@supyrb

MAJR NEWS BRIEF

In this morning’s brief, I breakdown one of the newest crowding funding mechanisms for launching token projects, the Initial DEX Offering (IDO). I detail how the IDO works, how it’s different than previous crowdfunding operations - the Initial Coin Offerings (ICO) and the Initial Exchange Offering (IEO), and I share my final thoughts on IDOs and where investors can participate.

What is an Initial DEX Offering?

A DEX is a decentralized exchange that allows users to swap different tokens without going through a centralized exchange such as Coinbase, Kraken or Binance. The DEX uses liquidity pools to make the swap vs. a traditional order book. Token holders stake their tokens in a pool to provide liquidity which allows users to swap tokens in exchange for a transaction fee. Decentralized exchanges are core to decentralized finance. The biggest DEXs are Uniswap, SushiSwap, 1inch and Binance’s PancakeSwap.

An IDO is a new way to bootstrap a token project and crowdfund using decentralized exchanges. Token projects are able to access immediate liquidity and investors are able to access the token at super low prices and in some cases before pre-sale investors and team members.

Different Crowdfunding Mechanisms for Launching Tokens

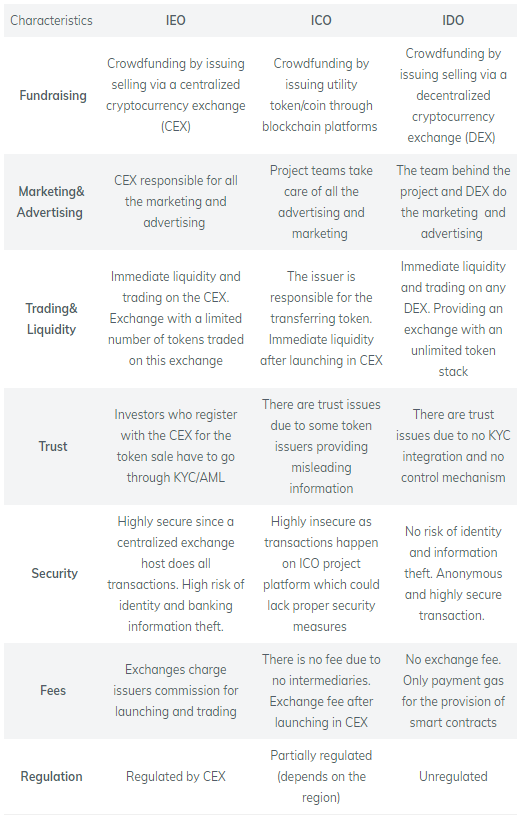

Initial Coin Offering (ICO) - the original crowdfunding mechanism used to launch cryptocurrency tokens. Came under fire from SEC as many were scams and the tokens were considered unregistered security offerings. Investors had to trust the issuer to transfer tokens post investment. Massive security risk.

Popular Projects - Ethereum, EOS, Telegram, Filecoin, Tezos, Bancor

Security Token Offering (STO) - is a public offering where tokenized digital securities are sold. These tokens can be used to trade real financial assets. Launched on centralized exchange. KYC / AML features. Complies with government rules. Mostly accredited investors. Very high costs to fundraising. Investments cannot be cashed out for longer periods of time. Three types of compliant regulated STOs - Regulation D (Reg D), Regulation A+ (Reg A+) and Regulation S (Reg S).

Popular Projects - Polymath

Initial Exchange Offering (IEO) - are fundraising events where crypto start ups use a centralized exchange to crowdfund liquidity. The projects pay a fee to the exchange, wait for approval and are strictly prohibited from offering their tokens on other exchanges. KYC / AML features. Popular in 2019.

Popular Projects - Elrond, Matic Network, Celer, WazirX, Band Protocol

Initial Decentralized-Exchange Offering (IDO) - fundraising through a decentralized exchange that’s permissionless, has no fees, allows for immediate trading and is considered a more “fair launch”. Tokens are immediate distributed to investors wallets which make it more secure then trusting an exchange.

Popular Projects - Raven Protocol, Universal Market Access (UMA)

How Does an IDO Work?

Token projects can work with specific decentralized exchange teams to set up the offering. This is mostly done through launchpads that specialize in IDOs. In some cases, the project and the DEX will share the burden of marketing the event, however this is not necessary.

The project will establish certain conditions for investors to meet in order to participate in the offering prior to tokens are released to the rest of the public market.

The issuer creates the token and tokenomics.

The issuer audits the token smart contract for backdoors and vulnerabilities (Certik).

The issuer selects the IDO launchpad or DEX.

The issuer decides if it will be public or private sale.

The issuer sets target funds for raise.

The issuer sets limit sell orders at various price levels.

The issuer conducts an auction.

The listing will be carried out on an automated market marker (AMM) ecosystem which is the DEX such as Uniswap, Balancer, PancakeSwap, etc.

The issuer will release pools of liquidity via tokens set at specific prices and quantities available to different audiences. Investors exchange the layer 1 blockchain currency for the new projects tokens (ETH, RUNE, BNB), which are then sent directly to the investor’s digital wallet.

Conclusion - Top Launchpads & Where to Participate

For anyone who’s interested in building and launching their own token project, IDOs are a great way to bootstrap liquidity without taking on serious outside capital funds and diluting your equity. Launching a token is becoming highly competitive as so many new tokens are coming onto the market. This makes it difficult to standout and raise funds, however the option is available and if done right - quality marketing, tokenomics and strong use case - an IDO is a great foray into the crypto markets.

Top Launchpads

UniCrypt (Ethereum)

Matt Verklin

IN OTHER NEWS:

Bitcoin drops below $30k for the first time since January bringing year to date performance to just 3%.

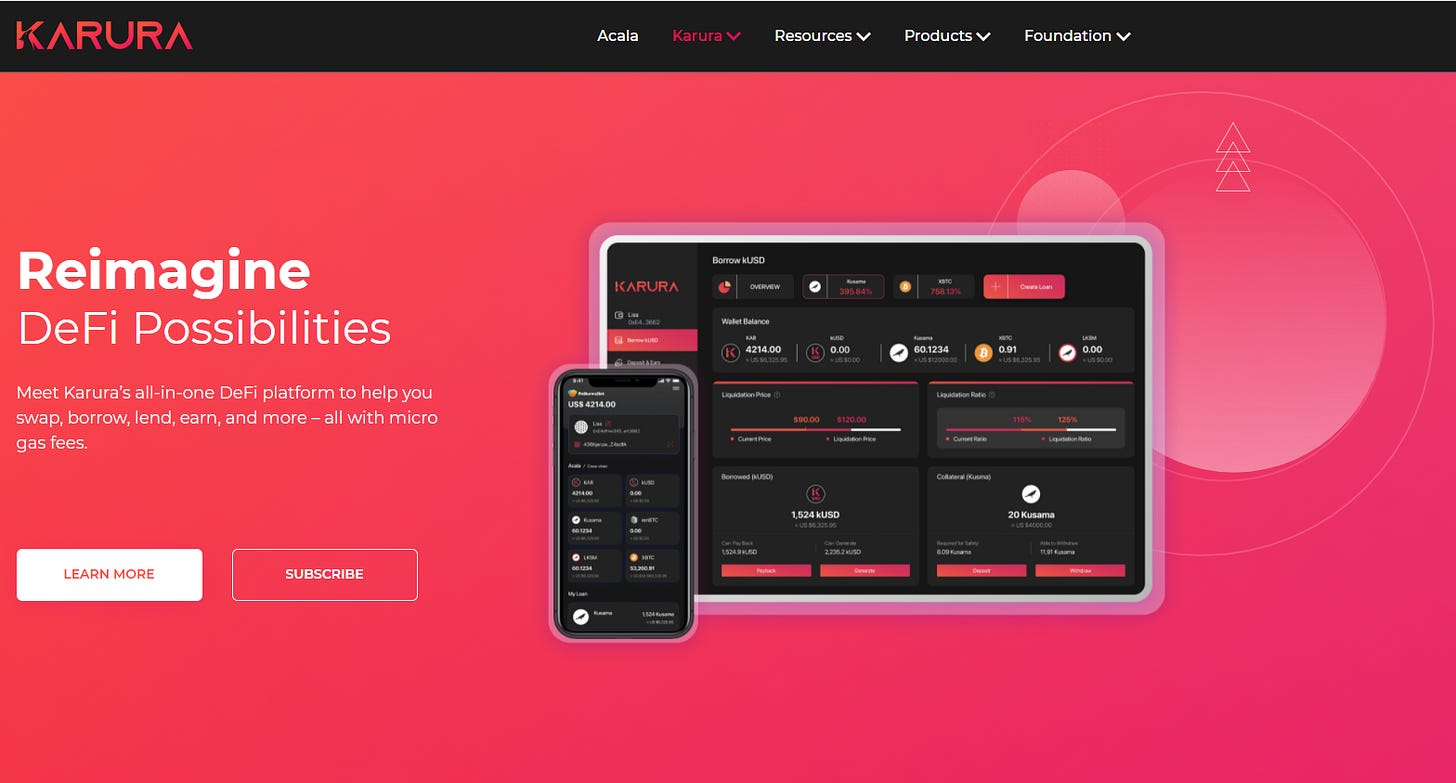

Karura, a DeFi project aiming to build on Polkadot won the first auction to build on Kusama, Polkadot’s test network. Karura secured a 48 week lease to build on the network. The project had a vote of confidence from 15,000 network stakeholders who locked up 500,000 KSM tokens ($100 million) in favor of Karura being added.

Visa and PayPal join Blockchain Capital’s $300 million venture fund to invest across the crypto ecosystem.

Fireblocks is being sued for losing $70 million of ether. An employee didn’t back up the private keys and the wallet was accidently deleted. These mistakes are huge set backs for institutional investment and one of the reasons why self custody is so important.

Deputy of El Salvador’s opposition party files lawsuit against the new bitcoin law calling it unconstitutional and an attempt to loot people’s pockets. The lawsuit will not go very far since it was voted with a super majority and in a controversial move, President Bukele has removed opposition in the Supreme Court.

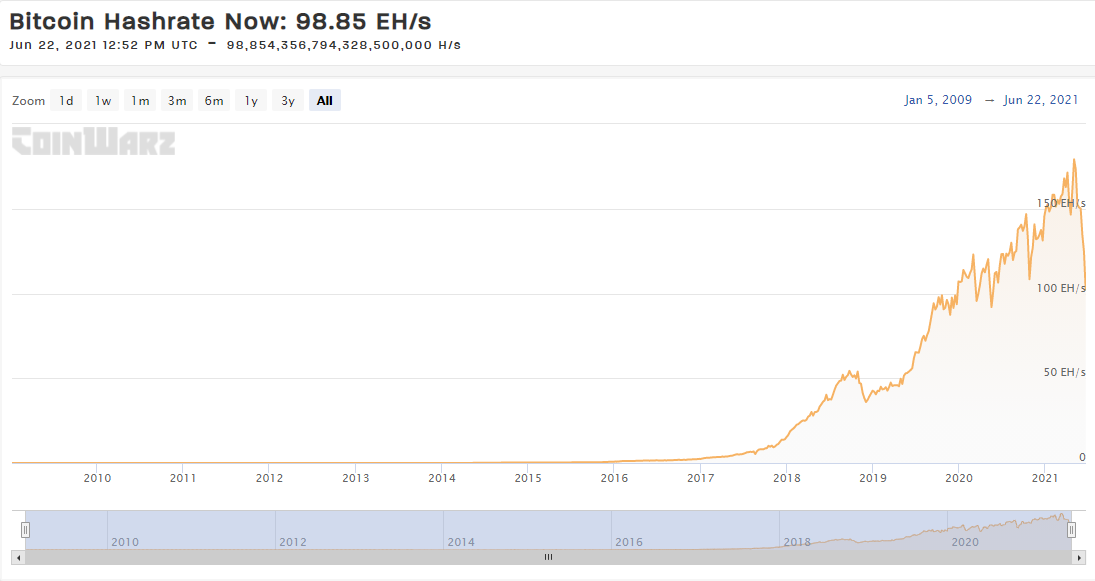

Bitcoin mining machines are fleeing China due to crypto crackdown. The world’s 5th largest mining pool and other miners are relocating to more acceptable countries with cheap electricity such as Kazakhstan and the US (Texas). Bitcoin’s hashrate has dropped significantly during this transition.

Blackstone is buying up homes and renting them out. The Wall Street firm is betting $6 billion to acquire Home Partners of America Inc, a company that buys and rents single family homes. Blackstone joins fellow Wall Street firm BlackRock, the world’s largest asset manager ($9 trillion AUM) who’s been outbidding typical buyers and snapping up single family homes.

New York Fed President John Williams reassures fragile market that Fed “liftoff” for interest rates is a long way out.

IMF plans to create $650 billion in new reserves of special drawing rights (SDRs) for its 24 member countries by August. This capital injection would be the largest in IMF history in hopes to boost global liquidity and help emerging and low-income nations deal with mounting debt and the covid pandemic.

FACTS or STATS

ICOs raised over $13 billion between 2016 and 2019.

In the first 3 months of 2018, $6.3 billion was raised.

The largest ICO was conducted by Block.one for the EOS blockchain which raised $4 billion. They were fined $24 million by the SEC for an unregistered security offering.

Messaging app Telegram was the second largest raise with $1.7 billion in funding in 2018. They were fined $18.5 million by the SEC for an unregistered security offering.

TOP STORIES

BITCOINBitcoin Price Drops Below $30K For The First Time Since January, Coindesk

Deputy of El Salvador’s Opposition Party Files Lawsuit Against Bitcoin Legislation, Coindesk

Chinese Bitcoin Mining Firm Relocates Machines to Kazakhstan, Decrypt

Strike Is Phasing Out USDT From Bitcoin-Based El Salvador Remittances, CEO Says, Coindesk

Bitcoin’s Money-Printing Machine Breaks Down as Futures Collapse, Bloomberg

CRYPTODeFi Network Karura Wins First Auction Slot on Kusama, Coindesk

Fireblocks Being Sued for Allegedly Losing Over $70M of Ethereum, Coindesk

Ethereum Transaction Fee Revenue at Lowest Level in a Year, Decrypt

Morgan Stanley, Blockchain Capital Lead $48M Investment in Crypto Firm Securitize, Decrypt

MACROBlackstone Bets $6 Billion on Buying and Renting Homes, WSJ

Record-high U.S. house prices, tight supply weigh on sales, Reuters

Wage Gains at Factories Fall Behind Growth in Fast Food, WSJ

Williams Says Fed’s Rate Liftoff Still Way Off in the Future, Bloomberg

IMF Board to Discuss $650 Billion Reserves-Creation Plan Friday, Bloomberg

Fed Pivot Seen as Bump, Not Dead End for Reflation Trade, Bloomberg

MEDIAEl Salvador - The Whole Story with Jack Mallers

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.