MAJR News: Terra buys $100M of bitcoin to back its algorithmic stablecoin, UST. New BTC total is $2.2B.

Luna Foundation Guard buys the bitcoin dip, Brazil to announce friendly bitcoin law, Institutions creep further into crypto, ETH Merge pushed to Q3, Inflation and bond yields are up and rising

@doodles

MAJR NEWS BRIEF

Videos

China’s strict Covid-19 lockdowns are driving Shanghai’s 25 million citizens crazy and into starvation. People have been locked in their homes since March due to an Omicron flare up.

Top Stories

BITCOINLuna Foundation Guard Adds Another $100 Million in Bitcoin to Back Terra

LFG, the Lunda Foundation Guard is the nonprofit behind the stablecoin and smart contract protocol Terra and they’ve been on a bitcoin buying spree. Do Kwon the founder of Terra (LUNA) said he wants to back their stablecoin reserves with $10 billion in bitcoin. They just added another 2,508 BTC worth $100 million to their existing $2.1 billion in BTC reservers. Terra previously added $100 million of Avalanche (AVAX) to their reserves as well.

MAJR Take: This is a genius move. Do Kwon is using a barbell strategy for their reserves. A bitcoin backed stablecoin almost guarantees longevity for the protocol, and AVAX paired with LUNA provides alpha to help drive the 20% yield on UST. YOLO.

Strike partners with Shopify and NCR

The CEO of Strike, Jack Mallers announced a partnership with merchant payment networks Shopify, NCR and BlackHawk to open up bitcoin payments on the Lightning network. Strike is a Lightning wallet application that leverages Bitcoin’s the peer-to-peer network to convert any type of fiat into bitcoin and back into any type of fiat instantaneously.

More on Bitcoin

CRYPTOBlackRock to Handle Circle's USDC Cash Reserves as Part of $400M Funding Round

Circle, the issuer of the second-largest stablecoin USDC, landed $400 million in funding from BlackRock Inc. and Fidelity Management and Research LLC, in a sign of traditional finance’s growing acceptance of the exploding cryptocurrency industry. Circle projects $438 million in revenue from it’s stablecoin reserves this year and $2.2 billion in 2023. BlackRock, the world’s largest asset manager with $10 trillion in AUM will be Circle’s primary asset manager for USDC reservers. Circle is valued at $9 billion.

MetaMask Institutional Adds Ethereum Gnosis Safe, Custody Options for DAOs and DeFi

MetaMask, the largest Ethereum based wallet with over 30 million users added crypto asset custody partners - Gnosis Safe, Hex Trust, Parfin and GK8 for it’s MetaMask Institutional service to attract asset managers, DAOs, DeFi and traditional financial clients like banks and corporations. MetaMask Institutional was launched in December 2020.

Pantera Says It's Raised $1.3 Billion for Blockchain Fund, Plans to Raise More in 2023

Crypto venture capital firm Pantera raised $1.3 billion to fund web3 startup opportunities and plans to raise additional funds in 2023 and growth fund in 2024. The funds will go towards startups, early stage tokens and digital tokens with established liquidity levels. There’s no shortage of capital flooding crypto with a16z’s third $2.2 billion fund, Paradigm’s $2.5 billion fund, former a16z partner Kathryn Haun’s $1.5 billion fund and FTX Ventures’ $2 billion fund.

Avatar Platform Genies Now Worth $1B After $150M Series C Round

Avatar platform Genies is one of the newest crypto unicorns with their latest Series C round of $150 million. Genies has an NFT marketplace on the Flow blockchain, known for other NFT based projects such as Crypto Kitties and NBA’s Top Shot. Genies has partnerships with Warner Music and Universal Music Group and promises owners full commercialization rights over characters.

More on Crypto

Dallas Cowboys Lasso NFL's First Crypto Exchange Sponsor Blockchain.com

Ethereum Merge Pushed to Q3 as 'Final Chapter' of Proof of Work Looms

Ethereum Trader Bought $400K in Tokens on Coinbase Shortlist—Before It Was Public

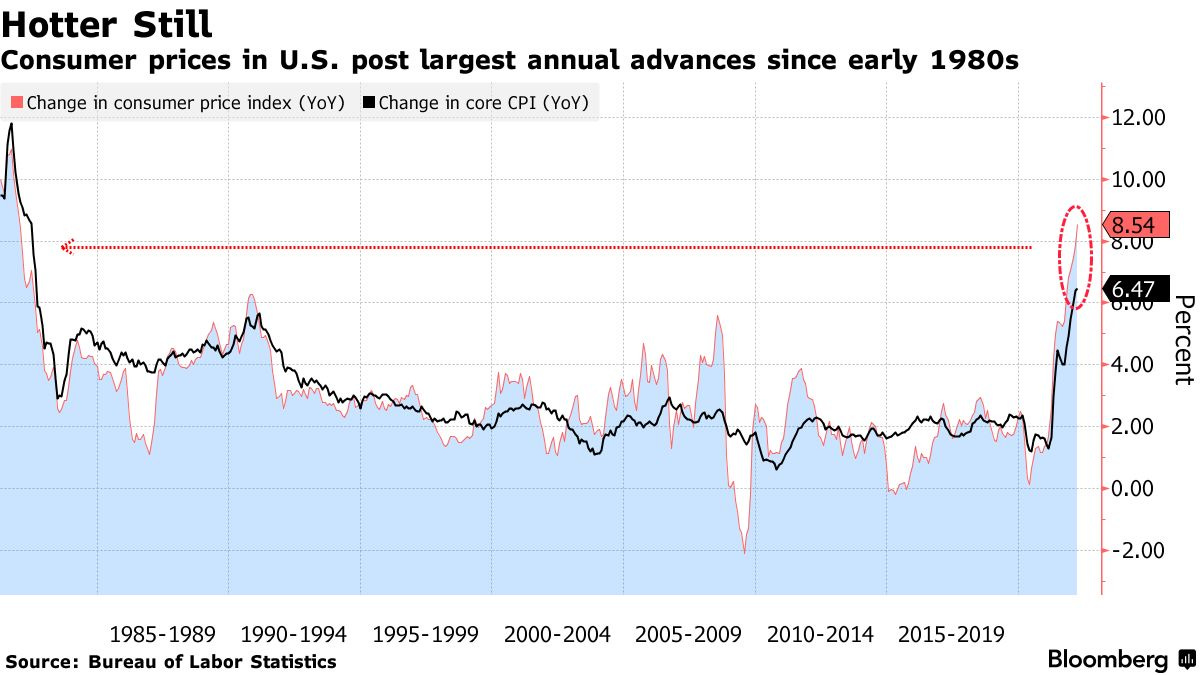

MACROU.S. Inflation Quickens to 8.5%

March CPI jumped from 7.9% in February to 8.5% YOY and the most since 1981. This is the 6th straight month with inflation over 5%. High inflation numbers are paired with a continued sell off in the bond market as yield surge. The benchmark 10-Y Treasury yields rose above 2.80%, the highest since December 2018.

Treasury Yield Surge to Threaten Bull Run’s Last Resistance Line

The chart above illustrates an end of an era in the bond market as the four decade downtrend in yields (bull market) looks like it’s about to come to abrupt halt. High yields are inversely correlated to the price of bonds meaning no one is buying the debt, therefore yields increase to price in additional risk and attract demand. The 8.5% March CPI print almost guarantees a 50 bps rate hike in May, but if yields continue to surge, the Fed will have to make a choice - inflation or the US bond market.

MAJR Take: They’re going to print. They will need to cap yields via yield curve control, call it something else, but ultimately dump new fiat units into the system to kick the can down the road. This will only cause more inflation.

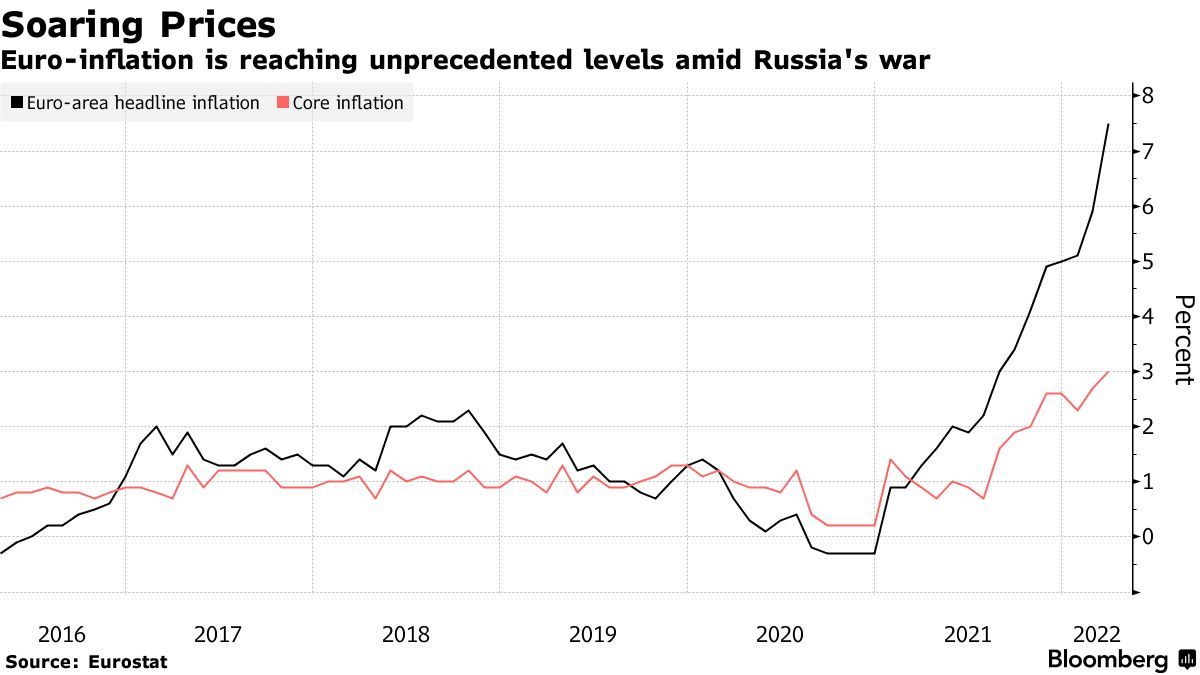

ECB Sticks to Speedier Stimulus Exit as War Fans Inflation

The ECB changes course away from accommodative monetary policy due to record inflation. The central bank pledges to end their bond purchases in the coming months and will most likely raise rates. German bonds yields have surged one basis point from 0.75% to 0.83%. Already deeply negative real yields for European investors are now even deeper due to ~8% CPI. The ECB is designing a “crisis tool” in the event that yields blow out.

MAJR Take: The European bond market was already underwater with negative real yields and now rising inflation most likely has bond holders losing double digits. Pay attention to the language used by institutions to disguise the reality of the situation. The ECB is designing a “crisis tool” to grapple with rising yields…what this really means is - they’re going to print more money and execute yield curve control. This is where things get hairy and inflation spirals out of control as more units flood the system.

More on Macro

Biden Sends Heavy Weapons as Ukraine Faces New Russia Offensive

Russia Warns of Nuclear Buildup If Finland, Sweden Join NATO

MEDIAShanghai Residents Call Out During Covid-19 Lockdown

'We are starving': Shanghai residents protest largest Covid lockdown in the world

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.