@Sussis

MAJR NEWS BRIEF

In today’s brief, I wanted to update readers on bitcoin’s adoption happening at the international level.

El Salvador made headlines earlier this month when President Bukele announced legislation that would make bitcoin legal tender in the country on par with the US dollar. The announcement was shortly followed by a super majority in congress signing the bill into law within 48 hours. Since this historical event, we’ve seen more news coming out El Salvador and other developing country signally for bitcoin adoption.

El Salvador

The country has a wealth of geothermal energy plants utilizing heat generated from volcano activity. They plan on transitioning these clean energy sources to mine bitcoin.

President Bukele announced that every citizen will receive $30 in BTC for their starter accounts using the optional government wallet and interoperable digital wallets. They hope to reach 4 million wallets with the initiative.

World Bank refused El Salvador’s request to help with bitcoin implementation into country’s financial infrastructure.

1,500 new cash-to-bitcoin ATMs to be established within the country.

Paraguay

South American country Paraguay becomes the second nation to propose bitcoin legal tender legislation. The bill proposal was confirmed by a member of parliament Carlitos Rejala who has been a supporter of Bitcoin and has shot into global fame in the past weeks.

Tanzania

Tanzania female President, Sami Suluhu Hassan has directed their central bank to prepare for cryptocurrency adoption. The country is a $63 billion economy that relies heavily on cash. The Bank of Tanzania is now working to overturn their previous ban on crypto at the president’s directive.

Nigeria & Ghana

Recently announced that the country’s central bank plans on launching a central bank digital currency (CBDC) before the end of 2021. The CBDC will be a complement to their cash system and it will be a means to help remittances flowing into the country, $26.4 billion in 2019. This news came on the heels of Ghana’s announcement for their CBDC pilot program.

Portugal

Central bank approves licenses for two crypto exchange operations.

According to the Portuguese tax authorities, the exchange of Bitcoin “constitutes an on-demand, VAT-free exercise of services”. This means that any gains made from the purchase or sale of Bitcoin are not taxed, nor is the exchange of Bitcoin for other currencies. Payments in Bitcoin to individuals in Portugal are also not taxed, however, any companies who deal in Bitcoin will be liable to tax on capital gains (paid on a scale between 28% and 35%).

Argentina

There’s over 20 crypto mining farms in the country. Bitfarms is a publicly traded bitcoin mining company announced that they will be ramping up its operations in the country from 60 megawatts to 210 megawatts. Government officials are discussing energy subsides for miners. Bitfarms estimated that the new facility could mine BTC at a cost of just over $4,000 per coin. Argentina has been reeling from inflation problems for decades and given their cheap power, they’re economy is poised for further crypto adoption.

Bitcoin and crypto adoption is happening faster than you think. Momentum is gaining.

Matt Verklin

IN OTHER NEWS:

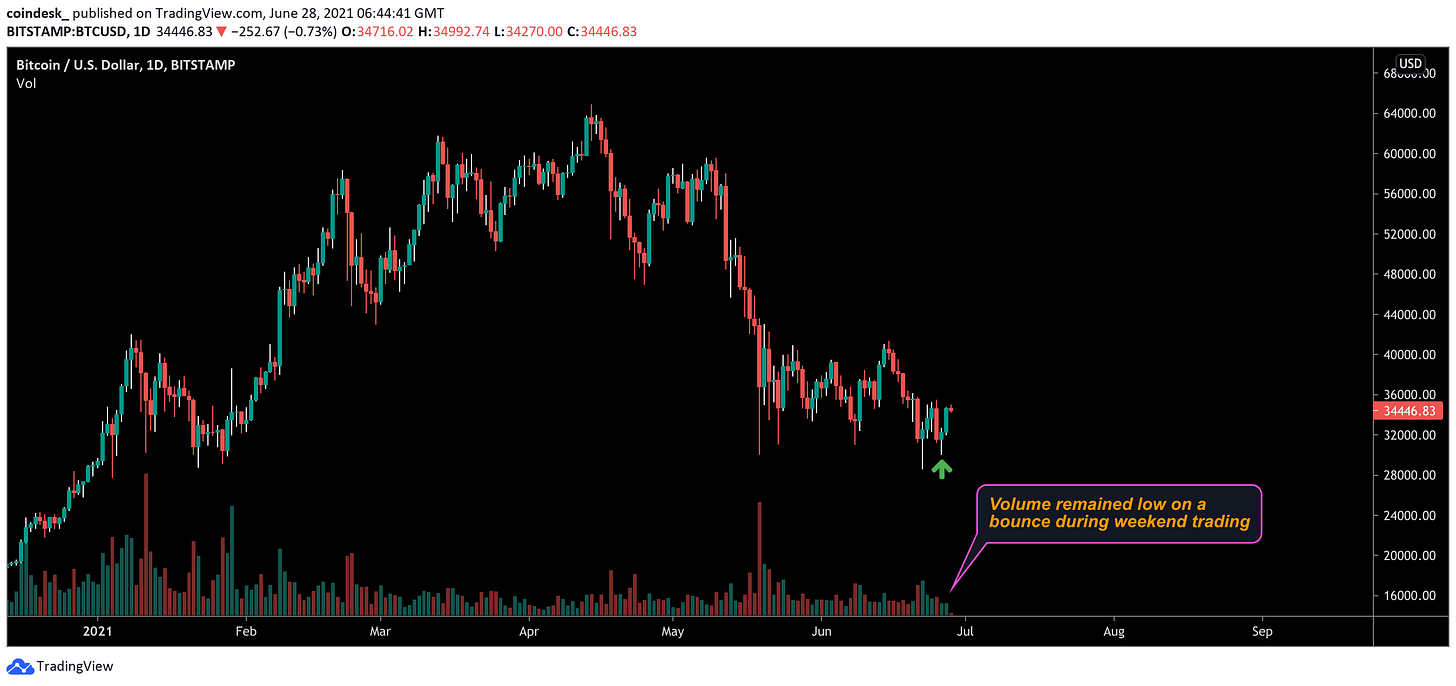

Bitcoin is range bound finding support at month long bottom $30k and resistance at $35k. RSI on 4 hr chart is showing slightly overbought near resistance. Bitcoin saw a 15% bounce over the weekend, however, volume remained low possibly pointing to investors still sitting on sidelines given high amount of FUD, mainly miners moving out of China.

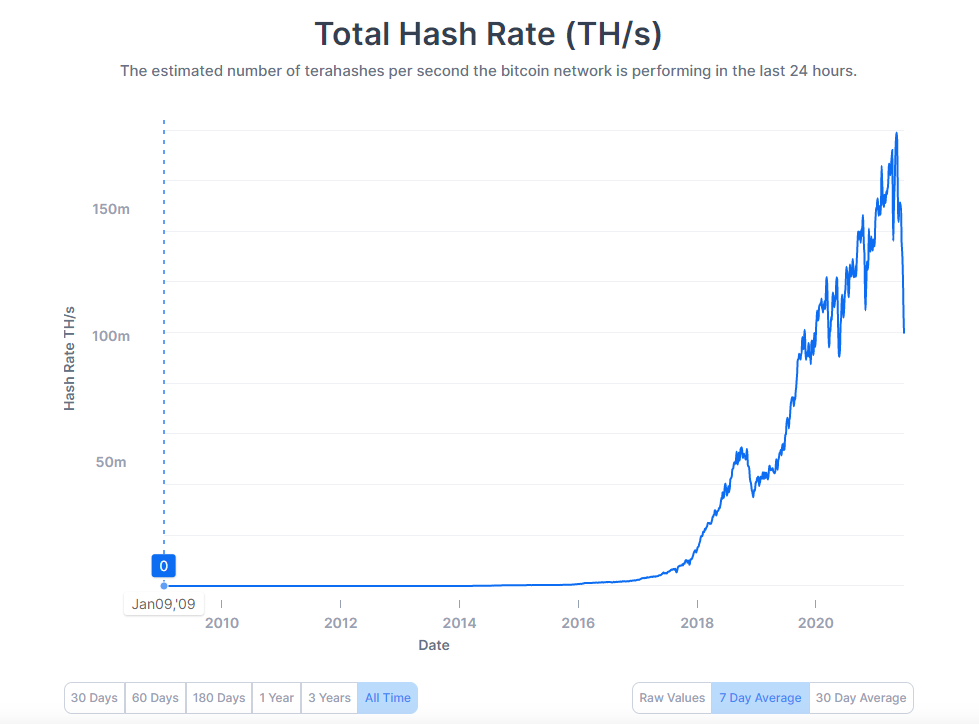

China’s crackdown on crypto crushes Bitcoin’s hashrate as miners exit China in droves. Mining hashrate hit a 13 month low and currently sits at 101.9 TH/s. Michael Saylor and other prominent bitcoin supporters believe this will be a trillion dollar mistake for China has miners find new more accepting homes across the globe. While, price action has been bearish, this transition is a net positive for the network as it will ultimately decentralize the network making it more secure.

Mexican Billionaire, Ricardo Salinas hit twitter with a video explaining why he’s done with FIAT as it’s a fraud and very bullish on bitcoin as a new store of value. He stated he and his bank, Banco Azteca will be one of the first banks in Mexico to accept bitcoin. Salinas also owns the number two Mexican TV broadcasters, TV Azteca and retailer group Elektra. His net worth is estimated at $15.9 billion.

Coinbase receives custody license in Germany. This comes shortly after Coinbase was approved to operate in Japan. This is bullish for bitcoin and crypto as the number one regulated public exchange is expanding it’s reach internationally.

Investors in India have increased their investment into crypto to $40 billion up from $200 million over the past year. More than 15 million Indians are now trading crypto in India. India’s population is 1.33 billion people. This data reported by Chainalysis comes out after India’s financial regulators are considering making bitcoin an asset class, despite their rocky relationship with crypto over the years.

Iran issues 30 new crypto mining licenses across the country.

21Shares launching the world’s first Solana Exchange Traded Product on SIX Swiss exchange. Solana’s market cap sits around $8 billion and the team Solana Labs just raised $300 million earlier this month to scale development on its network.

Zap Solutions Inc, the company behind the Strike Wallet and who’s been El Salvador’s main bitcoin infrastructure partner apparently lacks the money transmitter licenses necessary to transmit legal cash crypto transfers to El Salvador.

Marvel is launching NFT collectibles. They partnered with VeVe to launch official NFTs later this year. The NFT will be digital comic books, 3D statues and other collectibles.

Sotheby’s art auction house is auctioning CryptoPunk NFT Prints. This is just another example of crypto technology being accepted by these famous auction houses and the mainstream overall. A couple of prints have attracted bids of about $120k and Sotheby’s has sold one print for $11.8 million.

Consumer spending is expected fuel growth this summer as May’s consumer spending shifted away from big ticket items like cars to restaurants and travel.

Federal Reserve officials are restarting conversations about possibly tapering sooner than expected. Officials have questioned their purchases of mortgage backed securities and their possible impact on increased home prices. See quote below.

“There are some unintended consequences and side effects of these purchases that we are seeing play out,” Dallas Fed President Robert Kaplan said in an interview, referring to the mortgage-bond purchases, which he thinks are contributing to skyrocketing home prices.

MAJR TAKE: Why are they surprised that $40 billion monthly purchases of MBS would have this effect on the housing market? How could they not see this coming? They’ve partnered with BlackRock do perform theses purchases creating a back stop for all institutional risk when investing in MBS.

TOP STORIES

BITCOINBitcoin Meets Resistance at $35K, Support at $30K, Coindesk

Bitcoin Price Climbs After Mexican Billionaire Urges People to Buy, WSJ

Coinbase Receives Crypto Custody License From German Regulator BaFin, Coindesk

Indian Investments in Crypto Have Exploded, Coindesk

Iran’s Ministry of Industry Issues 30 Licenses to Crypto Mining Farms, Coindesk

Bitcoin Mining Hashrate Hits New 13-Month Low, Yahoo

CRYPTONFT-Powered Digital Comic Book to Let Fans Decide Heroes’ Fates - Tezos, Coindesk

Stablecoin SafeDollar on Polygon Hit by Cyberattack, Coindesk

21Shares Launching World’s First Solana ETP on SIX Swiss Exchange, Coindesk

Marvel Says It’s Finally Releasing Its First Official NFT Collectibles, Decrypt

Sotheby’s Auctions First Five CryptoPunk Prints, Decrypt

U.K. Financial Regulator Bars Crypto Exchange Binance Markets, Bloomberg

MACROConsumer Spending Is Primed to Fuel Summer Growth, WSJ

Fed Officials Debate Scaling Back Mortgage-Bond Purchases at Faster Clip, WSJ

Water Crisis Is Compounding an Inflation Time Bomb in Brazil, Bloomberg

Stretched global supply chain means shortages on summer menus, Reuters

MEDIAIs Bitcoin in a Bear Market? with Willy Woo

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.