MAJR News: Coins are leaving exchanges. Bitcoin supply shock underway.

BTC & ETH prices drop below $40k & $3k before bounce, Yellen lectures on the qualities of Bitcoin, The Sandbox to raise $400M, Moonbirds' NFT shoots to #1 in volume, Fed official says 75 bps in May

@artistname

MAJR NEWS BRIEF

Videos

Bitcoin Macroeconomic Landscape - Bitcoin 2022 Conference With Preston Pysh, Jeff Booth, Mark Moss & Jeff Ross.

Top Stories

BITCOINBitcoin institutional buying ‘could be big narrative again’ as 30K BTC leaves Coinbase

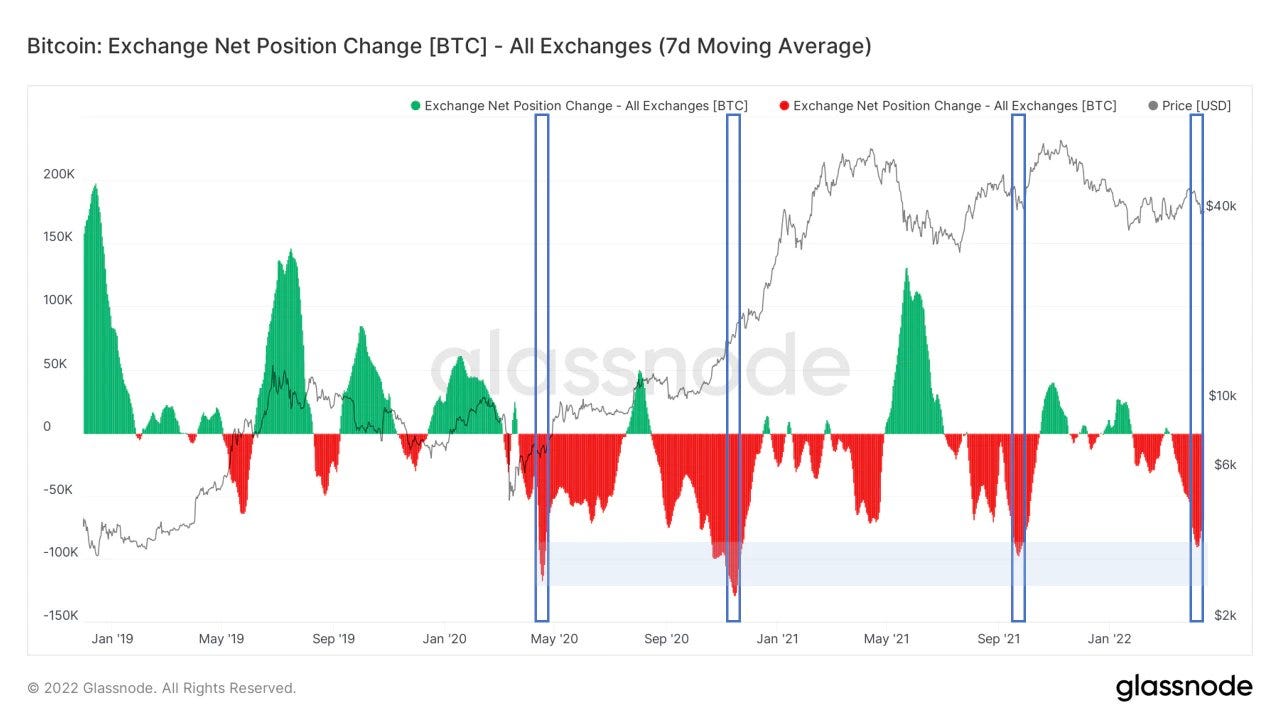

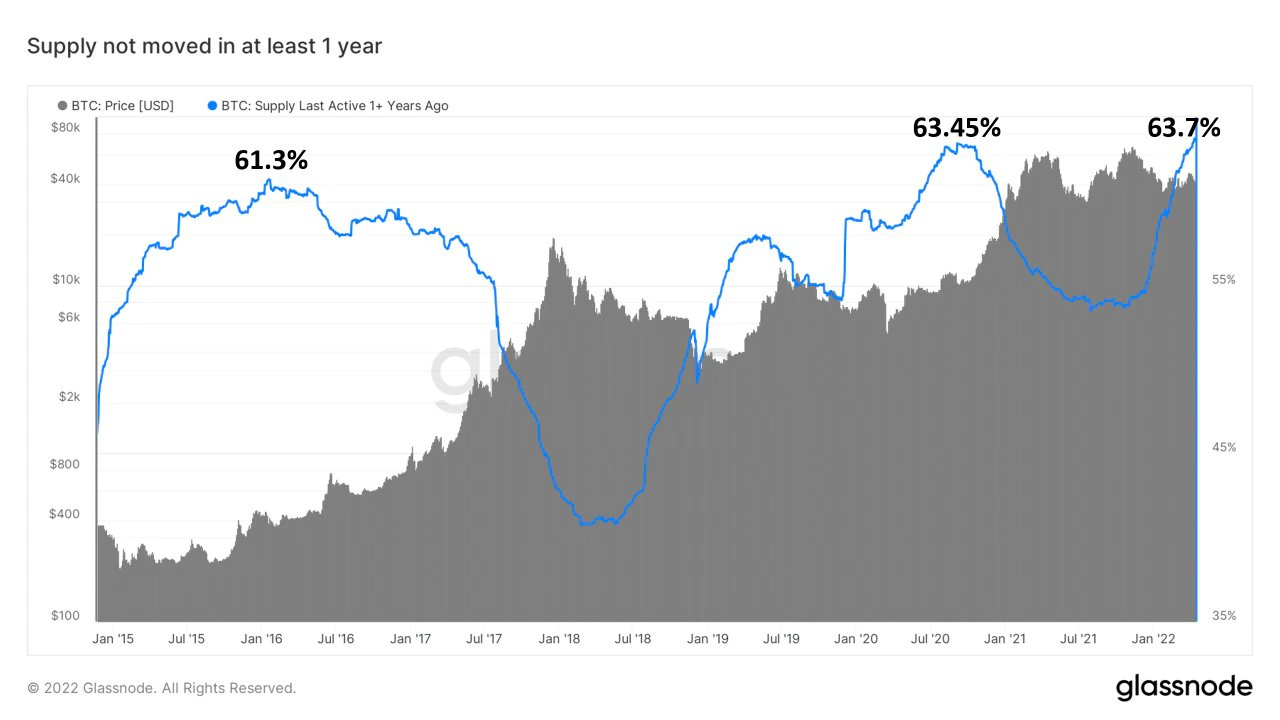

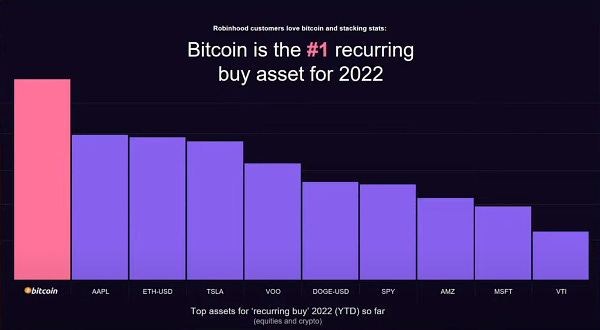

Institutions have been accumulating bitcoin at the current prices levels of $30k-$45k and coins have been leaving exchanges. When coins leave exchanges - it’s a bullish signal that the smart money, long term holders and institutions are moving coins into cold storage for safe keeping. This type of behavior occurred all through March and last week 30k bitcoin left Coinbase’s exchange in one day. We are nearing peak HODL mode - 64% of bitcoin supply hasn’t moved in over a year.

MAJR Take: This type data has led to bitcoin supply shortages and increases in price, last seen before the price spike in November 2021 to $69k.

Bitcoin Drops Below $40,000, Ethereum Falls Under $3,000 Yet Again

Bitcoin and Ethereum both dropped below psychological price levels $40k and $3k in the last 24 hours before bouncing back - currently priced at $40,954 and $3,060. The Bitcoin network saw a slight drop of 1% in mining difficulty of according to Blockchain.com - this means that protocol automatically made it more attractive / easier to win the block reward for miners as an incentive to bring more hash power to the network. It’s unclear why the drop occurred - most likely due to energy disruptions and rising costs of electricity.

MAJR Take: Finding directional trend in this chopping market is difficult as the macro environment is extremely bearish - escalating war in Ukraine with Russia, severe supply chain and energy disruptions, record setting inflation, a surge in Covid-19 cases, Chinese lockdowns and central banks tightening into what looks like a global slowdown. Each pump in price action is a possible bull-trap (meaning it looks like a bullish reversal, but the floor could fall out any second). Patience is key - dollar cost average into assets like Bitcoin or stack stablecoins.

MAJR Take: What looks like a deep fake video of US Secretary of Treasury Janet Yellen discussing how Bitcoin works, is actually real. Janet Yellen is talking about how Bitcoin solves the double spend problem and is a novel way for global peer-to-peer payments. It wasn’t too long ago that she wouldn’t even mention Bitcoin or said it was only used for illegal activity such as money laundering. She’s now flipped. This is bullish.

MAJR Take: Reminder - you don’t have to buy a full bitcoin, just grab some sats and chill.

More on Bitcoin

Making Bitcoin legal tender in Mexico will be ‘an uphill battle,’ says Ricardo Salinas (60% of the Mexican billionaire’s net worth is in BTC)

Watch all the awesome videos from the 2022 Bitcoin Conference in Miami

CRYPTOMetaverse Startup The Sandbox Looks to Raise $400M at $4B Valuation

The Sandbox (SAND) metaverse blockchain game and virtual world on Ethereum is looking to raise $400M, increasing it’s valuation to $4B. The Sandbox is perhaps the largest and most popular of all the blockchain enabled digital worlds with big brands, celebrities, and even banks - all buying and building plots that cost anywhere between $6k for the smallest plot and $150k for the largest - some more expensive depending on the location. The Sandbox is majority owned by crypto gaming and venture firm, Animoca Brands. Their last round was led by SoftBank, which raised $93M in their Series B.

Kevin Rose’s Moonbirds Ethereum NFT Launch Generates $280M in Two Days

NFT project called Moonbirds skyrocketed to bluechip status shortly after it’s mint debut this past weekend with record setting trading volume (more than Azuki, BAYC, Doodles, Beanz, Punks and CloneX - combined). It’s your standard 10k PFP (profile pic) collection and has taken in 97k ETH or about $280M in total sales, floor price is 21.3 ETH or $64k. The NFT collection didn’t come out of nowhere, but it’s from the PROOF Collective, which is a private NFT community led by entrepreneurs Kevin Rose and Ryan Carson (members pass costs 99 ETH). The NFT supposedly provides access to their Discord, access to “Moonbird-related” drops, Parliament meetups and IRL events. The NFT market did $25B in trading volume in 2021 and has already surpassed $12B in Q1’22.

MAJR Take: Something smells fishy about this project. Apparently, there was a sybil attack that may have prevented others from minting, the mint price was 2.5 ETH ($7,500), raffle manipulation and concerns of "rarity sniping” by project leaders with insider info. Not much utility if you ask me, however they do have a metaverse.

North Korean Hackers Responsible for Last Month’s Ronin Theft, FBI Confirms

The FBI confirmed that North Korean hacker groups, state sponsored Lazarus Group and APT38 are responsible for the $635 million hack of the Ronin Network - an Ethereum-linked sidechain. The US Treasury department sanctioned the hacking collective last week.

More on Crypto

Terra’s LUNA Surges 17% as UST Becomes Third Largest Stablecoin

Ethereum Foundation Holds $1.3B in Ether, $300M in Non-Crypto Investments

MACROFed’s Bullard Says 75 Basis-Point Hike Could Be Option If Needed

Federal Reserve St. Louis President James Bullard said a 50 bps increase on interest rates is his base case for May to combat rising inflation concerns, but he wouldn’t rule out 75 bps. The Fed’s target for the federal funds rate is 3.5% by EOY. It currently sits between 0.25% and 0.50%.

Spending More, Getting Less as Inflation Outpaces Retail Sales

Retail sales rose slightly in March, only 0.6% compared to February - coming in less than estimates. Consumer prices rose 1.2% during the same period of time according the Labor Department. Sales at grocery stores rose by 1.3% while prices increased by 1.5%. Price inflation is accelerating across the board.

BOJ Gov. Kuroda Reaffirms Easy Policy Stance

Bank of Japan Governor reconfirmed their stance on easy monetary policy in the face of high inflation and global tightening around the world from other central banks. The BOJ said they haven’t seen 2% inflation yet, so therefore there’s no need to tighten. The yen hit a 20 year low against the US dollar.

MAJR Take: Japan’s 2020 debt to GDP was 266%. The government has been executing yield curve control for the last decade and is perhaps the only if not the major Japanese bond buyer. They’re playing a different game with a smaller population and with a current account surplus - exporting more goods than importing. Unfortunately, some in the West see Japan’s monetary policy as a possible model for success and a way to print your way to stability.

More on Macro

Ukraine Rushes to Evacuate Civilians in East as Russia’s Offensive Pushes Forward

U.S. housing starts unexpectedly rise in March; building permits increase

European shares fall as Ukraine crisis, Fed tightening worries weigh

MEDIABitcoin Macroeconomic Landscape - Bitcoin 2022 Conference

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.