MAJR News: Dogecoin pumps as Twitter accepts Elon's $44B bid to take the company private.

Grayscale takes another go at the BTC Spot ETF, Central African Republic votes to regulate crypto, Australia launches BTC Spot ETF next week, Global central banks tighten as inflation increases

@cbc

MAJR NEWS BRIEF

Videos

“The Macro Trading Floor,” Alfonso and Andreas are joined by Lyn Alden, founder of Lyn Alden Investment Strategy. They discuss her macro framework, and Lyn explains the past two years of unorthodox monetary and fiscal policies. Drawing on the 1940s as an indicator, she correctly predicted the high inflation rates we’re currently seeing far ahead of most. Expecting a pendulum-style shift between reflation and stagflation, Lyn shares her actionable investment idea while giving a clear outlook for today’s macro landscape.

Top Stories

BITCOINGrayscale Renews Push With SEC for Bitcoin Spot ETF

As Bitcoin Spot ETFs pop-up across the world in places like Canada, Brazil and Australia - the US has denied every single proposal under the guise of “investor protections.” Grayscale wants to convert their $40B Bitcoin Trust into an ETF and has threaten a legal suit against the SEC if the bid gets rejected again.

Bitcoin Recovers Above $40K After Dipping Earlier to 6-Week Low

Bitcoin has been range bound for months between $35k-$47k, mostly hanging around the $40k support level, until it broke below yesterday reaching $38,202 (lowest since March 15th). ETH followed suit and has been down since the ETH 2.0 “Merge” was pushed back to the fall.

MAJR Take: Digital assets tend to be a leading indicator for global markets, as they’re still seen as a risk on asset. When markets get dicey - risk on assets are the first to get cut. This recent price action could be a sign of what’s to come as we enter a bear market. Regardless, there’s still strong accumulation and demand at the current prices levels.

The Central African Republic reportedly passes a bill to regulate crypto use

There was a lot of misinformation over the last few days speculating that another country had adopted bitcoin as legal tender. This is false and the Central African Republic only passed a bill to regulate crypto in the country. While, not legal tender - these are friendly steps towards further adoption.

MAJR Take: The international bitcoin adoption dominos will fall and they’ll fall faster than you think. Just make sure you’re on the right side of history.

More on Bitcoin

Fort Worth, Texas Set to Vote on a Bitcoin Mining Bill Tomorrow

Ukraine Bans Bitcoin Purchases with National Currency Amid Martial Law

CRYPTODogecoin Soars 26% After Twitter Accepts $44 Billion Bid From Elon Musk

Twitter accepted the $44 billion bid from Elon Musk who plans to take the company private. Elon has obviously been a huge proponent of Dogecoin, the multi-billion market cap meme-coin. The market seems to think Elon will integrate the token into Twitter. Dogecoin is up 16.2% in the last 24hrs to $0.16 with a market cap of $21.2B. It’s highs were $0.73 and a $88B market cap.

MAJR Take: I’ve been wrong on meme-coins before. I’ve always taken a more fundamental approach to digital asset investment strategy, but this changes things. Dogecoin could enter the portfolio allocation once we get clear market guidance and trend - it’s still too choppy to jump in. I’ll stay tuned.

Zilliqa, NEAR Protocol Suffer Double-Digit Losses as Crypto Market Dips

Crypto had a down day yesterday. Bitcoin and ethereum each went lower, but we saw even lower prices for top tier altcoins such as Zilliqa (-14%), NEAR (-10%), Harmony (-10.4%), Cosmos (-9.3%), Polkadot (9.2%).

MAJR Take: The macro situation isn’t great - the war in Ukraine, central banks tightening, a surge in Covid in China, global supply chains disrupted and record inflation across the globe. When bitcoin and top tier alts take a hit, this could a sign of what’s to come - then again - it could just be another volatile day in crypto. We’re close to the bottom, but not there yet. Three of the altcoins above are my top risk off picks for the next leg up given the lower caps + fundamentals - NEAR, Cosmos and Polkadot.

Nike and RTFKT Reveal CryptoKicks—Their First Ethereum NFT Metaverse Sneakers

Nike is taking over the NFT space with multiple drops in recent months generating a ton of fanfare and ETH. The top shoe brand revealed their NFT sneakers for the metaverse - digital wearables. Nike acquired RTFKT Studios in December - known for the original digital sneaker NFTs assets. The digital sneakers are selling for over 5 ETH on OpenSea - $14,800.

MAJR Take: This should be a turning point for crypto skeptics - a digital shoe - that has ZERO utility in the real world - you can’t wear it - is selling for $15k online. When have you ever thought about spending $15k on shoes??? NEVER.

More on Crypto

Coinbase Stock Hits All-Time Low After Ethereum NFT Marketplace Rollout

PROOF Raises $10M From Reddit’s Ohanian After Moonbirds NFT Launch

Shiba Inu Launches ‘Burning Portal’ to Reward SHIB Token Holders

MACROShanghai’s Lockdown Missteps Undermine Financial Hub Ambitions

About 16 million of the Shanghai’s 26 million residents are locked in their homes due to China’s strict “Covid-zero” policy. Social media posts show people scrambling for food, kids separated from their parents and unrest between police and resident protestors. Some factories have opened up, but only allow some workers and they’re forced to live and sleep in the factory. The lockdown started in early April due to a surge in Covid cases and there’s no sign of when the lockdown will be lifted.

Ships Refueling in China Show How Congestion Is Reshaping Demand

The strict lockdowns in Shanghai are causing mass congestion for ships that remain idle at Chinese ports for up to 21 days. This type of gridlock is causing ships to change course and skip regular stops like Singapore to refuel. Just another Covid wrinkle causing increased supply chain disruptions.

Bank of Canada’s Macklem Says Half-Point Rate Rise Will Be in Play in June Decision

March inflation was 6.7% in Canada and the head of the Canadian central bank says another 0.50% increase is in play in June, after raising rates by 0.50% in April. The highest increase in two decades. The Bank of Canada officially stopped purchasing bonds this week and will be reducing the bank’s balance sheet moving forward after ballooning to $314 billion during the pandemic.

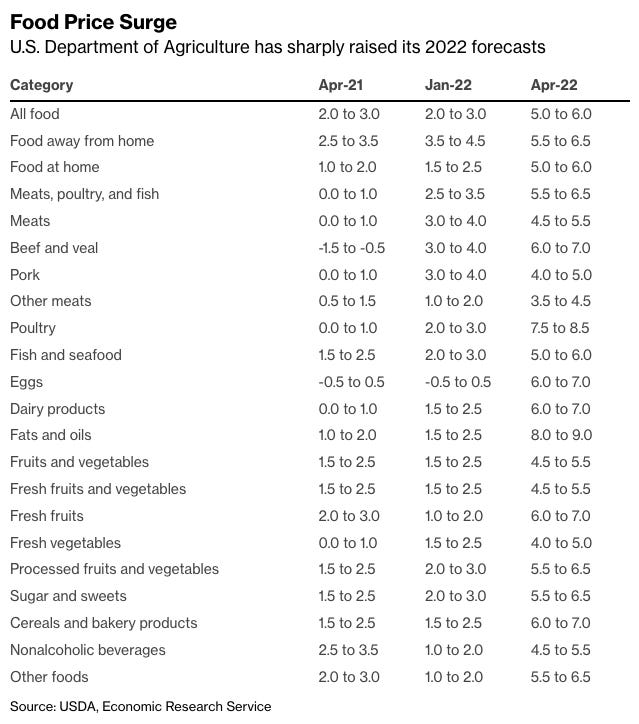

U.S. Ratchets Up Food-Price Forecasts

More on Macro

Fed’s Powell Seals Expectations of Half-Point Rate Rise in May

Four in Ten U.S. Small Businesses Plan to Raise Prices by at Least 10%

U.K. Says 43% of People Will Struggle to Pay Their Energy Bills

War in Ukraine Cuts Fertilizer Supply, Hurting Food Prices and Farmers

MEDIALyn Alden: A Pendulum Between Stagflation & Reflation

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.