@supyrb

MAJR NEWS BRIEF

BTC VS ETH: “One blockchain to rule them all? Or…Brothers in arms?

The tribalism in crypto is real and can be hostile. Especially, between the Bitcoin and Ethereum communities. The Bitcoin Maximalists were the originals and stay true to Satoshi’s gift of better decentralized money. All other blockchains are shitcoins and misunderstand why we’re here in the first place, the separation of government and money. The Ethereum community sees Bitcoin as the crypto Myspace to Ethereum’s Facebook. Bitcoin is great but it can’t handle the creativity and applications the Internet needs.

While some tribalism is probably necessary to maintain network security and a common belief of survival in crypto’s misunderstood and ultra competitive landscape; it’s most likely a negative that leads new users astray into higher risk projects without owning the two assets that matter.

First, they’re completely different blockchains with different goals.

Bitcoin’s elegance and simplicity in design is perfect for sound money.

Bitcoin’s 1MB blocks for global decentralization so anyone can run a full node and no one party can take over the network.

Bitcoin’s 21M hard cap supply turns money on it’s head and put’s a savings account on steroids in your back pocket.

Bitcoin’s Proof of Work (POW) consensus algorithm turns energy into the hardest money ever created, provides a global monetary incentive for clean renewable energy and puts the most secure bank in cyberspace.

Ethereum is blockchain playdough and the platform for everything.

Ethereum’s smart contracts put business logic on a secure network creating unstoppable applications that can be written by a 13 year old in Nigeria and accessed around the world.

Ethereum’s non-fungible tokens bring real world assets to the blockchain leveling up network liquidity and bringing new efficiencies and programmability to assets like real estate, modern art, intellectual property and financial securities.

Ethereum’s ecosystem of decentralized finance (DeFi), decentralized autonomous organizations (DAO) and the metaverse are mind blowing ideas that already exist on Ethereum and will capture enormous amount value as more people enter crypto and more global citizens come online in developing countries.

While some of these more nuanced innovations on Ethereum are starting to develop on top of Bitcoin like the Lighting Network and Taproot; the same thing is taking place on Ethereum. Bitcoin like digital scarcity and deflationary monetary policy was just approved for Ethereum, EIP-1559.

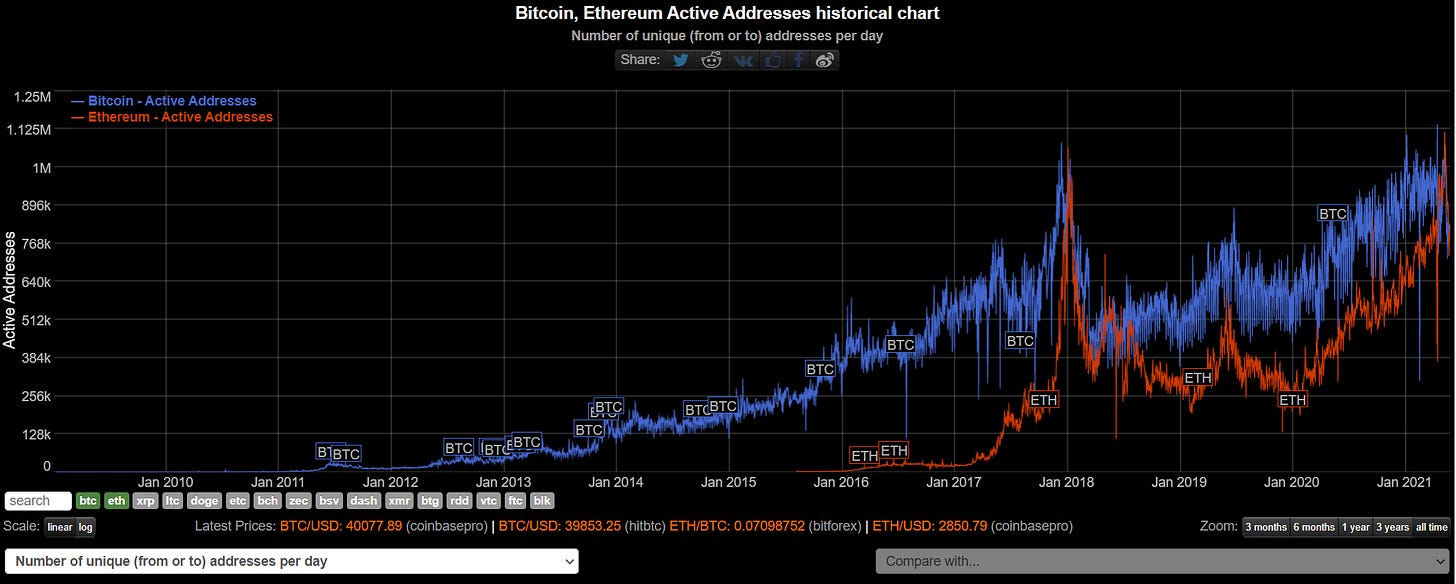

source: bitinfocharts

You want to go fast, go alone. You want to go far, go together.

The toothpaste is out of the tube. Crypto is here to stay. And, as new users discover these technologies and more regulators descend over these protocols, the community is definitely stronger together than fragmented.

Here’s what people need to know.

Bitcoin is the largest blockchain by market cap. Bitcoin is the most robust and decentralized digital asset with the strongest network security and the least investment risk. No one is pulling the strings and changing the underlying protocol. If you don’t have bitcoin in your portfolio, you’re missing the big picture and investing farther out on the risk curve. Bitcoin institutional adoption is driving this bull market and entire crypto asset class. Bitcoin is the first stop and perhaps only stop for large institutional investors.

Bitcoin is limited in it’s design and on purpose. It’s a very narrow blockchain that’s put network security and decentralization above flexibility and scalability. It’s evolving, but slowly and carefully which is a good thing. It serves a single purpose of sound money and one that’s massively important today as central banks destroy fiat currency. A global fixed peg used as money’s measurement instrument.

Ethereum is the second largest blockchain by market cap, but the first in terms of network development and use cases - DeFi, DAOs, NFTs, gaming, storage, prediction markets, metaverse, social networks, digital identification, etc. While, Bitcoin’s network effects are world class, Ethereum’s surface area as a platform could be the accelerant that flips Bitcoin’s market cap dominance in the near future. Ethereum’s migration away from POW to Proof of Stake (POS) and the implementation of EIP-1559 will greatly enhance network efficiency, scalability and it’s monetary policy. While, it’s too early to tell, some true believers have called ether “Ultra Sound Money” and Ethereum as “The Internet Bond.”

Ethereum may outperform bitcoin this bull market from a price standpoint, but it’s a more risky investment with less institutional adoption, although this is happening. Ethereum is a layer one smart contract blockchain that sits in an incredibly competitive market. Competitor chains (Binance, Solana, Polkadot, Cosmos, Cardano, Elrond, Avalanche, Tezos) come equipped well funded treasuries and new technological approaches in hopes of taking advantage of Ethereum’s slower transaction times and more expensive gas fees. The market landscape is fierce, although Ethereum dominates.

Ethereum doesn’t seem to be on the road to complete decentralization. While, it’s an open source project and anyone can access the network and deploy a smart contract, the underlying protocol is still being tinkered with and changed. And, the cost of running a full Ethereum node requires significant more capital which could lead to more centralization. I personally, don’t see this as a massive issue for what it’s trying to accomplish, becoming a world computer. It’s a complicated endeavor and users should be glad that the network is moving fast, but carefully to improve and evolve.

Conclusion

Being curious and having an open mind is what brought everyone into the space in the first place. Bitcoin, Ethereum and the digital asset ecosystem offer the greatest wealth creation and redistribution in the history of mankind. That’s not a hyperbolic statement. These are exciting times we live in, but with new disruptive technology comes risk. Capital risk as there will be more losers than winners, and the more new users that come into the space and get pushed away from these two assets into shitcoins and “rug pulls”, brings more regulation risk.

Who cares if Ethereum flips bitcoin’s market cap lead, they’re better together and both should be included in an investors portfolio.

Bitcoin is trust. Ethereum is innovation. And, together they’re hope and security.

In other news:

Billionaire Carl Icahn talks big game on Bloomberg about possible huge billion dollar investment into the crypto space joining fellow business and investment elites Michael Saylor, Elon Musk, Mark Cuban, Howard Marks, Stanely Druckenmiller, and Ray Dalio.

Is Apple getting into crypto? They posted a job for crypto experience in “Alternative Payments.”

US Regulators are weighing into the crypto discussion as SEC’s Gensler discusses the regulatory hurdles for protecting investors from fraud and manipulation in DeFi. While, FinCEN’s new Acting Director Michael Mosier says the controversial Trump-Era unhosted / private proposal is still pending.

SkyBridge and Fidelity Bitcoin ETF applications are starting the review process with the SEC.

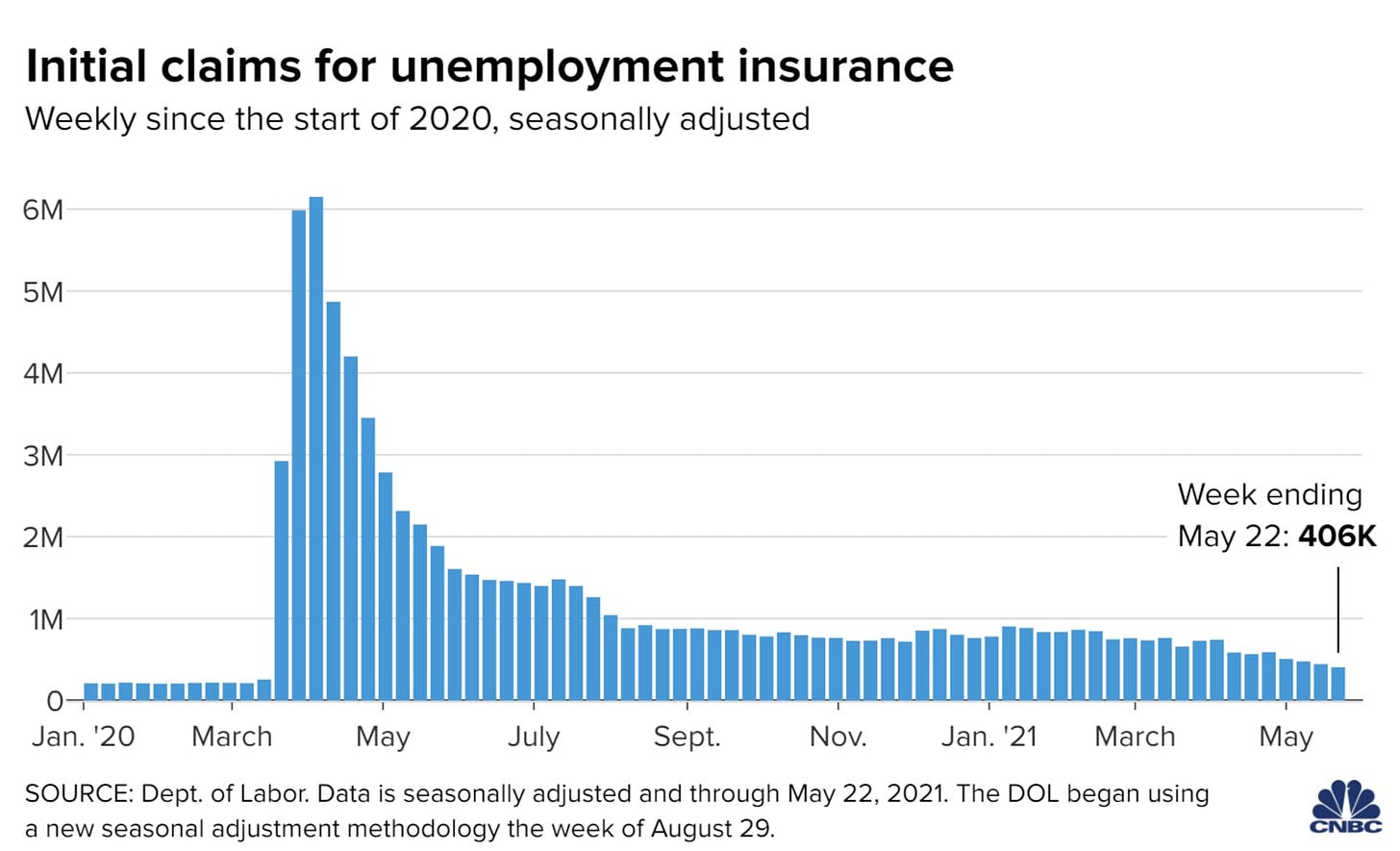

US jobless claims extend decline to a new pandemic low of 406,000 last week. These numbers are still crazy high (double the pre-pandemic numbers) as it’s close to half a million new people each week filing for unemployment claims.

More Fed officials begin talking about possible asset purchase tapering and suggest more data for the public to understand what they’re looking for, however, no time table is set.

Fed to publish first paper about their digital currency initiative this summer. Officials indicate that this is only the beginning of the process of deliberation and their goal is to complement the existing system, not replace it. Don’t hold your breath for details and expediency.

Republicans counter Biden’s $1.7 trillion infrastructure bill with a $928 billion plan.

FACTS: G20 - Government Debt to GDP

Japan - 266%Italy - 156%Span - 120%France - 116%Canada - 118%United States - 108%UK - 100%India - 70%China - 67%Russia - 14.6%

TOP STORIES

BITCOINBillionaire Carl Icahn Eyes Potential $1.5B Crypto Investment, Coindesk

Bitcoin Consolidates Around Short-Term Support; Faces Resistance Near $42K, Coindesk

SEC Starts Official Review of SkyBridge, Fidelity Bitcoin ETF Applications, Coindesk

PayPal to Let Users Send Bitcoin Off PayPal, Decrypt

Miami Mayor Francis Suarez Says Bitcoin is Crucial for Underserved Communities, Bitcoin Magazine

Cathie Wood, Still a Bitcoin Believer, Sees It Going to $500,000, Bloomberg

CRYPTO Watch Tom Brady Speak Today at Consensus 2021, Coindesk

Apple Is Looking for Crypto Experience in ‘Alternative Payments’ Job Post, Coindesk

DeFi ‘Raises Challenges’ for Investors, Regulators, SEC’s Gensler Says, Coindesk

Lack of knowledge is main barrier to crypto adoption, new survey says, Cointelegraph

Nvidia reports record earnings, claims it's 'hard to determine' impact of crypto miners, Cointelegraph

MACROU.S. Jobless Claims Extend Decline to New Pandemic Low, WSJ

Fed’s Quarles Joins Other Officials in Moving Toward Taper Debate, WSJ

Fed to Publish Paper on Digital Currency This Summer, WSJ

U.S. Republicans unveil $928 billion infrastructure counteroffer, Reuters

Zimbabwe Announces Penalties to Curb Currency Speculation, Bloomberg

Orders for U.S. Business Equipment Rise Most in Eight Months, Bloomberg

MEDIARoss Stevens - MacroMinds | NYDIG - The Beauty of Bitcoin

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.