@Gifmk7

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

MAJR NEWS BRIEF

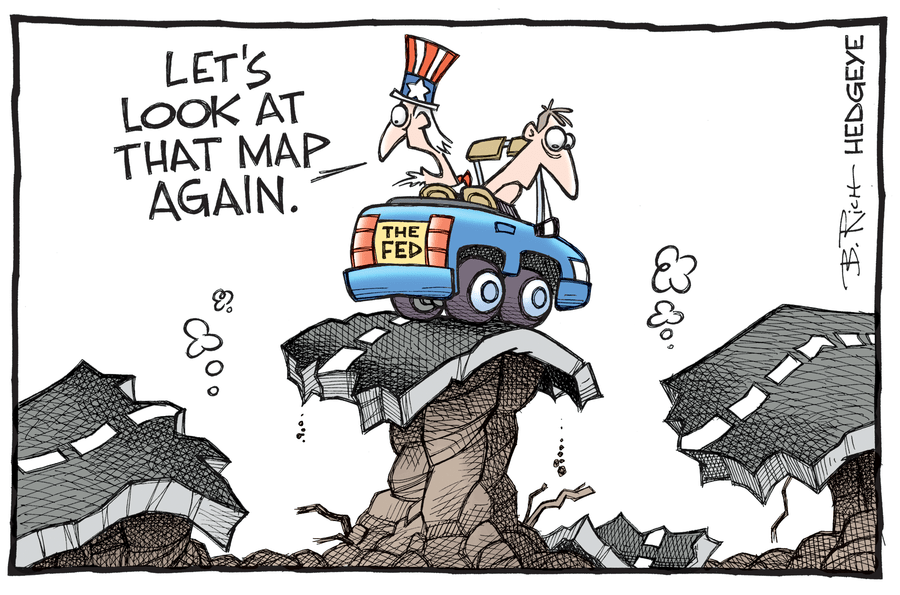

To taper or not to taper? That is the question.

All eyes are on the United States central bank. Federal Reserve Chair, Jerome Powell is slated to provide their latest policy decision this afternoon at 2p ET. Global markets, traders and investment managers are on the edge of their seats awaiting the central bank’s forward guidance.

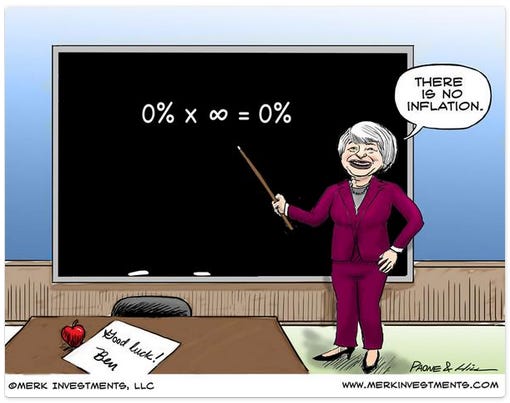

Do Fed officials believe that the recent rise in prices is transitory inflation risk or something they need to address immediately?

This is the question on everyone’s radar. But, isn’t this whole thing absolutely bizarre?

“Free and open” markets are waiting to hear what the 12 unelected officials think is happening across international economies. And, the investment community actually thinks that the Fed is going to give clear guidance.

I get it. It is what it is. In the end, the Fed is running point buying $120 billion in treasuries and mortgage back securities every month.

But, I bet they don’t say anything at all. Keep things vague in typical “Fed-speak” and stick to the tried and true “we’re monitoring the situation and have powerful tools at our disposal to counter inflationary effects if needed.”

Why do I think this?

Because they’re trapped. The White House has trillions in government infrastructure coming down the pipe that needs to be monetized. Every central bank is precariously waiting for the Fed’s direction. If other central banks tighten then their exports are more expensive, which isn’t great for their economies. Debt loads are at all time highs across the board, so how are these companies and governments going to finance the debt when consumer savings is at all time highs with $5.4 trillion in excess and we’ve just started to open back up? Especially if their debt is denominated in a stronger dollar.

They’re stuck and guess what, they’ve been here before. In 2018, Powell learned his lesson. The creature from Jekyll Island is too big and too entrenched to reign in monetary policy. A younger and more naïve Powell tried before and the market, like a typical drug addict had a taper tantrum.

The Fed has been saying the same thing forever. Nothing. They can’t be wrong. They need wiggle room in case they’re wrong. And, if this truly is a recovery, we’re only getting started so why risk a correction and a change in narrative. Plus, inflation is a good thing, especially when you’re a broke government with bills to pay.

The market is trying to call their bluff, but the show must go and because if not, the whole thing comes crashing down.

Bitcoin is the opposite and it’s got to be better than this.

Monetary policy and the flow of trillions in currency units should not be dictated by a few individuals. It should be dictated by the market.

Bitcoin doesn’t fix everything, but it was made to fix this. Monetary policy is programmed, predictable and unchanging. The issuance of new units is scheduled and changes every 4 years. That’s it.

This simple change destroys the concept of forward guidance. Bitcoin is forward guidance for the next century regardless of who’s sitting in the captain’s chair.

Frankly, I’m with the Fed. Pedal to the metal so we can accelerate Bitcoin adoption and move on with our lives.

Matt Verklin

@mverklin

IN OTHER NEWS:

Panamanian congressman Gabriel Silva plans to introduce a bill similar to El Salvador to legalize bitcoin and crypto as legal tender. However, a much slower process is expected as the situation is slightly different in Panama with more opposition.

Bitcoin like all markets is waiting on Fed’s policy decision.

Kyber Network is the latest Ethereum protocol to integrate with Polygon’s layer 2 scaling solution for DeFi. Polygon (MATIC) is building a strong case for a big DeFi summer and price acceleration.

Ocean Protocol which is a decentralized data exchange that aims to democratize data sales and ownership was just awarded for its blockchain technology by the World Economic Forum.

Twitter and Square CEO, Jack Dorsey promotes Project Mano on Twitter to raise awareness around their efforts working with Ethiopian government to adopt and embrace bitcoin and bitcoin mining.

Fox Entertainment launches a $100 million creator fund for studio’s NFT business.

Morgan Stanley works with NYDIG and FS Investments to expand bitcoin fund to provide more options for investors to get exposure to the asset class without holding the underlying digital asset.

House Financial Services Committee’s fintech task force, Rep. Maxine Waters said congressional Democrats have formed a working group focused on cryptocurrencies.

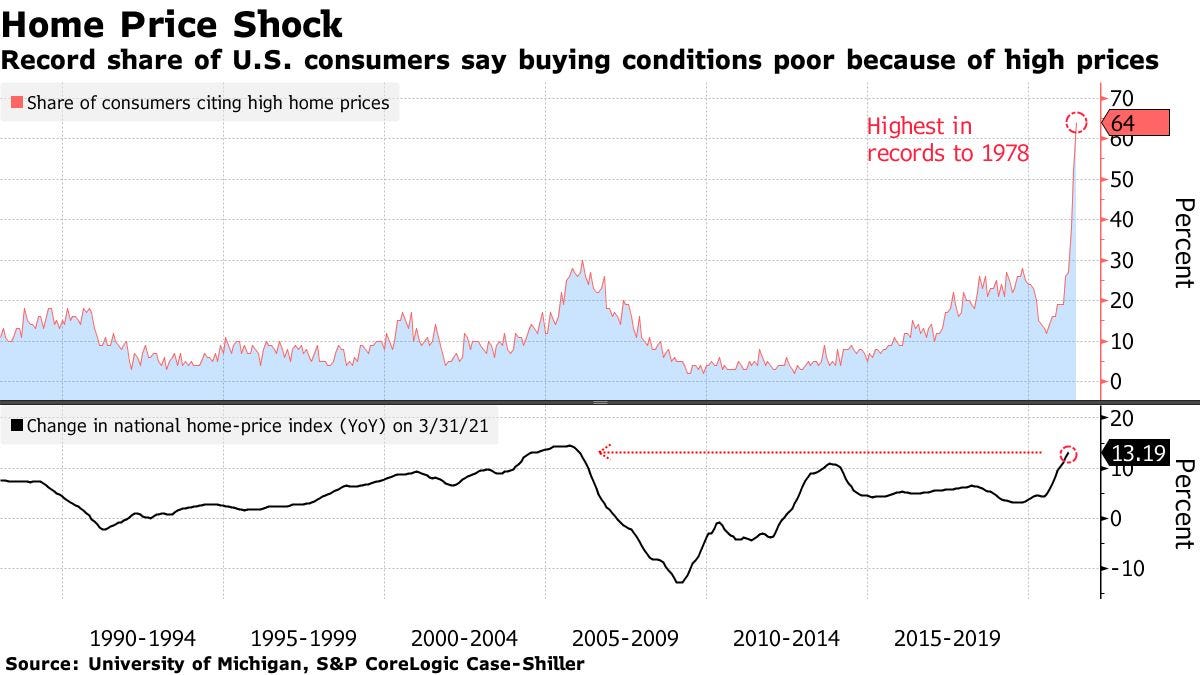

Housing could be taking a breathier as US housing starts rose slightly in May while building permits fell. Home buyers and builders are all pointing to high home prices and increased costs for materials.

China ordered state owned manufactures to limit exposure to oversees commodity risk to avoid market speculation and inflation risk. The country even dipped into their commodities stashed surplus to flood the market with metals (aluminum, copper and zinc) and bring prices down.

Turkey’s struggling economy battling political instability and tight monetary policy combatting inflation could be in trouble if the Fed raises rates strengthening the dollar. Turkey is a good example of the situation in other emerging markets.

JPMorgan is expects rate hike in late 2023.

FACTS

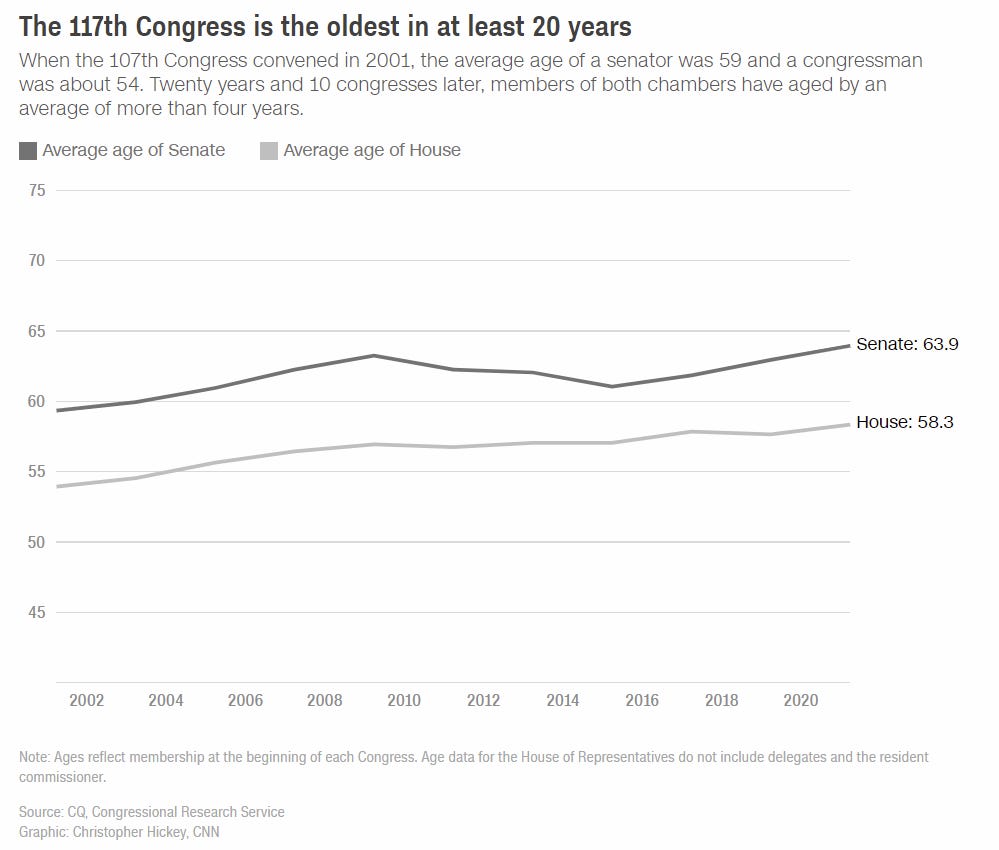

The United States 117th Congress is old.

TOP STORIES

BITCOINPanama to Present Crypto-Related Bill in July, Coindesk

Jack Dorsey notes lobbying efforts to get Ethiopian gov't to embrace Bitcoin, Cointelegraph

Morgan Stanley Set to Expand Bitcoin Fund Options, Decrypt

CRYPTOMaxine Waters Announces Congressional Working Group on Crypto, Decrypt

Kyber Network Announces Polygon Integration and Liquidity Mining Program, Coindesk

New DAO launches after $230M funding round including Peter Thiel, Alan Howard, Cointelegraph

Fox Launches $100M Fund for Its New NFT Studio, Decrypt

MACROStarts of U.S. Homes Increased Slightly in May, Permits Eased, Bloomberg

China’s Campaign to Control Commodities Goes Into Overdrive, Bloomberg

Turkey’s Troubles Point to Emerging-Market Risks as Economies Recover, WSJ

J.P. Morgan Moves Forward Expected Timing of Fed Rate Increase, WSJ

Companies With $2.1 Trillion of Debt Face Natural Capital Risks, Bloomberg

Real Vision Raises $35M in Bid to Shake Up Financial Media, Coindesk

MEDIABTC030: Bitcoin Security and Self Custody w/ Nick Neuman

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.