@gfaught

MAJR NEWS BRIEF

The world wants to de-dollarize itself and the US should too.

While, it might seem contrarian to avoid world reserve currency status, it actually makes sense. In this brief, we’ll discuss the international movements away from the dollar, why the dollar is a problem and why the United States should embrace this inevitable outcome.

De-Dollarization by World Powers - Russia, China, EU and India

Russian President Vladimir Putin is making good on his commitment to de-dollarize the country and no longer holds any dollars in their $600 billion sovereign wealth fund that stashes the government’s energy proceeds. They divested $41 billion in less than a month. They’ve increased holdings of euros (40%), yuan (30%) and gold (20%). De-dollarization for Russia is no small task as 80% of their currency is still traded in dollars, however for the first time they’ve reduced energy exports traded in dollars to below 50%. Six years ago, Russian exports to China were 98% dollar based. As of 2020, exports are 33% in dollars, 50% euros and 17% in their own currencies.

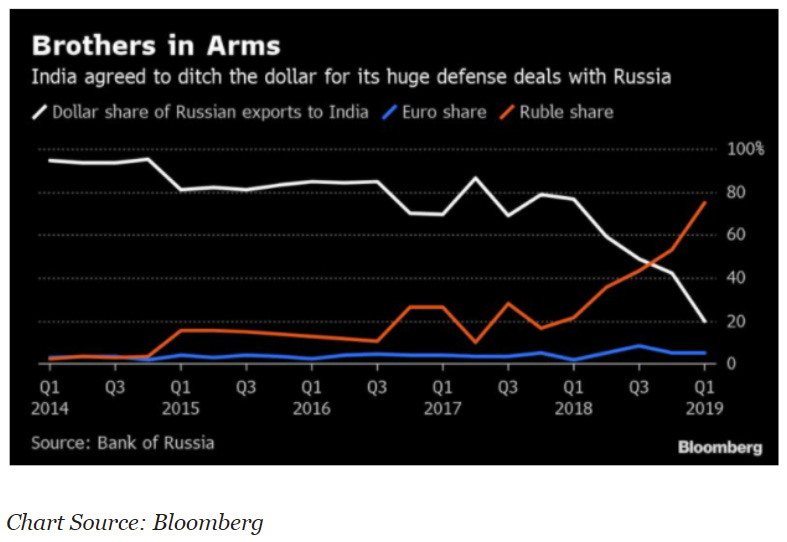

This trend continues with Russian exports to Europe and India. European trade with Russia has changed from 69% to 44% in dollars and 18% to 43% in euros. Indian trade with Russia has changed from 100% to 20% in dollars.

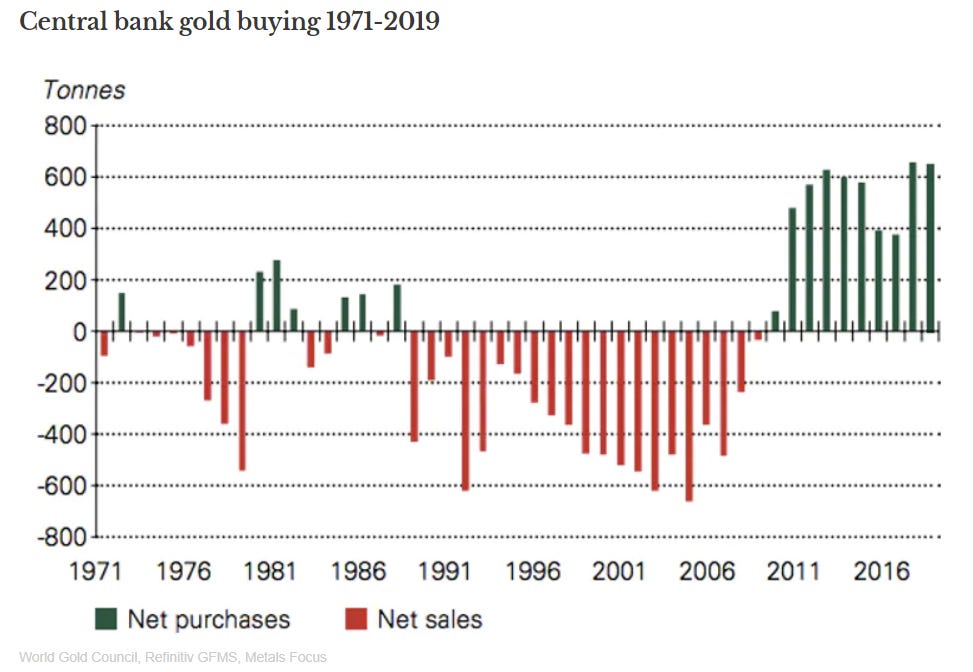

Energy has always been a contentious issue between international powers, mainly due to the 1974 deal between the United States and OPEC countries solidifying the dollar as the sole currency for trade, creating the Petrodollar System. In addition, countries are buying less US treasuries and increasing their central bank holdings of gold. Gold investment had a record year in 2019. China and Russia bought a total of 251 tonnes of gold, along with Turkey, Poland and Kazakhstan. In 2020, 21% of central banks around the world intend to increase their gold reserves of the next 12 months. In fact, this has been in motion for years.

In 2020, China confirmed that they will decrease their treasury holdings from $1 trillion to $800 billion, losing it’s status as the largest international US creditor behind the Japan. Instead, China has used their dollar surplus to invest in other foreign hard assets vs. treasuries. The Chinese Belt and Road initiative is one example of China investing in other developing countries in Asia, Africa, Latin America and Eastern Europe by providing infrastructure through dollar denominated loans. If the loans are defaulted on, China gains ownership and access to infrastructure, trading partners and hard commodity assets.

Why Nations Want De-Dollarization

The United States has weaponized the privilege of having the world reserve currency. The US controls the international SWIFT payment system and uses the dollar to sanction international countries that don’t fall in line, such as Russia and Iran.

This isn’t the first time the countries have tried to move away from the dollar, especially when trading energy. In 2000, Saddam Hussein of Iraq started selling oil in euros and a couple years later the United States waged war with Iraq at the cost of 4,500 American soldiers and $2 trillion in funding to reverse the euro for oil trend.

Nord Stream Pipeline 2

These aggressive reactions aren’t only pointed against bad actor states. Recently, the US has threatened sanctions against European countries such as Germany for their involvement in the Nord Stream 2 pipeline strengthening oil transport between Europe and Russia. Sanctions have also been placed on European countries for dealing oil with Iran.

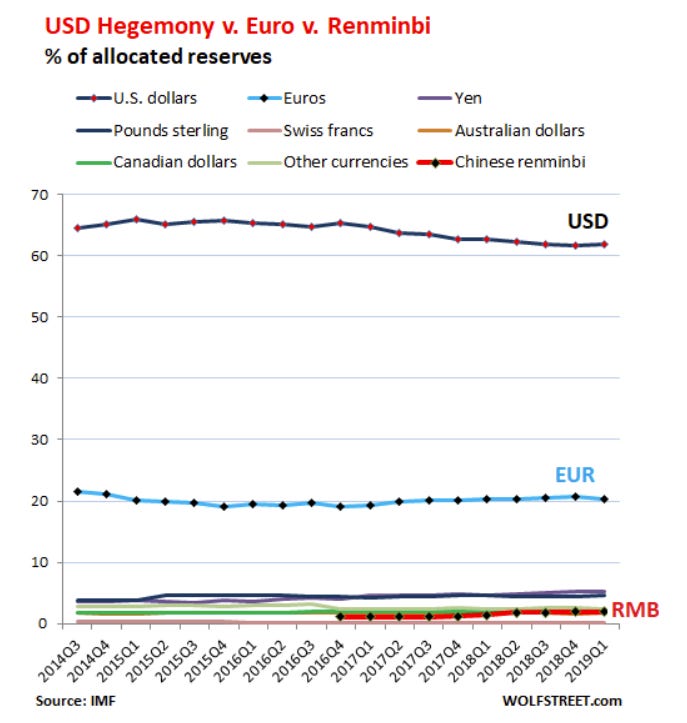

Economic explanations can also address the moves away from the dollar. For example, the US economy only represents 15.9% of GDP (adjusted for inflation) and is projected to continue it’s decline. However, the dollar is used in 80% of global transactions and over 60% of international reserves are held in dollar denominated assets. While this may seem great for the US as it can monetize its trade deficits via international investment, this makes the majority of countries susceptible to sanctions, and perhaps more importantly, dollar shortages.

Global debt is sitting around $280 trillion. This is a huge issue for any country who needs to service their debt in dollars, especially emerging market countries who’s debt is ~90% in dollars. The dollar has become the largest export for the US and it comes with profound implications for economies struggling to meet their payments. In many cases, this results in inflationary scenarios by printing easy local currency to pay for hard dollar debt.

It’s understandable why countries are looking for US dollar exits and working together to find them. The US can’t go to war with everyone.

Why the US Should Embrace De-Dollarization

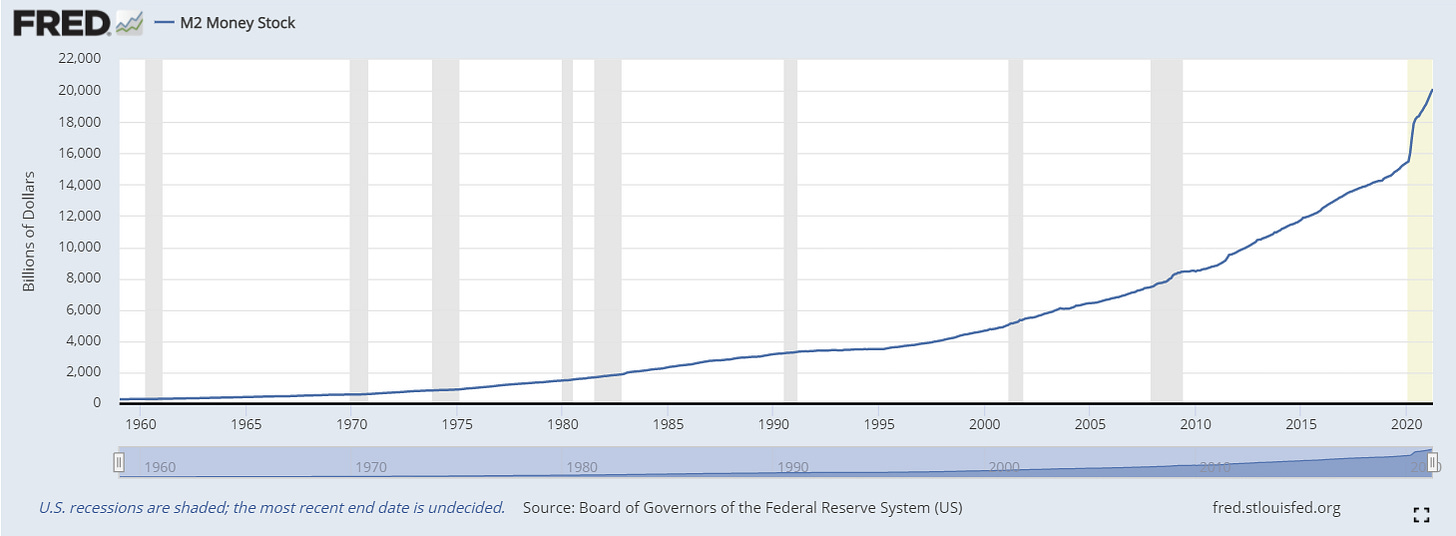

Muscling nation states and kicking the can down the road can only work for so long before gravity and social unrest takes over. The world reserve currency creates network effects. The US dollar is the most highly liquid asset and greases the wheels of global trade, therefore everyone needs it which creates demand for a strong dollar. If the dollar is strong, it means other currencies are weak which props up other country’s exports and in turn benefits US companies with cheap labor and materials. However, as technology makes things more efficient and naturally destroys jobs, the dollar creates an accelerant for companies to offshore domestic jobs to increase their bottom line. The incentive to sharpen a company’s focus on efficiencies becomes absolutely necessary for survival when taxes and the money supply (below) increase YOY, which makes costs more expensive and cash a liability.

source: fred.stlouisfed.org

This flywheel of destruction is a result from the world reserve currency incentive structure. Incentives matter and drive human behavior. The world needs dollars to service debt and trade. As a result, exporting nations manipulate currencies to incentivize the flow of dollars and investment which leads to US companies offshoring jobs. The US needs foreign investment in treasuries to monetize trade deficits and export dollars. This results in more money printing which devalues cash, inflates asset prices, increases costs of production and materials and drives inequality. As the loop continues, more US jobs disappear and evaporate the middle class. This then creates more social unrest which gets disguised as the rich stealing from the poor and heightens ideas around systematic racism.

Conclusion:

While this isn’t a perfect picture of what’s happening and its simplicity is incomplete, this is an accurate lens to view what’s happening around the world. The endlessly bloating debt loop is forcing the hands of central banks and international leaderships. Everyone is scrambling for solutions and scapegoats, however like most things, the money is to blame.

The dollar system is the debt anvil weighing on the global economy suffocating progress and cooperation.

We need to embrace the facts and see things for the way they are. The dollar and the competing fiat system is broken. The world has changed and technology is here to help. All we have to do is open our eyes and make the hard decisions.

“I cant change the direction of the wind, but I can adjust my sails to always reach my destination.” - Jimmy Dean

IN OTHER NEWS:

El Salvador Commerce Secretary reassured country that by accepting bitcoin as legal tender does not mean the dollar is going away. He says bitcoin is a growth opportunity.

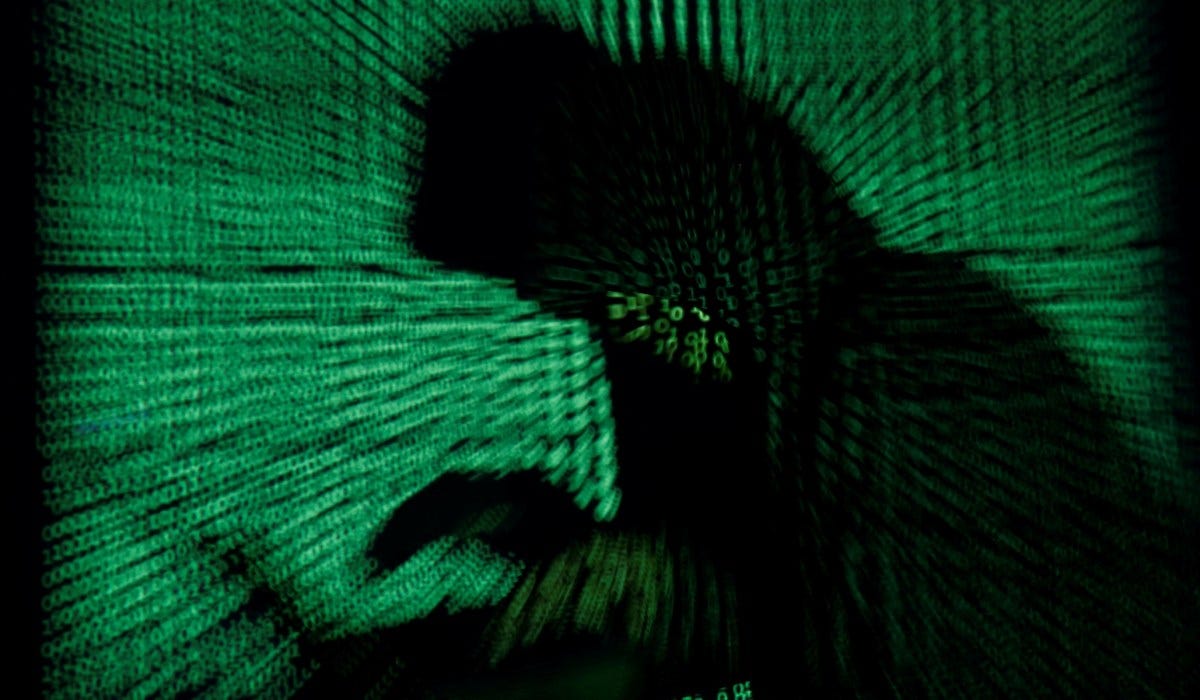

Bitcoin price falls and is acting in accordance with other securities as markets are in limbo awaiting Fed’s monetary policy among talks of tapering accommodative conditions. China’s negative stance on bitcoin mining still seems to be affecting price. Keep in mind, moving mining hash rate to the the west and the US is a good thing and we should embrace their negative policy. There is also some confusion about how the US government recovered the bitcoin from the Colonial Pipeline hacking attacking. Some of the public and media is making it out as if the US Government hacked the wallet, which is untrue. The funds were sent to an exchange willing to comply with the authorities. FUD.

Pomp did a good summary below.

DarkSide hacks the Colonial Pipeline and demands payment

Colonial Pipeline succumbs to demand and pays millions in bitcoin to DarkSide

DarkSide begins moving the bitcoin they received through a variety of wallets

US law enforcement begins using various tools to monitor the on-chain transactions

DarkSide eventually moves the bitcoin into a wallet or exchange account that US law enforcement has jurisdiction over

US law enforcement gets a warrant and demands the wallet provider or exchange business to turn over the bitcoin

The wallet provider or exchange business complies with the law enforcement demand in an effort to remain in good standing

White House Advisor Tim Wu holds millions in bitcoin (BTC) and Filecoin (FIL). He’s a long time critic of big tech.

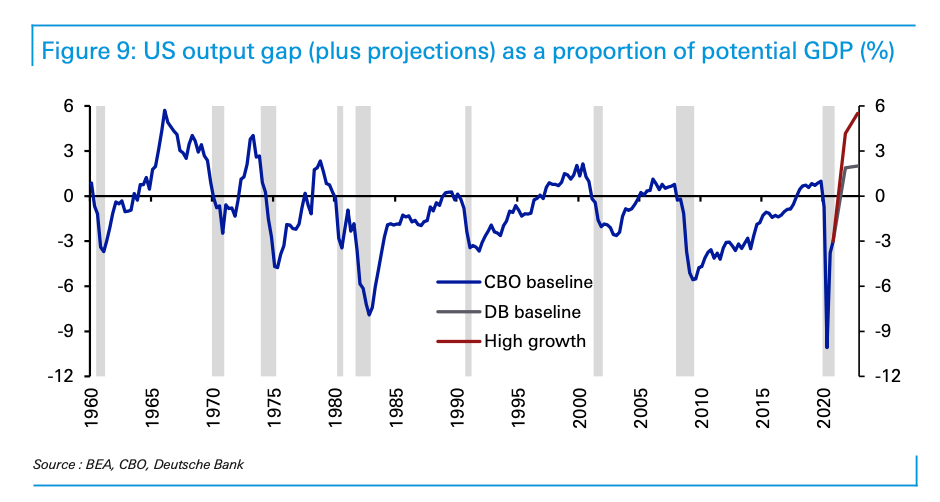

Deutsche Bank issues stark warning about US inflation saying the Fed may not be prepared to easy consumer caused price inflation as demand is outpacing supply (see output gap chart above). There’s $2 trillion in US savings, supply chain disruptions and a $5 trillion dollar Biden stimulus package which increases US deficits to 15%, numbers not seen since World War II.

Hong Kong includes central bank digital currency in new Fintech strategy.

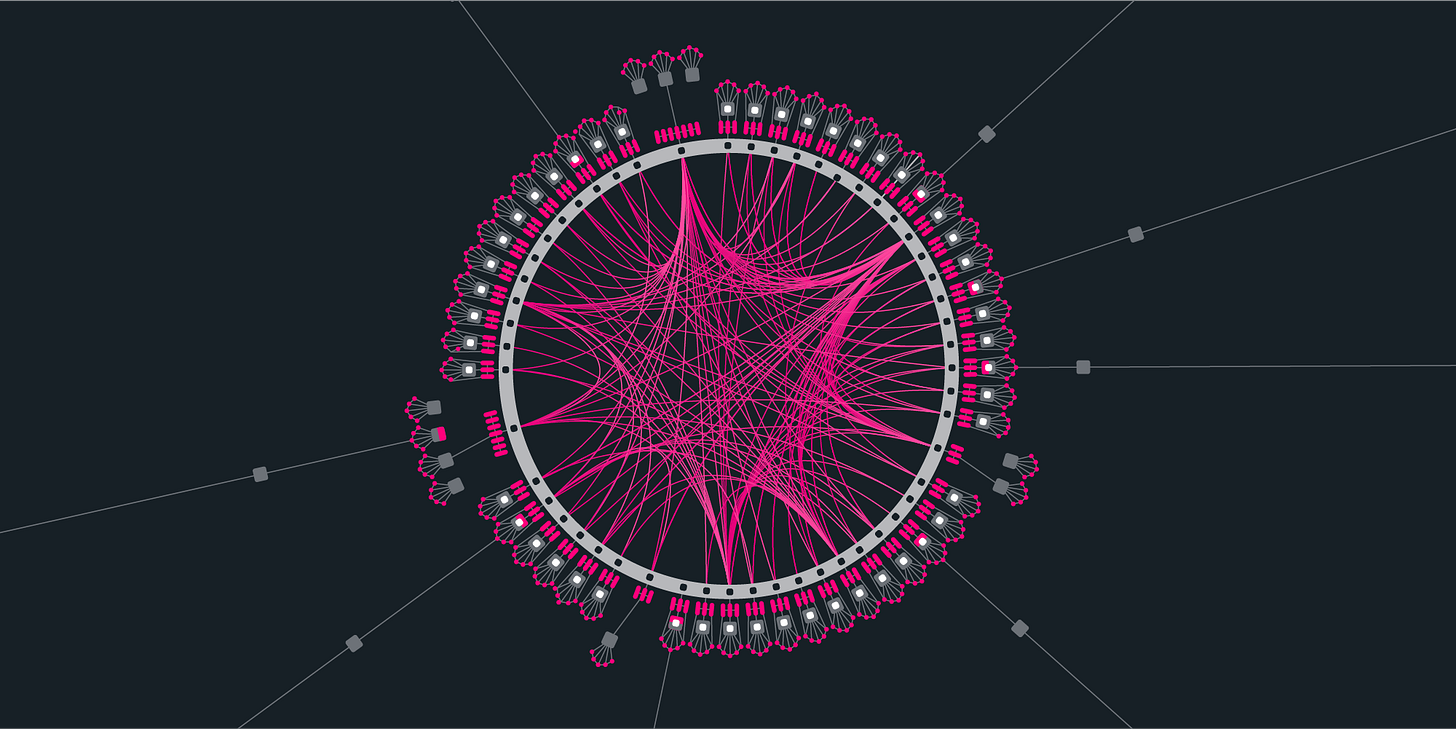

Polkadot creator Gavin Wood proposes June 15 for first Kusama (Kusama is Polkadot’s test network) parachain auction. Polkadot is a network protocol that allows arbitrary data—not just tokens—to be transferred across blockchains. Parachains are sovereign blockchains that can have their own token and functionality for specific use cases. These Parachains connect to the Polkadot Relay Chain which is responsible for the networks shared security, consensus and cross-chain interoperability.

(Polkadot(DOT - 100%) andKusama(KSM - 30%) are on deep discounts from highs. These are two of the best layer 1 protocols challenging Ethereum).Ethereum is running out of gas on the charts. Dependent on bitcoin’s upward momentum says Delphi Digital research analyst. Regardless, Ethereum has been seeing increasing inflows of investor capital. Bitcoin and Ethereum are tied at the hip.

ProPublica news organization report showed that Billionaires like Bezos, Musk, Bloomberg, Icahn, Buffett and Soros paid close 0%-0.1% in federal income tax in recent years such as 2007, 2011, 2014, and 2018.

Fastly, a major content delivery network (CDN) that helps deliver content for across the web ran into some global outages last night causing problems with websites like Amazon, Spotify, Twitch, Shopify, Etsy, New York Times, Bloomberg, Reddit, etc.

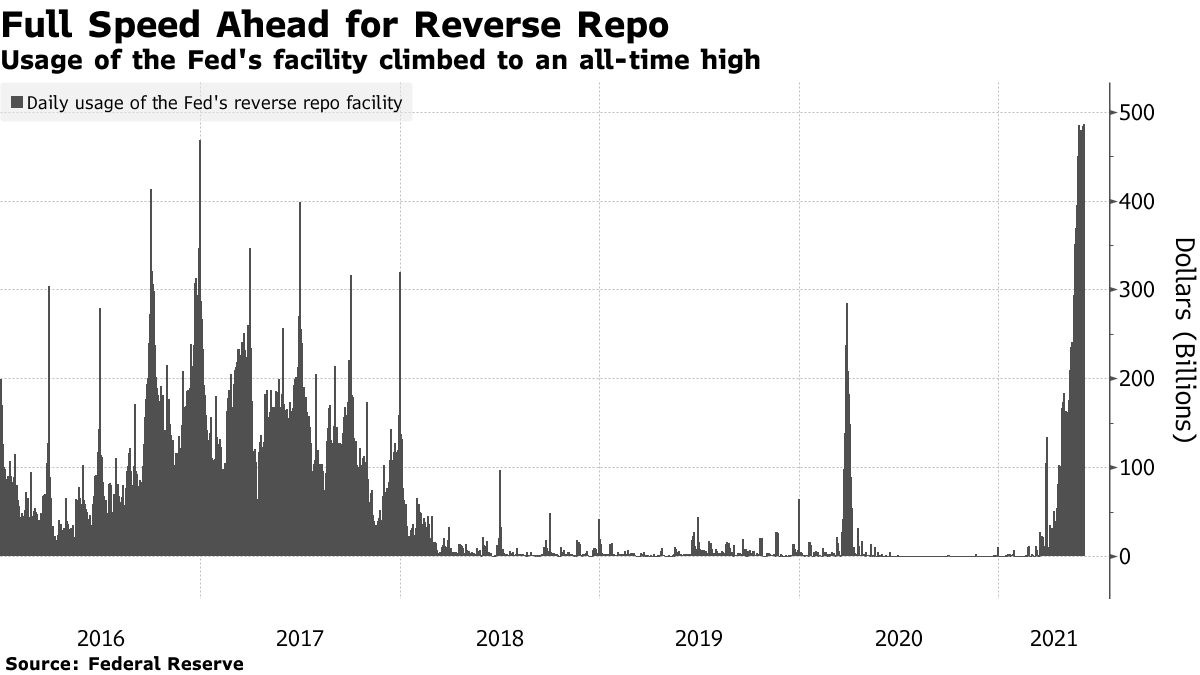

Federal Reserve Repo hits fresh highs as 46 banks, money markets and financial institutions stash their $486 billion in cash back at the Fed. This massive amount of liquidity is from the Fed’s QE and draw downs from Treasury General Account (TGA). In a reverse repo, the Fed sells treasuries and takes cash, removing liquidity from the market to help control short term interest rates. More on reverse repos here.

STATS

#15

Is the number of unmanned test flights for Blue Orgin, New Shepard spacecraft. Jeff Bezos plans to be on the first manned test flight this summer. Yikes.

TOP STORIES

BITCOINColonial Pipeline’s Bitcoin Ransom Mostly Recouped by U.S., Bloomberg

El Salvador Commerce Secretary: Bitcoin Won’t Replace Dollar, Coindesk

Bitcoin Suffers Steepest Drop in 10 Days as US Monetary Policy Causes ‘Short-Term Jitters’, Coindesk

Top White House Adviser Tim Wu Holds Millions in Bitcoin, Coindesk

Bitcoin Tumbles 8% on Fears that US Law Enforcement “Hacked” the Network, Decrypt

CRYPTOPolkadot creator Gavin Wood proposes June 15 for first Kusama parachain auction, Cointelegraph (pictured above)

Ethereum bull trap? ETH price signals breakdown versus Bitcoin, Cointelegraph

Ontario Regulators Crack Down on Firms Tied to Crypto Exchange KuCoin, Decrypt

MACROFed Reverse Repo Usage Climbs to Fresh Record Amid Cash Glut, Bloomberg

Deutsche Bank Issues Stark US Inflation Warning, Seeing Economic Parallels to 1940s, 1970s, Coindesk

U.S. Billionaires Faced Tax Rates as Low as 0%: ProPublica, Bloomberg

Website Outage Hits Reddit, News, U.K. Government Pages, Bloomberg

Russia Tries to Loosen Dollar’s Grip on Finance and Trade, Bloomberg

Biden administration sets up ‘strike force’ to go after China on trade, Reuters

Dollar shuffles higher, shares bask near peaks, Reuters

MEDIABitcoin 2021: Bitcoin For Billions, Not Billionaires

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.