MAJR News: Bitcoin and crypto take center stage in Russian Ukraine War

Bitcoin & crypto markets pumped in the last 24hrs, Crypto market cap regained $2 trillion, Strict sanctions placed Russia's economy, Russian banks have been excluded from SWIFT

@starfury

MAJR NEWS BRIEF

Videos

Ukraine Invasion: The Brits volunteering to go to Ukraine and fight Russians

Powerful video - watch

Mike Ippolito is joined by Jurrien Timmer Director of Global Macro at Fidelity & PlanB the anonymous quant investor & creator of the Bitcoin S2F model. They discuss the current macro forces driving markets from Fed rate hikes, yield curve inversion & equity market valuations. In the second half of the discussion, Jurrien & PlanB discuss valuation models for Bitcoin, how current market conditions could effect Bitcoin & what the next phase of Bitcoin will be as it enters the geopolitical landscape.

Russian Economy Stats

$1.5 trillion GDP

Its economic output is about equal to that of Iowa, North Dakota, South Dakota, Kansas, Minnesota, Missouri and Nebraska, combined. Texas’s economy is nearly 25% larger than Russia’s.

Important

Given the geopolitical situation, it’s time to take your coins off exchanges and self custody. These are uncertain and emotional times, and with national security at risk, crypto could come under fire. Better to be safe than sorry. Take custody now.

Top Stories

BITCOINFirst Mover Americas: Bitcoin Nears $45K on Increased Demand From Ukraine and Russia

Bitcoin and the crypto market jumped in the last 24 hours following the invasion of Ukraine and the heavy financial sanctions placed on Russia. Bitcoin is up 10% and above $43k while Ethereum is about to retake $3k. Other layer 1 coins such as Solana, Terra and Avalanche moved between 12%-25% yesterday. The total crypto market cap is $2.02 trillion, up 8.7% in the last 24 hours.

MAJR Take: The bitcoin and crypto trade is center stage as Russian and Ukrainian citizens deal with sanctions and crypto donations. Crypto may be proving itself right now, but investors should be cautious and expect volatility in both directions. The Fed’s March meeting is right around the corner and inflation is at all-time highs, and will most likely be going higher.

Bitcoin Trading Against the Ruble Surges as Russia's Currency Crashes

Crypto trading volume in Russia has exploded since the country has been leveled by strict financial sanctions limiting access to capital for government, corporations and private citizens. Ruble / bitcoin trading volume is at 9 month highs. Bulk of activity is on Binance. Tether / ruble trading has hit an 8 month high. The ruble fell 30% Monday morning, trading less than a penny. Russia’s central bank has ~$630 billion in foreign exchange reserves overseas that they’re prevented from accessing, while the ruble crashes.

Bitcoin was legalized and regulated in Ukraine in September 2021.

Crypto investment funds attract $36M in capital despite market turmoil

Investment funds flowed into bitcoin, ethereum and other large cap coins such as Solana and Litecoin. Volumes on crypto exchanges trading in Russian ruble’s jumped over 121% the past week.

More on Bitcoin

Bitcoin Back Above $40,000 as Crypto Market Recovers $200 Billion

Bank of America Sees No Crypto Winter Given User Adoption, Developer Activity Growth

CRYPTOUkraine Government Is Using Crypto Aid to Purchase Critical Supplies

$10 million in crypto donations have been made to the Ukrainian government. The crypto donations were distributed to government wallets and $6.5 million of ETH was spent on gas, food and water for people evacuating the city. The government is also buying, heat vision goggles and gas for their vehicles. All types of tokens including stablecoins are being sent to Ukraine, and estimated $40 million in crypto donations.

US Treasury Department Formally Adds Crypto Rules to Russian Sanctions Guidance

The US government has added crypto to the list of sanctions banning any companies or individuals from facilitating financial support to specific Russian entities and oligarchs.

“All property and interests in property that are in the United States, that hereafter come within the United States, or that are or hereafter come within the possession or control of any United States person of the following persons are blocked and may not be transferred, paid, exported, withdrawn, or otherwise dealt in … deceptive or structured transactions or dealings to circumvent any United States sanctions, including through the use of digital currencies or assets or the use of physical assets,” the document said.

Ukrainian Vice Prime Minister Calls on Crypto Exchanges to Ban Russian Users

Ukrainian Vice Prime Minister Mykhailo Fedorov has made a request to crypto exchanges to ban Russian users to help put Russian citizen pressure on Putin. Binance and Kraken have rejected the request, saying they’re not going to freeze millions of innocent users accounts.

MAJR Take: While, freezing Russian citizen accounts may seem like the right right thing to do to help fight the war for Ukraine’s, it’s welcoming to see crypto leadership stand firm on the idea against of financial censorship.

KPMG Canada Buys World of Women Ethereum NFT, ENS Domain Name

Accounting firm giant, KPMG Canada quickly jumped into the NFT buying leading female NFT, World of Women (WoW) #2681 for $70k or 25 ETH. They also minted their ENS Domain Name NFT kpmgca.eth. The firm recently purchased Bitcoin and Ethereum for its corporate treasury.

MAJR Take: There seems to be a lot of crypto dominos falling right now. Bitcoin legal tender laws in countries and US States. Increased crypto adoption from corporations and celebrities. Bitcoin and crypto taking the center stage in the Russian Ukraine War as a powerful way to donate to the attacked and a possible financial exit for the attacker. Pay attention. There’s only 21 million bitcoin.

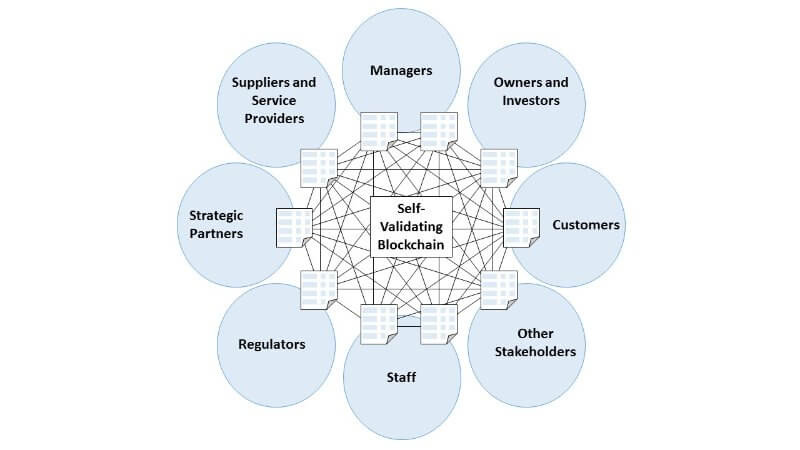

The DAO is a major concept for 2022 and will disrupt many industries

DAO, a decentralized autonomous organization is a concept that is brought to life using blockchain technology, largely being experimented with NFTs. They are essentially a flat or flatter organization that’s governed by token holders. The communities generally form around shared interests amongst strangers online, while the blockchain enables trust and coordination at scale. Everyone operates within the rules of the code written into the smart contract and are incentivized by the token’s price appreciation. Blockchains are trust machines and they can be used to create new higher performing communities or level up existing communities. We’re seeing a spectrum of DAOs exploring new ways to invest, collect and fundraise to accomplish objectives such as buy a golf club or a professional sports organization, purchase the IP rights to books and movies, or fund the release of controversial imprisoned individuals like Edward Snowden and Julian Assange.

MAJR Take: The toothpaste is out of the tube for DAOs. They’ll be highly disruptive. Everything we do in society is generally done together or with other people, but the incentives are not always aligned, operations can be opaque and centralized organizations can be limited by their vertical design. DAOs allow for transparency, accountability and mutual upside. The traditional sense of companies and governments will be put to the test.

More on Crypto

Ethereum Wallet MetaMask: Token Launch Won't Be a 'Cash Grab'

Coinbase Is Latest Exchange to Deny Ukraine Request to Block Russian Crypto Users

Dapper Hires 2 Execs as NFL NFT Marketplace Debuts to $5M in Sales

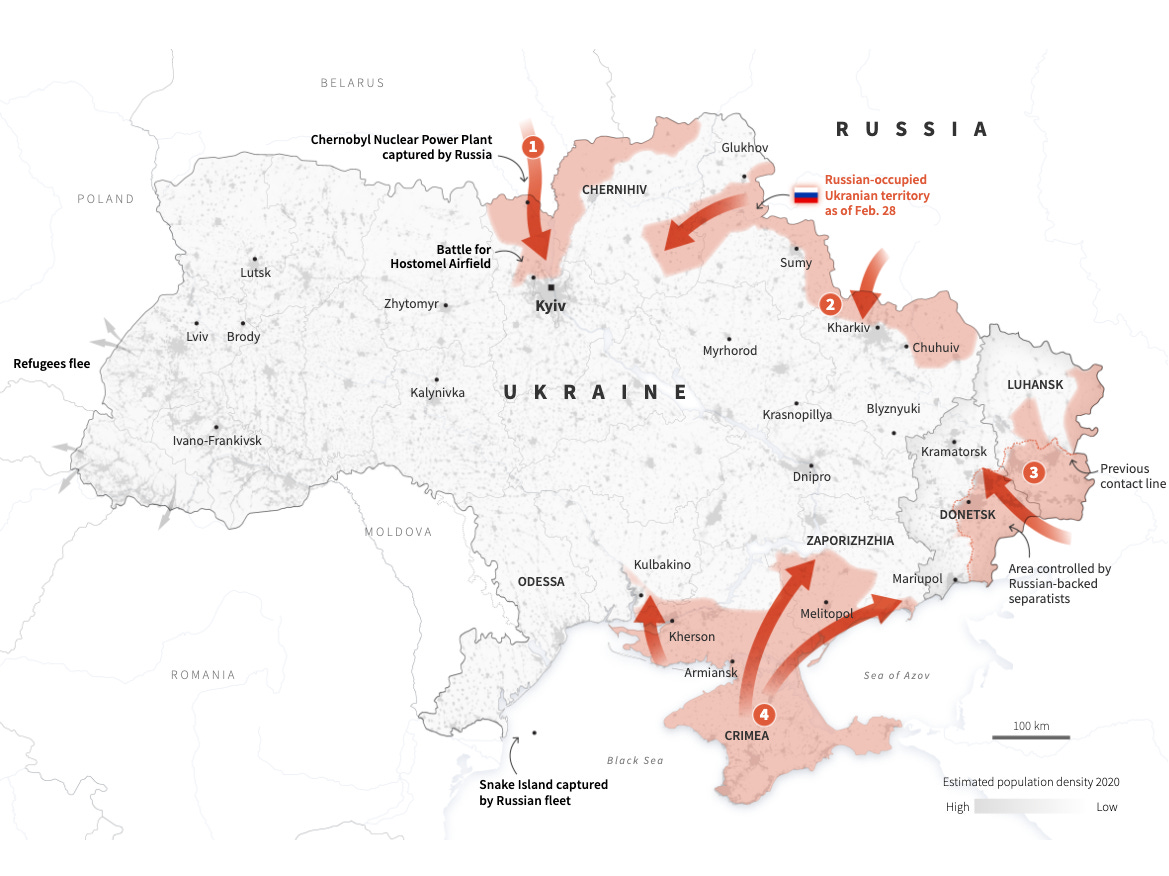

MACRORussia invades Ukraine

Reuters live blog tracking the invasion and following events.

U.S. Positioned to Withstand Economic Shock From Ukraine Crisis

On the surface, the US economy looks like it should be able to withstand the negative effects from the crisis in Ukraine. Economic indicators shows a strong consumer who’s spending more, traveling more and dining more. The Omicron variant seems to have run its course as hospitalizations have dropped significantly. Estimates for US payroll grew between 500k-730k in February and the jobless rate fell to 3.7%-3.8%. If these numbers are correct, they’d be much higher than the pandemic normal of 150k-200k monthly new jobs.

The West’s Sanctions Barrage Severs Russia’s Economy from Much of the World

Western banks and business have been ordered to halt operations and sales in Russia.

Russian airspace has been closed.

Foreign reserves have been frozen, $630 billion.

Sanctions have cut Russia off from the tech sector and manufacturing industries.

Russian banks have been removed from SWIFT, the international payment rails connecting more than 200 countries and 11,000 banks and financial institutions.

Russia has imposed capital controls, blocking residents from sending money to foreign bank accounts. There have been massive bank runs and ATMs are out of cash in Russia.

Russian inflation is about to get worse, it was already at 8.7% in January.

China has been relatively quiet with regard to Russia. The two countries made trade and energy deals prior to the crisis. However, it’s unlikely that China would risk jeopardizing trade with the western world, even though they’re the world’s largest trade partner.

Fertilizer Crisis About to Become a Food Crisis

Russia is a net energy exporter and many countries, especially Europe are reliant on Russian energy and with sky high oil prices (+$100 / barrel), fertilizers, nutrients and chemicals needed to harvest food are getting much more expensive, which means less food an higher food prices. It’s estimated that Europe could face a 9% deficit for its annual-fertilizer for the first half of 2022.

More on Macro

Blockade on Russia Central Bank Neutralizes Defense Against Sanctions, U.S. Says

Russia’s Ultra-Rich Count Cost of $83 Billion Wealth Wipeout

Could Russia And China Collectively Challenge The Dollar's Reserve Status?

Ukraine envoy to U.S. says Russia used a vacuum bomb in its invasion

MEDIAThe Macro Forces Driving Bitcoin | Plan B & Jurrien Timmer

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.