MAJR News: March CPI rolls in for the Eurozone and it's not pretty with 7.5%. Developing markets are much worse.

Bitcoin backed mortgages in Florida, 90% of all BTC has been mined, Luxury brand Off-White to accept crypto payments, Gemini survey finds increased crypto adoption, Inflation numbers are accelerating

@simstim

MAJR NEWS BRIEF

Video

Jason Yanowitz and Santiago Roel Santos are joined by Do Kwon, founder of Terraform Labs. Do explains Terra’s evolving roadmap, how UST will be the most dominant stablecoin in the interchain world, and why Terra is adopting BTC as a reserve asset. Do is an absolute force - don’t miss his alpha on Terra, Anchor, bridges and more.

Top Stories

BITCOINCrypto Firm Sidesteps TradFi Hurdles With Bitcoin-backed Mortgage Offering

Digital asset lending continues to grow with increased adoption, but this time it’s to get a mortgage. Crypto millionaires are reluctant to sell their coin, but want to buy a nice apartment, so digital asset lender Milo is offering bitcoin backed mortgages. Borrowers can collateralize their bitcoin and get financing up to 90% of their mortgage with a 10% bitcoin downpayment on 15 to 30 year mortgage rates. This is of course happening in Florida, which seems to be the center for crypto in the US.

Trudeau Challenger Wants Canada to Embrace Bitcoin

Canadian conservative leader, Pierre Poilievre has been a long time critic of his government’s appetite for increased spending and budget deficits without accountability or reason. He’s now flipped to bitcoin and crypto as a way out of the government’s mess and has made it core to his campaign to make Canada the blockchain capital of the world. He’s running to challenge Prime Minister Trudeau in the next election.

MAJR Take: Crypto has gone political and the conservative party seems to be aligned, however, it’s money and it shouldn’t be politicized. If you haven’t seen Pierre Poilievre’s YouTube videos breaking things down in Congress, then you should check it out. He’s great and speaks plainly.

Crypto Funds Draw Inflows for Second Straight Week

Crypto investor inflows increased for the second week in a row with nearly $180 million in net flows.

More Than 90% of All Bitcoin Is Now in Circulation. What's Next?

The 19th million bitcoin was mined this past Friday and 90% of the coins are now in circulation. At face, this may seem concerning as one may think there’s not enough bitcoin to go around / last. However, the digital asset can be divided into smaller units called Satoshis “sats” (8 decimal places). The 4-year halving cuts the amount of coins distributed per block in half - currently at 6.25 BTC, which is valued ~$300k and on March 2, 2024 it will be cut to 3.125 BTC. The final bitcoin is set to be issued around 2140.

MAJR Take: Bitcoin and it’s holders thrive off the first rule of economics - supply and demand. Right now, we’re seeing incredible demand for a digital store of value that’s designed to increase compared to the evaporating fiat currencies all over the world. Not to mention, the sovereign debt crisis looming around the corner. The supply side of the equation just keeps getting smaller. Bitcoin’s price and network is like an indestructible balloon - there’s only so much actual rubber but it keeps expanding and expanding as air flows in making the ballon bigger as a whole to float higher and higher.

More on Bitcoin

CRYPTOGemini Report: Crypto Reached ‘Tipping Point’ in 2021

Nearly 40% of global respondents in a Gemini survey said that they bought crypto for the first time last year. Nearly 60% of the adults in Africa and Latin America said crypto is the future of money, compared with 23% in the US. And, 41% of respondents who said that they didn’t own any crypto, said they were interested in learning more or are likely to acquire some in the next year. The store of value narrative in the face of mass inflation, especially in developing countries seems to driving the increased interest.

Luxury Brand Off-White Accepts Crypto Payments Across Flagship Stores

Luxury fashion brand, Off-White has started to take crypto payments. The company generated $7 billion in sales last year and now accepts bitcoin, ether, binance coin, XRP, tether and USDC. Other crypto friendly brands include - Hublot, Philipp Plein. Off-White’s consumer base consists of mainly Millennials.

MAJR Take: Future generations, especially the current younger generations understand the value digital items in a digital world. Crypto adoption for payments is popping up with celebrities, brands and musicians - you can see it across social media. We’re early, but we’re moving fast.

Dogecoin Rallies 9% As Elon Musk Takes 9.2% Stake in Twitter

Elon Musk buys 9.2% personal stake in Twitter, which then pumped Dogecoin by 9%. He purchased 73,486,938 shares of common stock for $2.8 billion. The stock then jumped more than 26% since the announcement. His first suggestion for Twitter is an edit button.

Staking Project Lido Finance Surges As Ethereum Merge Looms

As the Ethereum Merge to Proof-of-Stake approaches, Lido (LDO) the ETH staking service has jumped 15% this past week. Lido allows users to stake their ETH for a yield and rather than be locked up, they provide you with a loan against your staked ETH as collateral in stETH for liquidity. The service is more popular with institutional investors taking on leverage for more complex derivative trading strategies.

More on Crypto

As Crypto Regulatory Scrutiny Builds, Gensler Urges Firms To Register With SEC

PwC: More Than 80% of Central Banks Are Considering Launching a CBDC

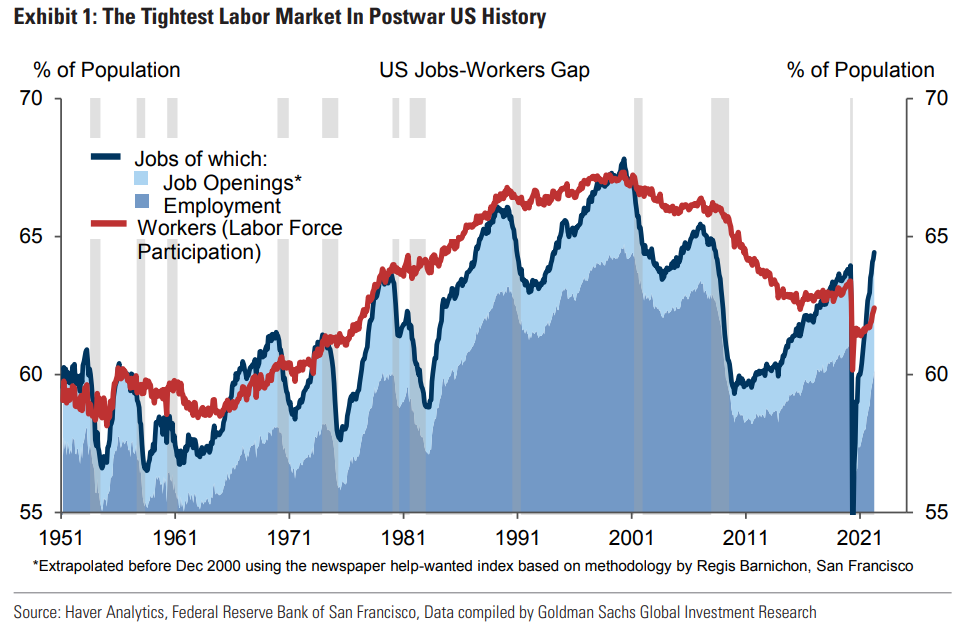

MACROU.S. Labor Market Is Tightest of Postwar Era, Goldman Gauge Shows

The labor market is apparently very tight with more jobs than workers, which worries the Federal Reserve as inflation pressures technically rise as salaries increase to attract demand. The data shows a gap of 5.3 million job openings compared to the supply of workers. US unemployment rate is currently 3.6%. Financial conditions will need to tighten much more and analysts forecast that rates will need to rise above the Fed’s 3%-3.25% in order to cool down inflation and a hot economy. Rates are currently 0.25%-0.50%.

MAJR Take: I’m seeing the inflation being quoted at 6.4% - the Fed’s preferred gauge for inflation on multiple articles across multiple publishers. This is fake news as the preferred gauge - “core inflation” does NOT include energy or food prices - the two things every person needs and spends the most money on. Inflation is much higher - the February numbers in CPI were 7.9% and will be closer to double digits in March. These are the numbers they’re reporting and CPI is most likely much closer to 20% given the increase in money supply, cost of housing and rent and the massive spike in energy and food prices. Be aware of the mainstream narrative as we move into more turbulent times. This article was from Bloomberg.

Inflation Weighed on Consumer Spending Growth in February

Consumer spending slowed in February, down by 2.7% from January. Spending in the services industry such as restaurants is steady, while spending on consumer goods declined 1% and purchases for new and used vehicles declined by 4% in February.

MAJR Take: This time the Wall Street Journal - only quoted the Fed’s preferred gauge for inflation. They even posted it front and center in the sub-heading of the article (image above). CPI was 7.9% in February and the CPI components only had price increases for housing at 5.95% (which makes up 42% of the basket)…This doesn’t make sense, we all know housing has been reported to be much higher, 20% YOY. The point is - you have to think for yourself and question the narrative because the mainstream media, government and monetary authorities are fearful about today’s economic situation and will do or say anything to keep order. While, they may be acting in good faith - it’s still not the truth and people need to know the truth in order to make good decisions and to protect themselves.

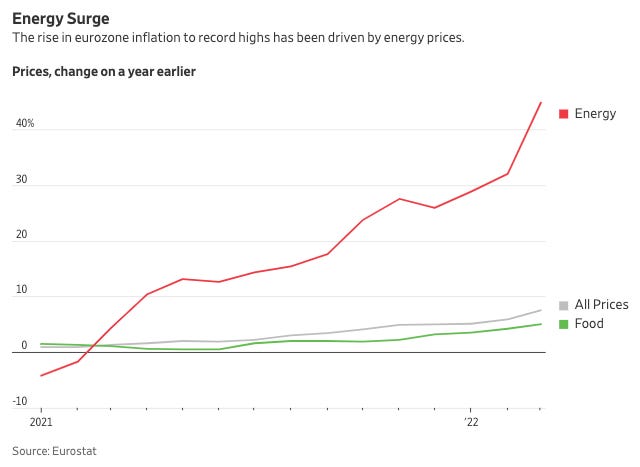

Eurozone Inflation Soars to 7.5%, Raising Pressure on ECB

European March CPI jumped from 5.9% in February to 7.5%. Driven by the 44.7% increase in energy prices as Europe gets nearly 45% of their energy from Russia. Food prices increased to 5% in March from 4.2% in February. The ECB was planning on keeping rates low for more accommodative policy, but these numbers could change things. Investors are anticipating rate hikes and are rotating out of bonds where they’re guaranteed to lose money in real terms.

The World Is Piling on Debt as It Battles Inflation

The rise in food and energy prices are putting pressure on governments to pick up the tab with handouts, “helicopter money.” While, “free money” sounds good, it’s like pouring gasoline on a fire. Governments around the world are drowning in debt. Increased spending puts more fiat units into economies and increases prices by devaluing the currency. Eurozone nations ran budget deficits of about 4.5% of GDP on average. Protests have broken out all over the world such as Sicily, Greece, Spain, Nigeria, Egypt and Bangkok requesting more subsidies from the government. The protests have a common theme popping up with truck drivers and the blue collars workers - the people that actually get our goods from A to B. This was highlighted in the Canada truck driver protests earlier this year. It’s even worse for emerging markets that need to refinance their $7 trillion of international debt, up from $5.5 trillion in 2021. This of course is based in harder currencies such as the dollar, euro or yuan, which means they need for further debase their local currency by printing to service debt payments. Developing countries are facing food and energy shortages - Egypt as an example buys 70% of their wheat from Ukraine and Russia and is now breaking out in food protests following price controls.

“They are making it too expensive for us,” said Mohammad Fakhani, the owner of several bakeries and dessert shops in Beirut. “The price of a bag of flour keeps multiplying, it’s like fiction.”

MAJR Take: If you haven’t been paying attention, now is the time. The US “hot economy narrative” can quickly turn negative, as the rest of the world decelerates into chaos. Deglobalization increases inflation and friction between economies driving instability and unrest.

More on Macro

MEDIADo Kwon: Why Terra is Buying $10 Billion Bitcoin

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.