@gustavo

MAJR NEWS BRIEF

In today’s brief, we wanted to highlight a recent Reuter’s interview done with Paraguayan Deputy Carlos Rejala who’s been very vocal about making bitcoin legal tender in Paraguay. In the interview, he back slid his comments and provided more color about his actual intensions and the reality of his position in the Chamber of Deputies.

In the STATS section, we’ve also included the countries with the highest rates inflation. Bitcoin adoption is mostly likely going to come from countries with high inflation, a concentration of power, an unstable economy and high remittance inflows.

Paraguay’s Political Reality

In early June, El Salvador became the first country to pass a law making bitcoin legal tender in the country. This historical moment set off a chain reaction of newfound pro-Bitcoin politicians from Latin American and developing countries. They lit up twitter, did interviews and posted pictures with laser eyes signaling that they want to be the second bitcoin denominated country. One in particular was 36 year old Paraguayan Chamber Deputy (congress) Carlos Rejala.

Deputy Rejala tweets about his love for technology and his intentions for bitcoin. He’s drafted a bill which will be sent to the Chamber in the next few weeks. He recently did an interview with Reuters that shed light on the reality of pushing the bill into law. Decrypt also did a piece on the situation.

While most bitcoiners are excited about nation states adopting the technology and see this as inevitable, it should be noted that El Salvador was an extreme situation and it might take longer for other countries to get on board. Which is ok. We’re playing the long game.

Paraguay is different than El Salvador and there could be alternative reasons for the surge in pro-Bitcoin politicians.

El Salvador had a president with a super majority in congress. Deputy Relaja is a newer Deputy and his Hagamos Party is also young with only 4 seats of the 80 in the chamber. El Salvador suffers from higher inflation than Paraguay. Paraguay’s banks are more conservative and their fiat currency (not the dollar) is one of the more stable in the region. It’s been reported that the first draft of the bill was filled with issues, taxes and uncertainties with regard to wallets. So, without the political capital, making bitcoin as legal tender seems like a far cry.

According to Luis Benitez, who’s an open-source activist who was working closely with Rejala said, “This draft seems to me one of the most unfortunate documents I have seen in matters of technology in the last 10 years….It is not even clear on the concepts of what a wallet is, and other important issues; it proposes crypto taxes and [even] a fund against losses.”

However, Deputy Relaja did say making bitcoin legal tender was impossible as they have have their own fiat currency, and there’s not immediate need for legislation as its currently not illegal to use cryptocurrencies in the country. The bill’s intentions is to put Paraguay on the map as a crypto-friendly country and beginning the process of getting lawmakers involved.

It’s important to note that crypto trading has picked up in Paraguay this year. Paraguay is a beautiful country that has cheap electricity and relatively low taxes. Not a bad place for bitcoiners and miners to set up shop.

Bitcoin Opportunists

Regardless if any Bitcoin law gets passed, it’s good to see more people in power speaking positively about the digital asset and I think any movement towards wider adoption, especially in developing countries is a great thing.

On the other hand, Bitcoin’s brand and technological reach is global. Everyone in the highest seats of power know about Bitcoin and/or are talking about what to do about it. Say what you want about the asset, Bitcoin has brand power.

The emergence of unknown politicians from developing country virtue signaling for Bitcoin may just be an easy way to gain political and celebrity clout. After posting laser eyes on Twitter, some of the politician’s audience instantly doubled and attracted big names like Jack Dorsey, CEO of Twitter and Square. They’ve received global attention out of nowhere, so one has to keep in mind perhaps some of these individuals are just Bitcoin opportunists seeking fame over change.

In the end, I don’t blame them. Bitcoin’s brand and technology is powerful. I’d recommend anyone and any company to use Bitcoin’s marketing influence to your advantage. But, it’s reminder that change takes time and patience is key.

Matt Verklin

@mverklin

IN OTHER NEWS:

Coinbase Pro to launch a dapp store (crypto application store). In essence, Coinbase want’s to be the Apple for crypto and decentralized applications - NFTs, smart contracts, DAOs, DeFi, gaming, etc.

Twitter drops 140 NFTs on Rarible. The highest bid at $2,147.94 for one NFT.

SEC filing revealed that Morgan Stanley Europe Opportunity Fund holds at least 28,000 shares of GBTC worth $1.3 at the time of purchase and now $880,000.

Approximately 650 banks will now have access to buy and store bitcoin with an integration deal between NCR and NYDIG. Now 24 million new customers will be easily able to on-ramp into bitcoin.

Crypto company and exchange, Crypto.com furthered expanded their presence in the world of sports with a new partnership with Formula 1. They will become the global partner for F1 and help make exclusive NFTs for their racing brand.

Syndicate DAO raised $800k from 100 investors some of which are the biggest names in crypto - Balaji Srinivasan, Jeremy Allaire, Meltem Demirors and dozens more. The Syndicate is decentralized autonomous organization that allocate venture capital by democratizing investing as a community. It’s a good example of the future of venture capital and hedge funds.

Canadian company, Hut 8 buys $44 million of bitcoin mining machines doubling their hashrate. They purchased 11,090 new miners from SuperAcme technology. They are expected to be delivered and in October and deployed in December. This investment comes after an $82 million raise done to expand mining capacity.

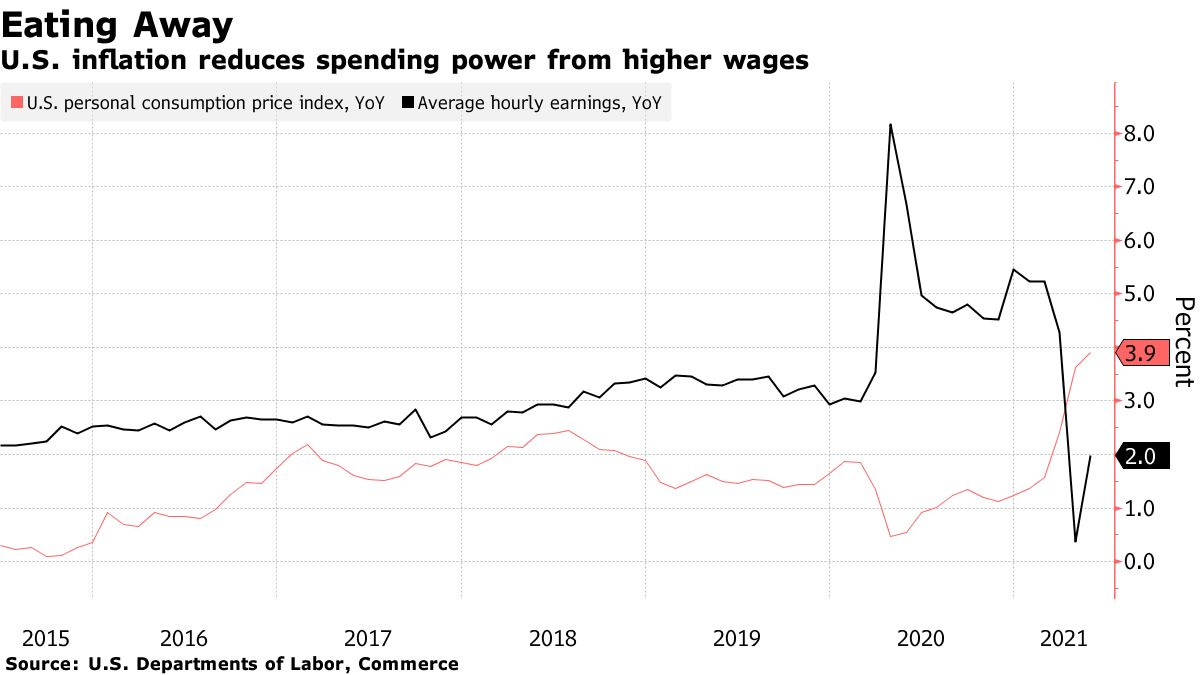

Americans are seeing increased pay from employers as incentive to come back to work, however, the pay is still failing to keep up with the price of inflation. Wages gained 3.6% in May, however inflation in CPI rose 3.9%. This is putting Republican pressure on Biden’s $4 trillion infrastructure plan as companies stuck between a rock and a hard place - materials and operational costs have gone up while they need to pay more to attract workers. As consumer confidence continues to increase, we should expect price inflation to follow.

Inflation pressure still increases in Russia despite central bank raising interest rates and making official agreements with producers and retailers to limit the prices of food and exports. Inflation rate recently jumped over 6% for the month of May.

Treasury yield fell slightly signaling investors are more weary of the economy and lowered expectations of more stimulus. When yield falls it means bond prices rise. They are inversely correlated and when bond prices rise it means investors are seeking protection from potential market corrections. The benchmark 10-year US Treasury yield settled at 1.47% Tuesday.

STATS

Countries with the worst inflation rates referenced over the last month.

Venezuela: 2,720%Sudan: 363%Lebanon: 120%Zimbabwe: 107%Argentina: 48.8%Iran: 46.9%Suriname: 44.4%Angola: 24.94%Zambia: 24.94%Ethiopia: 19.7%

TOP STORIES

BITCOINMorgan Stanley Fund Holds 28,000 Grayscale Bitcoin Trust Shares, Decrypt

Why Paraguay Isn't Going to Make Bitcoin Legal Tender, Decrypt

650 U.S. Banks Will Soon Be Able To Offer Bitcoin Purchases to 24 Million Customers, Decrypt

Hut 8 Buys $44M Worth of Miners, Doubling Its Hashrate, Coindesk

CRYPTOCoinbase Plans to Build 'Crypto App Store’: CEO, Decrypt

Crypto.com Inks $100 Million Partnership with Formula 1, Decrypt

Decentralized Investing Platform Syndicate Raises $800K From 100 Investors, Coindesk

MACROInflation Eats at Surging U.S. Pay With Biden Plans at Stake, Bloomberg

Russia’s Export Curbs Fail to Control Outbreak of Inflation, Bloomberg

Treasury Yields Signal Investors’ Waning Economic Exuberance, WSJ

MEDIAWhy Corporations Are Putting Bitcoin on Their Balance Sheet | Pomp Podcast #595

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.