@bitrefill

MAJR NEWS BRIEF

Here’s the latest update on bitcoin and where it is headed.

At the time of writing, the price of bitcoin is $37,420.

Over the last few weeks, bitcoin has been trading sideways. The price has been range bound between $30k-$41k, but bitcoin may be turning a corner making higher lows on the 4hr chart.

It’s anyone’s guess to what happens in the short term, but with a longer time horizon (+ 4 weeks) the bull market is still intact. This is a marathon, not a sprint. The on-chain data presents evidence to support this claim.

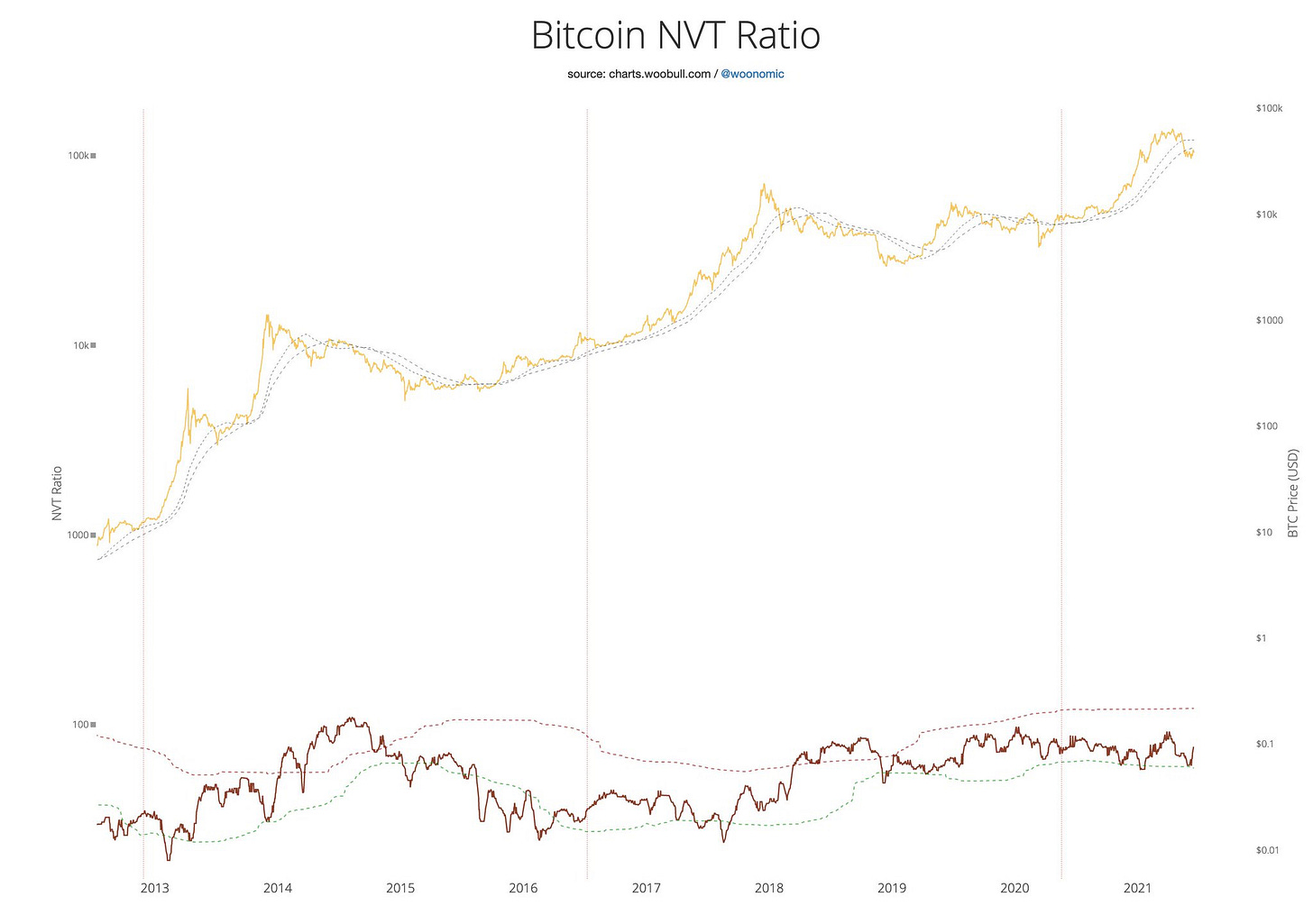

The Network Value to Transactions (NVT) Ratio signals bullish momentum. This ratio is used to measure investor activity and is calculated by dividing the network value (market cap) by the daily USD volume transacted on-chain. The formula helps highlight macro trends and gives insight into establishing fair value for a particular asset. For Bitcoin, the NVT Ratio continues to show an upward drift thus signaling this bull market is not over.

Gold line = Price of BTC , Red Line = NVT

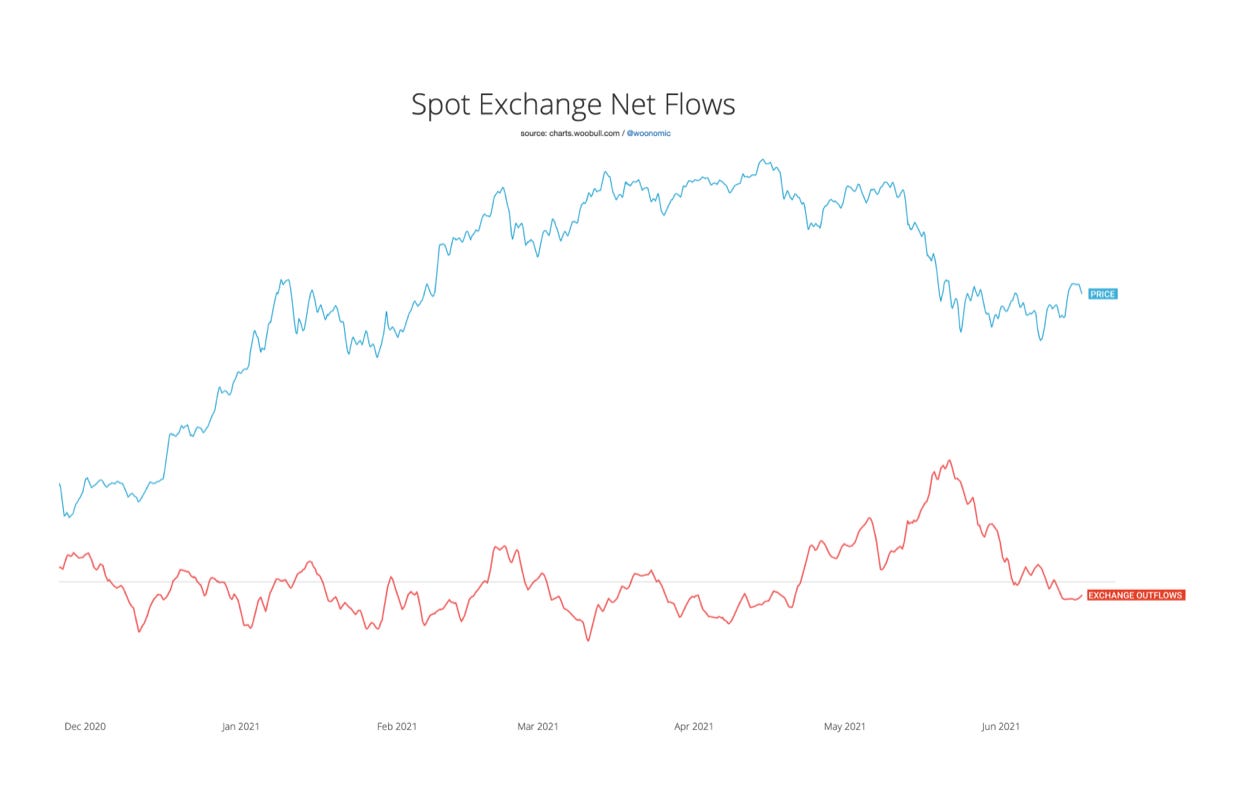

While we try to focus on the long term, short term indicators look positive.

On-chain data suggests a neutral to bullish stance for the short term. There is low to average buying power that currently exists on various crypto exchanges. This can be seen by evaluating the coin flows on and off of these platforms. Negative net flows are bullish as they imply coins are being bought, moved off exchanges, and put into cold storage. With this in mind, it is likely to see another week of consolidation before a bitcoin breakout.

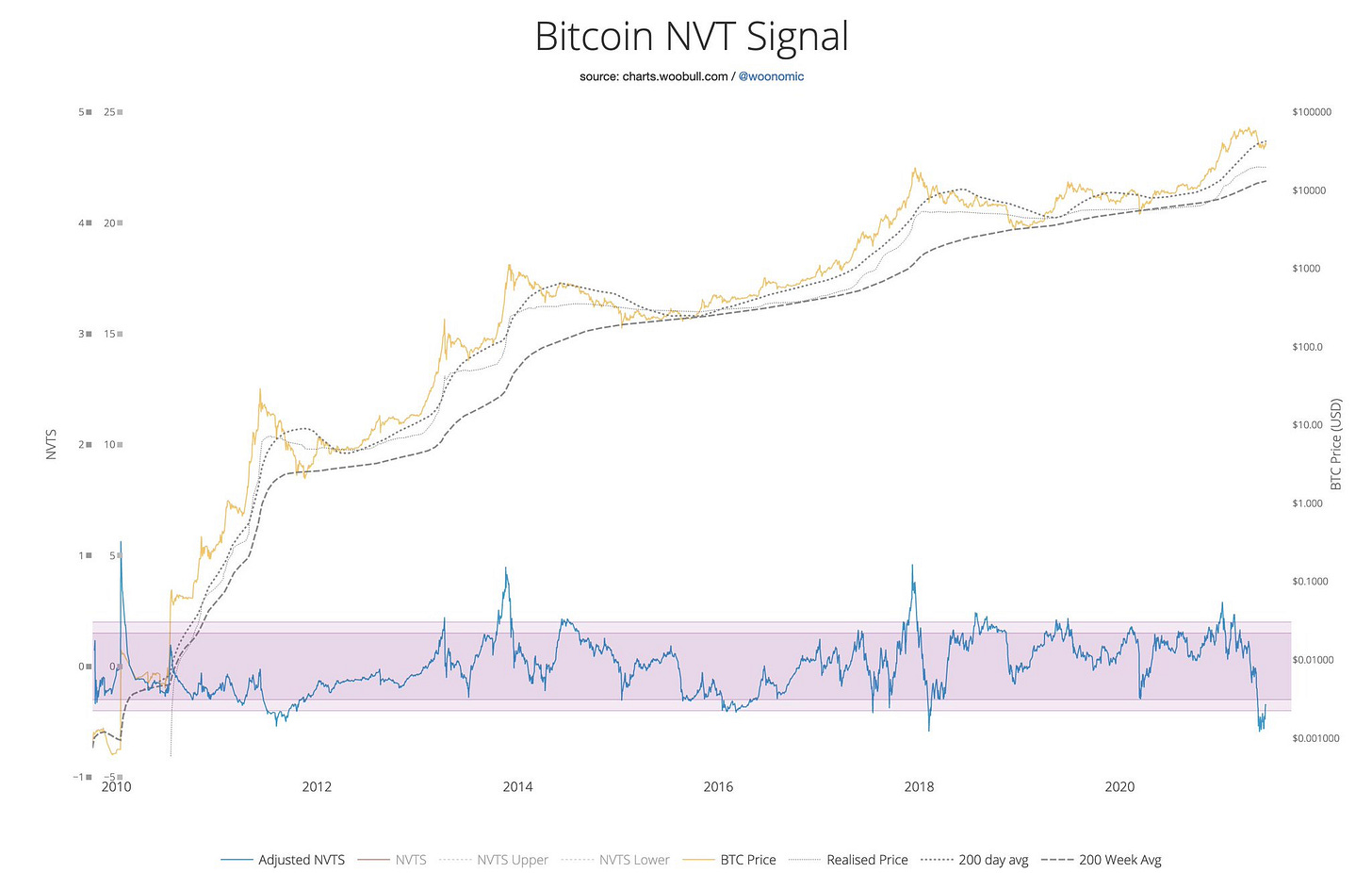

The NVT Signal (NVTS), a variation the NVT Ratio, suggests bitcoin is oversold at a historically high level and poised for a comeback. The NVTS is a derivative of the NVT Ratio that is primarily focused on predictive signaling before price peaks in the short term.

NVTS formula = Network Value / 90d MA of Daily Transaction Value.

The overall investment volume should set the foundation for a push upwards once the resistance at $40k is breached and flipped to support. We could see this happen after another week of trading sideways and more accumulation. This a rare buy opportunity to stack sats at a discount.

Over the coming months, bitcoin is expected to recover. The rate of recovery is the question. It can be another month before a legitimate, full recovery back to April’s all-time highs. Be patient and hodl.

Wrap Up

Volatility is a feature, not a bug. A recovery is on its way, and there are couple key reasons why this is the prediction.

Bitcoin’s overall network is growing. Although the recent price action has been relatively stagnant, new users have increased exponentially. A bear market would see user growth dropping. This is simply not the case. Instead, we are at the height of adoption and interest of Bitcoin. Now more than ever, Bitcoin and crypto are increasingly the main topics of conversation. It’s hard not to talk about when the price is up over 300% in the last year.

Capital is starting to funnel back into Bitcoin. As mentioned, this was a rare opportunity for investors to buy coins on sale compared to trend. A large amount of money moved into stablecoins during the pullback awaiting the best time to buy back in. That’s starting to happen now. This includes long-term hodlers and whales re-accumulating from weak hands who sold. Bitcoin newbies are also taking advantage at these entry points.

Nobody is 100% certain of what will happen in the next couple of weeks, but the data suggests a possible recovery is underway.

Brevin White

@brevinwhite

IN OTHER NEWS:

Bitcoin is trading in familiar ranges even as the U.S. dollar gains ground in currency markets on the Federal Reserve’s interest-rate outlook.

A growing bipartisan group of lawmakers and the White House haggled over how to finance a roughly $1 trillion infrastructure proposal, awaiting feedback from President Biden as Democrats began discussions on a separate economic package that could cost up to $6 trillion.

NASCAR driver Landon Cassill partnered with crypto brokerage firm Voyager Digital for the remainder of the 2021 NASCAR season. He will be paid fully in cryptocurrency for the duration of the 19-race sponsorship deal.

Chinese officials are drawing up plans to further loosen birth restrictions and transition toward policies that explicitly encourage childbirth, according to people familiar with the matter, reflecting increased urgency in Beijing as economic growth slows and China’s population mix skews older.

FACTS

The 121st U.S. Open is this weekend.

Last year, Tiger Woods earned more than $62 million.

$61 million came off the course.

TOP STORIES

BITCOINBitcoin Remains Relatively Resilient Post-Fed as Fiat Currencies Drop Against Dollar, Coindesk

How the Bitcoin Industry Is Responding to Wall Street’s ESG Concerns, Coindesk

BBVA Switzerland Opens Bitcoin Trading For The First Time, Decrypt

Bitcoin Bounce Falls Short at Resistance; Support at $30K-$34K, Decrypt

CRYPTOMcLaren Racing Teams Up With Tezos For Formula 1 NFTs, Decrypt

Grayscale Brings 13 More Tokens With DeFi Focus Under Consideration, Coindesk

NASCAR Driver Landon Cassill To Be Paid Entirely In Crypto, Decrypt

Security Audit Firm Raises $5.3M From Funds Investing in Polkadot, Cardano Blockchains, Coindesk

MACROBipartisan $1 Trillion Infrastructure Package Gains Steam, WSJ

U.K. Virus Cases Surge Even as 8 in 10 Have Received Shots, Bloomberg

China Considers Lifting All Childbirth Restrictions by 2025, WSJ

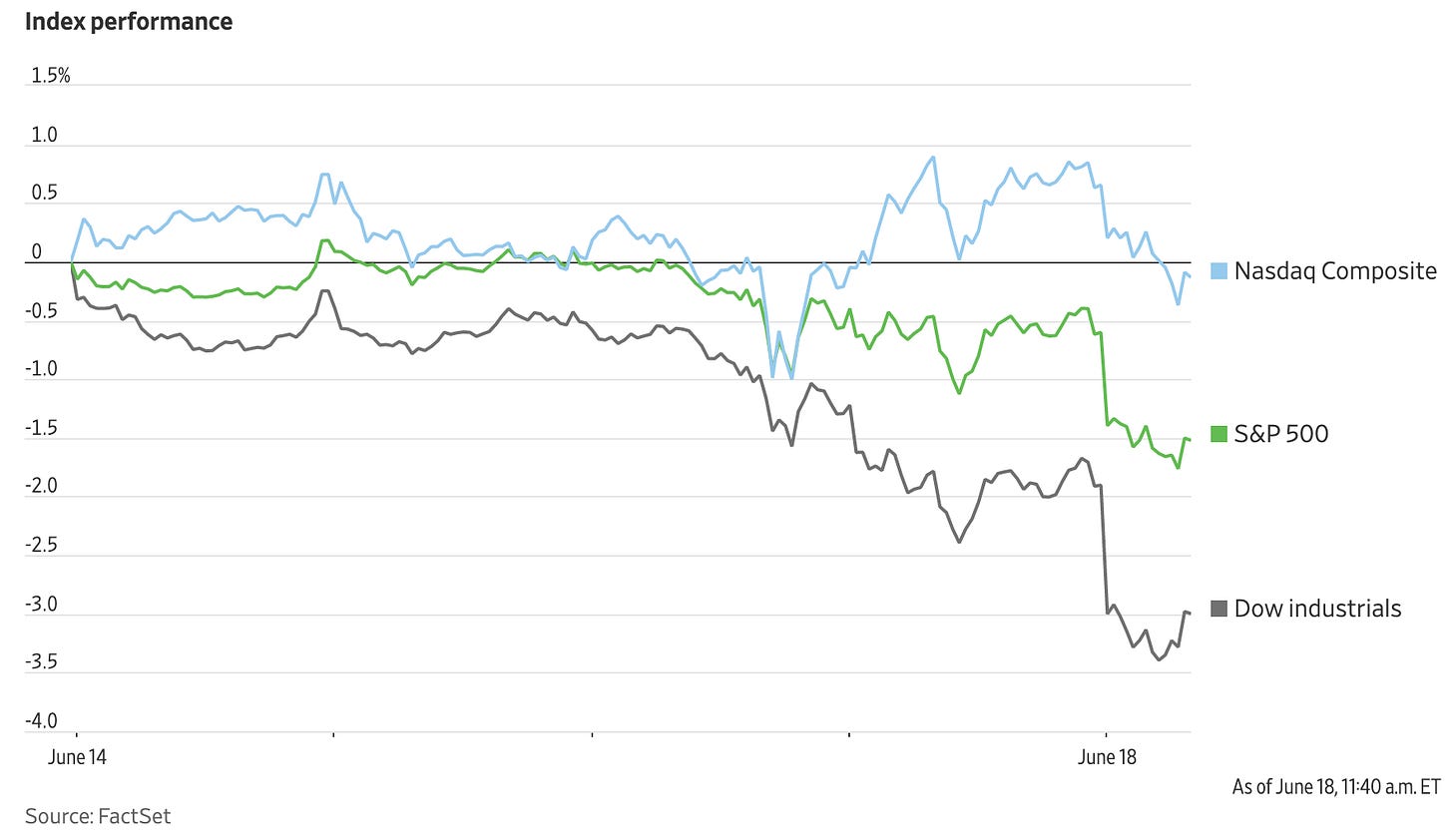

Dow Falls About 400 Points, on Track for Worst Week Since January, WSJ

MEDIA

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.