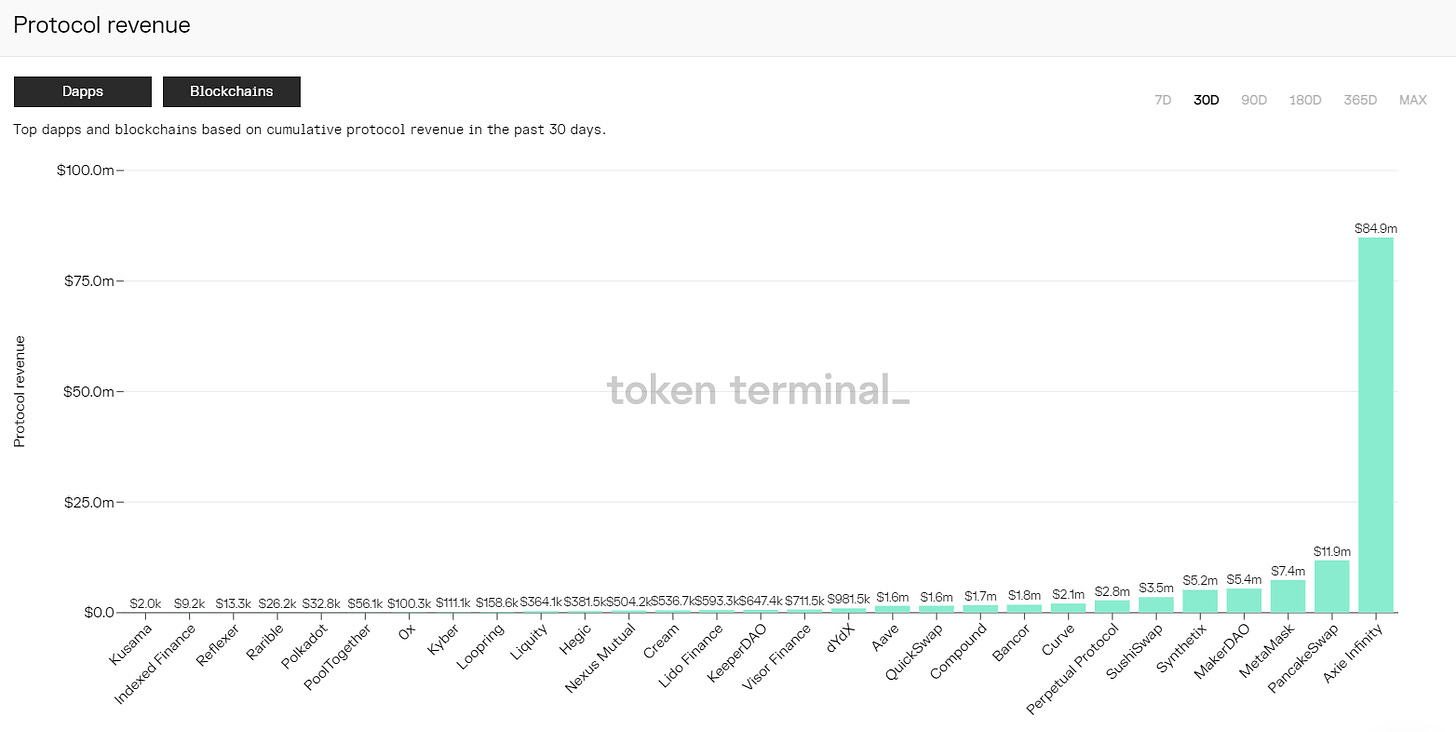

Grayscale, the largest cryptocurrency asset manager with ~$30 billion in AUM is starting a index fund focused on decentralized finance (DeFi) protocols. These projects are focused trading, borrowing and lending digital assets and are part of the fastest growing subsectors in the cryptocurrency industry with over $50 billion of value locked in these protocols. The index fund will only be eligible to individual and institutional accredited investors. The fund will be market cap weighted and could possibly include - Uniswap (UNI), AAVE (LEND), Compound (COMP), Curve (CRV), MakerDAO (MKR), SushiSwap (SUSHI), Synthetix (SNX), Yearn Finance (YFI), UMA Protocol (UMA) and Bancor Network Token (BNT). Each of these projects run on Ethereum (ETH).

Polygon Launches Unit to Grow Blockchain Gaming, NFTs

Ethereum layer 2 scaling project Polygon (MATIC) launched Polygon Studios focused on helping advance blockchain gaming and non-fungible tokens (NFTs). Polygon has been on a tear with partnerships and has gained a lot of attention from developers and investors looking to avoid high gas fees and slow transaction time working on Ethereum’s congested layer 1 mainnet.

Crypto Game Axie Infinity Has Generated $84.9M in One Month

The play-to-earn crypto game Axie Infinity is the most popular blockchain game and is becoming one of the most profitable applications using Ethereum. Over the past month, Axie has raked in over $84.9 million in funds for its treasury. Uniswap (UNI) was in second place followed by PancakeSwap (CAKE) in third, both of which are decentralized exchanges (DEX) part of the DeFi industry which as been prominent revenue generating protocols. This goes to show how much promise there is for the gaming industry and blockchain. Users earn cryptocurrency for playing the game.

Business as Usual: Binance Burns $400 Million as Regulators Circle

Binance, the largest cryptocurrency exchange by volume has just recorded its second largest token burn in history, burning $400 million in BNB tokens. Binance has it’s own cryptocurrency for it’s smart contract chain and uses it as an incentive mechanism within its centralized exchange to discount traders. The company uses it’s revenue to buy back tokens which are then burned (destroyed) ultimately to reduce the liquid token supply, making it more scarce and increasing it’s overall value. Their largest token burn was back in April when it burned $600 million worth of BNB.

DeFi Project Aave to Release Ethereum-Based Twitter Alternative This Year

Aave (LEND) the DeFi borrowing and lending protocol said the the company will launch their own social media application powered Ethereum’s blockchain network. It’s the decentralized version of Twitter. “We believe content creators should own their audiences in a permissionless fashion, where anyone can build new user experiences by using the same on-chain social graph and data,” said Stani Kulechov, founder and CEO of Aave.

Janet Yellen: We Must 'Act Quickly' on Stablecoin Regulation

Financial regulators expect to have recommendations on stablecoin rules in the coming months. US Treasury Janet Yellen called a closed door meeting with federal agency heads to discuss how to regulate stablecoins. Top three stablecoins - Tether, USDC and Binance USD have a collective market capitalization of $100 billion. Stablecoins have seen a rapid growth over the years and have been a crucial tool for the cryptocurrency market allowing traders to enter and exit positions with leverage and secure gains in a stable unit of account pegged to the US dollar.

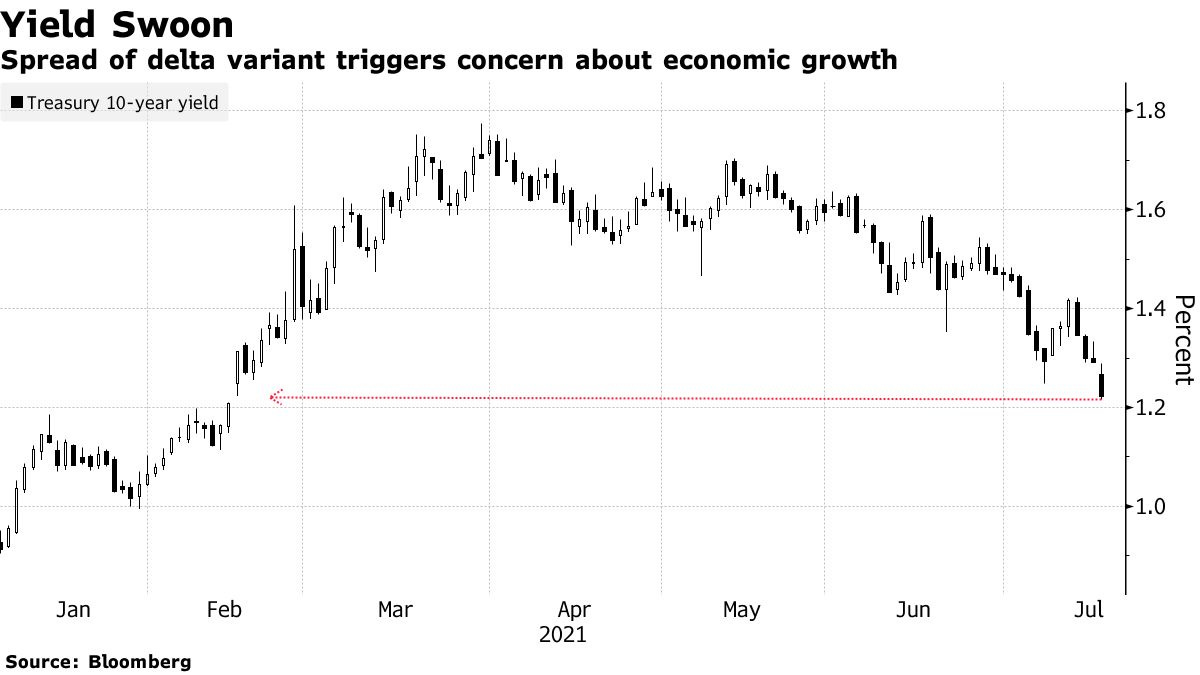

MACROLong-Term Treasury Yields Plunge as Investors Rethink Growth

The benchmark 10-year yield for US Treasuries fell to lowest point since this February, touching 1.17%. Investors pivot away from growth and take more risk off the table as the delta variant covid spreads.

N.Y. Cases Above 1,000; Vaccine Protests in France:

New York records 1k new daily covid cases for the first time since May prompting possible renewed mask mandates. Los Angeles reinstated their indoor mask mandate over the weekend. The Tokyo Olympics registers their first case of covid in the athlete’s village a week before opening. The UK reported most covid cases since January with over 54k on Saturday. While, covid cases are reaching record levels and hospitalizations are increasing, vaccinations have stifled covid’s lethal threat limiting its death count to 41 reported Saturday compared to 1,800 at peak. Indonesia becomes the world’s covid hotspot overtaking Brazil.

More Than a Third of Earth’s Population Faces Malnutrition Due to Covid

Due to significant supply chain disruptions, adults and children are suffering extreme malnutrition in low-middle income countries. As many as 3 billion people may be unable to afford a healthy diet as perishable nutrient-rich foods such as fruits vegetables, dairy, meat and fish have seen price volatility and declining consumption.

Biden Administration Blames Hackers Tied to China for Microsoft Cyberattack Spree

The Biden Administration publicly blamed the Chinese government for orchestrating and supporting the cyberattacks on the US government and American companies, including the Microsoft ransomware attack. The US government charged four Chinese nationals and resident working with the Ministry of State Security engaged in the hacking campaigns from 2011 to 2018. The National Security Agency, the FBI and the Cybersecurity and Infrastructure Security Agency have published details of more than 50 tactics used by hackers linked to the Chinese government. The US government claim against the communist country is supported by the EU, the UK, Canada, Australia, New Zealand, Japan, and NATO.

MEDIADebt Cycles & the Rise of Bitcoin with Greg Foss & Dylan LeClair

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all newsletter content including podcast, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.