MAJR News: Ethereum leads the crypto market as the protocol upgrade to Proof-of-Stake nears.

Ray Dalio inches closer to a crypto fund, Texas Congressman support Bitcoin mining as central part to US energy policy, $6B of ETH burned since August upgrade, Yield curve inversion closely watched

@majortomagency

MAJR NEWS BRIEF

Videos

PBD Podcast Episode 128. In this episode, Patrick Bet-David is joined by Adam Sosnick and co-founder of MicroStrategies Michael Saylor.

Top Stories

BITCOINRay Dalio’s Bridgewater Investing in Crypto Fund: Sources

Billionaire investor, Ray Dalio and his firm Bridgewater Associates, the world’s largest hedge fund with $150 billion in AUM are inching towards backing a crypto fund in 2022. It’s unclear if they’ll be directly investing into bitcoin and digital assets themselves or gain exposure through proxies like the futures market, companies like MicroStrategy or crypto related funds like Pantera or 10T.

MAJR Take: Ray is relatively late to the bitcoin and crypto scene, despite the fact that he’s been writing about the long-term debt cycles, a global monetary reset and a changing world order for the last 10-15 years. However, last year he publicly flipped his negative opinion on bitcoin to a possible solution as a global store of value.

Texas Congressman Endorses Bitcoin Mining for US 'Energy Independence'

Congressman, Rep. Pete Sessions (R) from Texas wants Bitcoin mining to become a key component of US energy policy and its path to energy independence. His remarks come at a time when energy prices have soared due to the Ukraine-Russia War and US & EU officials are begging energy exporters Saudi Arabia, Venezuela and Iran for increased access and production. Bitcoin miners have been flocking to Texas due to policy and cheap energy. Argo Blockchain, a mining company purchased 300+ acres in West Texas last spring, while Foundry is partnering with or buying up solar and hydroelectric firms in the state. Texas has the 4th highest Bitcoin mining hashrate than any state. Sessions joins other Texas politicians on the Bitcoin bandwagon - Sen. Ted Cruz and Governor Greg Abbott.

Malaysia Should Make Bitcoin, Crypto Legal Tender: Deputy Minister

The Deputy Minister of Communications and Multimedia in Malaysia urged the government to adopt Bitcoin and cryptocurrencies as legal tender. The minister governs sectors like broadcasting and internet infrastructure. Like many other countries, Malaysia has publicly stated their research for a central bank digital currency, but nothing publicly about an El Salvador bitcoin adoption style like event.

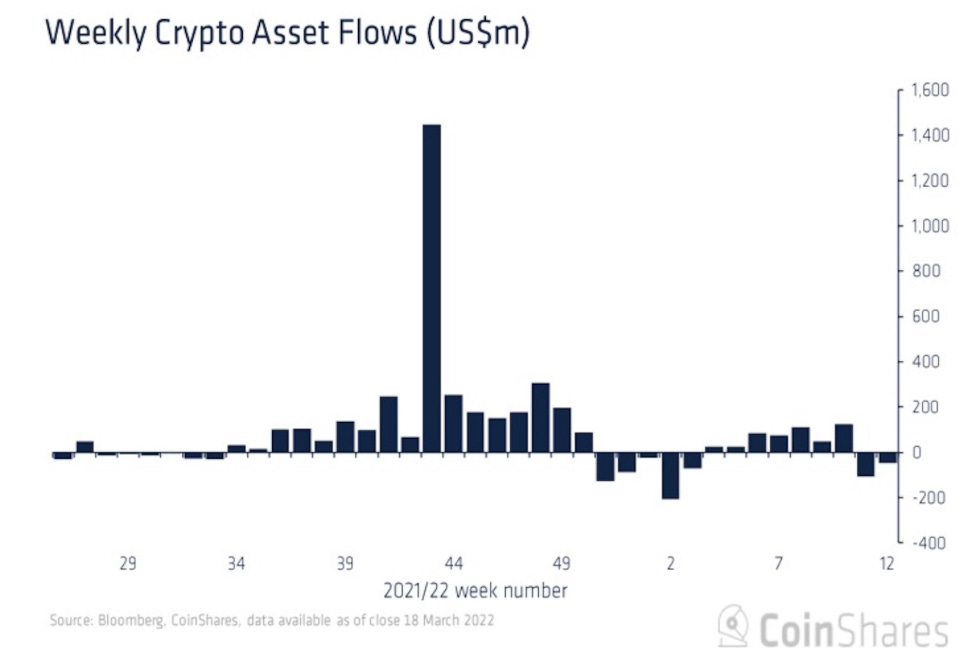

Crypto Funds Suffer Second Straight Week of Outflows

Investors pulled capital from crypto funds for the second week in a row despite bullish price action to finish last week. Around $50 million was redeemed from crypto products, bitcoin leading followed by ether. Altcoin funds saw relatively small inflows.

MAJR Take: When you look at the chart above, there’s just a lot of uncertainty and indecision on the direction of the market. While, investors may be pulling capital from crypto products, there’s still $53.7 billion in AUM across these products.

More on Bitcoin

Goldman Sachs Conducts First Over-the-Counter Crypto Trade With Galaxy

SEC Delays Spot Bitcoin ETF Offerings From WisdomTree and One River

Demand for El Salvador’s Bitcoin Bond Surges Amidst the Global Uncertainty

CRYPTONearly $6 Billion in ETH Burned as Ethereum 2.0 Edges Closer

Ethereum, the 2nd largest blockchain by market cap has burned over 2 million ETH or ~$6 billion since the EIP-1559 protocol upgrade happened last August. The upgrade introduced a burning mechanism that destroys ETH transaction fees from circulation in an effort to make the protocol more deflationary. So far, it’s doing just that, as its annual issuance is currently pacing below bitcoin’s. You can see ETH being burned - here.

Ether Outperforms Bitcoin as Excitement Builds for Software Upgrade

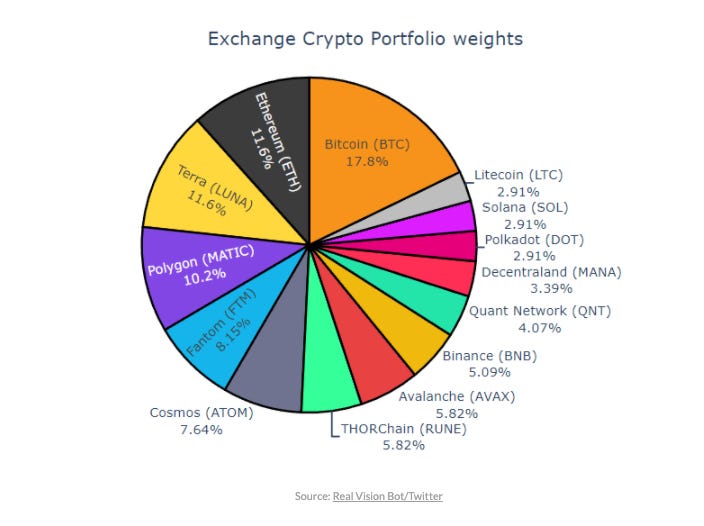

Real Vision ‘Hive Mind’ Bot Favoring Bitcoin, Ethereum, Terra and One ETH Competitor As Altcoins Bounce

Real Vision, the finance focused media company has a bot called ‘Hive Mind’ that crunches data and crypto metrics to create a weekly portfolio allocation. Apparently, the bot has outperformed the market by over 20%. The latest portfolio allocation reveals a diversified approach as follows: BTC - 17.8%, ETH, LUNA - 11.6%, MATIC - 10.2%, FTM - 8.15% and ATOM - 7.64% with the remaining assets below a 6% allocation. All large cap tokens.

Crypto users in Africa grew by 2,500% in 2021

KuCoin, a crypto exchange detailed a report showing rapid adoption of crypto in African countries. The exchange said the number of transactions increased by 2,670%. These numbers look astronomical because they’re starting from such as low base. Only 2.8% of the global volumes come from African nations.

MAJR Take: While small, these numbers shouldn’t be taken lightly. Mobile adoption has penetrated African populations and there’s no central trusted authority or legacy banking infrastructure that would detour the growing user base of digital youths. The median age in the continent is 19-years old and 40% of the population lives in urban areas with young people exploring programming and computer technologies for the first time.

Commonwealth Bank Of Australia Plans To Expand Crypto Services

The country’s largest bank by volume disclosed its intentions to expand its crypto services due to increasing consumer demand. They launched their crypto services in November and now plan to offer a full spectrum of services, although no specification around types and digital assets on the table.

More on Crypto

MACROPowell Says Fed Will Consider More-Aggressive Interest-Rate Increases to Reduce Inflation

Fed Chair Jerome Powell gets real with Americans stating that will be difficult to slow down inflation without creating a recession and that no one expects central banks to stick a soft landing. He said was prepared to raise interest rates by more than 0.25% at each of the consecutive FOMC meetings. The next meeting is in May. Last week they raised the federal funds rate off near 0% by 0.25%. The market had this move baked in and is showing mixed signals between bulls and bears.

MAJR Take: Be aware of language around “core inflation,” the Fed’s preferred gauge for inflation which excludes food and energy costs. It’s about 2% lower than CPI. The only reason this measurement exists is to obfuscate and downplay the economic realities facing the country since everyone needs food and energy.

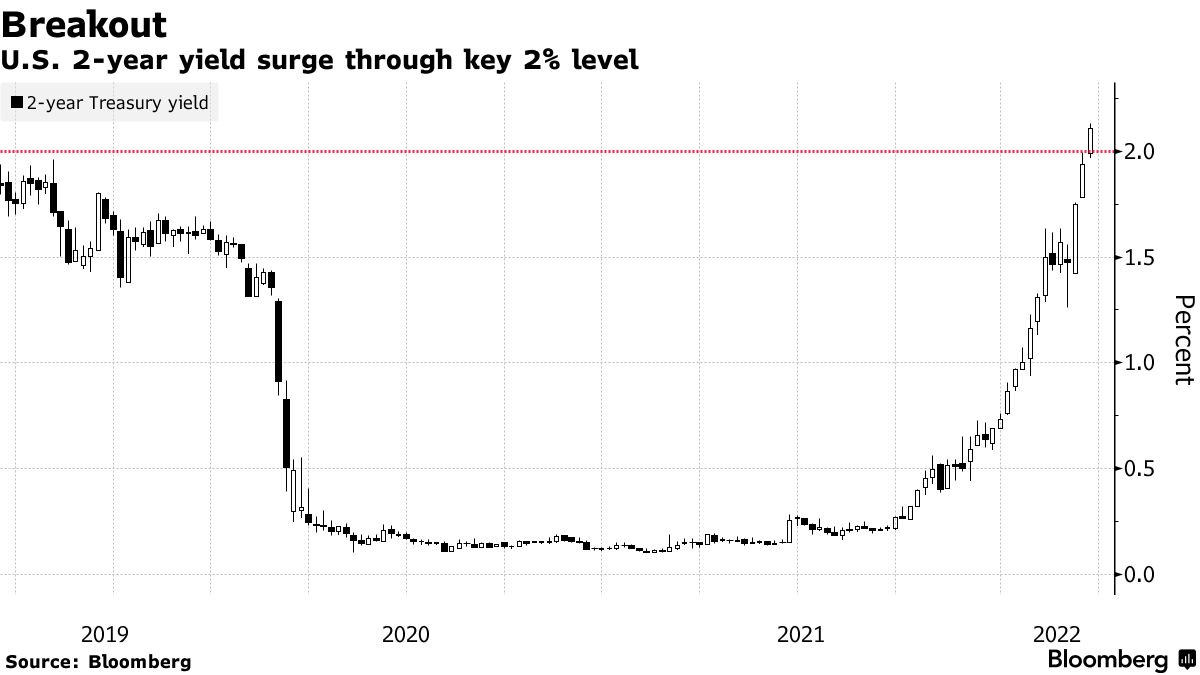

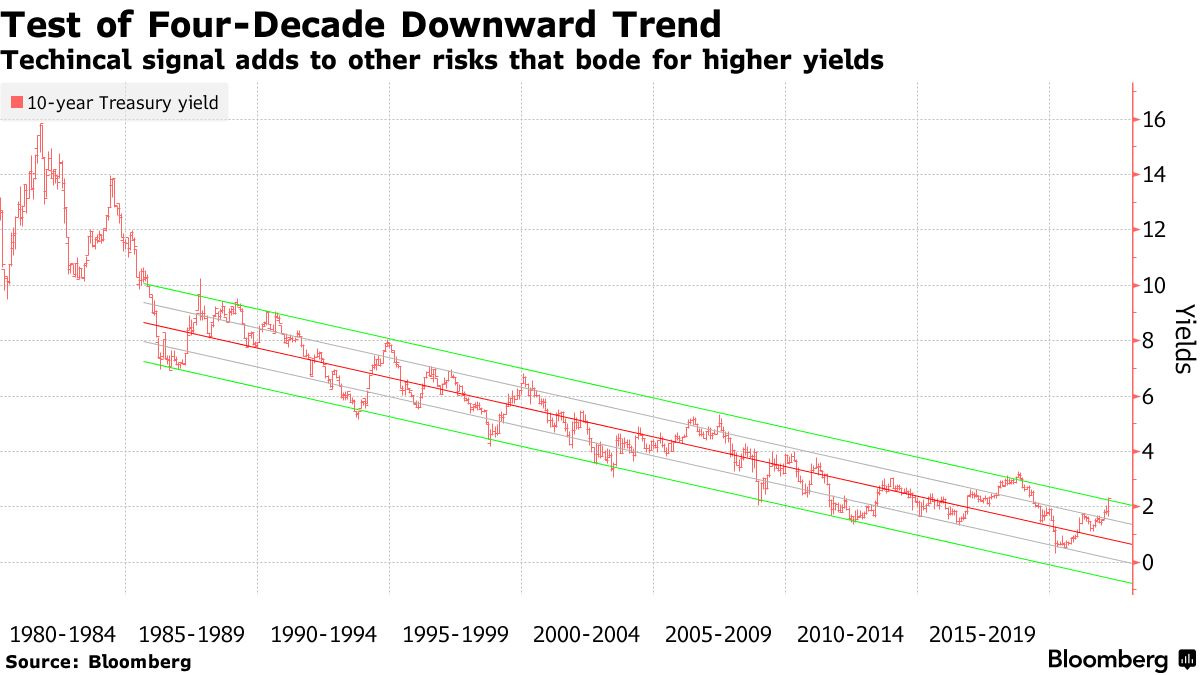

Bonds Extend Drop After Fed Sparks One of Worst Days in Decade

US Treasury yields jumped after Powell’s transparent and aggressive remarks about managing inflation in the near term without breaking the economy. Bond yields typically go down in times of uncertainty as investors rush to risk-off assets such as treasuries, especially those with a shorter duration such as two-year notes compared to 30-year bonds. However, yields on the 2-year rose 5 basis points to 2.17% on Tuesday, after an 18 basis point climb on Monday. The spread between 5-and 30-year yields narrowed, the smallest its been since 2007. If the yield curve inverts, meaning yields on the shorter end rise to that of the longer end, it means investors are buying longer duration bonds with more risk to avoid short term inflation and economic concerns.

The chart above details the 40-year downtrend in the 10-Y Treasuries. As you can see, yields are testing the top of the range. The 10-Y chart is considered the “chart of truth” by many analysts as a barometer for the economy. If yields break this range, it means investors are selling off bonds and getting out of cash equivalents because of inflation concerns. They need yield to protect their buying power. Bond holders are the investors most hurt by inflation as they get paid back in depreciated dollars and are guaranteed to lose money in real terms if they hold these instruments until maturity.

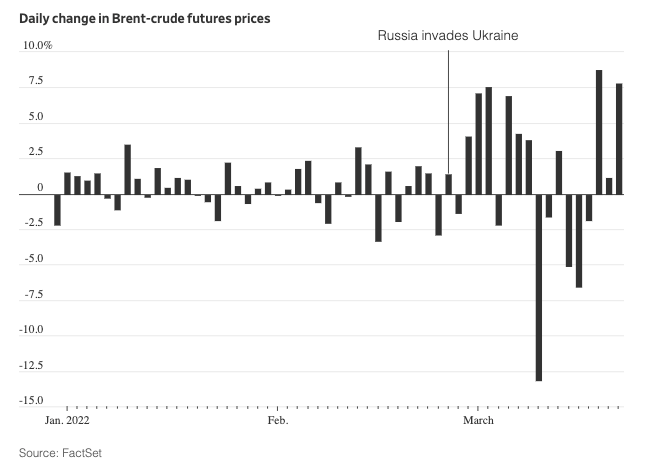

Cash Crunch Drives Wild Moves in Commodities

Exchanges and brokers are demanding more money up front to trade oil, wheat and natural gas, straining markets amid supply disruptions from war in Ukraine. Commodity traders are not only dealing with huge price swings, but cash in advance requests or more margin to deal with the volatility in prices. This puts even more pressure on liquidity constraints and adds more risks to possible liquidations.

MAJR Take: While the crypto market is running and looking through the uncertainty as the best inflation hedge with the highest possible returns, there’s cracks everywhere in the system that could lead to a possible March 2020 like liquidity crisis. Be careful out there.

China’s Big Tech Firms Are Axing Thousands of Workers

The economic slowdown in China is real and the biggest technology companies - Tencent, Alibaba and Didi are starting to cut workers in the thousands to reduce overhead. Some cuts represent more than 20% of their staff in some units. Outside of economic concerns, the layoffs are due to China’s recent government clamp down on tech. The layoffs follows are larger trend in China as the unemployment numbers have climbed, 5.5% up 0.4% at the end of the year.

MAJR Take: This is President Xi and government’s role in China’s “communist-capitalist” society. Unlike the US, which cares more about individual freedom, the Chinese care about the collective and they want the best from both capitalism and socialism, which can mean an aggressive oppression on free market principles.

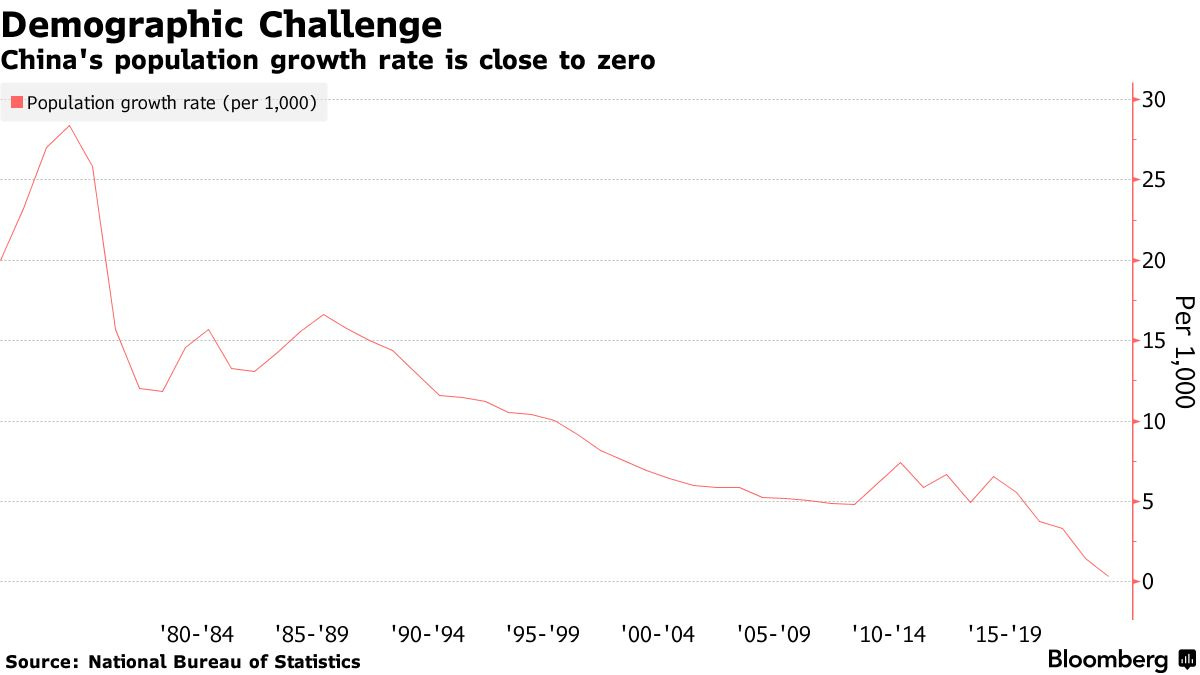

China’s Population to Peak as More Provinces Report Declines

China’s population of 1.41 billion people may have peaked at the end of last year. The country growth rate is rising at the slowest pace since the 1950s. The number of babies born in China was down by 1.4 million in 2021 from 12 million in 2020 and the number of marriages has hit its lowest point since 1982. The demographics don’t look good, they have a huge elderly population leaving the workforce without many replacements. This adds significant pressure to boost demand from migrant workers, granting them city permits to increase the workforce to maintain economic growth, an estimated 5.5% this year.

Year-Ahead Inflation Expectations Surge, Survey Finds

University of Michigan survey reported that consumer see inflation at 5.4% (March) compared to 4.9% (Feb) by the end of 2022. Five year expectations were held at 3%, still much higher than the Fed’s target 2%.

More on Macro

MEDIAPBD Podcast | EP 128 | Patron Saint of Bitcoin: Michael Saylor

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.