@mag3

MAJR NEWS BRIEF

Today’s Top Stories

BITCOINAllied Payment Network to Offer Crypto Access in NYDIG Partnership

Allied Payment Network partners with digital technology and financial service company NYDIG to make bitcoin allocations for the corporation’s treasury account. Customers will have access to NYDIG’s digital payment and banking platform. Allied’s customer base is 450 small-medium sized local or regional institutions who will now have access to buying bitcoin.

Most Institutional Investors Expect to Increase Crypto Exposure by 2023

Nickel Digital Asset Management recently did a survey that found 82% of institutional investors from US, UK, France, Germany, and UAE plan on increasing exposure to bitcoin and digital assets by 2023. 4 out 10 respondents said they would increase exposure dramatically.

Bitcoin and ether are seeing a resurgence in institutional capital inflows as all digital assets pick up steam: CoinShares

According to CoinShares, sentiment has now flipped bullish and investors are putting money back into bitcoin and crypto. Bitcoin saw weekly inflows pick up to $39 million, while Ethereum saw $17.7 million. Bitcoin and ether attracted the most institutional capital, however investment is flooding into the overall market.

Bitcoin Fraud Concerns Draw Scrutiny From Regulators

Regulators are eyeing the cryptocurrency market and exchanges. SEC’s Gary Gensler told lawmakers that investor protection rules should apply to crypto exchanges. However, market participants have pushed back saying the SEC guidance and regulation doesn’t make sense for this asset class and is extremely outdated given the technology's design. For example, these peer-to-peer networks allow individual investors to swap digital tokens and earn interest on deposits without every taking custody over assets which is the opposite of our traditional financial system.

“When you go into one of these exchanges, you don’t know whether the order book is accurately reporting the bids and the offers,” Mr. Gensler said. “You don’t really know if there is front-running. You don’t know whether some of the trading that is reported is real or fake.” Front-running involves the misuse of customer information to trade for one’s own gain.

CRYPTOFinCEN Appoints First Chief Advisor for Crypto

FinCEN appointed Michele Korver to be the agency’s first Chief Digital Currency Advisor who previously worked at the DOJ. Korver will work to prevent illegal practices around money laundering and crypto to crypto transactions. This is the second big hire for FinCEN’s crypto team. They hired acting director Michael Mosier from blockchain analytics firm Chainalysis. FinCEN’s latest rule which is under further review would require crypto exchanges to KYC user wallets.

Solrise Finance Raises $3.4M for Non-Custodial Protocol on Solana

Solrise will use funds from to build out the DeFi ecosystem within Solana. Solrise is a fund management and investment protocol. By creating a non-custodial protocol, investors will be able to enter and exit from Solrise Investment Management on their own schedule. Prominent investors include Delphi Digital, CMS Holidngs, Jump Capital, Parafi Capital and Alameda Research.

DAO Behind DeFi Pulse Index Raises $7.7M From Galaxy Digital, 1kx

Index Corporative a decentralized autonomous organization (DAO) behind the tokens like DeFi Pulse Index closed a $7.7 million round led by Galaxy Digital and 1kx. Index builds structured DeFi products to help investors gain exposure to various corners of the market. The funds will be used to hire more engineers to expand onto other networks.

The Top Decentralized Exchanges (DEXs) in 2021

NFT Sales Volumes Hit $2.5 Billion For First Half of 2021

Since March, we’ve seen 10k-20k NFT sales per week. Demand is outpacing supply. The new token technology has taken the industry’s attention by storm and brought new buyers, artists and investors into the space. Rarible closed a $14.2 million Series A round and NFT production company, NFT Genius raised $4 million round lead by Ashton Kutcher and Mark Cuban. Fox Corporation is investing $100 million into a NFT studio.

America’s First Legal DAO Approved in Wyoming

American CryptoFed DAO is the first legally recognized DAO in the US. Their mission is to introduce a new monetary system. DAOs can be officially registered in the state of Wyoming. Wyoming is also the first state to grant a charter to a crypto bank. Wyoming legislation makes it easier and cheaper to set up a DAO similar to setting up a LLC. American CryptoFed is launching it’s governance token Locke via SEC approved Token Safe Harbor Proposal 2.0.

Ethereum developer proposes August 4 for London mainnet upgrade

The long awaited mainnet upgrade looks is set to go live on August 4th. This upgrade will incorporate EIP-1559 which will change transaction fees in so a portion of the ETH fees are putting deflationary pressure on supply and theoretically boosting the price of ETH. There are some estimates that the London upgrade will increase price by 40% against Bitcoin.

The Future of DAOs: How the Investment Landscape is Evolving

Decentralized Autonomous organizations (DAOs) are growing fast. The DAO ecosystem has increased by $265 million in the past month to $862.8 million. The projects are pooling capital and allowing funds and community governance to be managed through blockchain voting technology. These online communities are testing grounds and windows into a future of company structure that’s global, open and has a spectrum of decentralization. DAOs are also faster and cheaper to create than other company structures, costing anywhere between $500 - $10k.

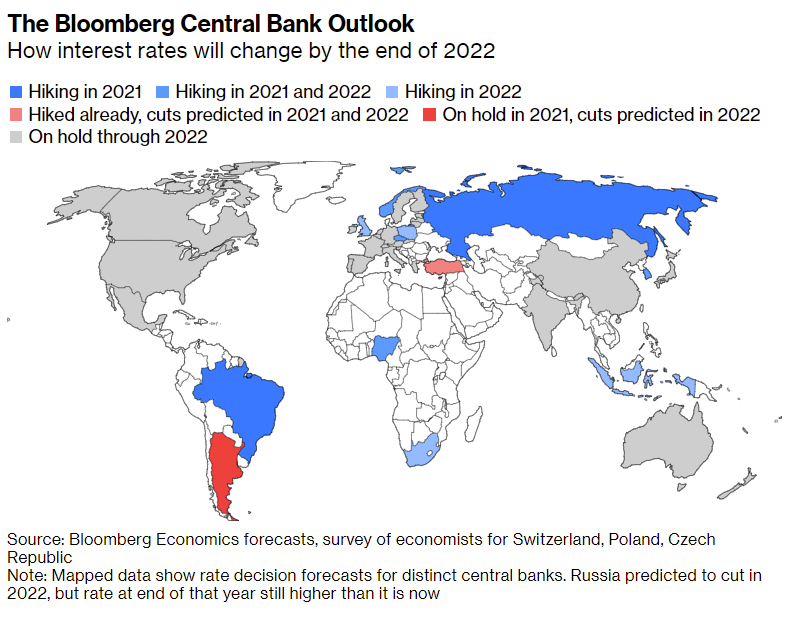

MACROIt’s the Beginning of the End of Easy Money

Central banks across the world are starting to discuss how they can taper their stimulus and monetary programs. China is curbing credit growth. Brazil, Mexico, Turkey, Czech Republic and Russia have increased interest rates. The Fed is sending mixed signals and analysts think we see an announcement come out of the Fed during the August 26-28 Jackson Hole policy meeting.

Dallas Fed Warns Its In-House Inflation Measure to Heat Up

Economists at the Dallas Fed warn that we could see a surge in inflation numbers as the economy starts to open up. The Trimmed Mean PCE inflation data used at the Fed was reading 1.9% in for May YOY and economists think we could see 2.4% by year-end 2022.

Mired in Crises, Lebanon Hopes Summer Arrivals Bring Relief

Lebanon has been hit hard by the pandemic and economic crisis that’s sent the country into a full blown currency crisis, losing more than 90% of its value since fall of 2019. Anti-government protests have ripped through the country over taxes, currency, government imposed lockdowns. Officials are hoping that more local tourism can support their country through these hard times. External tourism is down visiting their country as electricity flutters, stores have closed, gas is limited and being rationed.

MEDIABitcoin Whales Are Selling To Retail Investors | Will Clemente and Checkmate | Pomp Podcast #597

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter.We’ve moved some content behind the pay wall. This is the free newsletter that drops in the evenings on Tuesday and Thursday.

Subscribe to get the daily newsletter podcast, digital asset research and analysis and exclusive articles and media.