MAJR News: Russia Declares War on Ukraine. The Next Global Economic Crisis Begins.

Russia attacks Ukraine & global markets shed loses, Bitcoin is the strongest vs alts, but investors run to treasuries & gold, Energy prices hit highs, More inflation & supply chain troubles ahead

@starfury

MAJR NEWS BRIEF

Videos

In this interview, Peter McCormack speaks with serial entrepreneur and market analyst Mark Moss. They discuss peak centralization, the role of a state, the balkanization of society, the need for transparency and truth, and how Bitcoin enables people to free themselves from the tyranny of place.

Top Stories

BITCOIN$200 Billion Wiped From Crypto Market Cap Following Russia’s Invasion of Ukraine

Crypto markets have followed suit with all risk assets, shedding $200 billion in market cap as Russia declares war on Ukraine. Total market cap moved from $1.77 trillion to $1.56 trillion in the last 24hrs. Bitcoin remains the least risky vs. other tokens, however the price of BTC has dropped 18% in the last week and 9% in the last 24hrs. Russian equities have lost more than $250 billion. US S&P 500 and the Nasdaq are down 1.8% and 2.6%. While gold is up 2% in the last 24hrs, which is the largest single day increase since late 2020.

Mexico Senator Proposes Bitcoin Legal Tender Bill—But It's Unlikely to Pass

Mexico Senator, Indira Kempris is pro-bitcoin and introduces a bitcoin legal tender law, however she’s in the opposition party and the current president Andres Manuel Lopez Obrador has expressed distain for using bitcoin as a means of payment, let alone making it legal tender. The bill will have a hard time passing, as the President is focused on improving the economy by fixing tax evasion.

El Salvador Has $500M in Commitments for its Bitcoin Bond

El Salvador issued its first Bitcoin bond to fund its Bitcoin City and Bitcoin Volcano Mining initiative. It has already received $500 million in verbal commitments. Sources close to the deal say, El Salvador shouldn’t have a problem raising the $1 billion target and the El Salvador President has stated that they will look to raise $5 billion in the future. Since the country’s transition to a bitcoin legal standard in September of 2021, tourism has already increased by 30%, mostly from the United States.

More on Bitcoin

Sub $30K Bitcoin price sell-off would require panic ‘to a large degree’

Bitcoin Elliott Wave Theory suggests BTC price can drop to $25.5K this year

Mayer Multiple Falls to Oversold Region – Bitcoin (BTC) On-Chain Analysis

Total Value Locked in Bitcoin Lightning Network Hits 3,479 BTC ($1.3B)

CRYPTOTerra Says LUNA Token Sale Raises $1 Billion for Bitcoin Reserve

The Luna Foundation Guard, a nonprofit organization linked to the Terra blockchain, raised $1 billion in a private token sale which will be used as for their stablecoin UST Forex Reserver denominated in bitcoin. The round was led by crypto giants Three Arrows Capital and Jump Capital. Jump Capital recently made news for making the $320 million cross-chain Solana and Ethereum bridge, Wormhole hack whole.

Warner Music Group and Splinterlands Collaborating on Play-to-Earn Games

One of the biggest record labels, Warner Music Group is getting into the gaming space with play-to-earn crypto games, Splinterlands. The game will be centered around musicians and have an arcade style feel designed for mobile. Splinterlands is a digital card game built on the Hive blockchain.

StarkWare Launches Layer 2 Product StarkNet on Ethereum

StarkWare is a layer 2 scaling solution for Ethereum to help solve high gas prices and slow transaction times using zero knowledge (ZK) rollup technology. ZK rollups essentially batches transactions together on a second chain to reduce the computation burden and high gas fees on the Ethereum, and then settles on Ethereum’s main chain. StarkWare concluded a Series C funding round in November valuing the company at $2 billion. The technology is ready for mainstream application adoption.

MAJR Take: This is great news, however any use of a second layer solution or side-chain creates more friction for the user as they need to bridge assets to different chains, which is complicated and annoying even for crypto natives.

Solana’s Crypto Wallet Phantom Integrates Password Manager 1Password

Phantom wallet, one of the main Solana digital wallets has partnered with widely adopted and secure 1Password manager to help store credentials like seed phrase and private keys. This will be integrated into the 1Password API with Phantom making storing private keys much more manageable.

More on Crypto

Elwood Technologies To Integrate Crypto Trading Platform With Bloomberg AIM

Colorado's Pro-Crypto Governor Will Run for President—But Only if Job Is Decentralized

MACROU.S., Allies Poised to Hit Russia With Broad Sanctions for Ukraine Invasion

The US and European allies are meeting this evening to discuss severe sanctions on Russia for the invasion of Ukraine aimed at toppling the government. Over the past two days, western allies have already imposed the first round of sanctions on Russian sovereign debt, six Russian banks, wealthy Russians linked to the government, and halted the Nord Stream 2 natural-gas pipeline. Additional sanctions could include freezing all Russian assets, banning technology exports into Russia, target larger more critical banks and removal from the international SWIFT banking system. Russia’s economy is much stronger than it was years ago as Russia has increased their money reserves, gold and monetized its massive energy surplus. They provide 40% of the gas to EU countries, and the EU has not confirmed if they will switch suppliers, although they’re working with other nations for alternative solutions. China will most likely come into play and could help the Russian economy circumvent the economic obstacles.

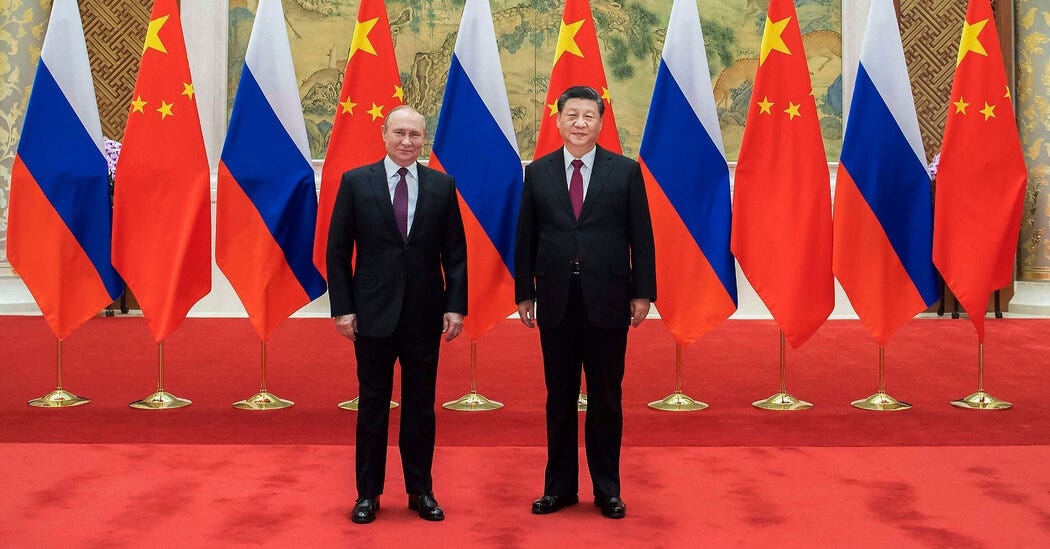

China Nods to Russia’s Interests in Attack on Ukraine

China expressed support for Russia’s interest in Ukraine due to a complicated history with the country and blamed Washington for fueling the tensions between the regions. Earlier this month, President Putin meet with Chinese President Xi Jinping prior to the Olympics in a closed door meeting. Sources say, it was to discuss economic assistance in the case of sanctions over a possible engagement with Ukraine. This puts China in a precarious situation as they have economic ties to the rest of the world, however this acts as leverage for increased support for Russia as China is the world’s largest trading partner and shares the same suspicion of the United States’ international influence.

MAJR Take: Nobody knew exactly how events would unfold on a global scale and this is an extremely unfortunate for Ukraine and the world, but there have been clear signs that we’ve been headed in this direction. In Sept’21, China and Russia made a deal to trade oil exports and settle in local currencies, pushing the de-dollarization trend for energy. China is Russia’s largest trading partner and in 2020, they reached a $100 billion agreement for three years to cement their relationship. China’s major exports to Russia include technology and auto parts, while they receive oil, natural gas, vegetable oil and other products. China and Russia have both been stock piling gold reserves for the last few years. This is no doubt a start of a long and dramatic decade of change on so many levels - geopolitical, technological, societal and economical. We’ve been beating this drum for almost 2 years now.

Oil-Price Surge Threatens U.S. Growth

Brent crude oil traded above $100 today, while futures for West Texas Intermediate or US crude oil topped $98, up 28% this year and up 52% YOY. As much as we’d like to think how we green we are today, the world still runs on oil and natural gas and high energy prices can cripple an economy. Consumer spending makes up 66% of US GDP, and when we have high energy prices, consumers spend more on gas, electricity and heat and therefore spend less on other goods and services.

MAJR Take: The Fed and economists have been pounding the table on raising rates, some even think a 0.50% increase in March and then as many as 6 more hikes this year. This was never possible without completely crashing the economy due to the levered financial system. If tensions escalate with Russia and China, we’d be lucky to get one hike in March. Global inflation is going to rip and raising interest rates will not solve supply chain disruptions and high energy prices. Facts.

More on Macro

World Economy Inflation Shock Set to Worsen From Oil at $100

Europe Currencies Slide as Russia Attack Spurs Stagflation Risk

Treasuries, Haven Assets Rally as Putin Moves on Eastern Ukraine

Trudeau revokes emergencies act powers, but the case for crypto grows

MEDIAThe Threat of Peak Centralization with Mark Moss

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.