@joluijten

MAJR NEWS BRIEF

Today’s Top Stories

BITCOINSEC Delays SkyBridge Capital Bitcoin ETF Decision Until August

The SEC has delayed another Bitcoin ETF, this time it’s Anthony Scaramucci’s SkyBridge Capital Bitcoin ETF. It’s extended to August 25th. The US has yet to approve any Bitcoin ETFs while countries like Canada and Brazil have ETFs approved. The SEC cites Bitcoin’s volatility and market manipulation as concerns.

MAJR TAKE: The real concern is most likely because an SEC approval of a Bitcoin ETF essentially gives a green light for the digital asset, which could quite possibly have massive implications across all markets and currencies given’s its decentralized global role of a store of value. The US reserve currency status has a lot to lose, but also a lot to gain with the acceptance of bitcoin.

Bitcoin, ether tumble as investors take off risk amid global markets slide

Bitcoin and crypto prices slid 6% overnight, while maintaining their range between $30k-$35k. Analysts estimate that the overnight correction could be due to another drop in 10Y-US Treasury yields shaking out to 1.25% as investors move into less risky fixed income assets. Another reason could be the surge in Covid-19 cases around some parts of the world such as Japan who’s hosting the Summer Olympic games and just declared a state of emergency due to a rise in cases. Galaxy Digital CEO, Mike Novogratz stated that the current market sentiment and temporary sell off is mainly due to China’s continued crackdown on crypto and the movement of bitcoin miners out of the region. “We’re consolidating in here between $30,000 and $35,000. What we’re seeing is Asia sells it off, and then the U.S. buys it back,” Galaxy Digital CEO Mike Novogratz.

Former CFTC chair explains why regulators should approve a Bitcoin ETF

Timothy Massad, former CFTC chair said the SEC should approve a Bitcoin ETF to improve the transparency and integrity of the crypto industry. This way investors can access the digital asset without having to buy it off exchanges and worry about custody. However, he said the chances of having one approved in the near future is low.

CRYPTOElizabeth Warren Gives SEC July 28 Deadline to Figure Out Crypto Regulation

Warren who is the chair of the Senate Banking Committee’s Subcommittee on Economic Policy sent a letter to SEC Chair Gary Gensler saying she needs an answer on crypto regulation by July 28. She’s been a long time critic of crypto, including bitcoin and has said it’s only speculative and will end badly. She’s mainly concerned with fraudsters and market manipulators, and lack of regulatory clarity on crypto’s energy use.

Crypto Payments Firm Circle To Go Public via SPAC

Circle, the crypto stablecoin company behind USDC announced that it is going public via a SPAC at a $4.5 billion valuation. The firm is backed by Goldman Sachs and one of the largest stablecoins in the market, next to Tether. CEO Jeremy Allaire said going public is the best thing for the company to do who’s in the business of being transparent with their reserve, and now they will be held to the highest accountability standards which will help them scale.

China Central Bank: Stablecoins Pose 'Risks' To Global Financial System

The People’s Bank of China expressed concern about the rise of stablecoins the speed of their adoption and development. They said they’re a threat to the international monetary system voicing concerns around transparency, possible monopolies and disorderly expansion of capital. They’re concern is justified when they’ve been working on their own payment system and digital currency that’s the complete opposite of some today’s stablecoins like USDC and Maker’s DAI - transparent and open. However, unlike Maker’s DAI, USDC is still centralized with possible censorship concerns.

DeFi Data Feed Service API3 Becomes a DAO

API3 is a service that provides data feeds to blockchain-based smart contracts is becoming a DAO. The DAO format allows for API3 token holders to vote on use of the API3 treasury ($100 million) and share in the yield that the API3 DAO creates through providing accurate and relevant data to blockchain smart contracts. This would be a more democratic and transparent form of Chainlink. Example data feeds could come from real world price feeds, social media platforms or other DeFi projects.

MAJR TAKE: DAOs will be the biggest thing to come out of crypto next to Bitcoin, smart contracts and DeFi. DAOs will be the future of companies and communities.

‘Walking Dead’ NFTs to Roam the Metaverse

Blockchain virtual reality platforms like Decentraland and The Sandbox have seen adoption skyrocket and NFTs are and will be a massive part of their platforms and monetization. For example, all of the land and in-gam items are NFTs. The Sandbox partnered with Skybound Entertainment, the creator of “The Walking Dead,” where gamers will be able to create their favorite “Walking Dead” characters to roam around the metaverse.

Israel Moves to Seize Bitcoin, Tether, Dogecoin From Hamas

The designated terrorist military group, Hamas has received crypto donations of Bitcoin, Dogecoin and Tether. Hamas, is the largest of several Palestinian militant Islamist groups. It runs the Gaza Strip and is designated a terrorist group by Israel, the US, the European Union, the UK, and other major world powers. Israel is looking to seize these assets from addresses that they believe are associated with the militant organization. They estimate that $7.7 million has been received.

MAJR TAKE: This is one of the realities that come along with decentralized cryptographic technology. While, this is definitely something that needs to be addressed a few things come to mind 1) it will be interesting to see how authorities actually seize the digital assets 2) most of the crypto was held in Tether which is pegged to the dollar and the dollar has historically been the main funding mechanism for illegal activities, not to mention the US gave billions of dollars in cash to Iran during the Iran Nuclear Deal which some is estimated to have funded terrorism and 3) this is a serious issue but regulators need to be careful not to throw the baby out with the bath water.

DeFi aggregator Zerion snags $8.2M in Series A

Ethereum based DeFi aggregator Zerion has raised $8.2 million in a Series A round led by Mosaic Ventures, Placeholder, Digital Currency Group, Blockchain.com Ventures and others. Zerion is a non-custodial application that brings over 60 DeFi protocols to user’s finger tips in a clean user interface.

MACROA $9 Trillion Binge Turns Central Banks Into the Market’s Biggest Whales

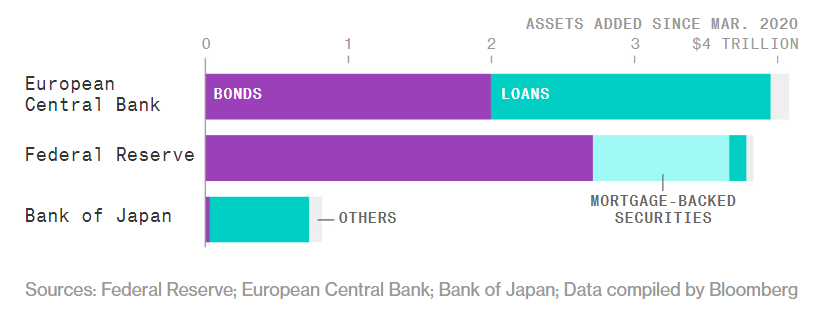

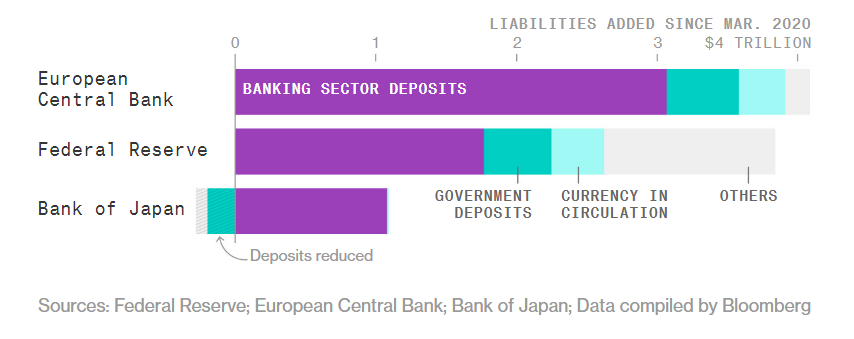

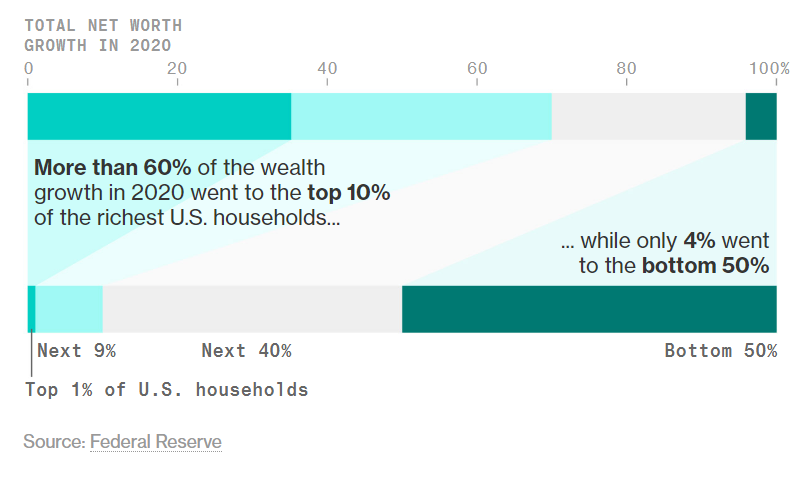

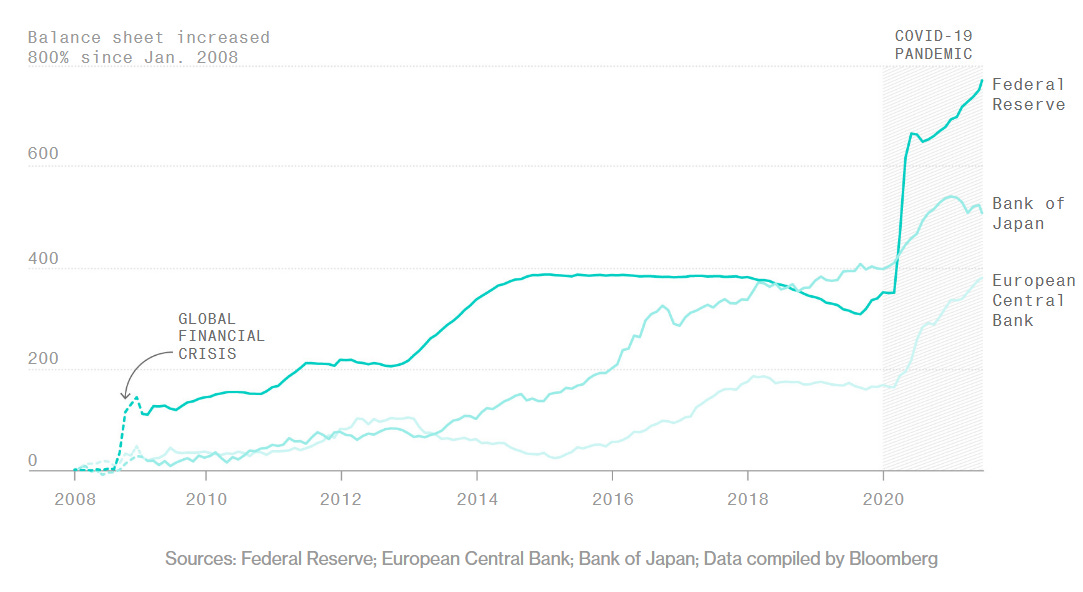

The US Federal Reserve, the European Central Bank and the Bank of Japan are the largest central banks and have racked up $9 trillion is spend bringing total combined assets to $24 trillion. This unprecedented buying spree has made the central banks the largest players in the market supporting the global economy since the pandemic. Turning off the stimulus spigot and reversing the buying spree will be extremely difficult without creating a massive hole in the economy shaking markets. It appears that central banks have backed themselves into the corner, making the rich get richer and creating credit risk all over.

ECB Unveils Policy Regime Change That Lets Inflation Overshoot

The ECB raised its goal for inflation saying that with interest rates at their lowest limits, the economy will need “especially forceful” monetary stimulus causing inflation targets to increase above 2% in the medium term. They said, inflation will be transitory.

MAJR TAKE: They’re obviously following the Fed like most central banks and providing themselves wiggle room to kick the can down the road and print money to support the already supported economy. The question is - what will happen next since they’re already so aggressive with their accommodative policies?

New Jobless Claims Hold Near Pandemic Low, as Number on Benefits Falls

Unemployment claims for last week were seasonally adjusted to 373,000. The four-week moving average is still relatively high around 394,500 claims. The number of unemployment benefits from state programs have started to end which could force more people back into the labor market. Companies have already started to see more applications for jobs and more people showing up for interviews.

MEDIACrypto Correction Over. Bitcoin To $100k & Ethereum To $10k.

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops in the evenings on Tuesday and Thursday.

Subscribe to get the daily newsletter podcast, digital asset research and analysis and exclusive articles and media.