@jonjon2000

MAJR NEWS BRIEF

In today’s brief, we’re breaking down the future of work and DAOs - decentralized autonomous organizations.

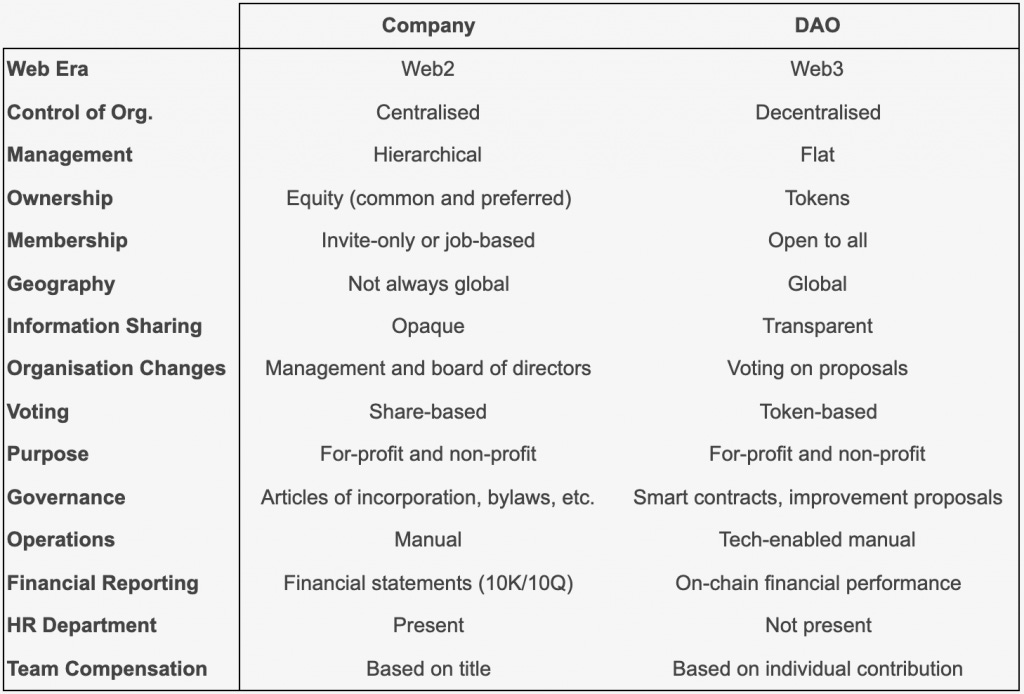

A decentralized autonomous organization or a DAO is crypto’s take on a company or enterprise. A flat organization that distributes decision making power (governance) to token holders vs centralizing authority at the c-suite.

In 2016, the first DAO was created on Ethereum called the DAO. It was a mechanism for token holders to aggregate capital and deploy that capital through on-chain governance. The DAO raised $150 million of ether through their token sale, but it was unfortunately hacked due to a bug in the cold base which resulted in Ethereum’s hard fork creating what we know as Ethereum today and Ethereum Classic (the original version). Without getting into the weeds, this was a dramatic point in Ethereum’s history that could have been fatal, but obviously wasn’t. However, the idea of a decentralized autonomous organization didn’t die with The DAO and since then there’s been an explosion of DAOs with hundreds of millions in AUM.

What is a DAO?

Ethereum’s smart contract technology makes it possible to level up a community through incentives, tokenomics and a distributed governance. Blockchain flips the idea of a company on its head and provides the infrastructure for token holders to vote on the organization’s direction, operations and treasury management. For example, Yearn Finance is one example of a protocol that’s on the forefront of decentralized governance. They communicate via discord and their governance forum. Other decentralized applications governed by a DAO such as Celo and MakerDAO publish their community video call recordings on YouTube.

Below is a chart comparing the differences between Web2 era companies (centralized) to Web3 era DAOs (decentralized).

Shared value creation

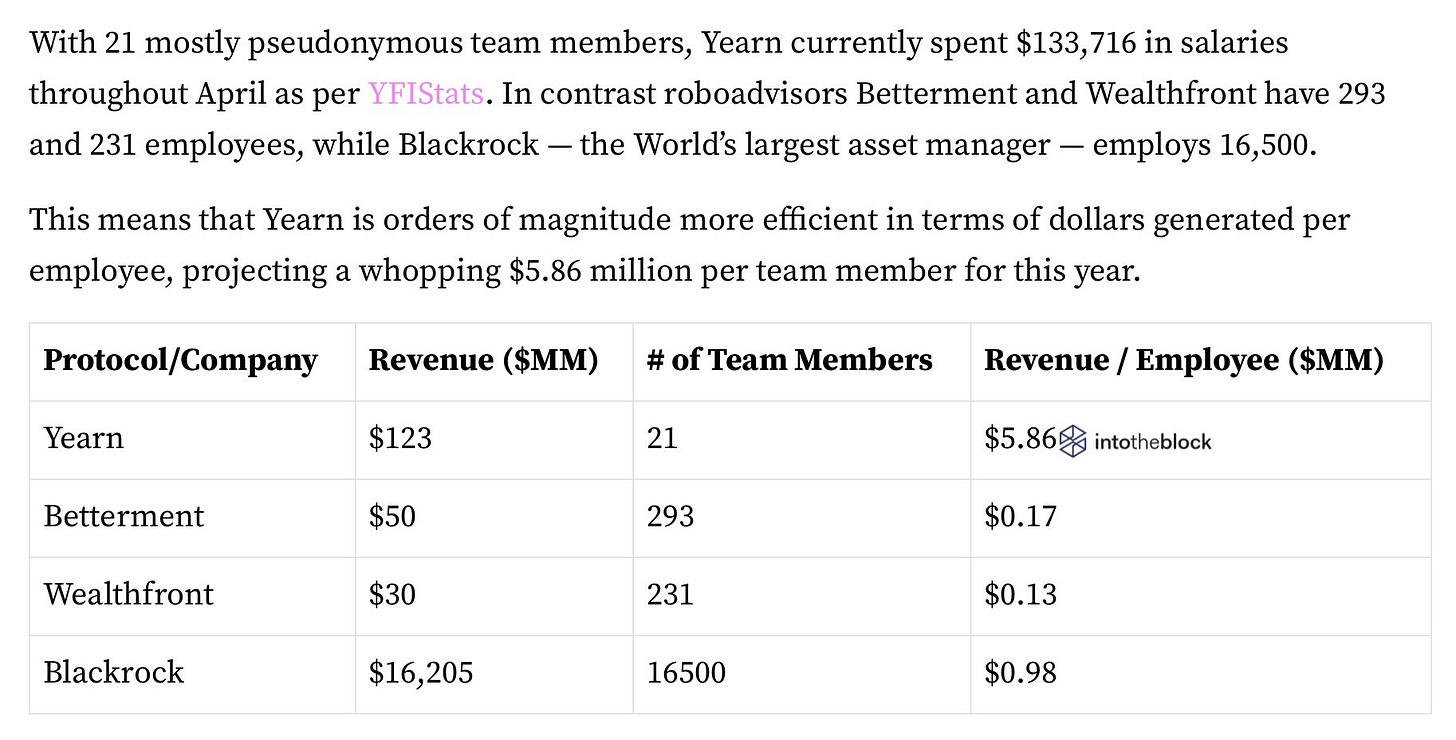

DAOs also provide a transparent and efficient way for communities to share in the value created from the organization. The communities can be big or small, known or anonymous and distributed across geographies. Efficiency is key as some of these protocols can generate huge amounts of value with a small number of key team members.

For example, Yearn Finance (YFI) has 21 team members and in May they generated $123 million in revenue. This shakes out to over $5 million in value creation per employee. In the chart below from YFIStats, you can see YFI’s market efficiencies compared to companies like Betterment, Wealthfront and Blackrock, the world largest asset manager with $9 trillion in AUM.

YFI isn’t the only example. Most protocols and especially DeFi protocols are small teams of ~30 people and can drive substantial value. Another example is Uniswap the largest decentralized exchange (DEX) by volume. Uniswap Labs has about 30 people working at the organization and does trading volume equal to if not more than Coinbase which employees over 1,000 people (~$400 million).

The future of work

DAOs are an emerging phenomenon and could possibly be the lens to view the future of work. Community members are incentivized to stake tokens to earn a yield from the revenue derived from the organization. Given the shared value creation, token holders are incentivized to vote on things that will effectively grow revenue and therefore the DAO itself.

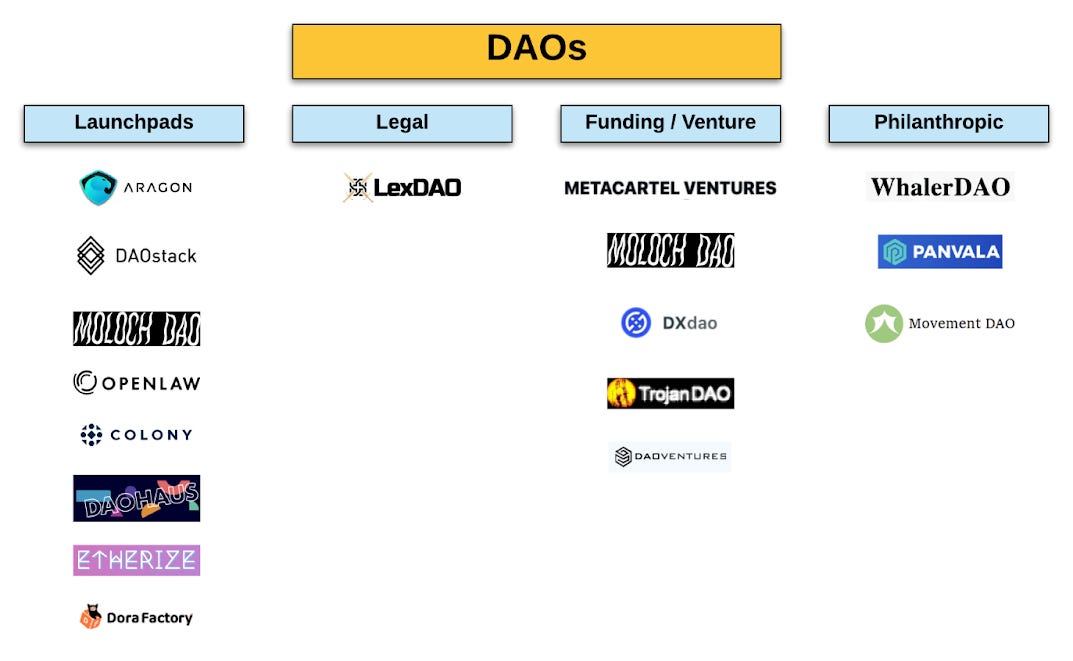

Below is a short list of existing DAOs across industries. According to DAO launchpad, Aragon they’ve created over 1,700 DAOs with over $900 million in AUM. This is a huge jump from 2016 and we’ll most likely see continued growth in the space since it easier and easier to launch a DAO.

Check out any of the launchpads below for learning how to launch your own decentralized community.

Matt Verklin

IN OTHER NEWS:

The world’s largest cryptocurrency by market value was trading around $34,000 at press time and is up 9% over the past 24 hours.

CoinShares chief strategy officer Meltem Demirors believes that most of the long-term holders are not selling, and this is a correction to weed out panic sellers.

Crypto exchange FTX continues their push into sports with another huge partnership. They’re now the “Official Cryptocurrency Exchange brand for the MLB”. This is their second deal following their partnership with the Miami Heat and getting naming rights to their stadium, which is now the FTX Arena.

As the price of bitcoin briefly surpassed the $35,000 mark on Wednesday morning after dropping to a six-month low below $30,000 earlier this week, the overall cryptocurrency market is showing signs of recovery.

Federal Reserve Chairman Jerome Powell said it’s highly unlikely that inflation will rise to levels seen in the 1970s but acknowledged significant uncertainty as the economy reopens.

TOP STORIES

BITCOINBitcoin Holds $30K Support After Volatile Shakeout; Resistance at $36K, Coindesk

Hodlers see opportunity in Bitcoin price crash, CoinShares exec says, Cointelegraph

3iQ’s Bitcoin ETF Rises on First Day of Trading on Nasdaq Dubai, Coindesk

SEC Delays Decision on Valkyrie Bitcoin ETF, Coindesk

CRYPTOFTX Sponsors MLB; Umpires to Wear Crypto Exchange’s Logo, Coindesk

DeFi Tokens Including Uniswap, Compound and Aave Recoup Losses, Decrypt

NFT Marketplace Rarible Raises $14.2 Million To Expand on Flow Blockchain, Decrypt

DeFi and NFT crossover project Aavegotchi releases ‘Gotchiverse’ litepaper, Cointelegraph

MACROFed’s Powell Plays Down Inflation Threat, WSJ

Biden Administration to Replace Fannie, Freddie Overseer After Court Ruling, WSJ

U.S. New-Home Sales Post Surprise Drop Amid Record-High Prices, Bloomberg

Bulking Up Battery Sector May Add Billions to Australian Economy, Bloomberg

MEDIALyn Alden on Bitcoin, Inflation and the Potential Coming Energy Shock

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.