@henque

MAJR NEWS BRIEF

Today, there are over 73.8 million digital wallets today. There are over 8 billion people in the world. Bitcoin has room to grow.

Bitcoin is the world’s largest and most popular cryptocurrency with a current market cap of roughly $616 billion dollars. While the network has seen amazing growth in adoption and appreciation in price, scalability and transaction throughput remains a target for improvement. Blockchain scalability refers to the amount of transactions that can be processed per second (TPS). Bitcoin was specifically engineered to handle a certain number of transactions can be processed, verified, and put into a block (1MB). This architecture was intended to maintain security and decentralization on Bitcoin’s layer 1 blockchain. Blocks of data are mined every ~10 minutes leaving users waiting between 10-60 minutes for their transactions to be confirmed.

This works fine for bitcoin’s store of value use case, but doesn’t scale as an efficient global payment system. Traditional payment infrastructures, like Visa and Mastercard, process thousands of transactions per second. On the other hand, Bitcoin’s layer 1 can process between 2-14 TPS. This simply is not enough to maintain growth and become a truly decentralized money, a medium of exchange.

Enter the Lightning Network.

The Lightning Network

The technology’s first whitepaper emerged in February 2015, by developers, Joseph Poon and Thaddeus Dryja. A year later, they published the Bitcoin Lightning Network Whitepaper framing a potential application to enhance Bitcoin’s scalability using a layer 2. The project was formally launched in 2018, and has made significant progress over the last few years.

What exactly is the Lightning Network?

The Lightning Network is a layer 2 technology that sits on top of the Bitcoin blockchain as a solution for scalability.

Lightning - a decentralized network using smart contract functionality on the blockchain to enable instant payments across a network of participants.

It was created specifically to help facilitate and manufacture rapid peer to peer transactions thus making the blockchain able to properly develop with its users.

Layer 2 - an off-chain secondary protocol that is built on top of the existing blockchain (layer 1). Off-chain means any event (transactions) occurring on a cryptocurrency network that is outside of the main blockchain.

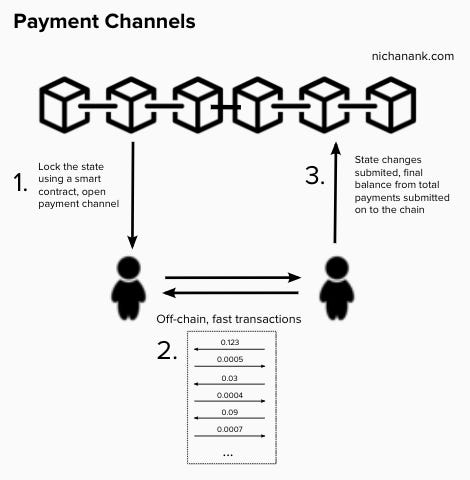

A layer 2 solution like Lightning allows users to send and receive transactions without having to record every transaction on the main blockchain saving space, time, and cost. The protocol accomplishes by using multiple off-chain payment channels that provide instant transactions between participants. The only transactions that are recorded on the main chain include the one that creates the payment channel and the exit transaction.

The Lightning Network is completely separate and independent from Bitcoin. It is its own software that is in constant communication with the main chain.

How It Works

Here’s a simplified version of how Lightning works.

Two participants create a ledger on a blockchain which each person signs off on and approves.

Both parties create and engage in transactions that are recorded on the Lightning Network but not broadcasted on the main chain.

This channel can be closed out at any time by either party by broadcasting the most recent version of that channel to the blockchain.

Think of the Lightning Network as a bar tab. Generally, individuals don’t pay for every single drink at a time. They start a tab that records every transaction and is then settled at the end of the night. The same goes for the Lightning P2P payment channels.

Wrap Up

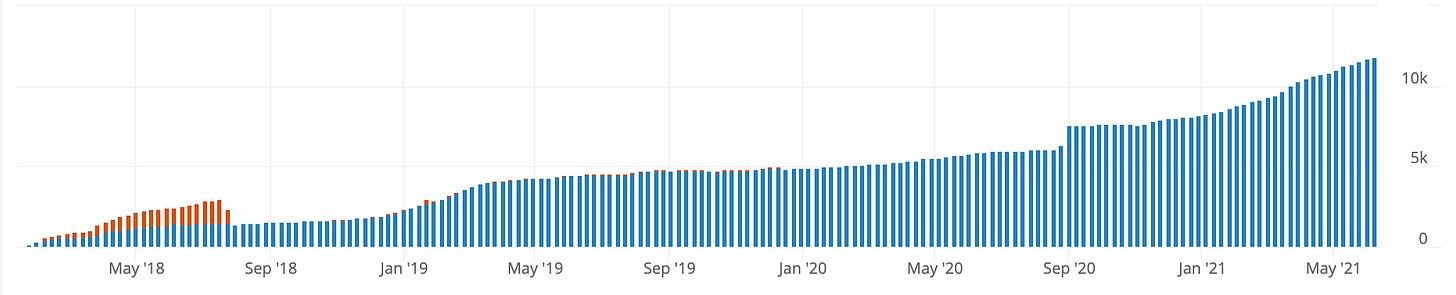

As the name suggests, transactions that occur through the protocol are truly lightning fast. Over the past year alone, the number of network nodes has doubled to ~12k which highlights the adoption and demand for the technology.

Number of Lightning Nodes Since 2018

Lightning provides instant payments, increased transaction throughput, and low costs that gives Bitcoin exponentially more value and uses cases real world adoption.

It’s already being supported by top crypto exchanges, such as Kraken.

And, it’s become central to the biggest event in Bitcoin’s 12 year history. Through the use of Jack Maller’s bitcoin payment application, Strike, Lightning will be the underpinning technology for El Salvador’s modern day bitcoin financial infrastructure.

This morning El Salvador was the first country to pass a bill confirming bitcoin as legal tender and will be used interchangeably with the US dollar. The bill was sent to congress and in a matter of two hours was being voted on and was ultimately passed with a super majority. Unreal.

Lightning was critical for El Salvador’s bold move puts Bitcoin on a whole new trajectory as an instantaneous peer to peer payment system. Bitcoin is now ready for global adoption.

Bitcoin keeps getting smarter with time. It’s a technology and future innovations like the Lightning Network will only make the protocol stronger, faster, and more valuable.

Follow the smart money.

IN OTHER NEWS:

This is the biggest headline of them all! With 62 favorable votes, the Legislative Assembly of El Salvador has just approved the Bitcoin Law presented by the president of the country, Nayib Bukele a few hours ago.

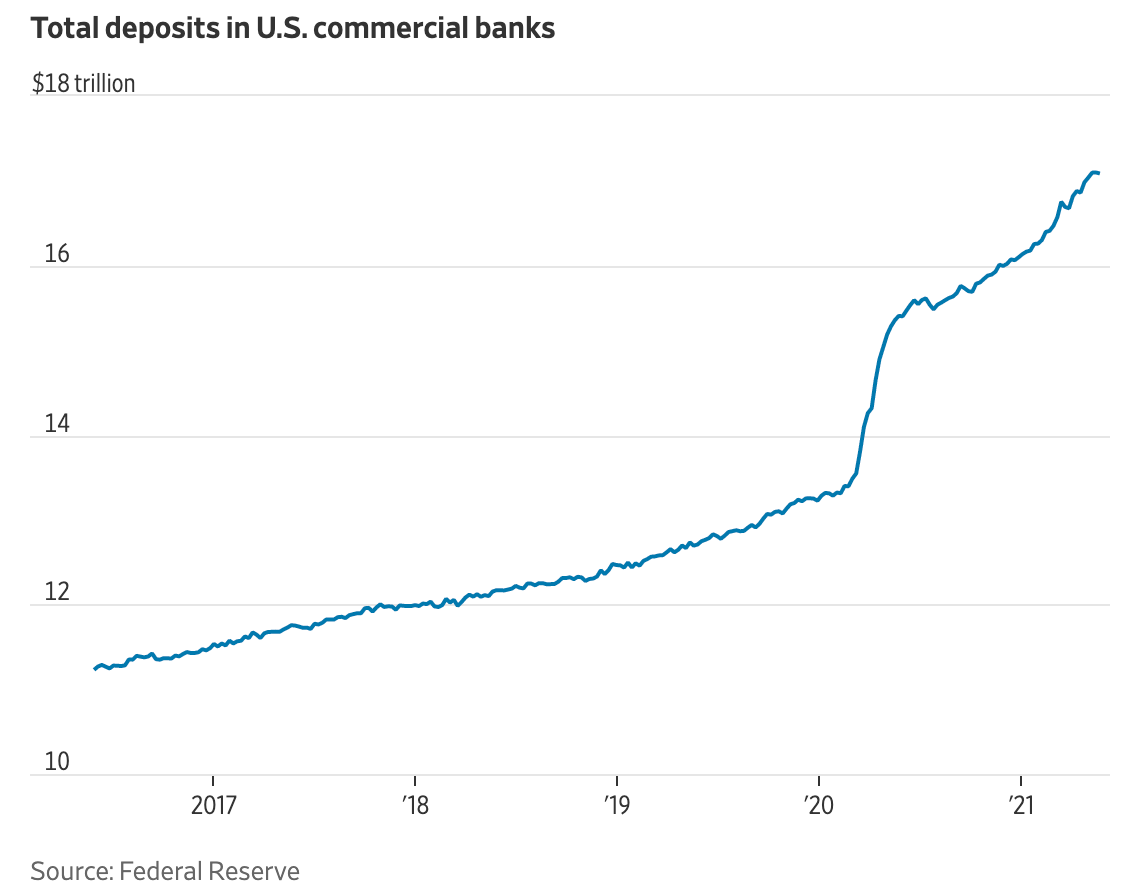

Bank deposits have continued to surge this year. Between late March and May 26, they rose by $411 billion to $17.09 trillion, according to the latest available data from the Federal Reserve. That is slower than the pace last spring, but still nearly four times the average of the past 20 years, according to the Fed data.

More players are getting involved as people want their bitcoin. Interactive Brokers will start providing cryptocurrency trading services by the end of the summer. Interactive Brokers provide services to both individuals and institutions—the firm's crypto offering will continue a long line of crypto interest from the institutional front

The gap between GDP and jobs is widening. It is important to keep in mind these are still not normal times we are currently in. Payrolls have risen 1.6 million in the past three months and are up 1.7% this year through May, which in normal times would be impressive. But these aren’t normal times. The economy is rapidly reopening, consumers are flush with federal stimulus cash, and retail sales, factory orders and housing are all booming. Inflation-adjusted gross domestic product is up 5.3% through May this year.

Gemini purchased a custody tech developer, Shard X, which claims to be the first company to offer multi-party computation (MPC) on hardware security modules (HSMs). In the past, MPC was thought to be too computationally difficult to store shards on hardware. This will ultimately strengthen Gemini’s security of its crypto offerings.

FACTS

Politicians from Brazil, Mexico, Colombia, Argentina, Paraguay, and El Salvador have laser eyes on twitter. Bitcoin is global.

TOP STORIES

Source: btcmanager.com

BITCOINEl Salvador Approves the "Bitcoin Law" Giving BTC Status as Legal Tender, Decrypt

Bitcoin Bounces From Two-Week Low as China Inflation Surges, Coindesk

Bitcoin Holds Short-Term Support; Faces Resistance at $36K, Coindesk

Bitcoin miner Poolin immortalizes El Salvador's BTC adoption on the blockchain, Cointelegraph

CRYPTOA Blockchain Project Just Bought $704k in Digital Real Estate To Build a Virtual Mall, Decrypt

Gemini Acquires Crypto Custody Firm Shard X, Coindesk

Interactive Brokers To Roll Out Crypto Trading by End of Summer, Decrypt

Nasdaq-Listed Victory Capital Plans Entry Into Crypto, Coindesk

MACROBanks to Companies: No More Deposits, Please, WSJ

Biden Seeks Allies’ Support in Confronting Putin, China, WSJ

Technology Fills the Gap as Jobs Lag GDP, WSJ

Surprise Jump in U.S. Wages Gives Inflation Debate a New Twist, Bloomberg

Australia Stays on Sidelines as West Unites to Sanction China, Bloomberg

MEDIA

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.