@supyrb

MAJR NEWS BRIEF

Bitcoin is not for the faint of heart. Accept the volatility and play the long game.

In today’s brief, I discuss the bearish market sentiment and address the mainstream FUD that’s most likely influencing bitcoin’s price. I also highlight the bullish bitcoin news and encourage investors to look past the volatility and use it to their advantage.

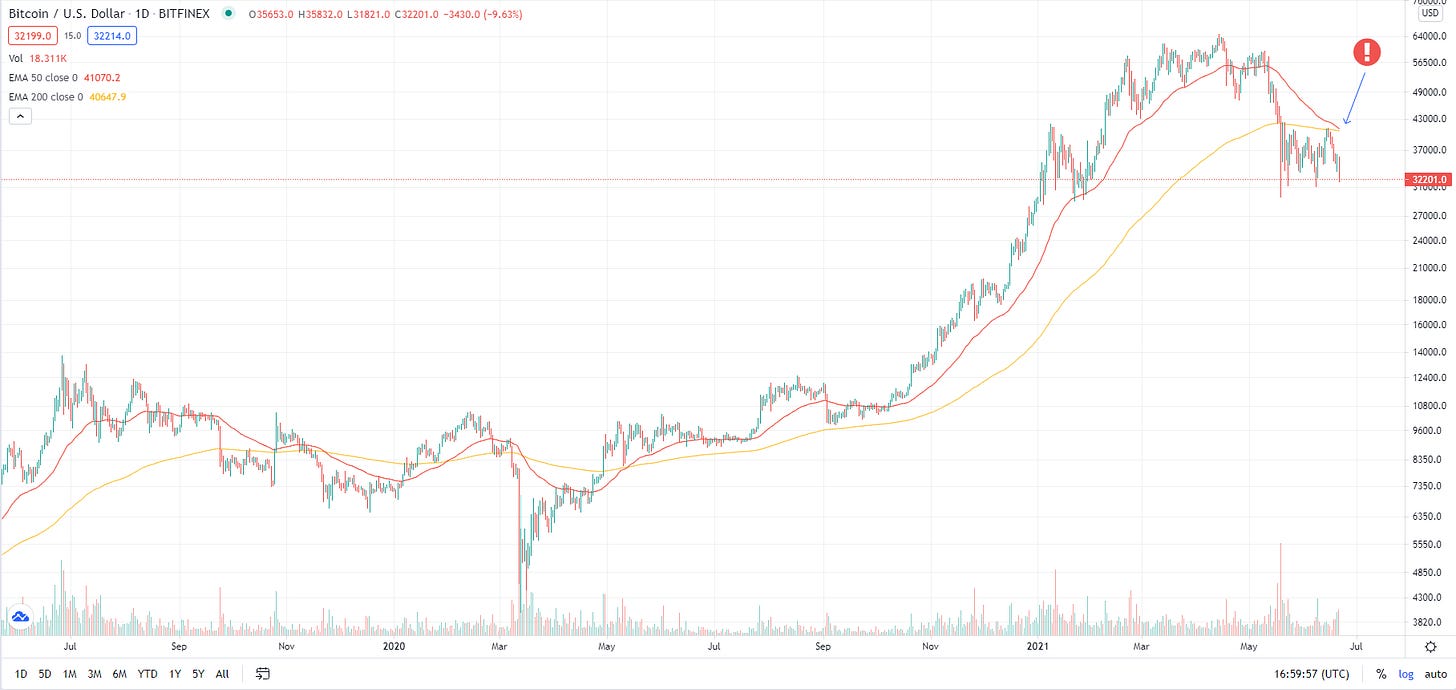

Bitcoin has been trading sideways since we topped at $65k on April 14th and it looks like we’re about to form a bearish indicator called the “death cross.” This is when bitcoin’s 50-day moving average crosses its longer term 200-day moving average. Historically, this indicator tells traders that bullish momentum has slowed and perhaps it’s a good time to sell.

While, technical analysis is a great compliment for your overall investing strategy, it doesn’t tell the whole story around price and what could happen next. Today, markets are driven by narratives and bitcoin’s narrative is a mixed bag. The mainstream media tends to tell a negative story about the digital asset, while a more positive story is spinning on the fringe.

Bitcoin Negativity: Bearish Market Narratives

Elon Musk rattled the market in mid-May when he dramatically changed course stating that Tesla will no longer accept bitcoin as means of payment due to environmental reasons.

Inflation has picked up across the globe affecting everything from food, housing, financial assets, raw materials and commodities. The Fed has taken a hand's off approach stating that the inflation is only transitory and they’re ready if things get worse. This has left the market trying to make sense of the moment and reposition itself accordingly.

China’s most recent, but not new negative stance on crypto and mining bitcoin. The majority of bitcoin mining occurs in China, but it’s now transitioning out given the authorities’ tough stance on the market. Banks are not allowed to provide any crypto services affecting transactions.

Bitcoin Positivity: Bullish Market Narratives

User adoption has increased dramatically from retail and institutional clients.

On-chain data indicates that strong hands and big money have started buying again at the $30k price levels and more bitcoin is moving off exchanges into cold storage.

Regulators are increasing capital requirements for banks providing crypto services, however, US regulators don’t see crypto as their primary focus and if anything have embraced the asset more than other countries.

Nation state adoption is underway. El Salvador drafted and signed the first bitcoin bill into law making the digital asset legal tender, an equal to the US dollar. Now, many other Latin American countries have taken a pro-bitcoin stance with possible legislation down the road.

Unfazed and Ultimately Bullish

Weird things can happen when interest rates hit the zero-bound and there’s no cost to capital. Fundamentals go out the window and markets are driven by narratives. This means being aware of the noise is important, but being able to cut through the noise and find the right signal is even more important.

First, let’s address the FUD.

Elon Musk is old news and has readdressed a more positive stance on bitcoin stating that Tesla will accept it once mining is using 50% renewable energy. The most conservative estimates show that 39% of the energy consumption is renewable.

Inflation is real, but so are the deflationary forces affecting markets. Debt, demographics and technology are all deflationary. Consumer, corporate and government debt are at all time highs. The largest generation, the baby boomers are leaving the work force and retiring, which puts downward pressure on productivity and spending. Technology is disrupting human behavior and all markets such as real estate, food, manufacturing, finance, etc. Technology creates market efficiencies, but also displaces specific jobs or old behaviors like commuting to work.

While inflation is most likely the biggest threat to markets, it’s also the most complicated given that the Fed is stuck, supply chains are mess and you have world economies in flux due to the pandemic. Inflation fears affect all markets, however bitcoin is quickly becoming one of the core inflation hedges and its small market cap provides investors immense upside if the inflation trade continues.

The China FUD is bullish. They’ve banned crypto before and now authorities are enforcing their views on market participants, but this is good for bitcoin and good for the US.

There’s been a concentration of bitcoin mining in China given the cheap hydro power, but this has always been a potential security risk. Bitcoin’s open monetary network is the opposite of China’s digital currency ambitions, which is a closed financial surveillance and control technology. While, the mainstream media is depicting this as a reason for concern, it’s actually better in the long term as more hashrate will come to the US and the network’s security will be more decentralized. China’s anti-bitcoin actions are a huge opportunity for other democratic countries like the US.

Reasons to be bullish

The adoption of bitcoin and crypto has accelerated across the board. Retail investors haven’t stopped buying and they’re actually “hodling” the asset. This indicates new buyers are coming into the market with a longer time horizon which reduces selling pressure.

The smart money has arrived. You have almost every major bank rolling out some form of crypto service - trading, borrowing / lending, custody, etc. There’s massive investment going into blockchain technology, infrastructure and applications. Legendary investors on CNBC are preaching the bitcoin standard and doubling down on the asset as a inflation hedge. Investors like Paul Tudor Jones, Bill Miller, Stanley Druckenmiller, Steve Cohen and Ray Dalio are bitcoiners. Bullish.

Nation states have arrived and the dominos are starting to fall. El Salvador has made bitcoin legal tender on par with the dollar. While the country is small from an economic standpoint, they’re paving the way for other countries to follow suit. I think we can expect two things from the El Salvador news. First, more FUD and complications. The IMF and other international authorities will condemn these actions as reckless and the media will focus on any issue coming from the technology and monetary transition. However, I think we can expect other countries to jump on board with pro-bitcoin legislation. Paraguay looks like it’s next.

The bitcoin mindset

Adoption is everywhere and it’s happening fast. Bitcoin and crypto are emerging asset classes and new technologies. Volatility should be expected and utilized during bitcoin’s price discovery phase. If you’ve studied the technology, understand its value and have a long enough time horizon then you actually look forward to these buying opportunities.

In times of economic uncertainty, investors tend to own what’s scarce. They turn to gold, real estate and now bitcoin. Seek solace in the fact that you’re early and you’ve invested in an asset that’s derived from mathematics and physics. Two scientific disciplines that instill confidence and certainty in times of chaos.

Paul Tudor Jones on CNBC:

"I like bitcoin...Bitcoin is math, and math has been around for thousands of years," Tudor Jones told CNBC. "I like the idea of investing in something that is reliable, consistent, honest and 100% certain. So bitcoin has appealed to me because it's a way for me to invest in certainty."

Matt Verklin

@mverklin

IN OTHER NEWS:

MicroStrategy buys 13,005 BTC and now holds over 100k BTC on the company’s balance sheet.

Bitcoin and the crypto market dropped to a two week low. Bitcoin hit $32k while ether touched $1,900. The market correction can be attributed to China’s recent tough stance on cryptocurrency and mining.

The People’s Bank of China (PBOC) told major financial institutions to stop facilitating virtual-currency transactions and they’re prohibited from providing trading services.

Banks anticipate tougher capital requirements from regulators when providing crypto services. In addition, JPM stated that their using a private version of Ethereum to conduct overnight repurchase agreements where digitized US Treasury bonds are swapped for JPM Coin (the banks stablecoin).

BlackRock, the world’s largest asset manager with $9 trillion in AUM is looking to hire a director level employee to bring blockchain technology into their proprietary tech stack, Aladdin (asset, liability, debt and derivatives investment network).

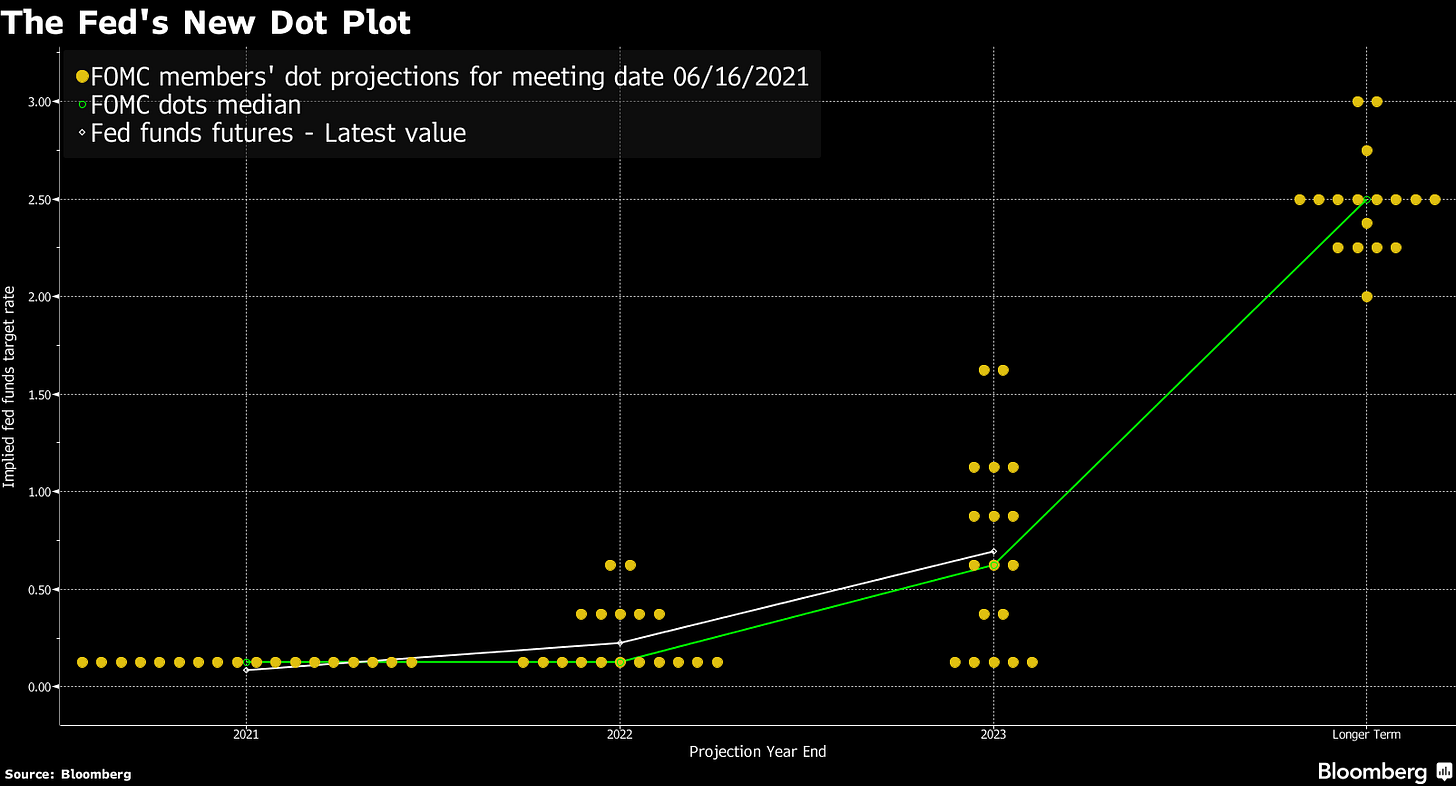

Markets are still trying to make sense from Federal Reserve policy and stance on inflation. Fed dot-plot shows an increase in interest rates starting in 2022 and and 2.5% by end of 2023. We think this is an over reaction. If you listened to Powell, he didn’t say anything out of the ordinary and in fact he kept things vague leaving the central bank wiggle room to course correct if things don’t go as planned.

FACTS

Baby boomers retiring will affect the economy. Seniors will make up over 20% of the population by 2030, ~70 million Americans. This means the following:

Spending decreases in retirement

Tax bases is relying on smaller working population

More people will be eligible and accepting social security putting strain on public funds

The largest population will rotate out of stocks and risk assets

TOP STORIES

BITCOINBitcoin Falls to Two-Week Low as China Cracks Down on Crypto, Bloomberg

Bitcoin just flashed a widely followed technical sell signal called a 'death cross,' suggesting more downside ahead, MSN

MicroStrategy Now Holds Over 100K in BTC Following 13,005 BTC Purchase, Yahoo News

CRYPTOBanks Chart Cautious Crypto Plans With Regulators Taking Aim, Bloomberg

China Says Banks Must Block Crypto Transactions; Market Falls, Coindesk

Portugal Grants First Crypto Exchanges Operating Licenses, Coindesk

BlackRock Wants a Blockchain Strategy for Aladdin, Its Investments Engine, Coindesk

Institutional selling of crypto reaches longest streak since Feb 2018, Cointelegraph

Coinbase-backed Securitize secures $48M in Series B funding, Cointelegraph

MACROPowell Heads to Capitol Hill as Market Churns on Dot Shock, Bloomberg

Kaplan, Dalio, Bullard Echo Call for Fed Pivot Toward Inflation, Bloomberg

What Investors Can Learn From the History of Inflation, WSJ

Chip Shortages Are Starting to Hit Consumers. Higher Prices Are Likely., WSJ

MEDIA Bitcoin Is WILDLY Oversold! | Pomp Podcast #586

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.