MAJR News: The Fed is Stuck. Inflation is Just Getting Started and Global Economy is Slowing Down.

SEC denies two more BTC spot ETFs, Institutional BTC accumulation is happening & removing coins from exchanges, BAYC buys IP rights to CryptoPunks to give to token holders, ETH 2.0 "Merge" for June

@simstim

MAJR NEWS BRIEF

Videos

In today's episode of Forward Guidance, Jack Farley is joined by Jim Bianco of Bianco Research and Luke Gromen, Founder of FFTT to discuss the situation the Fed finds itself in the face of the highest inflation in 40 years.

Top Stories

BITCOINSEC Turns Away Another Set of Spot Market Bitcoin ETFs, Denies NYDIG and Global X

The SEC denied two Bitcoin Spot ETF applications from NYDIG and Global X in the name of investor protections. However, they’ve already approved Bitcoin Futures ETFs, which began trading last year. The SEC recently denied applications from Fidelity and VanEck, along with many more before that.

MAJR Take: Denying a Bitcoin Spot ETF doesn’t make sense from an investor protections standpoint. Trading paper contracts in the futures market is more complicated than a traditional ETF and mainly done by professional investors. It’s well known that SEC Chairman, Gary Gensler is working closely with the Fed, the Treasury and the Biden Administration and these reoccurring ETF denials beg the question of “what’s really going on?” If I were to put on my tin-foil hat, two things come to mind - he’s withholding an ETF to prevent further mainstream adoption until his Goldman Sachs and banker colleagues carve out strong bitcoin positions or given the record high inflation print in CPI, they’re worried about capital flight out of the dollar and into bitcoin. If it’s the latter, then investor protections makes some sense.

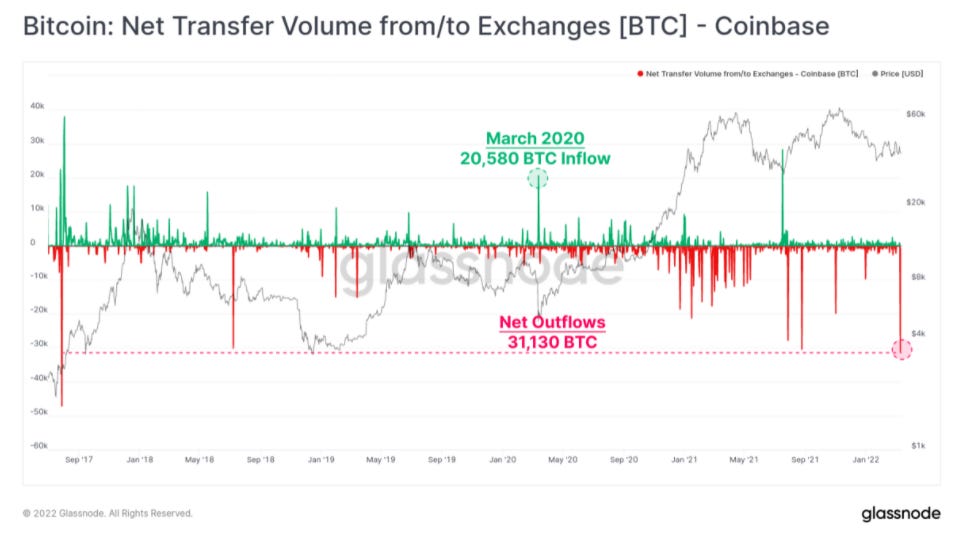

Bitcoin Worth $1.2B Leaves Coinbase in a Sign of Persistent Institutional Adoption

While, there’s fear in the marketplace and bitcoin has been trading sideways for months, institutional adoption hasn’t slowed as coins continue to leave exchanges. Coinbase saw 31,130 bitcoin or $1.2 billion in outflows leave its exchange last week, a sign that large players are moving coins into cold storage. Bullish. The number of bitcoin listed on Coinbase’s exchange has hit a 4 year low of 649,500 BTC and the balance across all exchanges has dropped to 2,519,403 BTC, the lowest since November 2018.

MAJR Take: Don’t lose sight of the big picture. Bitcoin is an emerging asset class, a new decentralized censorship-resistant money that’s increasingly becoming critical in the age of high inflation and financial oppression. Whales and institutions have been buying at these price levels and taking coins off exchanges causing a supply imbalance, which is generally followed by a strong move to the upside.

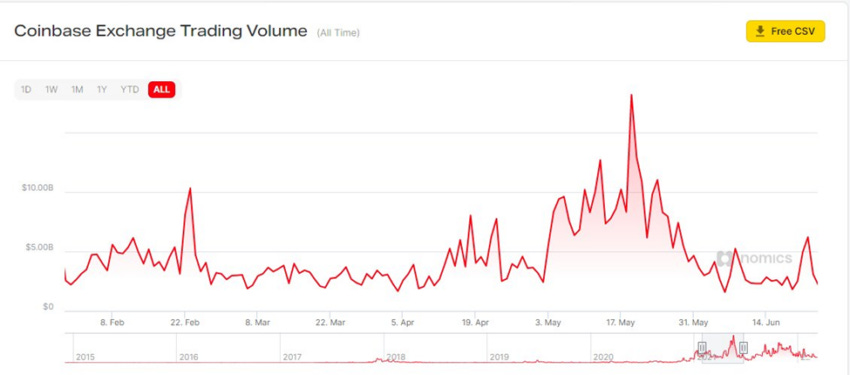

Coinbase Trading Volume Dipped to New Lows in February

Trading volumes on Coinbase, the largest US crypto exchange fell for the second month in a row to start 2022. January trading volume was $124 billion and fell by 25% in February to $93 billion.

More on Bitcoin

Jack Dorsey’s Bitcoin Hardware Wallet Will Use Fingerprint Authentication

Elon Musk 'Won't Sell' His Bitcoin, Ethereum, Dogecoin Amid Inflation Concerns

Crypto Funds See Their First Outflows in 7 Weeks: CoinShares

CRYPTOEthereum 'Merge' edging closer with final Kiln testnet launch

“The Merge,” Ethereum’s final transition from Proof-of-Work (POW) consensus done via mining to Proof-of-Stake (POS) consensus done via users locking up ETH on the network. This multi-year and highly anticipated migration could come as early as June 2022, as the final testnet has been launched, called Kiln. The Beacon Chain, which was the first component of the POS migration has 10M ETH ($26 billion) currently staked securing the protocol, which will soon dock with Ethereum’s mainnet.

MAJR Take: Users who’ve staked their ETH on the Beacon chain have been unable to unstake their assets for years, but have been yielding anywhere between ~4% to ~20% yield in ETH. POS should be good news for the network by increasing transaction times, but actually doesn’t bring down high gas fees. Some analysts forecast a short-term price drop post Merge, as the locked ETH will finally be unlocked, increasing the liquid supply on the market. Plus, I’m sure we’ll see a run up in ETH price prior to the final migration, creating an incentive to sell into higher prices.

NFTs Are a ‘Profound Invention’ Says Ethereum Co-Founder Joe Lubin

ConsenSys CEO and Co-Founder of Ethereum, Joe Lubin elaborates on why NFTs (non-fungible tokens), unique digital items will reshape industries at large. Adopted by the mainstream under the umbrella of digital art and collectibles, however the technology is much bigger than that since they connect a peer-to-peer network and users directly to value on the blockchain, essentially replacing intermediaries and platforms. He says, NFTs will force web2 technologies companies to evolve.

“We’re about to turn everything upside down on planet Earth…We’re about to flip the age of silos into the age of community, and intermediaries are about to become broad, much more valuable, and much more effective…Any business that can see its role as an intermediary replaced, made better, made less expensive, made less frictional, made more trustworthy, or more guaranteed—they are going to be subject to disruption if they don’t evolve themselves,” Lubin said.

EU Parliament Approves Crypto Legislative Package by Majority Vote

EU lawmakers passed crypto legislation called the “Market in Crypto Asset Regulation” (MiCA). In short, the legislation is similar to the Biden Administration’s executive order confirming the need for clear regulation to support technological innovation, while instilling appropriate consumer protection and financial stability. It didn’t include any details about the type of regulation to be put in place and it didn’t include anything about banning bitcoin or Proof of Work (POW) mining.

Bored Ape Yacht Club’s Yuga Labs Acquires CryptoPunks IP From Larva Labs

Yuga Labs, the company behind the Bored Ape Yacht Club NFTs bought the IP rights to CryptoPunks and Meebits from Larva Labs. The difference between BAYC NFT holders and CryptoPunks owners was IP rights, which CryptoPunks owners didn’t fully own. Post transaction, Yuga Labs is transferring IP rights (brands and logos) to the NFT holders. Now, CryptoPunks and Meebits owners can follow the path that the BAYC NFT holders have paved where individual token holders have launched branded enterprises.

CryptoPunks Ethereum NFT Sales Surge 1,200% After Bored Ape Creators Acquire IP

More on Crypto

Andreessen, Alexis Ohanian Back $30M Crypto Fund—That Only Invests in NFTs

Maker of Angelic Gets $10M in Round Joined By Animoca Brands, Pantera Capital, Solana Capital, Everyrealm - Gameplay Here

Solana NFT Marketplace Magic Eden Raises Paradigm-Led $27M Series A

Waves Protocol Surpasses $2 Billion in Total Value Locked (TVL)

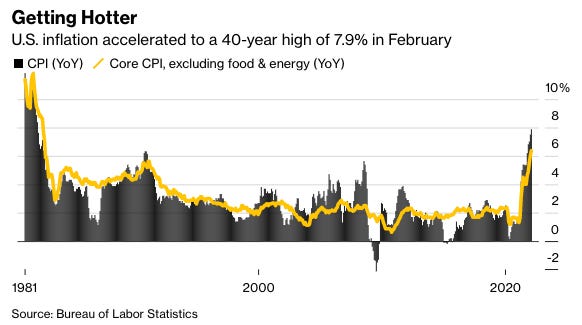

MACROThe Inflation Hits Just Keep Coming, Raising Stakes for the Fed

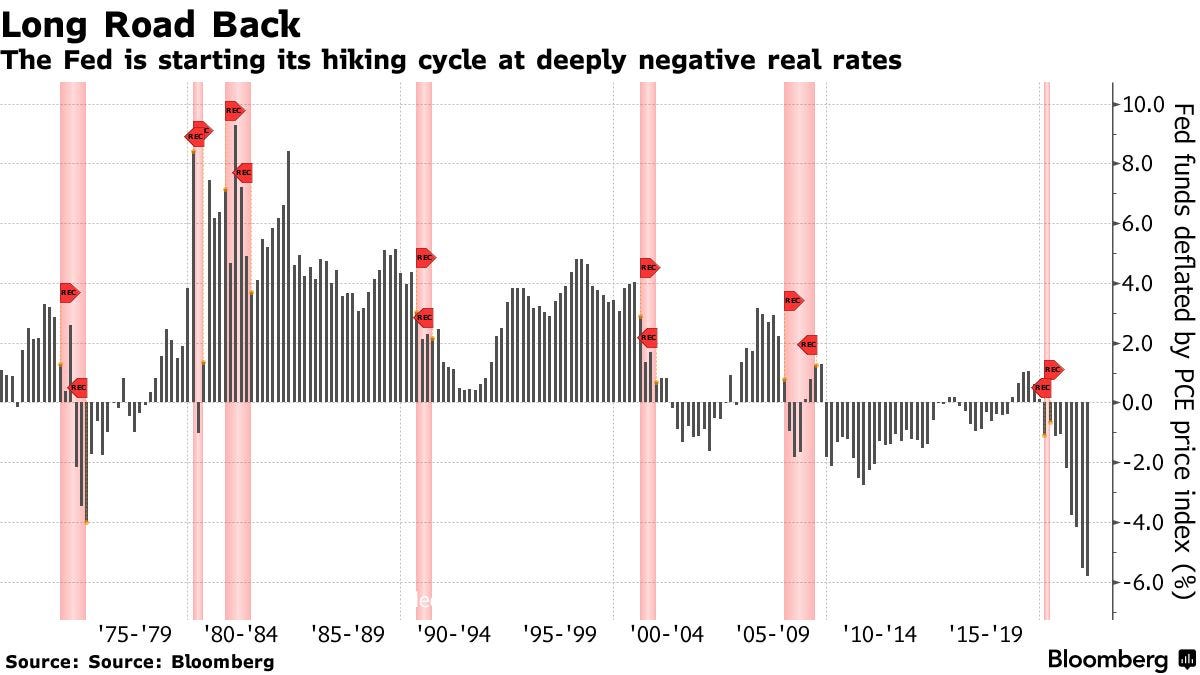

Central banks have generally raised interests when the economy is heating up and running on all cylinders in attempt to get ahead of price inflation. However, the Fed is actually way behind the curve and about to increase rates as we approach what looks like a massive recession. CPI inflation hit 7.9% in February, the highest it’s been in 40 years. The Fed can’t fix supply chains, cure the pandemic or stop the war, but they can raise rates to increase borrowing costs and stop reinvesting their balance sheet into the economy. This would remove liquidity and tighten markets to hopefully reduce equity prices and spending, which could slow the acceleration in consumer prices. Analysts expected the Fed to raise their benchmark interest rate to 3% by next year, but now they’re forecasting rates as high as 4% - 5% in order to stop runaway inflation. This period in time is being compared to the 1980s when then Fed Chair Paul Volcker took rates too has high as 15% to get inflation under control.

MAJR Take: This time is different in three big ways - Volcker wasn’t dealing with an economy running record trade deficits, spending deficits and a country with ~130% debt to GDP. Therefore, it’s mathematically impossible to increase rates to 5% without the US defaulting on its debts or requiring the US to print money to pay for the debts. Watch video below for more information.

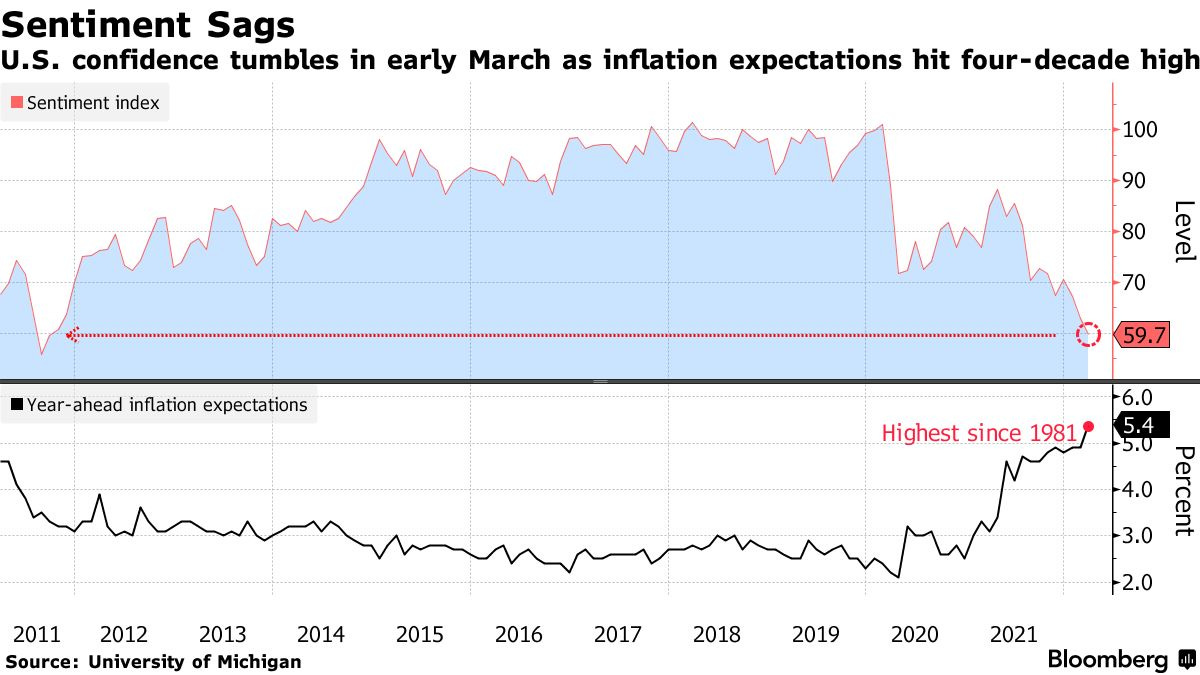

Fed to Start Rate Hikes With License to Turn Aggressive Later

This Wednesday the Fed will announce their plans for monetary policy against a complicated economic backdrop, high inflation and global slowdown erupting from the war in Ukraine / looming pandemic. A 25 bps interest rate hike is almost guaranteed and the market is betting on tighter policy throughout the year as inflation expectations, food, rare earth metals and gas prices are expected to climb. Forecasters are all over the map claiming that we’ll see 100 bps hikes by mid-year, while Goldman Sachs analysts believe we’ll see hikes into 2023.

MAJR Take: The Fed has to hike now. Their credibility is at risk and it would be a complete 180 from their forward guidance. The question is how much, how fast and how much has the market baked in? Inflation has never been this bad and the March CPI print is going to be much worse since February numbers didn’t include the effects from the war in Ukraine. Plus, the Fed hasn’t stopped adding liquidity into the market via asset purchases. How crazy is that? We have record high inflation and the Fed is still printing until the last second…Real interest rates have never been this bad since 1951. I wouldn’t be surprised if we see a 50 bps hike this Wednesday with a sharp correction in risk assets. Hold your hats and don’t sell your coin because we’re going higher after the crash.

Chinese Stocks Slide as Covid-19 Lockdowns Add to Investor Concerns

Covid cases in China have surged to 5,000 new infections on Monday, the highest since 2020 for China who’s now back to enforcing strict lockdowns. If China doesn’t slow down the spread of Covid, inflation and supply chain issues could become an even greater problem. A Bank of America fund manager survey showed that confidence for global growth was the lowest its been since July 2008 as expectations of stagflation jump by 62% (low growth + high inflation). The regions highly effected by Covid are some of the largest Chinese ports for exports, the Shenzhen region handles about 20% of the cargo coming into the US.

Chinese Stocks Slide as Covid-19 Lockdowns Add to Investor Concerns

More on Macro

Biden Hits Manchin Roadblock Again as Raskin Nomination Falters

From Beer to Semiconductors, War Will Hit U.S. State Economies

MEDIAFed Faces "Debt Death Spiral" While Inflation Soars | Luke Gromen & Jim Bianco

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.