@palerlotus

MAJR NEWS BRIEF

Today’s Top Stories

BITCOINHive to Increase Hashrate Almost 50% With 3,000 New Miners

Canadian bitcoin mining company, Hive Blockchain purchased 3,019 MicroBt WhatsMiner M30S machines to boost operating hashrate by 46% and increase estimated daily income by $80k.

El Salvador Bitcoin move will put pressure on network: JPMorgan

JPMorgan analysts continue to criticize El Salvador’s move to adopt bitcoin as legal tender pointing to fact that daily payment activity in El Salvador would represent 1% of the total value of the tokens transferred between wallets this past year which would limit it’s use as a good medium of exchange. They also noted that there may be an imbalance between the two monetary systems in El Salvador as bitcoin conversions into dollars could cannibalize onshore dollar liquidity. Meaning there may not be enough dollars in El Salvador support the BTC / USD conversions.

This company sells passports to Americans looking for a tax break on their bitcoin profits

Plan B Passports provides their wealthy crypto clients a path to a second passport to bitcoin and crypto friendly countries and tax-havens. They offer passports to 7 countries at the moment - Saint Kitts and Nevis, Antiqua and Barbuda, Dominica, Vanuatu, Grenada, Saint Lucia and Portugal. The company works with each countries government and citizenship-by-investment programs to secure the passports. It’s a great way for countries to bring in funds and stimulate growth. Saint Lucian passport could costs between $100k (donation), $250k (government bonds) and $300k (real estate).

The Lightning Network Is Going to Change How You Think About Bitcoin

Lightning network is a layer 2 protocol built on top of Bitcoin’s monetary network that allows users to send micropayments and settle transactions virtually instantaneously using user-hosted payment channels. The Lightning Network brings decentralized P2P payments to Bitcoin and will change the way people use and think about Bitcoin. Right now, Bitcoin is seen as decentralized store of value or savings technology, but now people actually use Lightning to actually transact with the asset. Read more about Lightning Here.

US Financial Giant Capital Group Buys 12% Stake in Bitcoin-Exposed MicroStrategy

Asset manager, Capital Group with $7.6 billion annual revenue and $2.3 trillion in AUM purchased 12.2% of MicroStrategy’s (MSTR) common stock. The purchase of 953,242 shares gives Capital Group direct exposure to bitcoin via MSTR’s 105,000 BTC. MSTR is down roughly 55% from it’s peak of $1,315 in February 2021.

Traders are withdrawing 2,000 BTC from centralized exchanges daily

Bitcoin outflows from centralized exchanges is a bullish sign for bitcoin and price action as traders move coins into cold storage signaling strong support and longer time horizons. Traders are moving 2,000 BTC ($66 million) off exchanges daily which means large market participants are accumulating bitcoin. Prior to the latest bull run to $65k, centralized exchange experienced similar volume of BTC outflows.

CRYPTOCrypto Exchanges Have a Plan to Beat Binance: Play by the Rules

US Crypto Exchanges - Coinbase, Gemini and Kraken are playing nice with US regulators in an effort to become more compliant which is a better long term strategy and faster way to scale internationally with US approval on their side.

Fidelity Digital Assets to Increase Headcount by 70%

Fidelity Digital Assets, Fidelity’s crypto focused subsidiary plans to increase their headcount by 70% in anticipation of growing institutional demand for crypto services and digital assets outside of bitcoin.

Sotheby’s Auctions Rare Diamond for $12 Million in Crypto

Auction house, Sotheby’s continues to push into crypto with a recent sale of a rare $12 million diamond accepting bids in fiat, bitcoin and ether. Sotheby’s entered the NFT market with a partnership with Winklevoss-owned crypto art marketplace Nifty Gateway and have sold NFTs for $5 million and $11.8 million.

Nifty’s Inc. launches social NFT platform with Warner Bros. partnership

Nifty’s is a social marketplace for NFTs (non-fungible tokens) officially launched Monday with partnership with Warner’s Bros. debuting Space Jam crypto collectibles. Nifty’s also announced a $10 million seed round led by Mark Cuban, Coinbase Ventures, Samsung Next, Palm NFT Studio, Dapper Labs and others. Nifty’s ultimate vision is to create a social media community for digital collectible that supports the new art scene while boosting personal interactions. NFT sales topped $2.5 billion for the first part of the year.

Small Love Potion (SLP) price doubles as Axie Infinity user growth explodes

Axie Infinity is a NFT game that’s played on Ethereum and it’s in-game currency, Small Love Potion (SLP) that is minted and rewarded to players for achieving specific milestones has rallied on increased user adoption. Axie Infinity is one of the leading blockchain games where uses can create these unique digital creatures, Axies which are based on NFTs and users can breed, battle and buy digital land with their creatures. The game is unique because users are rewarded in SLP tokens for their engagement. Axie Infinity has two tokens associated with the game. Small lotion potion (SLP) the in-game currency and a governance token, AXS which allows token holders to vote on rules within the game. Both of these tokens have rallied as players and investors continue engage with the platform.

MACROBond Market Junks ‘New Paradigm’ Talk, Frets About Too-Tight Fed

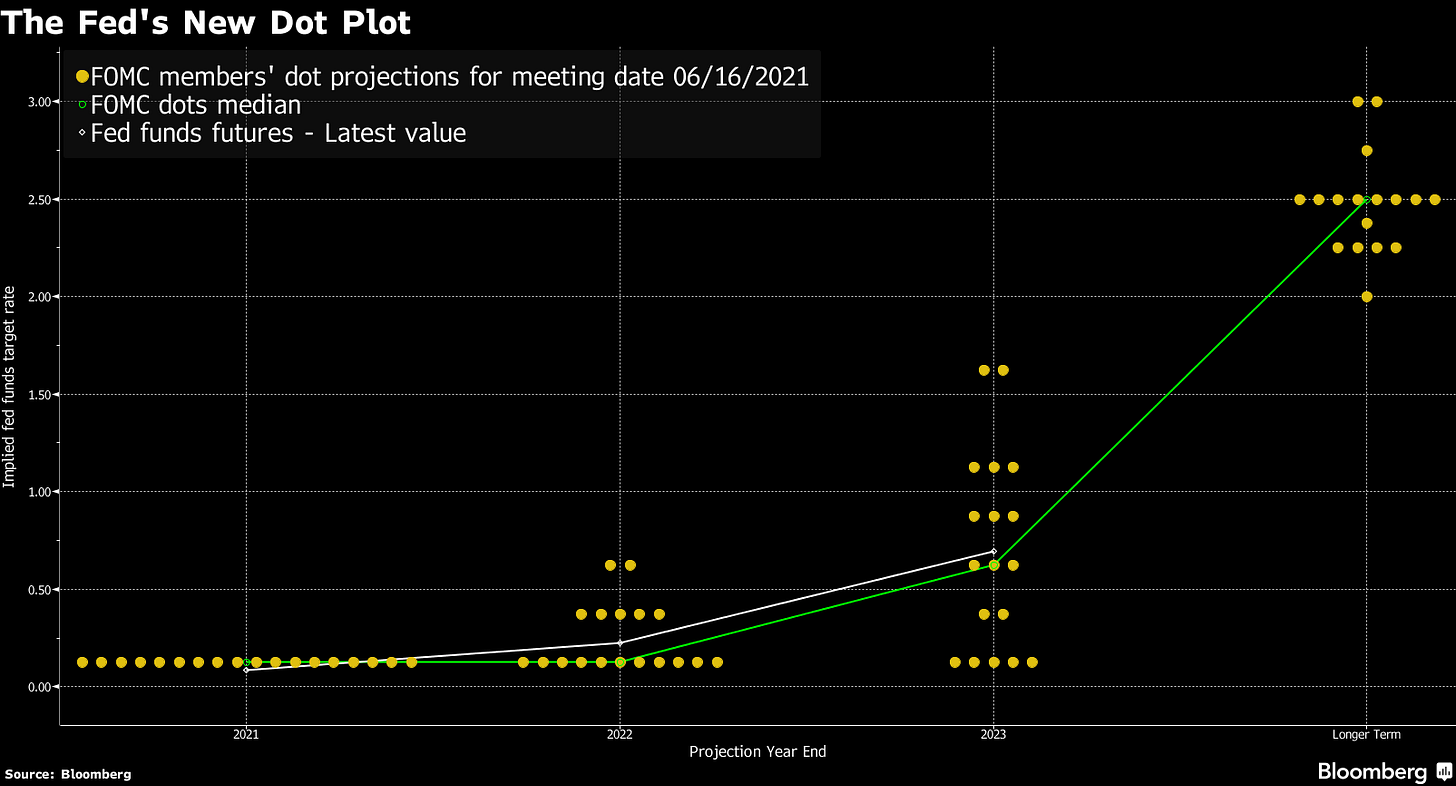

JPMorgan estimates that the Federal Reserve will not play as a big of an impact boosting growth and inflation starting in 2022. Analysts believe that the recent move in the bond market and decline in yields show that investors expect low growth and a shift away from budget busting fiscal packages. The rate on the 10Y-UST clocked in a new low since February at 1.25%. The market thinks the Fed is about to exit and pull back monetary policy, even though Fed Chair Jerome Powell’s rhetoric is quite dovish.

Global Boom in House Prices Becomes a Dilemma for Central Banks

Global monetary authorities have a new problem on their hand as pandemic-era fiscal and monetary stimulus are supporting an already hot housing market. Countries all over the world have seen a spike in housing prices that may lead to another 2008 housing crisis as central banks start to taper support. Home prices are becoming unaffordable and outpacing buyer’s income, and now large population are strapped with mortgage debt that might not be able to handle an interest rate hike.

China’s Central Bank Pivots to Easing as Growth Risks Build

The People’s Bank of China (PBOC) made a surprise cut to the bank reserve requirement ratio to free up capital and increase lending in the region. This signals that growth in China is slowing and more support may be necessary to keep economy afloat. The PBOC has been quicker than other central banks to pull back stimulus and increase interest rates, however this move indicates how fragile China is, but also how difficult it may be to tighten monetary conditions.

Treasury rally leaves investors scrambling for yield plays

As treasury yields tumble, investors are forced to accept more risk in search for yield. Investors look for dividend-paying stocks and emerging market bonds as analysts expect a rebound in yields to be unlikely because of new virus variants and tighter monetary conditions. However, there’s a different story playing out in the stock market as markets hit fresh highs.

MEDIAMastering Lightning with Andreas M. Antonopoulos & René Pickhardt

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the paywall. This is the free newsletter that drops in the evenings on Tuesday and Thursday.

Subscribe to get the daily newsletter podcast, digital asset research and analysis and exclusive articles and media.