MAJR News: Yield curve inverts - just another reason to be cautious despite bullish price action.

Bitcoin & Ethereum supply shock underway, Terra CEO bought $1B of bitcoin and plans on buying $10B for protocol reserves, Biden releases $5.8T 2023 gov't budget, Yield curve inverts as spreads tighten

@simstim

MAJR NEWS BRIEF

Videos

Andy Constan, founder of Damped Spring Advisors, is an expert on quantitative macro who has worked alongside legendary investors such as Ray Dalio and Alan Howard. Constan joins Forward Guidance to explain how Yellen can dampen QT's deleterious impact on market conditions, and he explains why, despite the myriad threats to risk assets, he remains constructive on a balanced portfolio of stocks, bonds, and commodities.

Top Stories

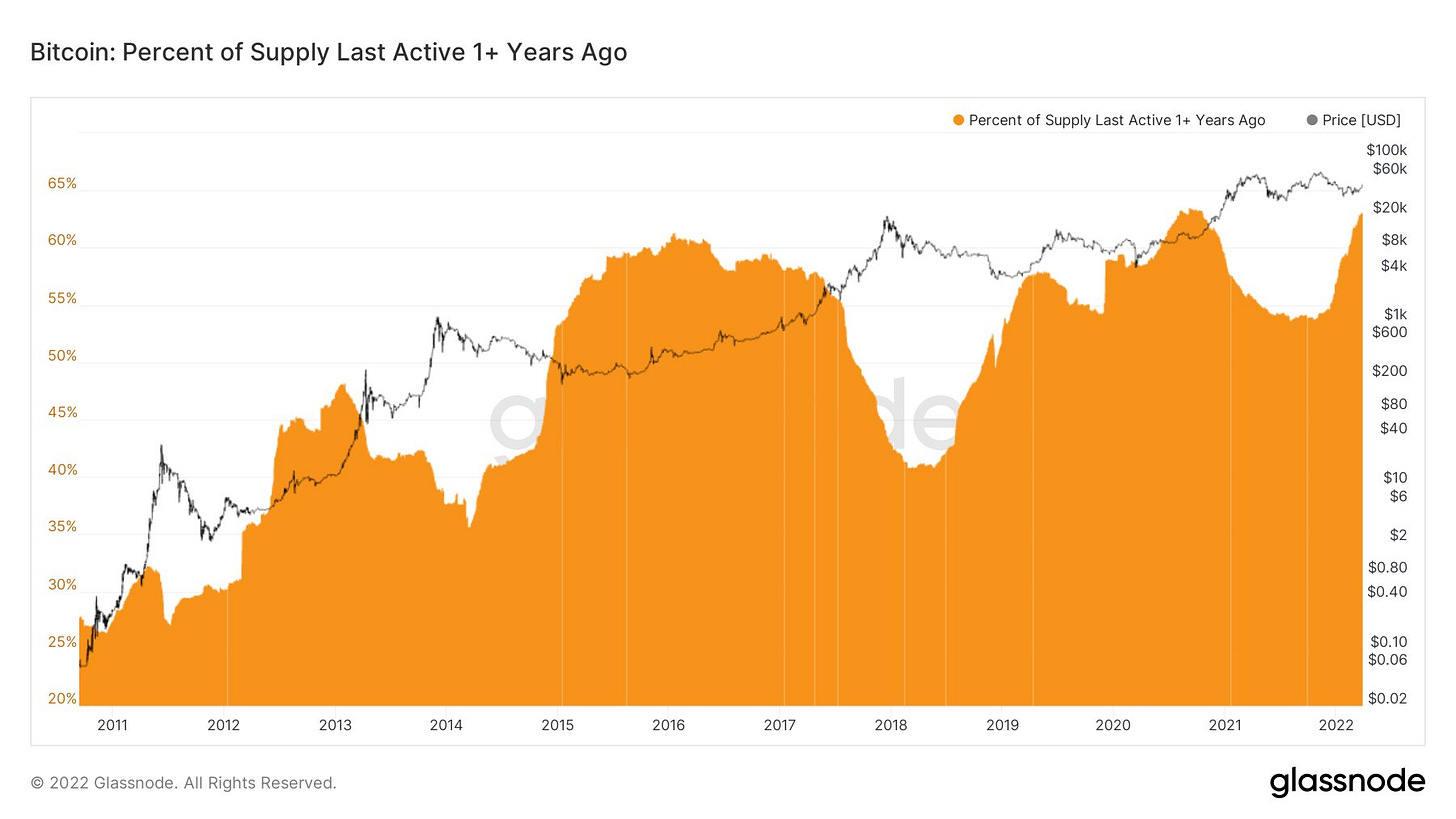

BITCOINBitcoin: Percent of Supply Last Active 1+ Years Ago

Bitcoin is trading at $48,000 and throughout its entire history, there has only been one other time that the percentage of supply that hadn't moved in over a year was at this level; September 2020.

MAJR Take: The on-chain data shows that there is a supply shock happening on the Bitcoin and Ethereum networks, less liquid supply for new buyers coming online, which increases price. This is happening at a time when the bond market is selling off. The global search for yield continues when record high inflation is destroying fiat currency purchasing power.

Bitcoin Has Now Wiped Away 2022 Losses

Bitcoin’s 2022 price has officially bounced back to where it started the year crossing $48k. One possible catalyst for bullish price action is the less critical tone from Washington such as the Secretary of the Treasury, Janet Yellen who’s flipped from negative to neutral. Other reasons could be a decrease in market FUD (fear uncertainty doubt) related to Covid or the fact that Do Kwon - the CEO and founder of the Terra blockchain has raised $3 billion to buy bitcoin for their reserves targeting $10 billion.

MAJR Take: Bitcoin as a reserve asset is a no-brainer for revenue generating businesses and it couldn’t be clearer across the world.

Grayscale Considers Flipping the Script and Suing SEC Over Bitcoin ETF

Grayscale, CEO Michael Sonnenshein told Bloomberg that all options are on the table including suing the SEC regarding another denial of their Bitcoin Spot ETF application. They’ve been working for over a year to get their $28 billion Bitcoin trust converted into an ETF, but just like every other application, they’ve haven’t gotten passed the SEC.

More on Bitcoin

CRYPTONFTs Could Go Mainstream With Instagram’s Planned Support, Deutsche Bank Says

Meta Platforms (FB) CEO Mark Zuckerberg said the company is working to bring NFTs to Instagram in the near term. Deutsche Bank research report said that the company will make it much easier for its large audience to buy and sell NFTs - lowering the barriers to entry and legitimizing the space. The report says that Instagram integrating NFTs could drive $8 billion net revenue for Meta Platforms given the high amounts of transaction volume in NFTs. Other companies like eBay, Snap, YouTube and Twitter are all looking to integrate NFTs which could push the market to over $1 trillion.

World of Women Galaxy Ethereum NFT Drop Generates $79M in a Day

World of Women (WoW) dropped a new NFT profile picture (PFP) edition called Galaxy with 22,222 NFTs. Women focused NFT projects are very hot right now, and lots of celebrities are stepping into the market as well. For example, Reese Witherspoon is planning TV shows and movies for the WoW collection. The primary mint generated more than $34 million, while the secondary market sales have done $60 million - more than BAYC ($45M), Azuki ($49.5M) and Mutant Ape Yacht Club ($42.3M).

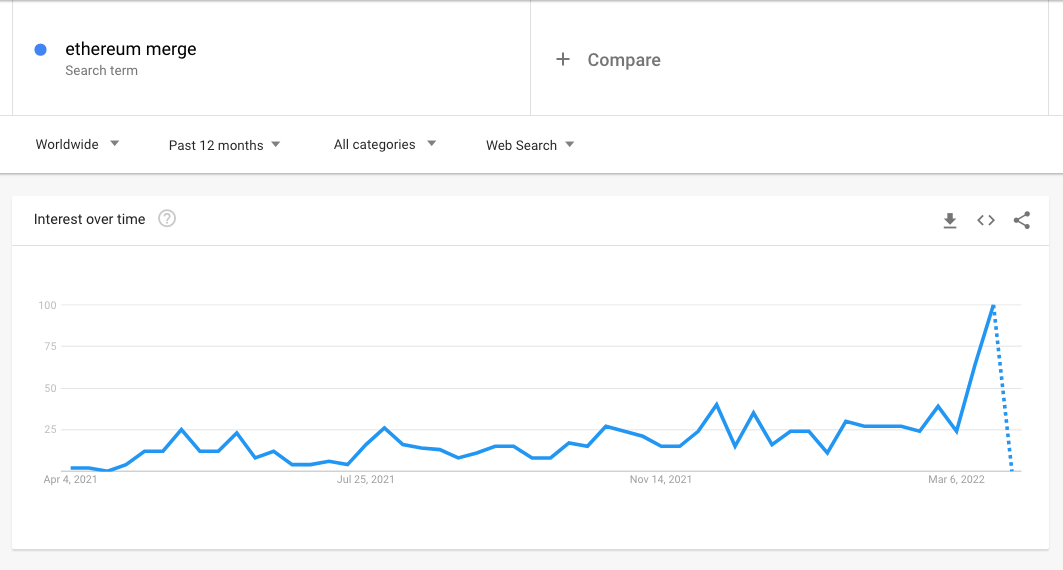

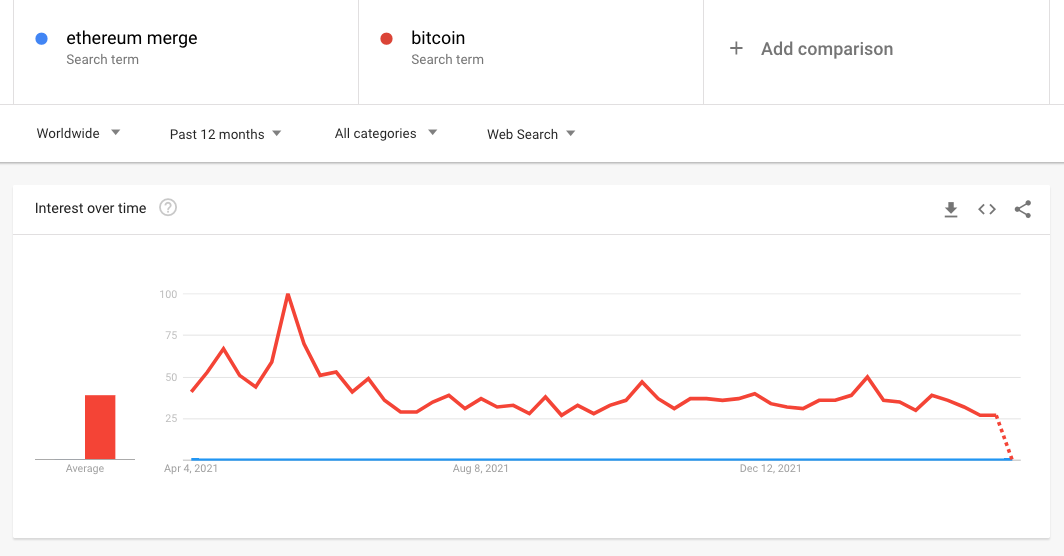

Google Searches for ‘Ethereum Merge’ Have Hit an All-Time High

Last week Google Trends data for ‘Ethereum Merge’ search term hit an all time high with Canada leading for most interest followed by Singapore, Australia, United States and then the Netherlands. Ethereum Merge is the long awaited protocol transition from Proof of Work (POW) mining to Proof of Stake (POS) staking consensus. It’s tentatively scheduled to go live sometime later in Q2’22.

MAJR Take: Here’s the comparison to Bitcoin search data. Bitcoin interest is much higher globally and concentrated in Russia, Europe and South American countries.

More on Crypto

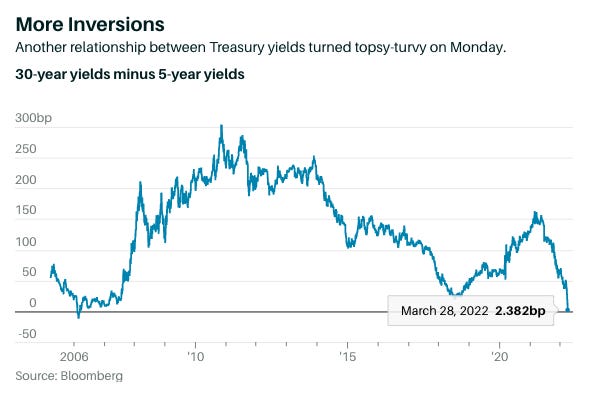

MACROAnother Part of the Yield Curve Just Inverted. It’s the First Time Since 2006.

An “inverted yield curve” in the bond market (most common between 2Y & 10Y or 3-Y & 10-Y) is a bearish indicator that’s been used to help predict possible recessions. This happens when short-term bond yields exceed those of longer duration. This is uncommon and a distortion in the market as a healthy yield curve is upward sloping, investors should receive a higher interest rate for holding investment contracts for longer periods of time. Treasuries have been selling off across durations, but yesterday morning 5-Y notes yielded 2.64% compared to that of the 30-Y bonds yielding 2.57%. This is the first time this has happened since 2006.

MAJR Take: With CPI and inflation at record highs - almost double digits, bond holders are guaranteed to lose money in real terms and therefore, investors are exiting what used to be “risk-off” safe heaven assets like US treasury bills. U.S. investors have withdrawn $26 billion from bond funds this year.

Here Is What Wall Street Thinks Will Happen To Bond Yields Next

U.S. Jobless Claims Fall to 187,000, Lowest Level Since 1969

US initial jobless claims decreased by 28,000 to seasonally adjusted 187,000 claims. The 4-week average is 211,750. The continuous claims of the number of people on regular state programs dropped to 1.35 million from 1.42 million, lowest level since Jan. 1970. There were 11.3 million open positions in January, down slightly from 11.4 million openings.

MAJR Take: The job market is tight, which only puts more pressure on inflation since there’s lots of jobs and not as many workers, therefore companies are increasing salaries to keep and attract new employees, therefore more money to spend on less goods and services.

Oil Prices Stay High as Russian Crude Shortage Hits Market

Russian oil exports fell to its lowest levels in the last 8 months. Experts forecast that roughly 2 million barrels per day could be disrupted causing one of the worst energy crisis in decades. Energy companies have refused to buy Russian oil, while some banks are unwilling to finance the trades, putting increased pressure on supply and prices, especially in Europe. The benchmark for Brent crude was up 9% last week, settling around $117 a barrel. The world consumes about 100 million barrels per day and Russia is the world’s 3rd largest exporter oil producer behind the US and Saudi Arabia.

Biden’s 2023 $5.8 trillion budget would hike taxes on the ultra-rich and corporations, boost defense and police spending

The budget is marketed as one that reduces the federal deficit by $1 trillion over the next decade, partly due to the increase in taxes for corporations from 21% to 28% and a 20% minimum tax on unrealized gains for households with more than $100 million. The budget has shifted away from Covid-19 protection and safety nets to increased spending on defense, jumping from $782 billion to $813 billion and includes $6.9 billion in defense spending going to NATO.

MAJR Take: Corporations will have the hardest time with the increase in taxes as they now carry much of the burden from inflation and a tight labor market - higher cost of materials, transport and energy along with increased wage pressure. Even with the “cut in budget deficits,” Biden’s 10-year outlook would still rack up $14.4 trillion in deficits.

The budget request shows the U.S. spending $72.7 trillion over a decade while taking in $58.3 trillion in tax and other revenue. The resulting deficits would swell gross federal debt to $44.8 trillion from about $30 trillion now, per the summary tables put out by the administration.

More on Macro

El-Erian warns of ‘cost of living crisis,’ says Fed rate hikes could cause recession

Biden’s Trillion-Dollar Deficit Reduction Barely Dents U.S. Debt

Manchin Pans Biden’s Proposed Tax on Unrealized Gains of Wealthy

MEDIAWill Janet Yellen Pull the Trigger? | Andy Constan

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.