MAJR News: Fed Chair stands firm on .25% rate hike in March FOMC meeting

Bitcoin continues to pull the crypto market higher, SEC probing into NFT markets, Ukraine has received $50M in crypto donations, Russians pulled $14B from banking system in 24hrs, Women enter web3

@airyvision

MAJR NEWS BRIEF

Videos

Preston Pysh talks with Luke Gromen about Luke's overview of the macro landscape since the Russian invasion of Ukraine, Bitcoin's potential involvement, and much more.

Top Stories

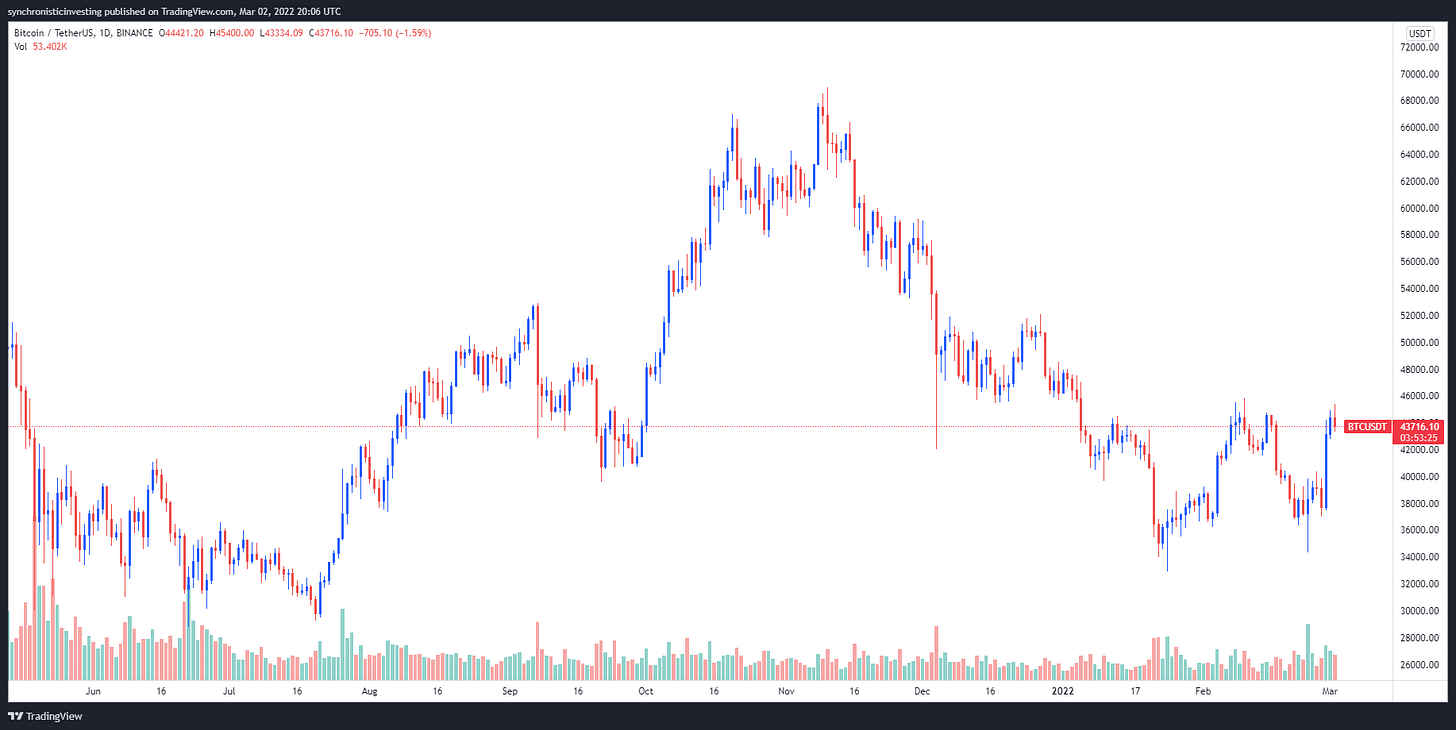

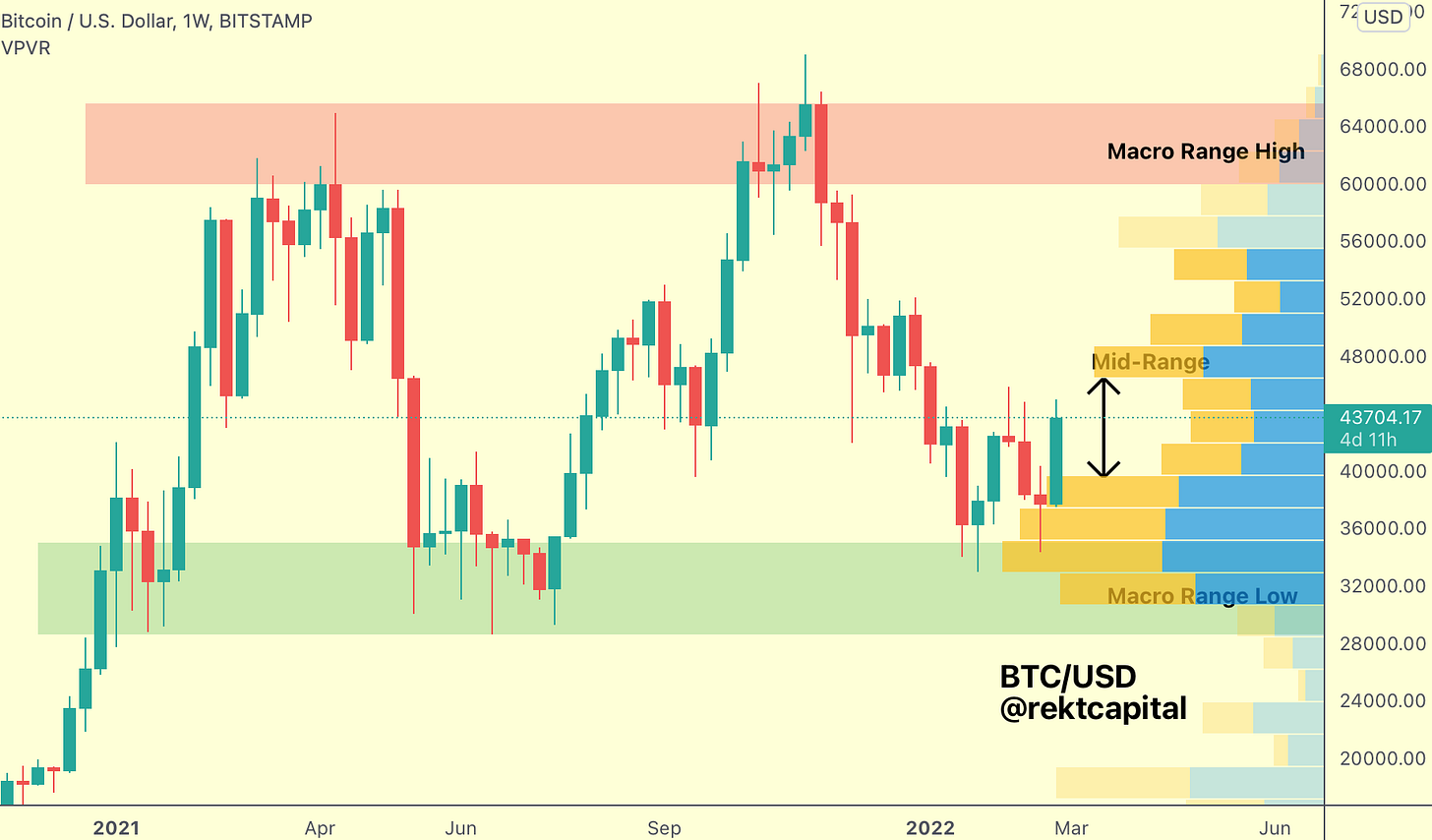

BITCOINAnalysts say bulls will aim for $48K now that Bitcoin’s ‘accumulation phase’ has begun

Bitcoin has seen an increase in demand and trading volume since Russia invaded Ukraine, jumping from $37k to $44k, before stalling at strong resistance levels at $45k. The digital asset has taken center stage as a possible vector for Russia to avoid sanctions and as an effective way to send donations to the Ukrainian government and people. Given the strong bounce, some analysts see these levels as time for accumulation with little worries of dips into the $28k range, while others are waiting to see what the Fed does on the March 16 FOMC meeting. Despite the economic uncertainty, the Fed is still expected to combat record inflation levels and hike rates, which isn’t good for bitcoin, crypto and risk assets.

MAJR Take: While, we’re confident that bitcoin will perform in the medium and long term, it’s probably best to let the dust settle and see how things play out post Fed meeting and where the Russia Ukraine situation goes in the next couple weeks. This strong move could be a bull-trap.

Bitcoin Decouples From Traditional Markets Amid Russia-Ukraine Conflict

Over the past month, the S&P 500 and the NASDAQ has dropped about 6%, while Bitcoin and Ethereum have both risen roughly 18%. Crypto focused stocks have also performed better than the overall market as Block (SQ) is up 10.5% and Coinbase (COIN) is up 4.7%. Digital asset investors have waited for the great “decoupling,” but it’s still too early to tell in this financial environment.

Ukrainians Buy Record Sums of Bitcoin on Binance After Russian Invasion

Data shows that Ukrainians are buying up huge amounts of bitcoin and the Tether stablecoin on Binance, the largest crypto exchange to stash their wealth during the Russia invasion. Trading volume shot up to $8.5 million before the invasion in a 24hr time period. Cryptocurrency trading activity has also surged in Russia as civilians dump the crashing ruble to buy bitcoin, again mostly on Binance. The Ukrainian government also announced that they are accepting donations in Polkadot, the 11th largest cryptocurrency by market cap.

More on Bitcoin

Bitcoin Celeb Brock Pierce Outspending Rivals in Vermont Senate Race

Bitcoiners Were Right: Weaponized Finance Just Created a Post-Dollar Planet

CRYPTOSEC Targets NFT Creators, Marketplaces Over ICO-Like Sales: Report

The SEC has reportedly sent subpoenas to NFT marketplaces and creators as part of its investigation into NFTs as possible unregistered securities used to raise money and skate regulation. The federal agency sees some NFTs that pay royalties to creators when sold on secondary markets akin to unregistered security, just a new variation of an ICO (initial coin offering).

MAJR Take: The SEC seems to hate financial innovation, risk taking and individuals leveraging technology to monetize their creativity. It’s always under the guise of “investor protections,” but it’s most likely the agency probing to claw back control. I’m not sure how they plan to regulate millions of people around the world launching an art project on a blockchain and stopping people from purchasing and trading the asset on decentralized networks.

Terra’s LUNA Passes Ether to Become Second-Largest Staked Asset

Terra (LUNA), an alternative layer 1 smart contract blockchain which includes a native algorithmic stablecoin (UST), has passed Ether to become the 2nd largest staked asset with ~$30 billion worth of tokens staked on their network. Users stake their LUNA token to receive about 7% in yield. Some 41% of eligible tokens are staked on their network. Solana holds the crown has the number one staked asset with over $40 billion staked on its network, however both are dwarfed by the economic and user activity taking place on Ethereum.

Pplpleasr’s Shibuya Video Platform Uses Ethereum NFTs to Fund and Shape Films

Shibuya is a web3 video platform built on Ethereum using NFTs and tokens that’s part Kickstarter and part Netflix as the platform lets users vote with NFTs to help fund films while also influencing their storylines. This drastically differs from the traditional Hollywood model that’s very political and complicated with middlemen, paperwork and legalities needed to find, fund and distribute films.

Leveling up: 1 in 3 Women Plan to Buy Crypto in 2022

The crypto financial firm, BlockFi conducted a survey that the once male dominated industry is seeing an influx of female crypto enthusiasts. The data showed that 24% of women own crypto and 70% of those are hodling with no plans of selling. Additional data showed that 45% of women know how to buy crypto, up 2x over the last 6 months. However, 80% of women find it confusing and 72% said it’s too risky.

More on Crypto

US lawmakers and Fed chair push for crypto regulation in wake of Russia sanctions

Bob Dylan and Miles Davis NFTs Planned as Sony and Universal Join Solana Marketplace Snowcrash

Square Enix Enters The Sandbox Ethereum Metaverse With Dungeon Siege

Ukraine Now Accepts Dogecoin Donations Amid Russian Invasion

Polymer’s $3.6M in Seed Funding Says IBC Is the Future of Crypto

MACROPowell Plows Ahead Toward Rate Hikes With Eyes on War Impact

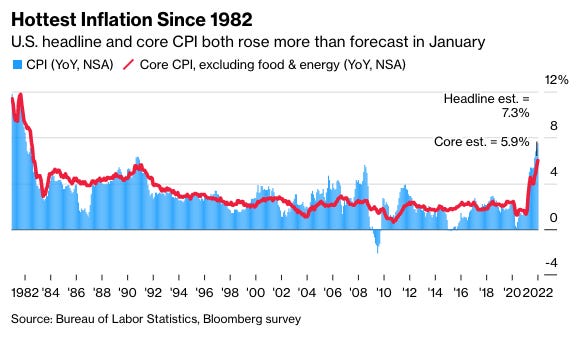

Fed Chair Jerome Powell, spoke in front of the House Financial Service Committee today and said he’d support moving forward with a 25 bps rate hike at their March meeting in two weeks. Powell confirmed they’re also making plans to shrink the balance sheet. In addition, he said the labor market is extremely tight as employers are having a hard time keeping employees as workers are quitting jobs for higher wages which only fuels inflation. Therefore, the Fed feels that they’ve met their full employment mandate and the best thing they can do for the economy is support price stability.

MAJR Take: There are some that feel that the Fed is making a mistake by tightening into a slowing and weak economy despite the increase in payrolls, while some analysts believe that the Fed is tightening in order to restore its credibility during a time when inflation is at record 40 year highs. Others feel that the Fed needs to increase rates to provide some cushion and room to maneuver during such uncertain times, such as lowering rates again.

“I am inclined to propose and support a 25 basis-point rate hike,” Powell told the House Financial Services Committee Wednesday. “To the extent that inflation comes in higher or is more persistently high than that, then we would be prepared to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings.”

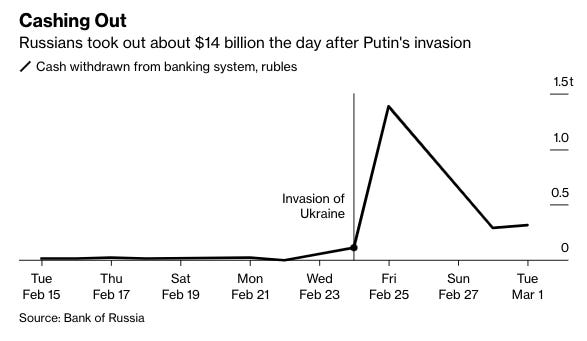

Resignation Sets In as Russians Face Their New Economic Reality

One day after Putin ordered the attack on Ukraine, Russians fled to the ATMs and banks to withdraw their savings, cashing out $14 billion in 24hrs. The Russian Central Bank has taken extreme measures to prevent further bank runs by increasing the interest rate to 20%, banning foreigners from divesting Russian assets and freezing local equity trading since Friday. The $1.5 trillion economy could shrink between 3%-5%.

Eurozone Inflation Climbs to Fresh High as Russian Invasion Confronts ECB With Dilemma

European Union inflation rate hit new highs, increasing from 5.2% to 5.8% in February largely driven by energy prices. Europe gets 40% of their energy from Russia. Markets have started price oil higher anticipating a Russian move to cut their flows to Europe despite still flowing. The higher CPI numbers put the ECB and President Legarde on their heals as they’ve been determined to keep rates low and provide accommodating monetary policy. JPMorgan analysts expect the European economy to slowdown over the next three months as higher energy prices means less consumer spending.

More on Macro

Soaring Fertilizer Prices Are About to Increase the Cost of Food

Wall Street Is Buying Starter Homes to Quietly Become America’s Landlord

MEDIABTC067: Russia Ukraine War & Global Macro Impacts w/ Luke Gromen

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.