@boopygifs

MAJR NEWS BRIEF

In this morning’s brief, I wanted to highlight Wall Street’s role in the current housing market.

Buying a house today has become increasingly competitive, difficult, and expensive. Strong demand amongst buyers combined with a limited supply of homes on the market have created astronomically high prices. Competing bids often make for an overvalued final sale reaching 20% above asking price or even more. Even in a pandemic, 2020 was a record-setting year for home sales. The overall market grew $2.5 trillion. Furthermore, the median price of an American house has gone up 28% over the last two years. Part of the reason is there are more than just single families looking to purchase a home.

BlackRock, Blackstone, and Institutional Buyers

There are hundreds of companies and investment firms that have entered the infamous house hunt and compete with single families trying to buy a home. One of the biggest names on the list is BlackRock, the world’s largest asset manager with $9 trillion in AUM. BlackRock has roughly $60 billion in real estate assets.

There are roughly 80 million housing units categorized as single-family homes around the country, 15 million of the units are considered rental properties. Institutional investors own about 300,000 of those properties. BlackRock alone owns about 80,000.

These profit maximizing firms are turning to real estate for that exact reason…profits. Specifically, the residential real estate market has been booming, and they are looking to capitalize.

Housing has had a huge spike in prices and single-family homes have been the favorite bet for banks. Though these institutions are a dominant player mainly in the multi-family space, they are beginning to build their portfolio of single-family properties. This needs to be noted.

Institutions like BlackRock and Blackstone, who owns single-family rental companies Invitation Homes and Home Partners of America, bought up 15% of U.S. homes for sale in the first quarter of 2021. They target older, affordable properties that are located in growing metropolitan areas ignoring the costly, turn-key homes. This is smart on their part because they are operating in demographics with strong demand and high rent growth potential. On the contrary, it is a significant disadvantage to be a common buyer that has to compete for the best bid with the largest asset manager around. The constant bidding war has only one result. It props up the prices for typical American families and puts them out of reach. This is a problem.

Wrap Up

There are contradicting opinions on how big of an impact institutional buyers currently have on the housing market. The reality is that they may not represent a huge portion of single-family housing market share today, but it is only continuing to grow. BlackRock and Blackstone structurally have such a big advantage in this market and pose to be an unfair competitor for average American families.

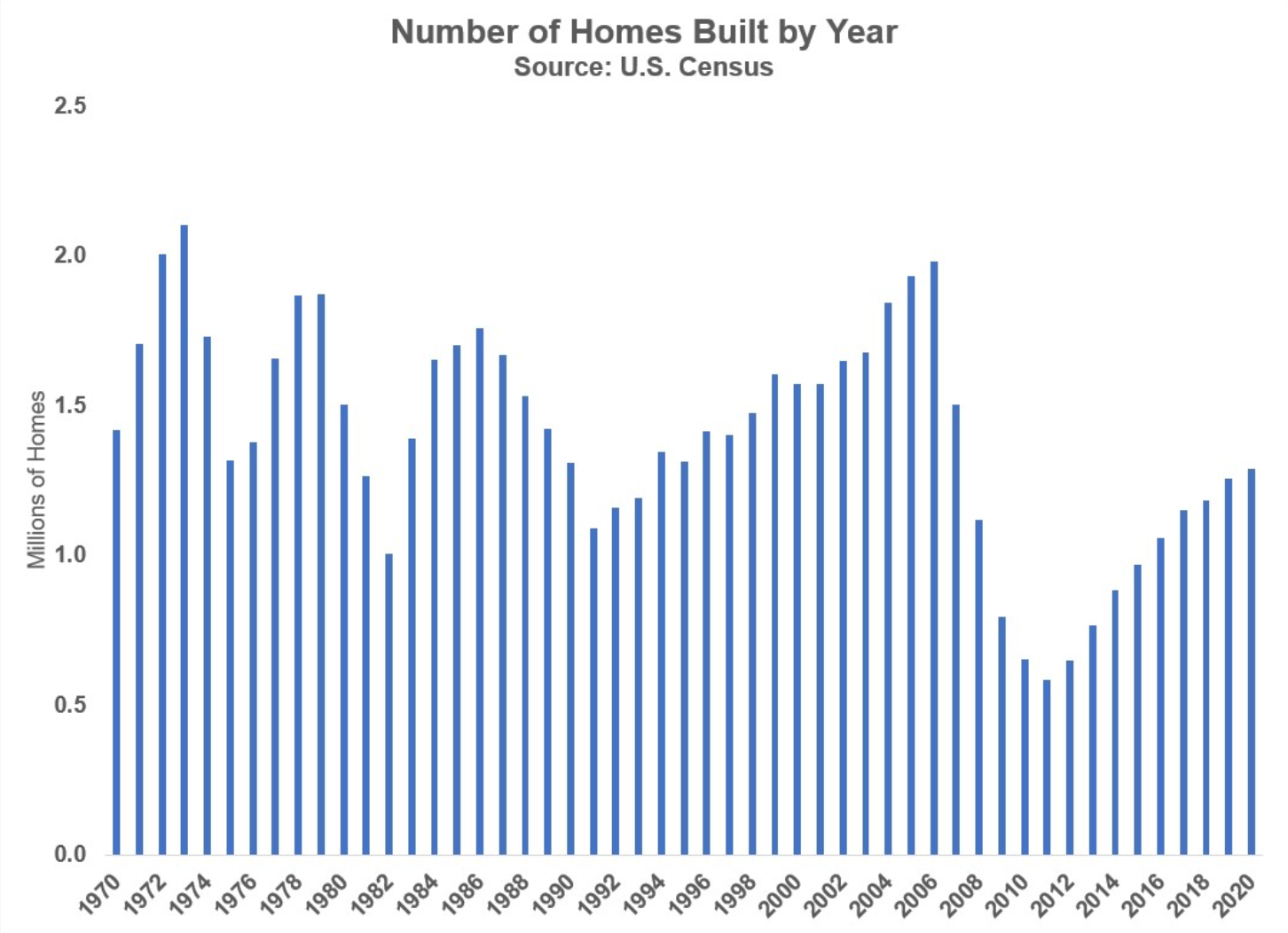

There could be a solution to help fix this but it would require support and cooperation with local government. The construction of new homes would help alleviate the absurd housing prices we are experiencing and provide some equilibrium. We are reaching new peaks in our domestic population, yet the number of homes are lagging behind. More houses would be extremely beneficial for the families trying to purchase a home and it could possibly decrease the rate at which American housing is ending up in the portfolios of the top 1%.

Brevin White

IN OTHER NEWS:

Eric Adams, who has outstripped the better-known crypto advocate Andrew Yang in New York City's mayoral race, has made his own Bitcoin pledge as he retains his first-place lead.

Venture capital giant Andreessen Horowitz (a16z) raised a whopping $2.2 billion for its much anticipated Crypto Fund III.

Switzerland-based token issuer Digital Assets AG, or DAAG, has officially launched its stock-tokenization infrastructure on the Solana blockchain, offering users of the FTX trading platform a novel way for accessing traditional equity markets.

Biden’s Plan secures bipartisan agreement on overhauling the nation’s transportation, water and broadband infrastructure.

A recent downward trend in worker filings for jobless benefits stalled in mid-June amid other signs the labor market continues to gradually recover.

FACTS

The most expensive piece of real estate bought is the penthouse atop 220 Central Park South, a residential tower in Manhattan, New York.

Billionaire hedge fund manager Ken Griffin bought it in January 2019 for $239,958,219.

TOP STORIES

BITCOINmNYC's mayoral frontrunner pledges to turn city into Bitcoin hub, Cointelegraph

Winklevoss’ Gemini buys carbon credits to cut Bitcoin’s CO2 footprint, Cointelegraph

Asset manager QR launches Bitcoin ETF on Brazilian stock exchange, Cointelegraph

South African Crypto Founders Vanish, $3.6 Billion Allegedly Missing, Decrypt

CRYPTOAndreessen Horowitz Rakes In $2.2B for Third Crypto Venture Fund, Coindesk

Coinbase Enters Japanese Market After Completing Registration With Financial Watchdog, Coindesk

Blockchain.com introduces username-based crypto transactions, Cointelegraph

Swiss-based Digital Assets AG launches tokenized stock offerings on Solana, Cointelegraph

MACROBiden, Senators Agree to Roughly $1 Trillion Infrastructure Plan, WSJ

Downward U.S. Jobless Claims Trend Stalls Out, WSJ

Yellen Says U.S. Could Breach Debt Limit Deadline in August if Congress Doesn’t Act, WSJ

Bubble Expert Grantham Addresses ‘Epic’ Stock Euphoria, Bloomberg

MEDIAWhy El Salvador Made Bitcoin Legal Tender with President Nayib Bukele

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.