@Gifmk7

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

MAJR NEWS BRIEF

In this morning’s brief, I wanted to highlight the institutional adoption that’s happening with bitcoin and the overall crypto industry. Most investors get caught up in the price action and forget about the overall story unfolding on a daily basis.

Smart Money is Getting Smarter

Money will go where money is treated best and institutional investors want to put their money to work in digital assets. While, some are more savvy then others and others are hamstrung by investment charter guidelines, i.e. we can only invest in junk bonds - the big money is finding it’s way into crypto’s budding market regardless.

Michael Saylor, the CEO of MicroStrategy is putting on a corporate bitcoin clinic showing investors they can buy the digital asset with hundred of millions in cash, lever up through convertible and secured notes to raise billions to buy bitcoin, sell over a billion dollars in MSTR equity to buy bitcoin and then dollar cost average into the asset with smaller $15 million buys. Yes, Saylor is betting the house, but he’s highlighting the different ways investors and companies can get exposure to bitcoin, while removing the career risk by doing it first. He’s also showing the institutional appetite for the asset since each raise has been over subscribed.

Another example that highlights the speed of institutional adoption is this morning’s news out of Switzerland regarding the digital asset bank Sygnum who’s offering ETH 2.0 staking opportunities to customer banks. This goes well beyond bitcoin and crypto from a high level standpoint. Ethereum’s smart contract and general purpose blockchain is a complicated investment opportunity to digest, let alone use via staking to generate yield in ETH. Ethereum, the second largest blockchain by market cap is undergoing a protocol upgrade. The upgrade allows ETH holders an opportunity to “stake” (lock up assets in a smart contract) for an undetermined amount of time (roughly two years) to earn yields generated from new ETH issuance and transaction fees. This is a fairly technical operation for putting crypto to work, but this is where we are and the possible asymmetrical returns are too ridiculous to ignore.

Three other crypto adoption stories jumped out to me this morning such as Kazakhstan building a bitcoin mining farm, the National Republican Congressional Committee accepting donation denominated in bitcoin, and Exchange Traded Commodities (ETC) powered by blockchain. I want to highlight the ETCs as it’s rather dry, but important because it takes us further down the crypto rabbit hole.

Everything will be tokenized - stocks, bonds, real estate and metals. Nornickel, a Swiss metal producer wants to leverage their ETC products to educate their institutional clients about tokens and digital assets. Like most exchange traded products and securities, investors receive certificates of ownership, however these certificates are still centralized and held with a custodian. Nornickel is providing investors with certificates and tokens for proof of ownership in the fund. To be clear, the tokens will still be centralized on and unable to leave Nornickel’s blockchain platform. However, the CEO of Nornickel hopes to one day sell tokens directly to investors. In the meantime, he understands that his cliental has investment mandates and can only buy specific types of products, but hopes this will be the intro education course to digital assets.

Bullish on Crypto

It’s easy to get lost in the sauce of meme coins and dramatic price action, but the digital asset ecosystem is so much bigger than $100k bitcoin. The smart money is only getting smarter and right now they’re telegraphing their intensions by testing the waters through a variety of investment vehicles.

For those retail investors paying attention, don’t overthink the space and try to time this market. If you’re reading this, you’re early and aren’t tied to an investment mandate. Opportunities to front run walls of money don’t come often. They’re scarce, almost as scarce as bitcoin.

The writing is on the wall. Buy bitcoin.

Matt Verklin

@mverklin

IN OTHER NEWS:

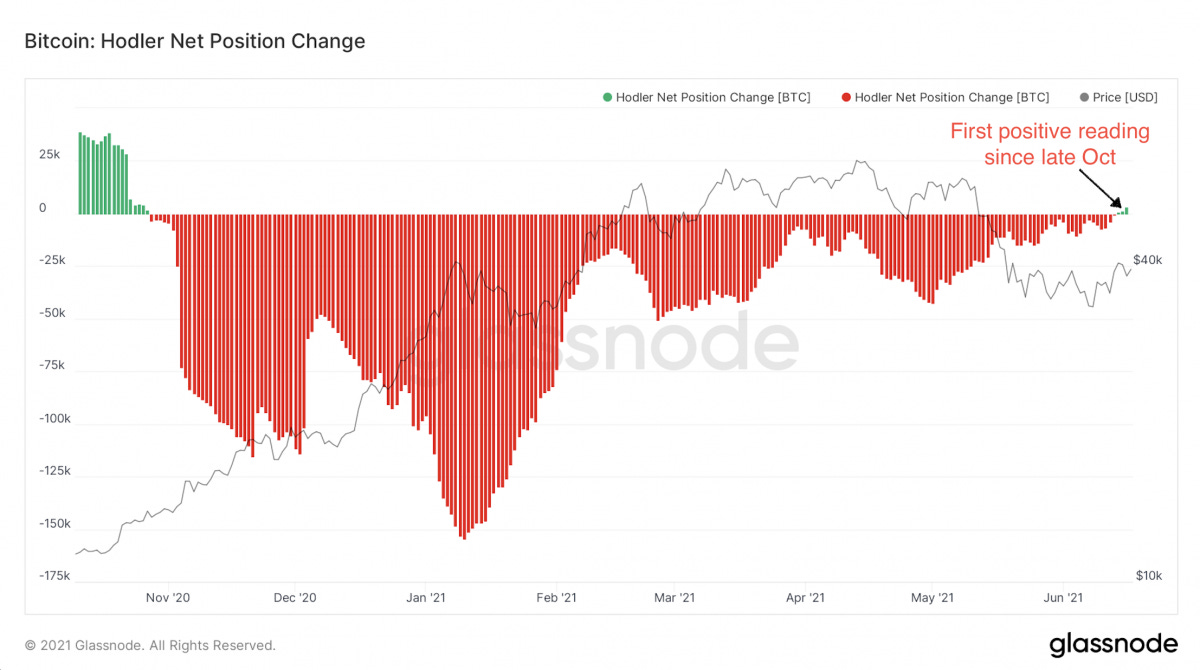

On-chain indicator suggests, Bitcoin long-term holders are net buyers at these price levels. This is generally a bullish sign as more buying pressure is being applied by strong hands (not sellers) which could single an accumulation phase or an upward trend. However, short term volatility should be expected since there’s significant resistance at $42k. Bitcoin is currently trading ~$38,500.

Kazakhstan is building a 16 megawatt bitcoin mining facility in conjunction with Energix. Energix works as a so called mining hotel, meaning that it provides space, energy and maintenance services for miners looking for locations for their machines.

Crypto.com partners with digital asset custody and prime brokerage service Fireblocks to bring institutional investment to the exchange. Fireblocks’ network, which was launched back in June last year, includes a number of global banks, liquidity providers, OTCs, hedge funds, and digital asset managers such as Binance, Bitfinex, Coinbase and FTX.

Pantera Capital CEO, Dan Moorehead says now is the time to buy bitcoin. It’s only been this “cheap” relative to trend 20% of the time over the last 20 years.

The United States’ National Republican Congressional Committee — the body responsible for coordinating Republican electoral efforts — is introducing donations in cryptocurrencies like Bitcoin. Minnesota Representative and Bitcoin proponent, Tom Emmer leads the charge.

Giant investment firm Wedbush Securities announced that it would begin using blockchain technology to settle certain stock trades. Similar moves by the likes of Credit Suisse and Bank of America. Using blockchain can make stock markets faster and more efficient. Wedbush looks to uses Paxos to handle infrastructure and implementation.

World Bank turns down El Salvador’s request to help with the implementation of Bitcoin into their financial system. The World Bank cited transparency and environmental concerns.

Initial unemployment claims slightly increased last week by 39,000 to 412,000. First time since April that the claims have risen vs previous week.

Yellen and Biden administration toy with the idea of retrofitting an increased capital gains tax for high earners, roughly 39.6% for individuals making over $1 million, before the law is passed.

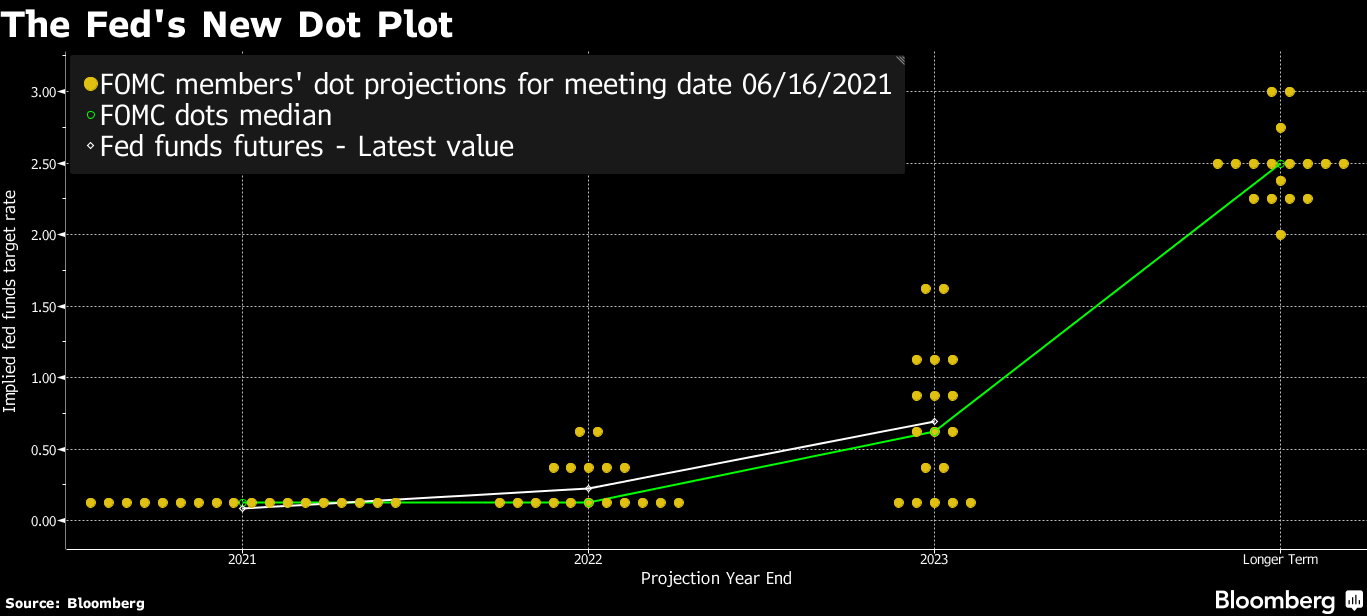

The Federal Reserve’s monetary policy will remain as is with rates at zero to 0.25%, where it’s been since March 2020, and maintained the $120 billion pace of its monthly bond purchases. The Federal Open Market Committee vote was unanimous. Powell mentioned two rate hikes at the end of 2023, but he caveated that they have a long ways to go and essentially have no idea what to expect two years from now.

STATS

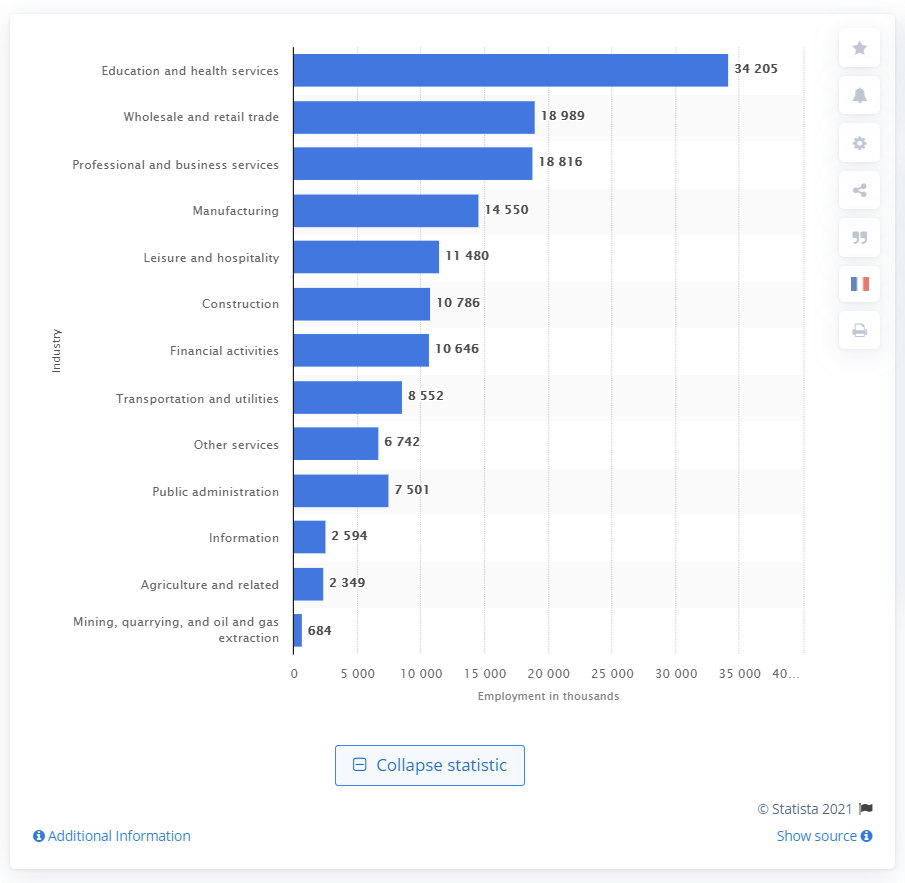

Total employed persons in the United States in 2020, by industry (in 1,000s)

TOP STORIES

BITCOINBitcoin Holders Become Net Buyers for First Time Since October as Death Cross Looms, Coindesk

Wattum to Build Kazakhstan Mining Farm in Conjunction With Energix, Coindesk

US Republican Party's election arm to accept cryptocurrency donations, Cointelegraph

Pantera CEO: Crypto market 'panic' is subsiding, now's the time to buy, Cointelegraph

World Bank Won't Help El Salvador Develop Its Bitcoin Project, Decrypt

CRYPTOBanks Edge Closer to Ethereum 2.0 Staking, Coindesk

Crypto.com Expands Institutional Reach With Fireblocks Integration, Coindesk

Nornickel Launches Hyperledger-Based Tokens Backed by Nickel and Copper, Coindesk

Stocks on the Blockchain: Wedbush Uses Paxos to Settle Trades, Decrypt

MACROU.S. Jobless Claims Rose Last Week for First Time Since April, Bloomberg

Yellen Floats Idea of Capital Gains Hike Dated to Two Months Ago, Bloomberg

Fed Sees Two Rate Hikes by End of 2023, Inches Towards Taper, Bloomberg

MEDIABitcoin 2021: Banking The Unbanked with Jack Dorsey

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.