@creativecourage

The newsletter has been delayed this week due to our team attending the 2021 Bitcoin Conference. Thanks for your patience.

- MAJR TEAM

MAJR NEWS BRIEF

As I’m reading this morning’s global headlines, one thing is abundantly clear - we live in a complex world with different cultures and economies, unstable governments and shaky leadership, free floating fiat currencies and a biological virus with unclear origins and data. Obviously, these are only a few of the crazy characteristics that make global challenges difficult to overcome, but they resonate because technology is our greatest tool to create a better world for the masses.

I’m writing this letter in Miami, FL a day prior to the biggest Bitcoin Conference yet to take place. Over 12k tickets were sold and Eventbrite’s 3rd largest live event for 2021. Bitcoin is one of the existing technologies that can provide a global tool to help solve the world’s problems and we need to embrace it now.

Let me be clear - Bitcoin the network and bitcoin the digital asset will not solve poverty, disingenuous governments and leaders or future biological threats, BUT it will provide anyone with an internet connection and mobile phone a hard money exit and a true savings account. We all need money and we all need a secure method to insure that our efforts and time aren’t lost due to incompetent leadership facing true difficult complex problems.

McKinsey estimates that 2.5 billion people are unbanked without access to a savings or checking account or the financial infrastructure to borrow money, let alone invest. Developing countries struggling to handle the virus and maintain economic sovereignty rely on foreign help from institutions like the IMF to save them by increasing their debt in a foreign currency. This is a band aid on a gushing infected wound that’s only getting worse. Post debt infusion, these countries are in a deeper hole which most likely leads to increased money printing in their own local currency in order to help service this debt.

Lebanon is facing one of the worst economic and financial crisis of its history. Leadership is paralyzed between the President and the new Prime Minister delaying government action. Their GDP is projected to drop another ~10% in 2021 after a 40% decline from 2018-2020. In 2020, they defaulted on their foreign debt and their currency lost more than 85% of its value, leaving nearly 5 million or half the country living in poverty. Central bank reserves are dwindling and medical supplies are limited to help fight the virus.

Bitcoin doesn’t solve all of these problems. There’s no easy fix, but Bitcoin provides a release value and a global citizen check on leadership. Governments and political leadership have proven that they will sacrifice the currency in order to accommodate more spending and fiscal irresponsibility. If they were serious about finding real solutions and avoiding the “kick-the-can-down-the-road” approach to fixing hard problems, then they’d vote for term limits. And, if they really cared about their country’s economic well being they’d turn to technology, look past Bitcoin’s mainstream shallow FUD, understand it’s capabilities and put bitcoin on their balance sheet thwarting inflation and strengthening their local fiat with a hard asset. Just like gold did prior to the digital age.

The world is fraying. Globalization is retreating. Government’s inability to come to consensus and create long lasting solutions is the new normal.

Should we believe 12 unelected officials manning the helm of the Federal Reserve can really run the global economy?

Should we believe them we they say inflation is transitory and 0% interest rates are temporary?

We’ve heard this before and all temporary solutions have been long standing and over time get even more aggressive. For goodness sakes, income tax and going off the gold standard were temporary. Now, we have free floating fiat currencies and increased proposed income tax + capital gains tax + and all sorts of government taxation initiatives to help provide “solutions.”

It’s safe to say these are not long-term fixes or even solutions at all. They haven’t proposed any new technology solutions outside of vaccine tracing…We need something better and something that comes from outside central authorities. A technology for the people, by the people.

Bitcoin is technology for money. We all need money. And, we all need a taste of personal responsibility. We can’t count on others or governments to save us. While, bitcoin the digital asset is a bearer asset (meaning yours to lose), it’s a technological solution that incentivizes savings, personal responsibility, financial education and low-time preferences. These are what we need for increased independence and prosperity, not stimmy checks and handouts.

People still don’t realize that bitcoin was designed to help the individual. It protects them from government and central authority overreach. Its peer-to-peer decentralized network and fixed hard cap 21 million supply provides an elegant way to exit the system and save hard money. And, the folks that understand this sooner vs later will benefit dramatically as the price is engineered to increase with new demand. About 1% of the world is estimated to currently hold bitcoin and there’s 8.2 billion people on the planet.

Do the math. Save yourself. Enough of this madness.

IN OTHER NEWS:

Dogecoin is listed on Coinbase professional trading platform sending DOGE price higher.

Cardano and Nervos networks to launch first bridge contract in coming weeks. Cardano still doesn’t have any active smart contracts live on platform and has a market cap of $50B+.

Wisdom Tree Bitcoin ETF application is delayed by SEC.

US Kraken Exchange updated mobile trading app to trade over 50 tokens straight from your phone. It’s not available in Washington State or New York due to regulations.

Elon and Tesla are in hot water with the SEC as the company has broken rules from 2018 fraud investigation and haven’t controlled his tweets about stock price and crypto harming shareholders.

Major financial institution Guggenheim Investments has filed for a fund that could offer indirect bitcoin exposure.

AMC is embracing the meme stock phenomenon and reddit traders by offering them free popcorn. This is early evidence of companies embracing non-traditional methods of engaging with their audience, investors and the nature of decentralized networks. While reddit and AMC is a centralized companies, these actions highlight a trend of offering incentives to the individual retail investor to engage with your stock / token.

The IMF moves to provide bailouts to African debtor nations Uganda and Democratic Republic of Congo. Covid cases have surged in the countries in recent months. While developing countries struggle to control the spread of the virus and regain economic normality. Government paper seems to grow on trees and the debt colonization playbook for developing countries is in full swing. Accumulating national debt in foreign currencies only incentivizes inflation in local currency in order to meet their debt obligations.

Inflation in Poland surges nearly 5% bringing back old memories of high inflation during the collapse of the communist government in the 1990s.

Another US cyber attack has now taken down central infrastructure for the global meat supply chain. These proposed Russian affiliated cyber attacks are hitting where it hurts, energy and now food. These issues can be fixed, but only with proactive leadership and better technology. These events and the pandemic are not completely unforeseen, but rather ignored.

Inflation in rich countries hits a 12 year high in April. Damaged economies, money printing, disrupted supply chains are most likely to blame, however April 2020 base effects are a huge contributor and it’s unclear how price inflation will shake out for future months.

FACTS

There will only ever be 21 million bitcoin.

There are currently 18,724,768 BTC in circulation.

TOP STORIES

BITCOINGuggenheim Investments exploring for fund for exposure to bitcoin, Bitcoin Magazine

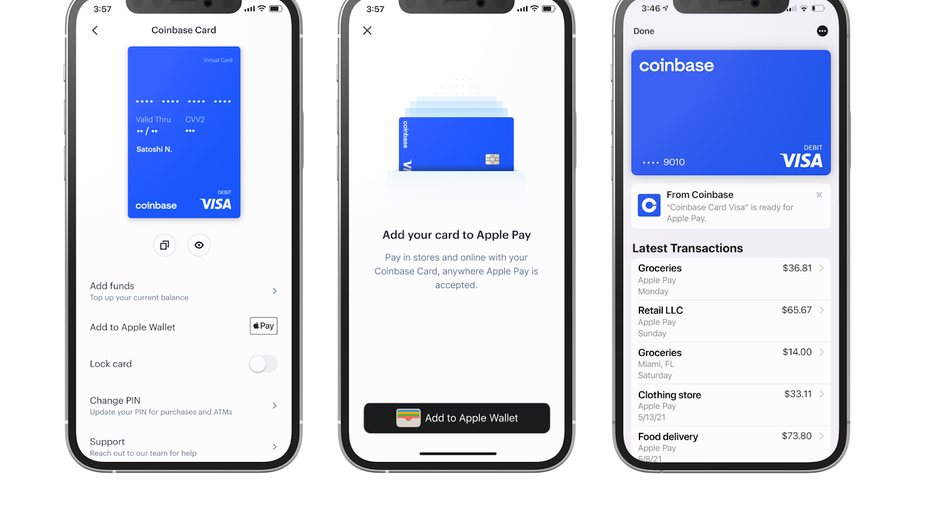

Coinbase Card Partners with Apple and Google Pay to help spend crypto and reap rewards, Bitcoin Magazine

SEC Delays Decision on WisdomTree Bitcoin ETF Application, Coindesk

CRYPTOCardano to Launch Its First Cross-Chain Bridge With Link to Nervos, Coindesk

Coinbase Lists Dogecoin on Professional Trading Platform, Coindesk

Kraken Crypto Exchange Releases Mobile App in US, Coindesk

Elon Musk’s Tesla Tweets Twice Violated Court-Ordered Policy: SEC, Decrypt

OnePlus Could Follow Samsung With Cryptophone Launch, Decrypt

MACROAMC Embraces Retail Traders With Free Popcorn After 1,400% Rally, Bloomberg

IMF Offers Bailout to Second African Nation in One Week, Bloomberg

Inflation Angst Goes Mainstream as Polish Prices Surge Nearly 5%, Bloomberg

Lebanon Crisis Among World’s Worst Since 1850’s, World Bank Says, Bloomberg

Erdogan Renews Rate-Cut Demands as Economy Erodes Support, Bloomberg

Meat Buyers Scramble After Cyberattack Hobbles JBS, WSJ

Inflation in Rich Countries Hit a 12-Year High in April, WSJ

Fed’s Kashkari Says Central Bank Can Control Inflation, WSJ

MEDIAThe Monetary Experiment Scam | Dan Held | Pomp Podcast #571

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.