MAJR NEWS BRIEF

In today’s brief, I wanted to share one of the most read articles about bitcoin and why it’s important written by Vijay Boyapati. In this post, I’ve summarized the 41 minute read to 15 minutes and included the entire article here.

The Bullish Case for Bitcoin

by Vijay Boyapati

Part 1 - Genesis

Yes, investing in bitcoin is risky. It shows signs of a bubble, which is compared to the tulip mania or the dot.com era. And, it’s an asset without any intrinsic value essentially backed by nothing. However, as the author argues there’s a massive opportunity in bitcoin from a technological standpoint and an investment standpoint.

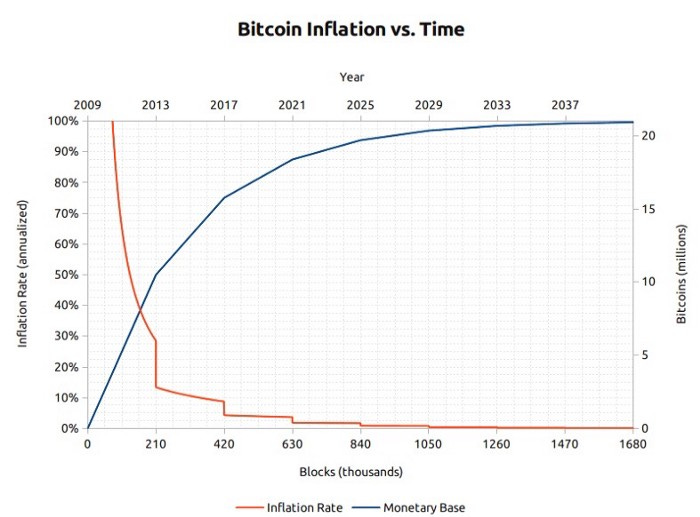

In all of history, we’ve never been able to send value from one place to another without using a 3rd party intermediary such as a government or bank, let alone send it at the speed of light. Satoshi Nakamoto’s 9 page Bitcoin whitepaper was a huge breakthrough for both computer science and economics. It solved the long standing computer science problem of decentralized trust called the Byzantine General’s Problem and created the profound invention that we call digital scarcity. There will only ever be 21 million bitcoin.

Bitcoin is different from other investments. It’s not backed by a physical commodity. It can’t be valued by discounted cash flow models like equities. So why invest in bitcoin?

Bitcoin is unique as it falls into the monetary good category, whose value is set game-theoretically. Each market participant values the good based on their appraisal of whether and how other participants will value it. In order to better understand the value of monetary goods, the author takes us back to the origins of money.

Part 2 - Origins of Money

First, we had barter which was incredibly inconvenient and impossible to scale due to the main problem of “double coincidence of wants.” I’m a fisherman and I need food, however I only have fishing rods to exchange, but other the person with the cow needs shoes and not a fishing rod…This situation doesn’t allow for communities to scale, until humans traded collectibles or an independent rarity that society understood had symbolic value. These collectibles changed over time and ranged from rye stones, glass beads, sea shells and finally metals.

Part 3 - The Attributes of a Good Store of Value

Individuals had to anticipate which good would make the best monetary good. These monetary goods have specific properties.

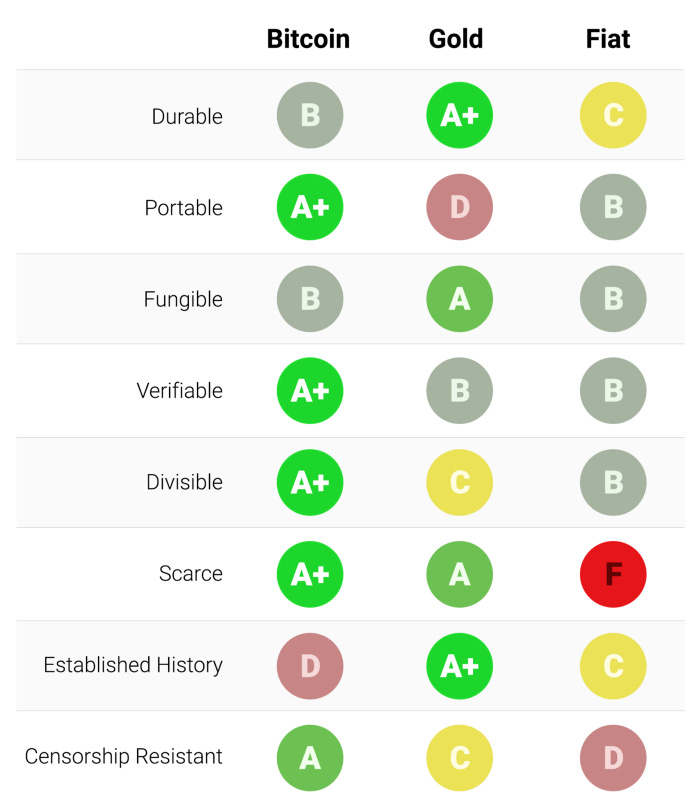

Durable - good must not be perishable or easily destroyed.

Portable - good must be easy to transport, not heavy or alive.

Fungible - good must be interchangeable with another of equal quantity.

Verifiable - good must be easy to identify and verify authenticity.

Divisible - good must be easy to subdivide to trade with range of items.

Scarce - good must be hard to obtain or produce in quantity. Likely the most important quality as it taps into human desire to own what’s rare.

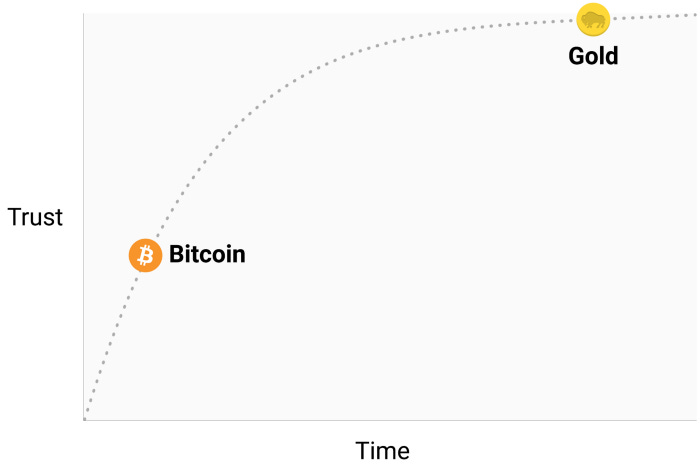

Established history - the longer society perceives the good to have value the greater the appeal.

Censorship resistance - a new attribute that’s become increasingly important in the modern and digital world. A good must be able to move freely without central authority control and manipulation.

It should be noted that the individuals who anticipated the future use of specific monetary goods were able to acquire much more of them while they were cheap and before they were widely adopted and society demanded it for trade.

Part 3 - The Evolution of Money

While the store of value component has been the cornerstone property of money, it’s been superseded by the medium of exchange function, since states have monopolized the issuance of money and continually debase the number of units.

Money has historically always evolved in the following four stages.

Collectible - Money will be demanded solely based on its peculiar properties, usually becoming a whimsy of its possessor. Shells, beads and gold were all collectibles before later transitioning to the more familiar roles of money.

Store of value - Once money is demanded by enough people for its peculiarities, money will be recognized as a means of keeping and storing value over time. As a good becomes more widely recognized as a suitable store of value, its purchasing power will rise as more people demand it for this purpose.

Medium of exchange - When money is fully established as a store of value, its purchasing power will stabilize. Having stabilized in purchasing power, the opportunity cost of using money to complete trades will diminish to a level where it is suitable for use as a medium of exchange.

Unit of account - When money is widely used as a medium of exchange, goods will be priced in terms of it. i.e., the exchange ratio against money will be available for most goods.

“Bitcoin is currently transitioning from the first stage of monetization to the second stage. It will likely be several years before Bitcoin transitions from being an incipient store of value to being a true medium of exchange, and the path it takes to get there is still fraught with risk and uncertainty. It is striking to note that the same transition took many centuries for gold. No one alive has seen the real-time monetization of a good (as is taking place with Bitcoin), so there is precious little experience regarding the path this monetization will take.”

Part 4 - Path Dependence

The process of monetization always looks like a bubble as monetary goods are not based on any intrinsic value, but rather the market determining the price. The price swings are evidence of a monetary premium placed on the particular good during specific times against possible other monetary goods. That premium could be outpaced by another good with possible better characteristics, until the market decides otherwise.

As currency continues to lose its store of value component, the market will find other goods that make for a better store of value, creating new premiums and new bubbles. This could be seen between silver and gold over the years and now bitcoin making its way into the store of value conversations with diamonds, stocks, bonds and real estate.

However, the notion of “cheap” and “expensive” don’t necessarily matter for monetary goods as their price is a function of the market determining their value over time. Not pricing based on cash flows.

“Monetary goods or money is the foundation for all trade and savings, so the adoption of a superior form of money has tremendous multiplicative benefits to wealth creation for all members of a society.”

The author goes into the bitcoin’s price history and specific events that have lead us today, when nation states begin to adopt bitcoin.

Part 5 - The Entrance of Nation States

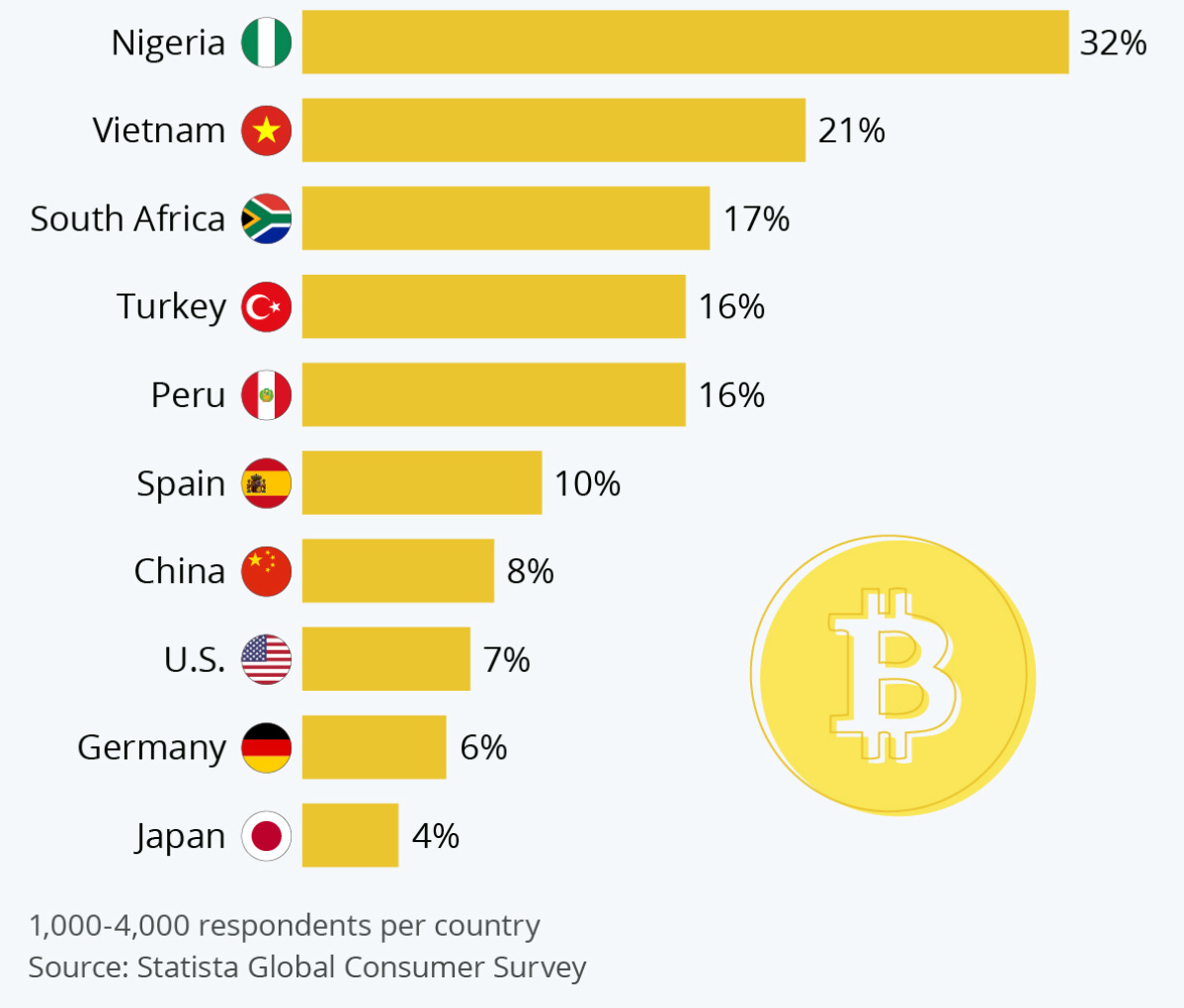

Bitcoin is one of the most unique assets today and its monetary network works differently than other asset classes. Investors generally want to get in as early as they can in order to capture the upside. However, with monetary goods like bitcoin, the larger the market cap and the higher the price, the more safe the asset class becomes for large institutions and nation states to begin investing into the asset.

In the 2018 article, the author predicts that the first movers will be the smaller countries with more authoritarian powers. They will be able to move faster vs democracies and will be faster to accumulate the asset. The public will see this as a negative given the insignificant and problematic states that are accumulating bitcoin and improving their financial systems, and therefore postpone adoption hurting them in the long run.

Part 6 - Common Misconceptions of Bitcoin

Bitcoin is a bubble - Like all market based monetary goods, each comes with a monetary premium that fluctuates with the market demand and sentiment. It’s actually a defining characteristic of money, especially money in its early adoption and price discovery phase.

Bitcoin is too volatile - This is a function of its infancy. However, bitcoin’s volatility has reduced over the years as the asset class and the market cap have increased becoming more liquid. When bitcoin’s market cap is of gold or higher, volatility should be equal to those assets.

Transaction fees are too high - This is the misconception that comes out of our current economic thinking of prioritizing medium of exchange over store of value. Critics want a payment system first, but don’t realize the important of being a store of value when value is being destroyed. Like all money systems, bitcoin will have layers and layer 2 solutions will provide the scalability necessary to become the desired payment system.

Competition - There will always be competition from other cryptocurrencies such as Litecoin and Ethereum, however Bitcoin’s first mover advantage and elegant design has created a moat of network effects around the asset class in the form of decentralization, intellectual capital, specialized hardware, economic density and security and even it’s own language / memes - “HODL,” “Bitcoin Fixes This,” and “Have Fun Staying Poor.” While the open source code is easy to copy paste, bitcoin’s path dependence and network effects are much more difficult to replicate.

Part 7 - Real Risks

While many of the mainstream media risks are surface level and expunged, there are real risks to the protocol’s future adoption.

Protocol Risk - If a bug is found or introduced into the core protocol or new technology is created to undermine Bitcoin’s cryptography, then faith in the asset could be compromised. However, Bitcoin’s core development is handled with great care and patience, plus the primary attributes of bitcoin have been almost cemented by the community - 21 million coins, 1MB blocks and Proof of Work consensus algorithm.

Exchange Shutdowns - The possible ban of on-and-off ramps of fiat into the bitcoin network is definitely a risk of slowing down adoption. However, new decentralized exchanges are emerging that could make this risk less concerning and more difficult to implement. And, as more countries adopt the asset, there will be more incentives for people with strong bitcoin positions to move to where their money is treated best.

Fungibility - Bitcoin’s network and digital asset are open and transparent which makes it possible for authorities to claim some bitcoins that have been “tainted” (not ESG mined, flowed from specific exchanges or merchants, etc). This is a common topic today, but it’s unlikely to persist as the Taproot upgrade was just locked in which makes bitcoin more private. And, if bitcoin’s fungibility were to be compromised by authorities then it would just force some of the coin underground as the transactions are censorship resistant.

Part 8 - Conclusion

The world is witnessing society monetize a new monetary good in real time. We’re moving from a collectible to a store of value in less than 12 years. Merchants are already accepting this as a medium of exchange, however, this phase will most likely not happen until the opportunity loss is diminished when trading the asset.

Although bitcoin is risky, this type of event is a once in 5,000 year occurrence and technology disruption of money itself. The asymmetric upside and downside for not participating in this transition is monumental. The global adoption of bitcoin as a store of value and then money as the unit of account is the bullish case for bitcoin.

The potential opportunity was detailed best in an email exchange between Satoshi Nakamoto and cryptographer Mike Hearn and Hal Finney.

If you imagine it being used for some fraction of world commerce, then there’s only going to be 21 million coins for the whole world, so it would be worth much more per unit.

Imagine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. With 20 million coins, that give each coin a value of about $10 million.

Bitcoin only needs to reach a fraction of these numbers mentioned above to become a global store of value. After that, it’s anyone’s guess.

Regardless of what happens over the next 20-30 years, it might not be a bad idea to have some coin as a hedge.

Summarized by

Matt Verklin

@mverklin

IN OTHER NEWS:

Bitcoin breaks through $35k resistance with stronger volume and is up 3.5% in the last 24 hours and up 14.2% this past week. Next resistance test will be at $37k and $40k levels.

Coinbase rolls out new high yield savings product with 4% APY on USDC.

Mexico’s Financial Authorities quickly followed Mexican banking and media billionaire Ricardo Salinas Pliego’s public comments calling fiat a fraud and how he’s bullish on bitcoin. Authorities said bitcoin and crypto are not legal tender and institutions are prohibited from accepting them. They reiterated that this will not change in the near future…

MAJR Take: This sounds familiar. Many countries who take a strong stance against the decentralized digital assets just find adoption increase within their borders or some form of capital flight to these assets.Fetch.ai launched a DeFi AI service called DeFi Agent tool that could help traders using DEXs like Uniswap and Pancake by implementing stop losses with preset conditions to combat crypto’s volatile markets.

Tom Brady and Gisele partner with FTX trading firm. The couple will receive equity in FTX and this is the third public endorsement for crypto trading firm FTX into the sports world - FTX Arena in Miami, Partnership with MLB and now the GOAT.

Ark Invest is partnering with 21Shares to provide marketing assistance to 21Shares Bitcoin ETP product.

Crypto startup Worldcoin wants to scan your eyeballs in exchange for cryptocurrency to create a unique personal identifier. The company is lead by Silicon Valley veterans from Y Combinator and backed by a16z, Coinbase Global, LinkedIn’s Reid Hoffman and Day One Ventures. The goal is surpass the government and be able to distribute money, a universal basic income to everyone on the planet.

Coinvise is a new social media platform that operates on both Ethereum and Polygon networks. “The goal is to use social tokens as a means to incentivize better coordination with communities and enable creators to monetize their work without giving ownership to centralized platforms.” Other similar platforms are Rally, Roll and Fyooz which are making it easy for creators to use their tokens for rewards, airdrops, crowdfunding and exclusive access via NFTs.

a16z leads $12 million seed round for on-chain analytics company, called Nansen who’s tracking flows of smart money through smart contracts and DeFi. Other investors include Skyfall Ventures, Coinbase Ventures and others. On-chain analytics is a hot space. Chainlysis, one of the leading on-chain analytics companies was just valued at $4 billion.

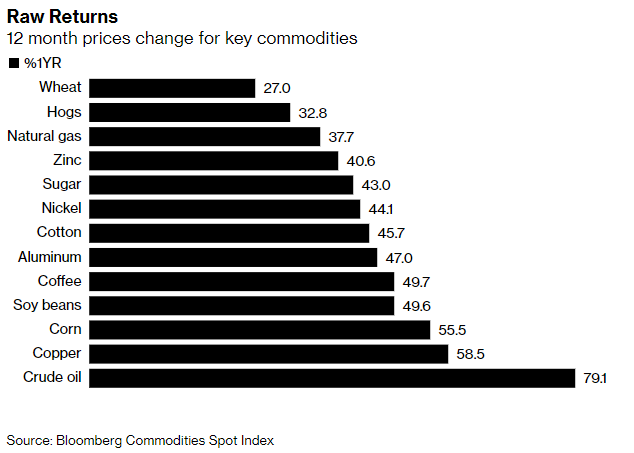

The inflation trade has done very well for commodity traders. While, Unilever and P&G have announced price increases and the world is seeing inflation across the board in lumber, corn, aluminum, copper and oil - traders are raking in billions. Economists typically define a supercycle as period of abnormally strong demand where commodity companies, miners and farmers cannot keep up and these supercycles can last much longer then normal cycles and are typically driven by a transformational socioeconomic events. The entire world wants everything right now, yet real supply chain constraints, emergent technology, geopolitical repositioning and a lingering pandemic could be the ingredients for the next decade long commodity supercycle.

US & UK home prices rose fastest 15 and 17 years. Indexed across US 20 metropolitan areas gained 15% over the last year ending in April. Month over month increases range between 1.6%-1.7%. UK property prices rose 13.4% from a year earlier. This is largely due to limited supply of home vs. demand.

TOP STORIES

BITCOINBitcoin Gathers Upside Momentum, Faces Resistance Near $40K, Coindesk

Ark Invest Lending Name to Swiss Bitcoin ETF, beincrypto

Mexico's Financial Authorities Pour Cold Water on Billionaire's Bitcoin Bank Plan, Decrypt

CRYPTOCoinbase Jumps into High-Yield Crypto Game with 4% Interest on USDC, Decrypt

Sam Altman Wants to Scan Your Eyeball in Exchange for Cryptocurrency, Bloomberg

NFL Legend Tom Brady and Wife Gisele Bündchen Partner With FTX, beincrypto

DeFi Meets AI: Fetch.ai Launches ‘Intelligent Automation’ for Uniswap V2 and PancakeSwap, Coindesk

Web3 Creators Have a New Platform for Minting Social Tokens, Coindesk

A16z Leads $12M Investment in DeFi-Native Crypto Tracing Firm Nansen, Coindesk

MACROCommodity Traders Harvest Billions While Prices Rise for Everyone Else, Bloomberg

U.S. home prices rose in April at fastest pace in 15 years - S&P/Case-Shiller, Reuters

U.K. House Prices Jump Most Since 2004 Before Tax-Break Deadline, Bloomberg

MEDIAParker Lewis and Vijay Boyapati - Swan Signal Live E61

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.