MAJR Newsletter 091

Nation states are buying bitcoin. If there was ever a time to get off zero...that time is now.

@starfury

MAJR NEWS BRIEF

It was inevitable.

The first domino has fallen as El Salvadorian President Nayib Bukele proposes new legislation to adopt bitcoin as legal tender, put bitcoin on the country’s central bank balance sheet and remove any capital gains tax from citizens selling the digital asset.

The adoption of bitcoin has followed the same path of previous new and profound technologies. It starts with the hobbyists and the technologists. Then it moves to the early adopters and the risk takers. Then it enters the mainstream as retail investors speculate on price appreciation. Then the institutional and the professional investors take over with larger bets and calculated risk. Then the publicly traded companies start to understand its potential value. And now, the nation states race for dominance and control.

The 21st century bitcoin space race has officially started. Nobody wants to be first and now nobody will want to be last.

President Bukele’s bitcoin announcement came at the 2021 Bitcoin Conference in Miami this past weekend. The Founder and CEO of Strike, Jack Mallers (pictured above) introduced President Bukele’s video announcement on the conference big screen. Strike has been working closely with the people and leadership of El Salvador. Strike’s digital wallet and technology works on top of Bitcoin’s monetary network on the layer two, Lightning Network. It allows for instant fiat payments and transactions anywhere in the world by using Bitcoin as the transfer network and the asset without incurring any fees.

For example, if I’m an El Salvadorian working in the US and I want to send US dollars back to my family in El Salvador; I’d traditionally have to use a remittance company such as MoneyGram. Companies like this take anywhere from 1%-6% of the total amount, days to clear and settle and is generally collected at a physical location which can be a dangerous honey pot for gang activity.

With Strike, that same worker can take their fiat dollars, convert them into bitcoin and send it over the Lightning Network and then instantly convert and settle back into dollars (or keep in bitcoin) on a family member’s digital wallet using only a mobile phone.

This is huge as billions of dollars are sent in remittances every year with large percentages lost to intermediaries. The President confirmed that their government will be working with Jack Mallers and the Strike team to build the modern day financial infrastructure to support the use of bitcoin in their country.

By the way, Jack is 27 years old…

El Salvador’s adoption of bitcoin cannot be understated. Here’s the bullet points.

El Salvador is the first country to publicly announce the adoption of bitcoin the asset and Bitcoin the network.

By making bitcoin legal tender means bitcoin is now a legal currency accepted for payments, used to pay debt and would no longer carry a capital gains tax, per the El Salvador President.

Bitcoin has ~$680 billion market cap. If 1% of bitcoin is invested in El Salvador, that would increase the GDP by 25%.

El Salvador’s population is ~6.5 million people. That’s ~6.5 million new bitcoin hodlers.

El Salvador doesn’t have property tax.

El Salvador doesn’t have it’s own sovereign currency. It tied it’s monetary policy to the US dollar in 2001. Therefore, there’s no monetary policy risk adopting bitcoin since they’ve avoided currency controls and manipulation.

$6 billion dollars is sent to El Salvador in remittances annually, and now none of that can be lost to intermediaries. More than 1 million low income families will now increase their bottom line. Even more if some remittance is saved in bitcoin.

70% of El Salvadorian are unbanked. Bitcoin will accelerate financial inclusion for the country and avoid the now outdated 20th century debt based monetary system detour. The economy will boom as more people have access to property rights, credit, savings, investment and secure transactions.

Crypto entrepreneurs, capital investment and jobs will flock to El Salvador. Great beaches. Great weather. And, the crime in El Salvador has gone down by over 90% since the 1980s.

1 day later, Congressman, Carlitos Rejala of Paraguay encouraged leadership to adopt bitcoin.

Conclusion:

We’ve written about this moment in the past and how to prepare for it. Technology adoption looks like a S curve. It’s gradual, then sudden and then exponential. Bitcoin is already the fastest asset to reach $1 trillion market cap and it’s been the best performing asset over the last decade. While this adoption was dramatic, it was felt by only a few early adopters and is still a fraction of what bitcoin will ultimately become.

Money is the apex predator of social networks and bitcoin perfected this network by giving it a hard digital asset with a fixed supply.

Once you understand that bitcoin is only open source code, is completely decentralized and is protected with military grade encryption - there’s only one conclusion you can make - it’s going to be adopted and I can’t afford to fuck this up.

We are still early, but we’ve entered into a new phase as nation states start to adopt bitcoin. Pay attention and get off zero. You must have a sense of urgency.

Your future depends on it.

We’ve written previous articles to help you understand the gravity of the current macro circumstances and accelerate your education and your decision making. Click on links below. IN OTHER NEWS:

HotNewCrypto’s $2500 per month fee for new crypto projects gains traction.

MAJR Coins: This is MAJR’s newest initiative where we shed light on undervalued projects (hidden gems). In the past two weeks we’ve highlightedSolana(+45%) and alistof undervalued A+ projects (+30%-80%). We analyze projects using fundamentals, pumpamentals and social sentiment inclusive of how to acquire the tokens. Stay tuned for more alpha. Paying subscribers only.

MicroStrategy intends to offer $400 million senior secured notes to raise funds to purchase more bitcoin. Previous debt capital raised was via convertible notes into company’s shares, which are different than senior secured notes - lower risk, lower interest and guaranteed if company declares bankruptcy.

JPM is exploring the programmability of their coin attempting to make in road into DeFi (decentralized finance).

Former President Trump says “Bitcoin is a scam” on Fox Business today. That makes sense because he’s never read a book and because it’s another currency competing against the dollar.

Jack Dorsey and Square announced a Solar-powered mining operation. They will be working with Blockstream to build infrastructure.

Chainalysis tracked total US dollar gains from investors in different countries in 2020, and while the US leads smaller countries like Vietnam, Czech Republic, Turkey and Spain fall within top 20 even though GDP is ranked much lower.

Traditional Wall Street execs are embracing crypto and showed up at the 2021 Bitcoin Conference.

Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates.

Student loan payments were paused during the pandemic to offer financial relief, however they’re coming due in October. More than 40 million people have loans that equate to nearly $7 billion per month in payments. This will be a drag on the economy come October.

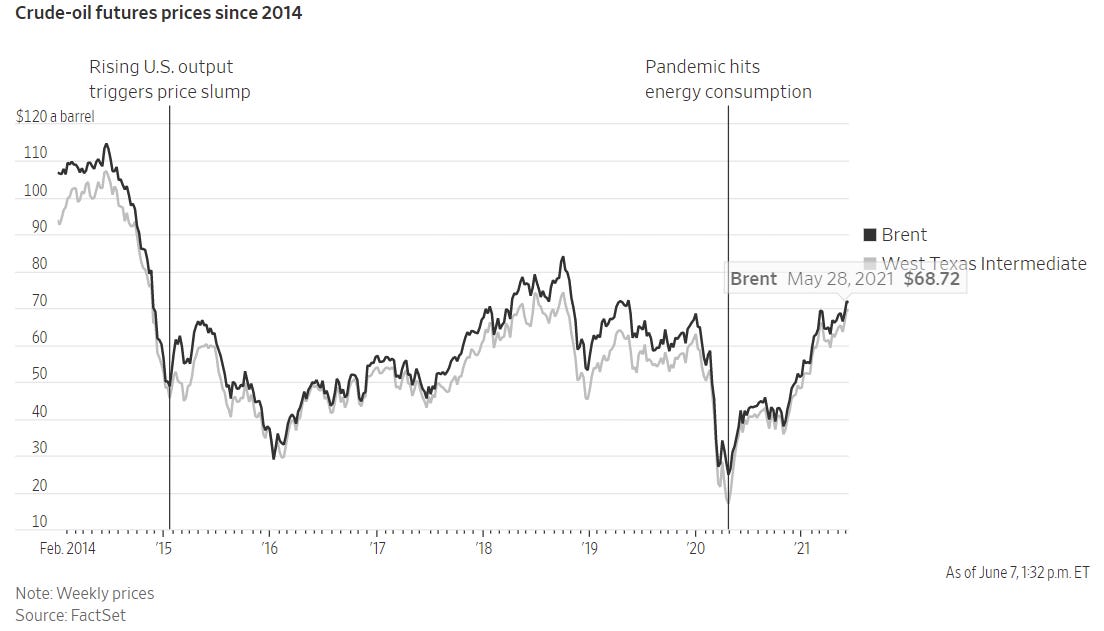

Option traders are betting on $100 oil again. Is the inflation trade over? Yea, right…we’re only getting started.

China is on a raw materials buying binge. Imports have grown the fastest in decade despite high prices. There’s an international race for raw materials which will only increase commodity price inflation.

Rhetoric around tapering the Fed $120 billion monthly bond buying program starting to become more prominent. New discussions to be had at the next meeting on June 15th.

G7 countries reach consensus around a proposed 15% global corporate tax.

STATS

Bitcoin is currently ranked 16 amongst all the 116 fiat currencies using this data set. I’ve listed relevant fiat currencies by market cap in dollars below from this data set.

Bitcoin adoption is imminent.

China | CNY | $27.96 trillion

European Union | EUR | $14.82 trillion

United State of America | USD | $14.22 trillion

Japan | JPY | $12.24 trillion

United Kingdom | GBP | $4.01 trillion

South Korea | KRW | $3.34 trillion

Canada | CAD | $1.94 trillion

India | INR | $1.95 trillion

Brazil | BRL | $1.17 trillion

Bitcoin | BTC | $675.46 billion

Taiwan | THB | $624.85 billion

Russia | RUB| $605.88 billion

Mexico | MXN | $487.24 billion

Indonesia | IDR | $388.29 billion

Poland | PLN | $372.64 billion

South Africa | ZAR | $259.83 billion

Turkey | TRY | $225.85 billion

TOP STORIES

BITCOINEl Salvador looks to become the world’s first country to adopt bitcoin as legal tender, CNBC

Bitcoin users will get help relocating and working in El Salvador: President, Cointelegraph

Paraguay To Embrace Bitcoin? Paraguayan Congressman Calls for Adoption, TheStreet

MicroStrategy to Offer $400M in Notes to Buy More Bitcoin Even as It Warns of $284.5M Impairment, Coindesk

'Bitcoin Seems Like a Scam': Former US President Donald Trump, Decrypt

Square Teams With Blockstream For Solar-Powered Bitcoin Mining Farm, Decrypt

Small countries are punching above their weight in terms of Bitcoin gains, Cointelegraph

CRYPTORemember JPM Coin? Next Step Is Programmable Money, Bank Exec Says, Coindesk

Wall Street’s Crypto Embrace Shows in Crowd at Miami Conference, Bloomberg

Information Wants to Be Free but Secrets Are Worth Paying For: HotNewCrypto’s Story, Coindesk

FTC: Consumers Lost $82 Million to Crypto Scams In 6 Months, DecryptPolygon (Matic): Recent Developments, Community, Future Events, DailyCoin

MACROYellen Says Higher Interest Rates Would Be ‘Plus’ for U.S., Fed, Bloomberg

Frozen But Not Forgiven, U.S. Student Loans Are Coming Due Again Soon, Bloomberg

G-7 Strikes Deal to Revamp Tax Rules for Biggest Firms, Bloomberg

Options Traders Bet on Return of $100 Oil, WSJ

China's imports grow at fastest pace in decade as materials prices surge, Reuters

MEDIAWatch the Entire 2021 Bitcoin Conference Highlights from Miami on Bitcoin Magazines YouTube Channel Here - Here’s one of our favorite’s below.

Bitcoin 2021: Fireside: Michael Saylor And Max Keiser

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.