MAJR News: End of the Petrodollar. Saudi Arabia Moves Closer to Energy Deal with China Settling in the Yuan.

Billionaire investors flip from bearish to bullish on bitcoin, Possible bitcoin bottom and reversal, New South Korean President is Pro-Crypto, ApeCoin for BAYC drops today, Fed raises interest rates

@dualvoidanima

MAJR NEWS BRIEF

Videos

In this episode of On The Margin Mike is joined by returning guest Danielle DiMartino Booth, CEO & Chief Strategist for Quill Intelligence. As a former advisor at the Federal Reserve Bank of Dallas, Danielle provides a unique insight into the Fed's policy decisions throughout 2022.

Top Stories

BITCOINBitcoin Pops Above $41K as Crypto Market Shows Signs of Recovery

Bitcoin was up 5% yesterday while Ethereum was up 6% after Fed Chair announced the first rate hike since 2018. The market has been in a tight trading range, but sentiment and on-chain analysis shows signs of improvement. Demand has returned on-chain and long-term futures market are showing signs of reversing from selling into buying. This could be a macro bottom.

Bill Gross, 'King of Bonds' and Prominent Crypto Critic, Invests in Bitcoin

Bill Gross, ‘King of Bonds’ and founder of PIMCO, a firm with with $2.2 trillion in AUM admitted he was wrong about bitcoin and now holds a small position. To be clear, he still believes that crypto is in a bubble with most tokens going to zero.

MAJR Take: We agree with Bill, most of these tokens are going to zero. But, bitcoin has proved itself and will benefit from the migration away from bonds, as the $100 trillion asset class is bleeding with more than $17 trillion in negative real yields, guaranteed to lose money for investors.

Billionaire Ken Griffin Admits He Was Wrong About Bitcoin, Crypto

Billionaire investor Ken Griffin and founder of Citadel Securities is changing his tune about bitcoin and crypto. A once fierce critic of the technology admitted he was wrong and alerted the market that his firm will be investing in the asset class.

"Crypto has been one of the great stories in finance over the course of the last 15 years. And I’ll be clear, I’ve been in the naysayer camp over that period of time…But the crypto market today has a market capitalization of about $2 trillion in round numbers, which tells you that I haven’t been right on this call…It’s fair to assume that over the months to come, you will see us engage in making markets in cryptocurrencies," he said.

MAJR Take: Everyone will eventually be buying bitcoin and crypto, just at different and most likely higher prices. It’s only a matter of time.

PlanB @100trillionUSD - Inventor of the Stock-to-Flow Value Model Sees Possible Bitcoin Reversal

The infamous anonymous Dutch institutional money manager and inventor of the widely adopted Stock-to-Flow model using scarcity to value bitcoin posted a bullish chart of a possible double bottom. The zoomed out chart above is using weekly candles and shows the bitcoin price unsuccessfully breaking support to further lows (bullish). This pattern possibly means we’ve reached a potential bottom and reversal in price.

MAJR Take: The chart also shows a long term upward trend with the double bottom making higher lows (good thing), however it doesn’t mean we can’t drop into $30k price levels given the wicks into that zone. Bitcoin and crypto got smashed from all-time highs washing a lot of leverage and short term holders out which transfers coins to stronger hands. These price levels are seeing lots of accumulation from institutional investors, so retail should be layering in and holding cash for fat dips and a possible March 2020 like event. The medium to long term set-up is massively bullish, however we should be very cautious in the short term. Expect volatility.

Bitcoin rallies as new South Korean president vows crypto push

A pro-crypto candidate has been elected President of South Korea. Yoon Suk-yeol. The leader of the People Power Party supports the adoption of crypto, and his first action as president is to overhaul the country’s regulation on digital assets, introducing favorable tax laws for crypto investors and businesses. He wants to create an environment where crypto entrepreneurs can have confidence to build and create jobs and value within the country.

MAJR Take: We’re witnessing bitcoin’s game theory play out on the international stage. It won’t be long before South Korea puts bitcoin on the central bank’s balance sheet and another country announces the same. There’s only 21 million bitcoin. How many do you own? There’s limited time to front run the trillions that will flow into these assets.

More on Bitcoin

CRYPTOApeCoin Launches for Bored Ape Ethereum NFT Holders With Reddit, FTX, Animoca Execs on Board

The Bored Ape Yacht Club is launching its ApeCoin governance token on Ethereum (ERC-20) today to NFT holders as well as the general public. The token will power its ecosystem of games and commerce. The coin will be available on Binance, Kraken, FTX, and OKX. Other exchanges announcing soon.

NFTs Are Coming to Instagram Says Mark Zuckerberg

Mark Zuckerberg confirmed at the SXSW technology and music conference / festival that NFTs are coming to Instagram. Rumors are that you will be able to mint NFTs on Instagram and share those already in your collection.

MAJR Take: All big tech and publicly traded companies will use NFTs as their foray into crypto since it’s accretive to their existing business models and not disruptive like issuing a governance / utility token. Launching a token requires transparency, data and revenue sharing.

The Sandbox Metaverse Token Jumps 8% Amid HSBC, Paris Hilton Tie Up

The Sandbox (SAND) metaverse game just got a bump from HSBC, a large British investment bank and crypto-bull Paris Hilton that bought digital land on their blockchain. The Sandbox is by far the most popular metaverse, but it’s still in its infancy, although land costs between $25k for the smallest plot and $150k for the larger plots, and those closer to the action and avatar foot traffic are selling for $500k-$1M+. There’s not many users in the games, however it’s a great marketing stunt.

More on Crypto

Ethereum Wallet MetaMask Passes 30M Users, Plans DAO and Token

Ukraine President Signs Law Legalizing and Regulating Crypto Assets

MACROSaudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales

Saudi Arabia, the world’s top crude oil exporter is in talks with Beijing to price some its oil sales in the Chinese yuan, a move that would threaten the US dollars hegemony and the Petrodollar system (read post here about the Petrodollar system). The Petrodollar system was created in 1973, when the US made a deal with Saudi Arabia to price their oil in dollars and buy treasuries with the proceeds in exchange for transportation security from the US Navy. Saudi Arabia has been unhappy with Washington’s security commitments and for not interfering in the war in Yemen (a humanitarian catastrophe that mainstream media has ignored - worse than Ukraine). China buys 25% of their oil from Saudi Arabia, who produces more than 6.2 million barrels per day, 80% of the sales are done in dollars. A move to the yuan would strengthen the yuan and tilt the global power away from the US towards China.

MAJR Take: This is a HUGE deal. The writing has been on the wall for a long time as China has been in talks with Russia, Saudi Arabia and other global oil exporters to use their yuan for trade. The US dollar is not backed by gold, it’s backed by oil and this puts the US dollar reserve status at risk. The US has historically gone to war for these types of actions - Iraq and Libya are two examples.

Saudi prince, rebuked by West, faces dilemma over Russia and China

Once A Pariah, Venezuela's Maduro Now Courted by the U.S. for Oil

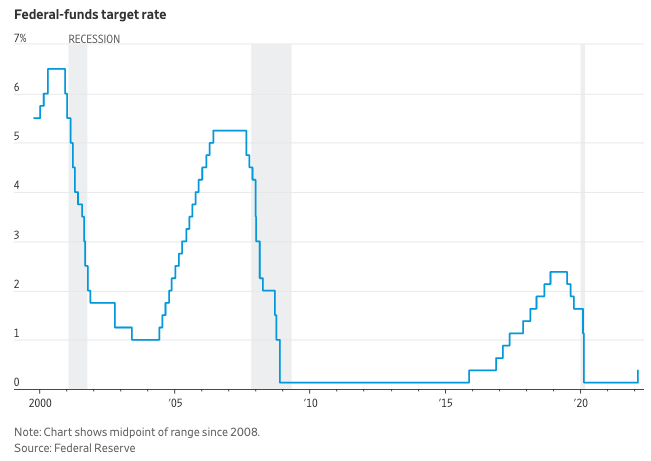

Fed Raises Interest Rates for First Time Since 2018

Yesterday, the Fed announced they will be raising the federal funds rate by an expected 0.25% and will start to shrink their balance sheet at their next FOMC meeting. This is the first time the central bank has raised rates since 2018 from near 0%. The Fed is in charge of price stability and they’ve been completely wrong about inflation and are way behind the curve for tightening monetary policy, which is why inflation is approaching double digits. The effective federal funds rate is the interest rate that banks charge each other to borrow overnight, but this isn’t exactly controlled by the central bank. The Fed creates a range and sets an upper limit - Interest on Reserve Balances (IORB) the rate at which banks earn interest on their deposits at the Fed; and a lower limit - Overnight Reverse Repurchases (ON RRP) - these are repurchases of treasury bills that the Fed lends to banks, usually for a day while paying interest. The effective federal funds rate is a floating rate set by banks lending to each other overnight which is generally between this range.

MAJR Take: The 0.25% interest rate hike was baked into the market, but is still a break on a highly levered economy. The Fed will most likely need to crank up rates after seeing March inflation numbers.

Powell Ramps Up Inflation Fight in Economy Tough Enough to Cope

Bond Market Delivers Mixed Verdict on Fed Rate Forecasts

After the Fed announced the hike, short-term treasury yields actually rose, which indicates selling in the treasury market. Long-term treasuries sold off, but then reversed which may indicate that interest rates will increase earlier in the year, dampening inflation and then cool off later. Regardless, these are mixed results as an increase in rates and tightening of monetary policy generally reduces risk in the market pushing investors out of risk assets like equities and into “safe haven assets” like treasuries causing yields to fall. This indicates that investors are still unsure about how the fed will be able to get ahead of inflation, which would continue to dilute bond holders as their coupon payments and principle would be paid back in devalued dollars.

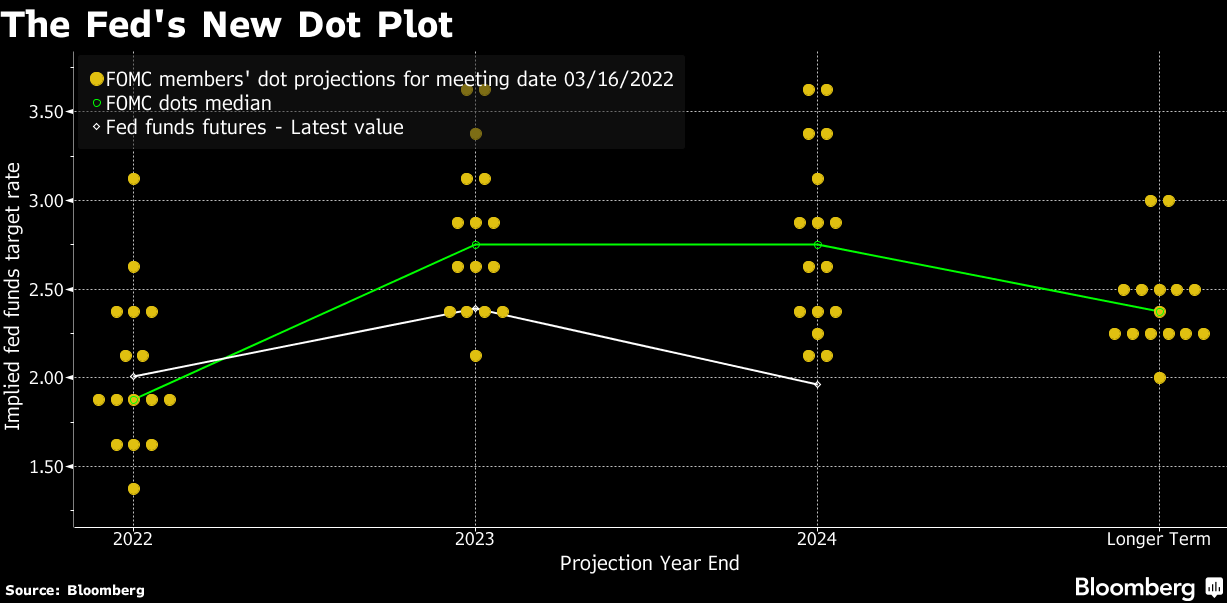

MAJR Take: FOMC members voted on a new dot plot highlighting where interest rates could be by the end of the year and years to come. They project interest rates to climb as high as 2.50%-3% in 2022 and upwards of 3.50% in 2023 and 2024. Much higher than they had last year. While, the Fed has admitted to being wrong about inflation, these number are unrealistic given our national debt and deficit spending. If interest rates were to climb to 3%, the country would default on its debt because tax receipts can’t even cover a 1% increase in rates. What does this mean? The Fed and the government will have to stimulate the economy and print money again, it will just be called something else outside of QE. Remember the Fed is in a total reactive position and way behind the curve. This means that they’re making decisions based on events that have happened in the past and now dealing with the ripple effects. This pattern will continue until the system fully breaks.

More on Macro

iPhone Assembler Foxconn Forecasts Tough Operating Environment From Pandemic, Inflation, War

Think tank calls for EU database to help trace oligarchs' assets

U.N. Security Council to vote Friday on Russia move on Ukraine

MEDIAWhat Will Happen if the Fed Raises Rates with Danielle DiMartino Booth

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.