@G1ft3d

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

MAJR NEWS BRIEF

What is Tokenomics?

Tokenomics is the study of how specific cryptocurrencies work and incentivize human behavior within their ecosystems. This includes things like token distribution, issuance, staking mechanisms, rewards and governance. A project with the right tokenomics can help tell their brand’s story, attract massive liquidity and recruit network participation overnight.

Bitcoin invented digital scarcity. This profound idea is playing out in real time across the crypto universe.

A digital token that represents a unit of real world value is a great incentive to drive human behavior. When a central bank wants to incentivize borrowing and spending; they change their monetary policy, lower interest rates and print reserves. Similar mechanics can be implemented in crypto, but it’s done in the open, so the network’s operations are predictable and immutable.

Token distribution

Projects need to distribute tokens to become a distributed network. The question is - how to do this and how to do this in the best way to bootstrap liquidity, increase the token’s value and drive network effects?

Projects can:

Reward network validators or miners through new issuance.

Host a private sale where users get early access to discounted tokens and which are then locked for a particular period of time post launch to help stabilize price.

Reward users for specific behaviors. For example, Uniswap the largest DEX uses liquidity pools that allow traders to swap different tokens without a centralized party. The liquidity pools are created by users who stake their tokens in exchange for yield created by the cash flow from the exchange fees.

Governance

Since there’s no one authority, decentralized projects need a way to evolve and make decisions as a community. These decisions can impact the projects token issuance schedule, which can impact the token’s scarcity and ultimately it’s value. Therefore, the project’s core designers can create rules that help drive quality decision making for the long-term health of the network.

In our recent, MAJR Coin’s research piece on the Internet Computer Protocol, part of their tokenomics was to proportionally reward users with more tokens the longer they staked their tokens. The users with more tokens had more voting power when it came to different governance proposals. This mechanism creates a positive feedback loop. Users are incentivized to stake tokens longer which removes tokens from the liquid market, therefore driving scarcity and ultimately putting upwards pressure on price. The users who staked their tokens are now more loyal to the network. Their total holdings have increased in value as the token has become more scare and via the issuance of new tokens. When it comes time to vote, the users with more tokens and more voting power are now inclined to vote on decisions that should drive value for the network rather than harm the network.

A circular economic solution that pulls the network forward.

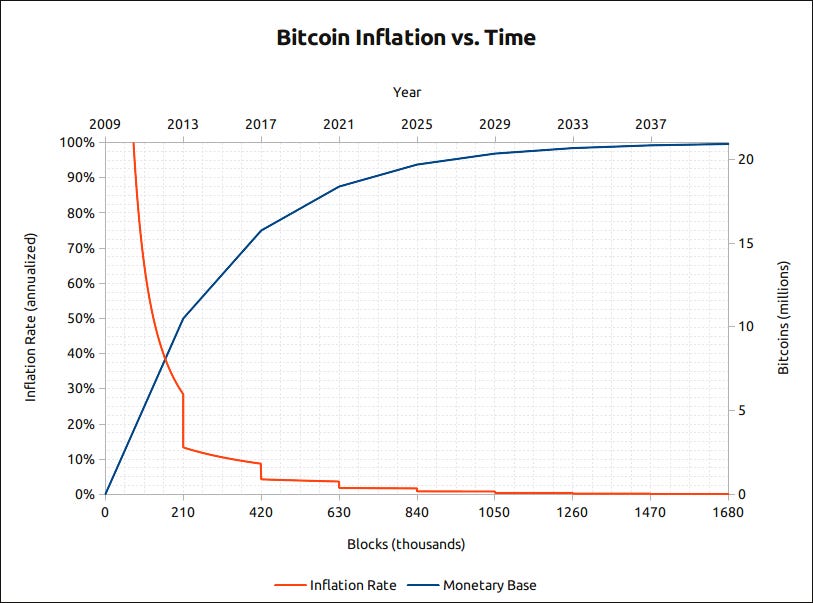

Deflationary Token Models

Like I said at the beginning, digital scarcity is a profound idea. Bitcoin uses a deflationary token model where the new issuance is cut in half every four years. There’s guaranteed to be less new bitcoin issued in the future then today. This simple incentive scheme has helped drive Bitcoin’s market cap from $0 to over $1 trillion.

A shrinking new issuance schedule isn’t the only way to create a deflationary effects. A deflationary currency, is one where your currency increases in value compared to the goods and services it can buy. This is the opposite of fiat’s inflationary effect where your currency decreases in value compared to it’s buying power…but I digress.

Projects can create deflationary effects through token burning.

When tokens are burned they are removed from circulation. This is done by sending tokens to a burn address, an address that can’t be accessed. Therefore, the tokens are gone forever. This incentive scheme can be implemented in a number of ways. If the project wanted to reduce selling pressure, the protocol can implement a sales tax. The users who sell are then taxed additional percentage of tokens which can either be distributed to the rest of the network or automatically sent to the burn address. This reduces the overall supply, therefore putting upwards pressure on price as the tokens are more scarce. This scheme does two things. It helps maintain the network’s value and creates a negative feedback loop for sellers. By selling, users miss out on the token’s upside appreciation in price.

Bullish on crypto

New and interesting tokenomics are being explored by all sorts of projects which is one of the main reasons for investing in tokens outside of bitcoin. This is also one of the main reasons why I believe investing in digital assets is the best place for investor dollars.

Incentivizing human behavior is built into these protocols. It is their business model. It’s very difficult for non-crypto businesses to implement such schemes at this scale and velocity.

Quality tokenomics put stock buy backs to shame.

Excited to share MAJR’s tokenomics in the near future.

Matt Verklin

@mverklin

IN OTHER NEWS:

It’s fair to say that MicroStrategy is past doubling down on bitcoin. Their treasury reserves are in bitcoin, they’ve raised over $1.5 billion in debt to buy more bitcoin and now they’re selling $1 billion of MSTR stock to buy more bitcoin. CEO, Michael Saylor will either go down in flames or as the greatest CEO of all time.

Bitcoin-stablecoin ratio oscillator indicator has just flashed green for “Buy the Dip”. This leading indicator shows the ratio of bitcoin on exchanges compared to stablecoin.

More DeFi projects are flocking to Ethereum layer 2 solutions like Polygon (Matic) to attract users trying to avoid high ETH transaction fees. SushiSwap, the Automated Marker Maker (AMM) has 15k unique active wallet addresses using Polygon’s layer 2 vs 4k using Ethereum’s layer 1. Polygon has outperformed most projects, MATIC is up nearly 9,000% year to date.

Crypto investment survey finds that more than 80% of respondents are more bullish then ever and plan on increasing their crypto exposure over the next quarter despite the April and May crypto correction, more than 50%.

Hedge Funds expect 7.2% of assets in crypto by 2026, according to survey by Intertrust who surveyed 100 investment managers representing $7.2 billion in AUM. If this allocation is accurate, then $312 billion is going to move into the crypto markets over the next 5 years…This seems conservative.

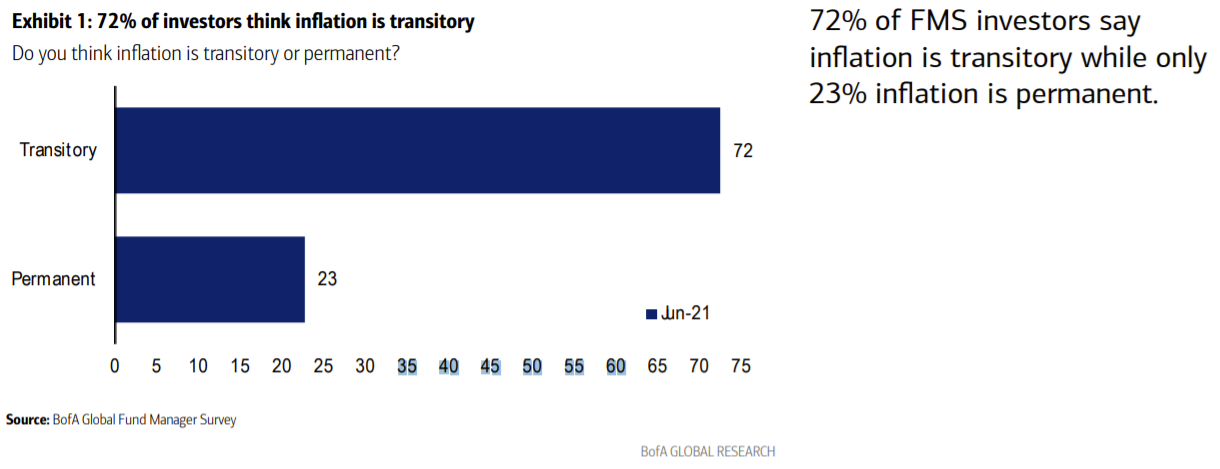

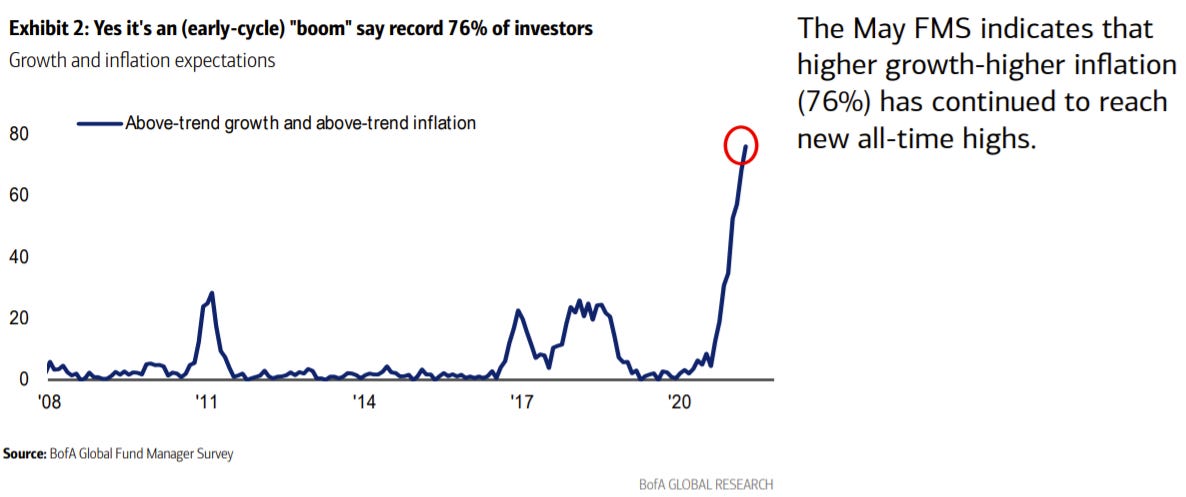

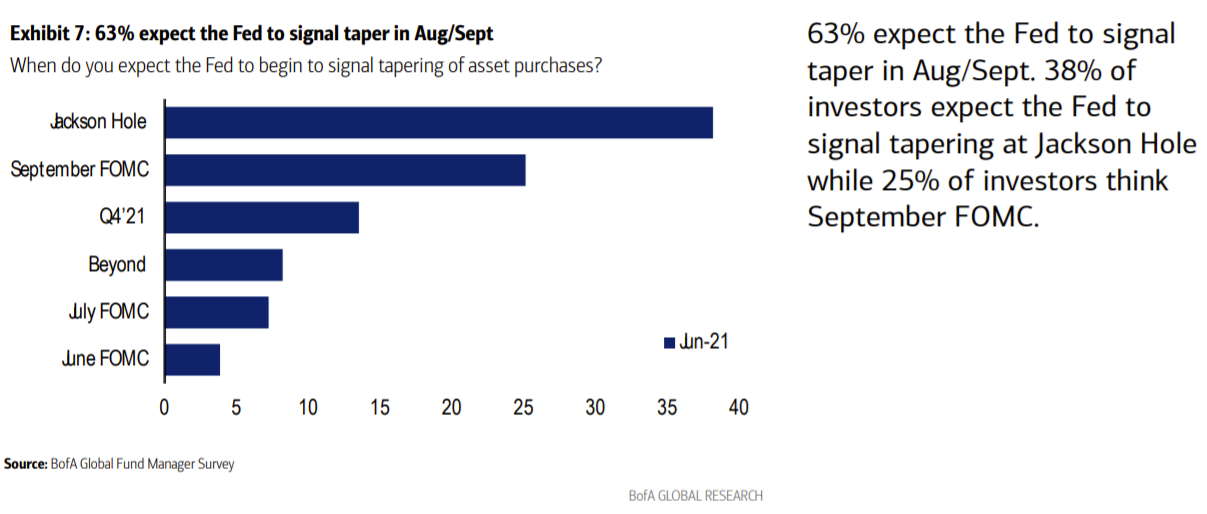

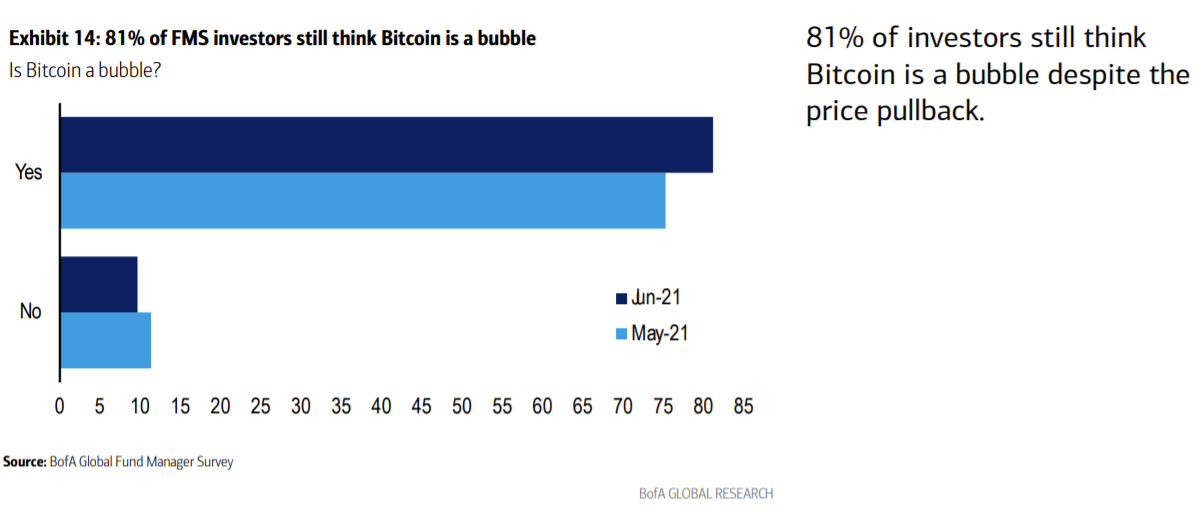

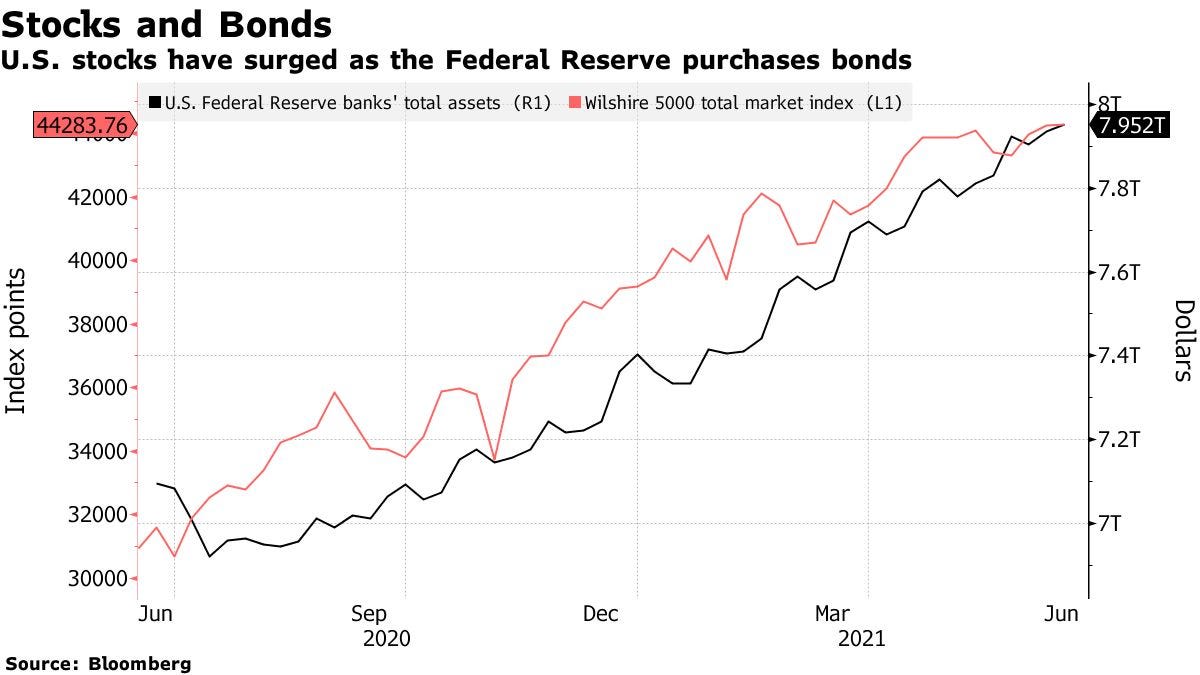

In another survey performed by Bank of America, 81% of fund managers think bitcoin is in a bubble. The survey was done across 200 asset managers controlling $650 billion in AUM. The survey had some interesting charts. I’ve shared some below. Careful who you listen to.

Bitwise Asset Management, a crypto firm making inroads with America’s $20 trillion financial advisory industry, raised $70 million at a $500 million valuation. Some of the lead investors were Electric Capital and Wall Street Giants - Stanely Druckenmiller and Daniel Loeb.

DeFi exchange dYdX raises $65 million from crypto heavy weights a16z, Paradigm, Three Arrows Capital and Polychain. dYdX is a decentralized exchange for spot, margin and derivatives trading.

Polkadot, the Ethereum competitor has seen a price increase of 16% this week due to upcoming parachain launch and Coinbase listing. The Coinbase effect is real with average returns of 91% after being listed for 5 days. Polkadot’s native token DOT should listed on Coinbase Pro today.

Goldman Sachs expands crypto trading operations and explores ether options.

Retail spending is down in May as consumer switch habits from big tickets items such as cars to services like dining out.

STATS

TOP STORIES

BITCOINBitcoin investors more bullish than ever despite 50% price crash, Cointelegraph

MicroStrategy May Sell $1 Billion in Stock to Buy More Bitcoin, Decrypt

81% of Fund Managers Still Think Bitcoin Is a Bubble: Bank of America Survey, Decrypt

A Bitcoin indicator with a ‘perfect’ history just told you to buy the dip, Cointelegraph

CRYPTODeFi Projects Continue Flocking to Layer 2 Solution Polygon, Coindesk

Hedge Funds See 7.2% of Assets in Crypto by 2026, Coindesk

Hedge Fund Giants Druckenmiller, Loeb Back $70M Raise for Crypto Asset Manager Bitwise, Coindesk

Ethereum DeFi Exchange dYdX Raises $65 Million From a16z, Paradigm and More, Decrypt

Coinbase Listing and Parachain Progress Boost Polkadot 16%, Decrypt

Polkadot price soars 37% after Coinbase Pro DOT listing, first parachain auction, Cointelegraph

MACROGoldman Expands in Crypto Trading With Plans for Ether Options, Bloomberg

U.S. Inflation Is Highest in 13 Years as Prices Surge 5%, WSJ

Fed Poised to Crawl Onto ‘Knife Edge’ to Rein In Record Largesse, Bloomberg

U.S. Producer Prices Accelerated in May, Stoking Price Pressures, Bloomberg

Lumber Prices Are Falling Fast, Turning Hoarders Into Sellers, WSJ

Retail Sales Dropped 1.3% in May as Pandemic Shopping Habits Shifted, WSJ

MEDIAEric Weinstein on Bitcoin

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.