MAJR News: Will central banks tighten or flip with record energy prices and the war in Ukraine?

Bitcoin holds support above $38k, Virginia state banks to custody bitcoin, US & EU crypto regulatory frameworks expected this week, War in Ukraine shakes world order for money & energy

@simstim

MAJR NEWS BRIEF

Videos

Ray Dalio believes the world is changing in big ways that hasn’t happened before in our lifetimes but has happened throughout history. A brief animated video detailing historical events that highlight his perspective and what’s to come. He’s talked about events similar to what’s unfolding now for years in his Principles books.

In this week's Blockworks round up, Mark Yusko, Mike Ippolito and special guest Mike Green of Simplify Asset Management focus on answering one big question: "how will sanctions and financial exclusion reshape geopolitics?"

Top Stories

BITCOINVirginia Senate Passes Bill Allowing State Banks to Offer Bitcoin Custody Services

Bitcoin adoption is increasing at the state level as the Virginia Senate passes a bill that allows state banks to custody bitcoin. The bill swept with 39-0 votes in favor and now the bill is going to be signed into law. States in favor of bitcoin are the following - Wyoming, Texas, Arizona, California, Arkansas, Florida, New York, Colorado, New Hampshire, Missouri and Tennessee.

Biden Planning to Sign Executive Order on Crypto This Week

The White House is expected to sign an executive order on crypto this week summarizing the US government’s strategy for managing the growing ecosystem. No specifics have surfaced outside of a central push from the administration for federal agencies to create clear regulatory guidance with the expectation of progress later this year.

MAJR Take: The Biden Administration has been pushing for regulatory clarity on crypto for the past year. It’s now a bigger deal given that bitcoin and crypto have landed center stage in the Russia Ukraine war, and national security concerns have entered the rhetoric. We said this last week and will say it again, it’s time to self custody your crypto and take your assets off exchanges.

Europe Crypto Regulations Set to Move Forward—Without Bitcoin 'Ban'

The European Union’s crypto directive, MiCA - Markets in Crypto-Assets is announcing new regulations for crypto this week. It was previously paused because of unpopular and vague language that read as if they were banning “proof-of-work” (POW) mining for environmental reasons. This was not the case, so it was reworked and ultimately thrown out all together. They announced a bill that goes to vote on March 14th by the European Parliament’s Economics Committee. The regulation appears to be focused on stablecoins and crypto services. MiCA’s primary goal is for clarity and not posing obstacles to the technology.

MAJR Take: It makes sense for bitcoin to be removed from these bills because its already defined as property, not a security and it’s already decentralized and pretty much unstoppable. It’s yet to be determined what regulators actually put in place, and if anything its just to slow the industry down to regain some control. This will be very difficult without pushing financial innovation overseas.

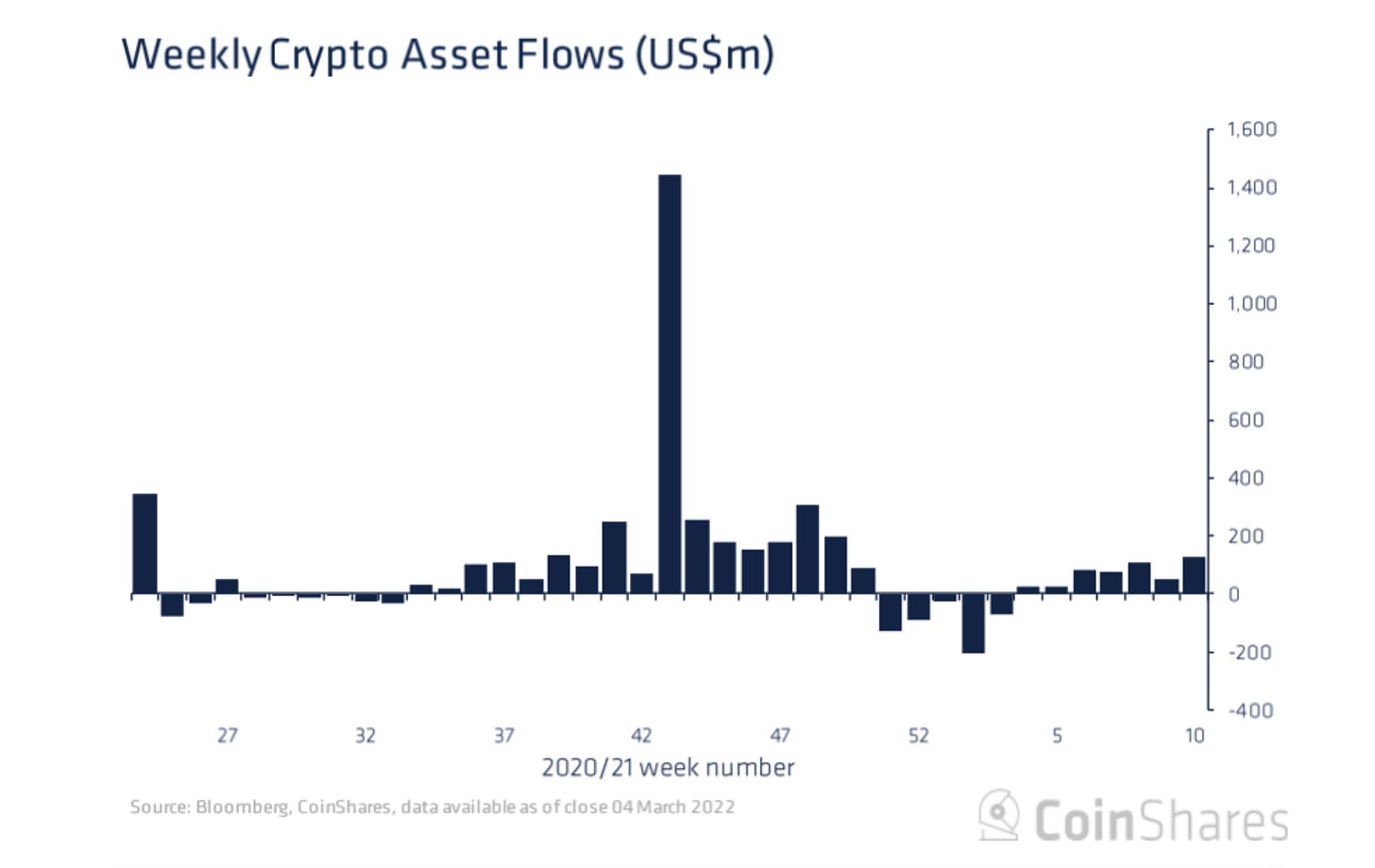

Crypto-Fund Inflows Tripled Last Week to Highest in Almost Three Months

Despite the market volatility and uncertainty, investor crypto-fund inflows increased last week to the highest amount in the 3 months, $127 million net. Bitcoin saw 75% of funds, while Ether picked up nearly the remaining 25%. Alternative layer 1’s like Solana and Polkadot saw small outflows.

More on Bitcoin

Bitcoin Creeps Toward $40K as Surging Oil Prices Create Bear Market Worry

Core Scientific Plans to Increase Hashrate to 42 EH/s by Year End

Investors See Bitcoin as Inflation Hedge, Nickel Digital's Survey Shows

Apple Co-Founder Steve Wozniak: Bitcoin Built On 'Pure-Gold Mathematics'

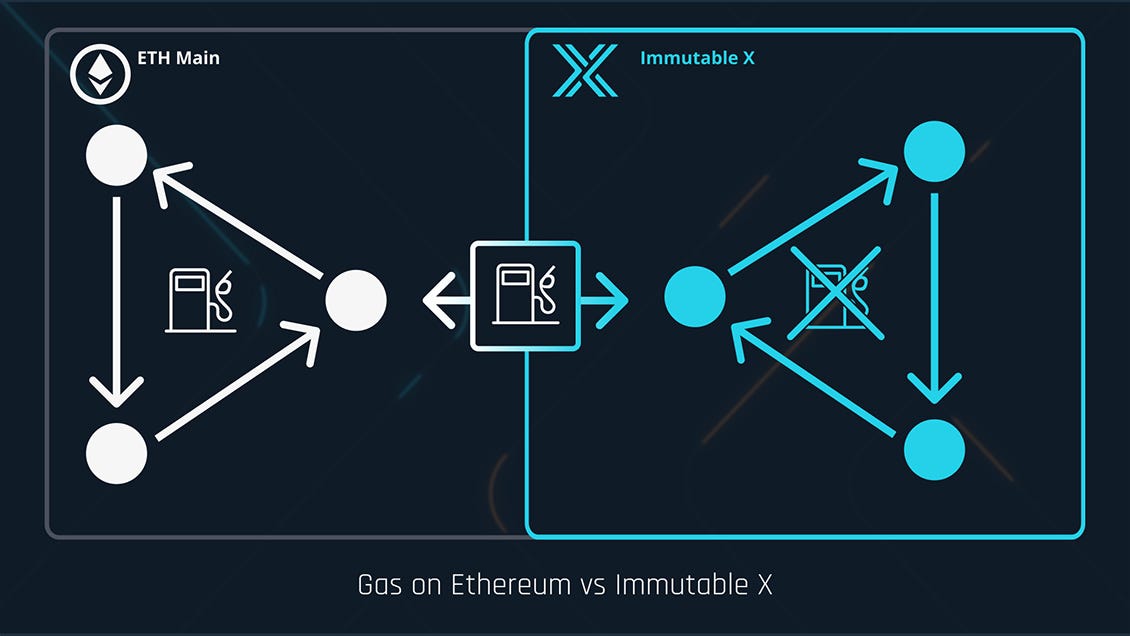

CRYPTOEthereum Layer 2 Service StarkNet Goes Live on Alchemy, Promises 100x Lower Gas Fees

StarkNet, technology created to reduce gas fees and transaction times on Ethereum is gaining traction with large developers like Alchemy and Immutable. StarkNet uses ZK technology (zero knowledge proofs) or “roll-ups” to batch transactions on a side-chain of Ethereum and periodically settle the transactions on-chain. StarkNet’s development company, StarkWare raised $173 million in funding and is competing with other layer-2 solutions using a variety of techniques including roll-ups such as Polygon, Optimism and Arbitrum.

Bain Capital Ventures Launches $560 Million Crypto Fund

Investment firm Bain Capital Ventures is launching a $560 million fund called Bain Capital Crypto that’s exclusively focused on the crypto industry. The firm is looking at investments across the industry including startups and DAOs (decentralized autonomous organizations). It’s a long-term fund (10 years) that wants to actively participate in governance and add liquidity to the protocols.

Santander Launches Loans Backed by Tokenized Commodities Such as Soy and Corn

Agrotoken, is an Argentinian platform that tokenizes commodities like soybeans, corn and wheat. The Spanish bank Santander is working with the platform to issue crypto-backed loans to farmers in Argentina. Each token corresponds to a ton of grain that the farmer has sold and has delivered to a grain elevator, which is then validated by the Agrotoken platform. If the farmer complies, then the loan is issued, held in an escrow smart contract and is automatically converted to pesos if the farmer pays off his loan in tokens or fiat.

MAJR Take: Everything is going to be tokenized. This use case shows how blockchains can create trust and incentivize investment across the globe.

Ethereum NFT Gaming Startup Immutable Hits $2.5B Valuation After $200M Raise

Immutable, an Australian startup focused on layer-2 Ethereum scaling solutions just raised $200 million in a Series C round, valuing the company at $2.5 billion. The company provides solutions for gaming and NFTs and is used by TikTok and GameStop. The company uses StarkWare’s ZK roll-up technology to process thousands of transactions on its own network before settling on Ethereum’s mainnet. The round was led by Temasek and included other investors such as Animoca Brands, Tencent, Arrington Capital, Mirae Asset and Liberty Global.

More on Crypto

DraftKings Co-Founder Says Becoming Polygon Validator Helps 'Futureproof' Company

The Sandbox, World of Women Form $25M NFT Alliance for WoW Foundation

MACROGlobal Economy Braces for Impact of Russia’s War on Ukraine

Stagflation, when economies are seeing high inflation and low growth. This could be on the horizon for global economies as the war in Ukraine escalates, unprecedented sanctions begin to sink in and a possible ban on Russian energy imports to European countries becomes a reality. Contagion risk to Russian exposure and assets is still unfolding, which could lead to a possible liquidity crunch in credit markets. The 1970’s were known for high rates of stagflation as the US came off the gold standard and inflation soared. Fed Chair Jerome Powell made it clear last week that they’re planning to raise rates in March by at least 25 bps and are determined to shrink the Fed’s $9 trillion balance sheet. However, global uncertainty and record energy prices could force central banks’ hands on letting the economy run hot.

MAJR Take: Central banks are stuck. Markets have already been battered, but is it enough to quell consumer demand and dampen inflation? We believe that the Fed’s credibility is at risk if they don’t raise rates in March. We hold a controversial opinion that the Fed needs to send the economy into a recession to flush the system in order to get back to printing money with the public’s support. Manipulating interest rates can only help supply chain dislocations and energy prices so much before diminishing returns. We wouldn’t be surprised if the Fed increases rates by 50 bps before easing mid-year.

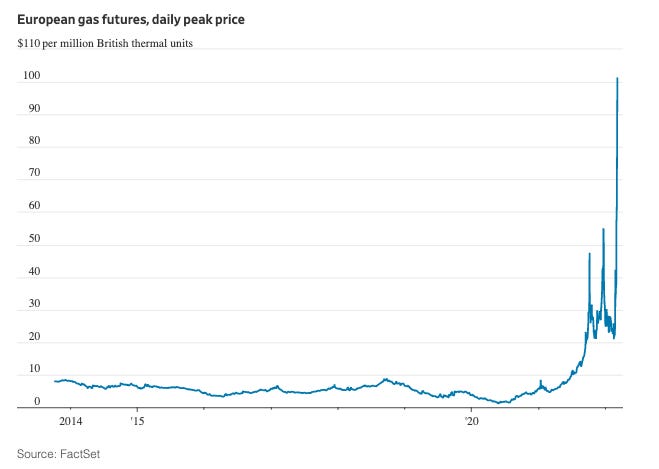

Russia Threatens to Cut Natural Gas Flows to Europe Via Nord Stream 1

European gas markets have been seeing wild swings as energy prices have surged as high as 80% this year, with prices reaching over $135 per barrel. If there’s a ban on Russian energy to Europe, oil could surge between $200-$300 per barrel causing catastrophic consequences around the world. Both Russia and the US / EU have threatened to ban Russian imports, which make up 40% of the EU gas supply and 25% of their oil supply.

Replacing Russian Gas in Europe Will Require State Planning

Natural gas is cleaner than coal fossil fuels and was Europe’s hope to a cleaner energy base, however they’ve heavily relied on Russia for their gas as it’s a regional market and delivered over pipeline. Europe has taken great strides decarbonize and go green faster than perhaps reality allows. For example, Germany was targeting 100% renewable power by 2035. These long-term plans had budgets, outlines for infrastructure, market rules and incentives. Now, everything has changed and in order to avoid a complete energy crisis, they are looking for alternative sources from Qatar and the US, which could take up to 1 - 3 years for deliveries. They’re also looking to access gas pipelines in Norway, Azerbaijan and North Africa.

MAJR Take: Radically shifting energy logistics sounds like a nightmare and close to impossible in a short time frame. It begs the question, what were lawmakers thinking when posing strict rules and targets to go green, but rely on Russia, technically your communist foe for 40%-80% of their energy? The same goes for the west’s reliance on exports from China. Lawmakers are continuously driven by emotions and sacrifice long-term solutions for short-term fixes. This is obviously dangerous, but unfortunately leading with science and common sense is no longer in vogue.

If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock

What is money? This question is as old as time, but is now front and center for every country holding foreign reserves in another country or in another currency. The war in Ukraine is accelerating the geo-political order of things. When western countries issued unprecedented sanctions against Russia and confiscated Russia’s $630 billion in foreign reserves, countries like China were put on high alert. The current financial system is actively being weaponized by a few countries and is a national security liability for others. China and Russia have been stockpiling gold for the last decade and have structured trade and energy deals to be settled in their domestic currencies, an offense that the US has historically gone to war for in order to protect the Petrodollar. China currently holds $3.3 trillion in currency reserves, outside of the renminbi. Recent events only push countries like China to build up their reserves with hard assets like gold, oil, commodities and other money like instruments that don’t carry the counterparty risk as currencies. While, this seems isolated in Russia, the dangers of the current financial system are on full display and will most likely continue to fray global trust and fuel deglobalization.

MAJR Take: We keep reading about countries stock piling gold, but you don’t see gold flowing into Ukraine for donations or being used as the potential exit for Russia to avoid sanctions. It’s crystal clear where this is headed, and bitcoiners have seen this coming for years. Bitcoin is an open, apolitical monetary network that doesn’t carry any counterparty risk and can’t be stopped. It’s a matter of time before energy is traded and settled in bitcoin.

More on Macro

US Jobs Up 678K in February, More Than Expected, Adding to Price Pressures

Russia Recruiting Syrians for Urban Combat in Ukraine, U.S. Officials Say

MEDIAPrinciples for Dealing with the Changing World Order by Ray Dalio

Historic Sanctions Are Reshaping the World Order | Weekly Round Up

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.