MAJR News: MicroStrategy Levers Up Against its Bitcoin Holdings to Buy More Bitcoin.

ExxonMobil is mining bitcoin with flare gas, Solana NFTs coming to OpenSea, Biden to release 180M barrels of oil reserves to fight inflation, Home prices continue to rise with limited inventory

@simstim

MAJR NEWS BRIEF

Chart of the Day

Videos

Preston Pysh's round table conversation with Joe Carlasare, Jeff Ross, and Jay Gould, about the broader market conditions and how Bitcoin plays into its development.

Top Stories

BITCOINMicroStrategy Takes Out $205M Bitcoin-Backed Loan to Buy More Bitcoin

MicroStrategy raised a $205 million cash loan from Silvergate Bank using its bitcoin holdings as collateral to buy more bitcoin. The company has raised debt capital before, but never using their bitcoin as collateral, the same asset that they’re buying with the leveraged loan - this is known as mark-to-mark - a much riskier move if price moves against you. The new leveraged loan increased the company’s holdings to 128,687 BTC - worth more than $6 billion.

Exxon is mining bitcoin in North Dakota as part of its plan to slash emissions

ExxonMobil, the top oil and gas producer in the US, is mining bitcoin in North Dakota using their excess flare gas to power the mining rigs. Flare gas is wasted energy that gets thrown off during petroleum gas extraction. Rather than letting the natural gas into the environment, they’re powering bitcoin miners which may provide monetary benefits, but it actually reduces their carbon emissions.

More on Bitcoin

CRYPTOSolana Surges as NFT Trading Rises 80% Following OpenSea Reveal

Solana, one of the fastest layer 1 Proof-of-Stake blockchains saw a bump in its token price of about 12% in the last 24hrs after OpenSea announced that Solana NFT trading will be available on their platform.

Helium Crypto Wireless Network Founders Raise $200M, Rebrand to Nova Labs

Helium, the decentralized internet infrastructure company which is now known as Nova Labs raised $200 million in a Series D round, valuing the company at $1.2 billion. Nova Labs provides a true utility case for their tokens. Users can purchase their internet routers which are nodes / miners to provide public internet service signals and get paid in their HNT tokens. The network had 14k active nodes in 2021 and now has more than 680k nodes powering their network. The round was led by Andreessen Horowitz, Seven Seven Six, Goodyear Ventures, Deutsche Telekom, and others.

How the SEC Proposal to Change One Definition Could 'Kill' DeFi

The SEC is trying to sneak a slight change in a footnote of the definition of a ‘dealer’ in a proposed rule change that would expand the definition to include ‘people who employ passive market making strategies that have the effect of providing liquidity to others.’ This definition could technically hurt DeFi (decentralized finance) applications that allow users to trade, lend, borrow tokens without a middlemen and a bank - a complete financial breakthrough that provides marketplace efficiency, reduces costs and shares value with users in the form of fees for providing liquidity.

MAJR Take: It’s clear that SEC Chair Gary Gensler who worked on Wall Street at Goldman Sachs is not trying to protect investors, but actually stall innovation to protect the banks and his former colleagues.

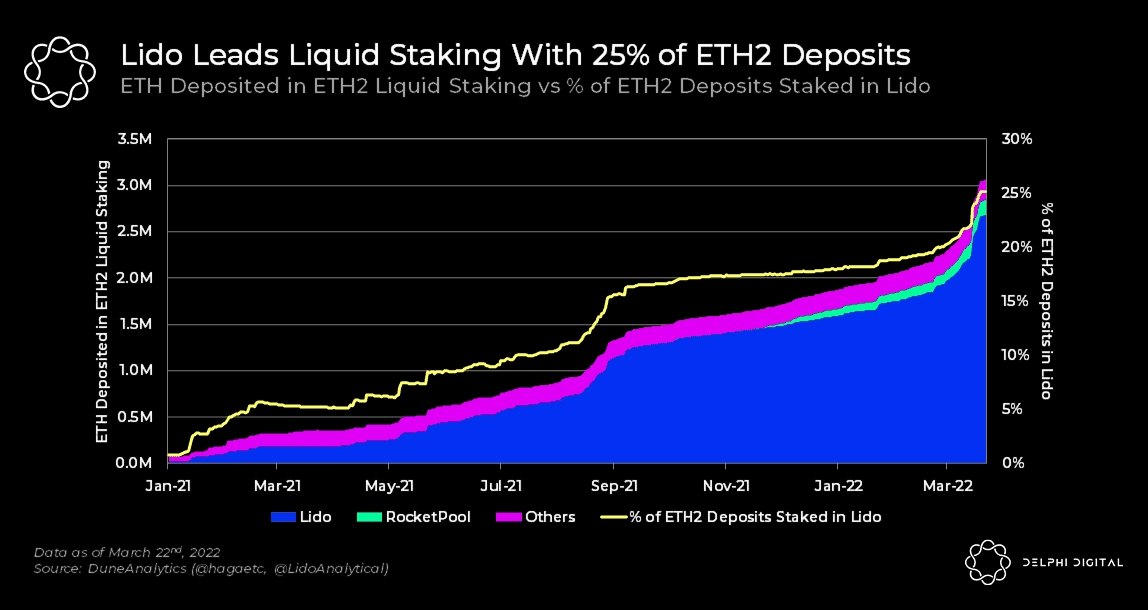

How a Post-Merge Ethereum Could Attract Institutional Investment

Ethereum, the second largest blockchain by market cap and the first smart contract blockchain is migrating from Proof-of-Work mining to Proof-of-Stake staking consensus. This allows users to stake (lock up) their ETH to process and confirm network transactions in exchange for a yield. The migration to POS will attract a number of institutions, especially ones using complex derivative trading strategies. For example, staking platforms like Lido allow users to stake their ETH and receive stETH, which can used as collateral to borrow more ETH to stake again. Essentially earning more yield from staking.

MAJR Take: These staking strategies are very complex and can be risky for the average person. The main takeaway is that users can stake their own ETH for yield in ETH, which is like earning interest in a deflationary currency. When lots of users do this it removes ETH from the market putting increased upward pressure on price. This is a big deal and we recommend reading our 2020 post about the ETH 2.0 Internet Bond.

More on Crypto

MACROBiden Team Weighs a Massive Release of Oil to Combat Inflation

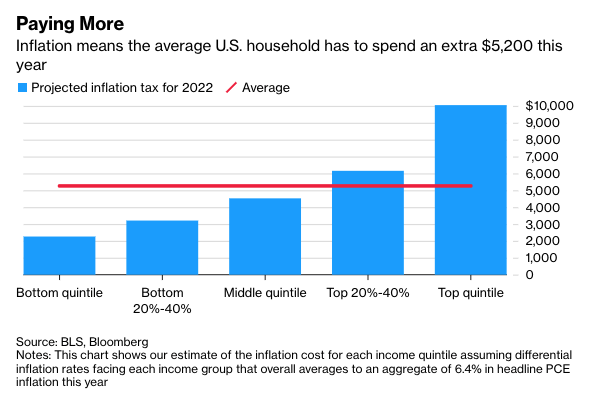

Mid-term elections are this fall and the Biden administration is under political pressure to bring down the cost of gas and inflation. Their plan is release up to 1 million barrels a day of US oil reservers for several months, totaling 180 million barrels. They’re also trying coordinate with energy exporting countries to increase production in order to lower prices. In addition, Russia is threatening to cut of the flow of oil to western countries if they don’t settle in the Russian ruble, which G7 countries said they would refrain from doing, however they rely on Russia for more than 40% of their supply.

MAJR Take: This is the beginning of the end of the Petrodollar system where countries have had a quasi-mandate to trade oil in US dollars since 1973. It will most likely be very difficult to convince OPEC nations and energy exporting countries to increase production when they’re making more for less given the higher prices.

Profits Soar as U.S. Corporations Have Best Year Since 1950

Profits surged 35% last year with the average profit margins peaking in the second quarter at 15%, the most since 1950. This was fueled by strong consumer demand and government handouts. Fed data suggests that Americans accumulated $4.2 trillion in extra savings since 2019.

MAJR Take: While profits may be up, they’re denominated in debased dollars in highly inflationary environment where corporate and consumer buying power is impaired across goods, services & financial assets. Of course the nominal numbers are at all time highs - there’s more dollar units in the system.

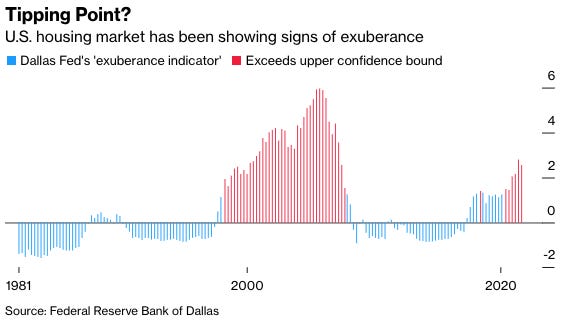

Home-Price Growth Accelerated in January

Average home prices were up 19.2% YOY ending in January. This is predominately due to the limited amount of homes for sale as inventory has decreased to its lowest point since 1999. Mortgage interest rates have climbed, with the average 30-year fixed mortgage above 4.4% last week, up more than 1% since the start of the year.

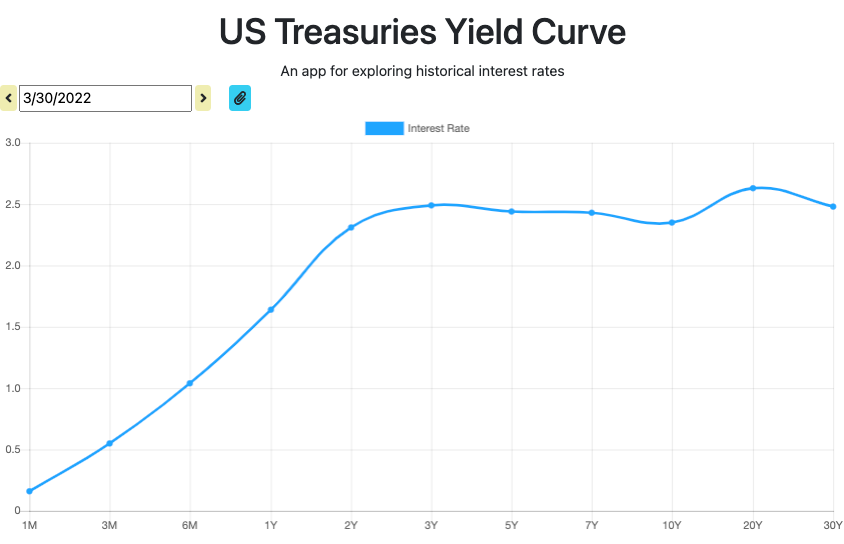

White House Plays Down Yield Curve as U.S. Recession Indicator

The bond market is flashing signs of incoming recession as short term yields are inverting against longer duration bond yields. The administration and Secretary of Treasury Janet Yellen are playing down treasury market warning signs saying the chances of a recession are slim with hot jobs market even with high inflation.

MAJR Take: When the US and G7 countries seized Russia’s $630 billion in foreign treasury reserves, they have created a cause for caution to international buyers. If the bond market continues to sell off there may be less demand, which will be the next step before we see yield curve control from the Fed to cap interest rates in order to ease market panic. This will only exacerbate the current inflation problem making things much worse.

More on Macro

Risk of a 1970s-Style Inflation Shock is Rising, Warns Brevan Howard

Home Prices Suggest Housing Bubble Brewing in U.S., Dallas Fed Says

MEDIABitcoin Round Table w/ Joe Carlassare, Jeff Ross, and Jay Gould (BTC070)

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.